Report Snapshot

Situation

The market likely expects some further yield reductions in the months ahead as we learn the true size of the corn crop. Prices have recovered from their August lows and remained near those levels despite an upward net revision to corn supplies in September. Meanwhile, the 2025/26 marketing year has reached a record level of export commitments due to prospects of cheap corn.

Outlook

I currently project the season average cash price to be $4/bu., with a range from $3.80/bu. to $4.20/bu. If we see yield estimates reduced in upcoming USDA reports, I expect possible reductions in the residual use, potentially leaving the stock position relatively unchanged and resulting in prices still in the $4/bu. range.

Finding

Looking ahead to 2026, farmers may want to consider strategies that secure current price levels without significantly limiting upside price potential.

The 2024/25 marketing year finished with above-estimated stock levels. Ending stocks were surveyed to be 1.5 billion bushels versus the 1.3 billion estimated in the September World Agricultural Supply and Demand Estimates report. These stock levels are in line with the 30-year average but in the 30th percentile on a stocks-to-use basis.

While the early and middle parts of the 2025 growing season had a generally favorable weather situation, the season finished with disease and weather issues. Unexpected upward revisions to acres (now the highest planted acres number since the 1930s) in both the August and September USDA reports have led to some price volatility over the last quarter, and production expectations have varied widely.

The market likely expects some further yield reductions in the months ahead as we learn the true size of the corn crop. Prices have recovered from their August lows and remained near those levels despite an upward net revision to corn supplies (by almost 100 million bushels) in September. Production is currently estimated at 16.8 billion bushels, and when combined with the carry-in stocks mentioned earlier, this leaves total projected supplies for the 2025/26 marketing year at almost 18.4 billion bushels. If realized, this would exceed the prior record by 1.4 billion bushels.

Export Extravaganza

Export commitments — led by Mexico, Japan and Colombia (excluding the Unknown category) — have responded to the prospects of cheap corn, with these and other foreign customers securing near record commitments as we began the 2025/26 marketing year. Those purchase commitments have continued, with current outstanding commitments (as of September 18) now a record at over 1 billion bushels.

Rising Brazilian domestic consumption, driven by higher domestic feed use and ethanol use, is expected to continue to limit its growth in exports over the medium term.

A hot start has happened before and has not always meant a hot finish. The most recent example was in 2021/22, when we began the marketing year with about 1 billion bushels in export commitments yet finished the year with slightly under 2.5 billion bushels of exports.

Brazilian crop agency CONAB expects the country’s 2025/26 corn crop to be 138 million metric tons, down 1% from the prior season (which saw record yields) despite a 3.5% increase in total corn area to 22.6 million hectares.

Rising Brazilian domestic consumption, driven by higher domestic feed use and ethanol use, is expected to continue to limit its growth in exports over the medium term. Brazil continues to expand corn-based ethanol production capacity, consuming more of its corn production domestically and limiting the growth in export competition, which helps support U.S. corn exports.

Feed and residual use of corn is projected to rise significantly in 2025/26, helping to avoid even more burdensome stocks.

While I think the current export forecast is achievable, if U.S. exports were to falter, that would put additional stock pressure on prices and potentially alter planting decisions for the 2026 crop year.

Residual or Feed Riddle

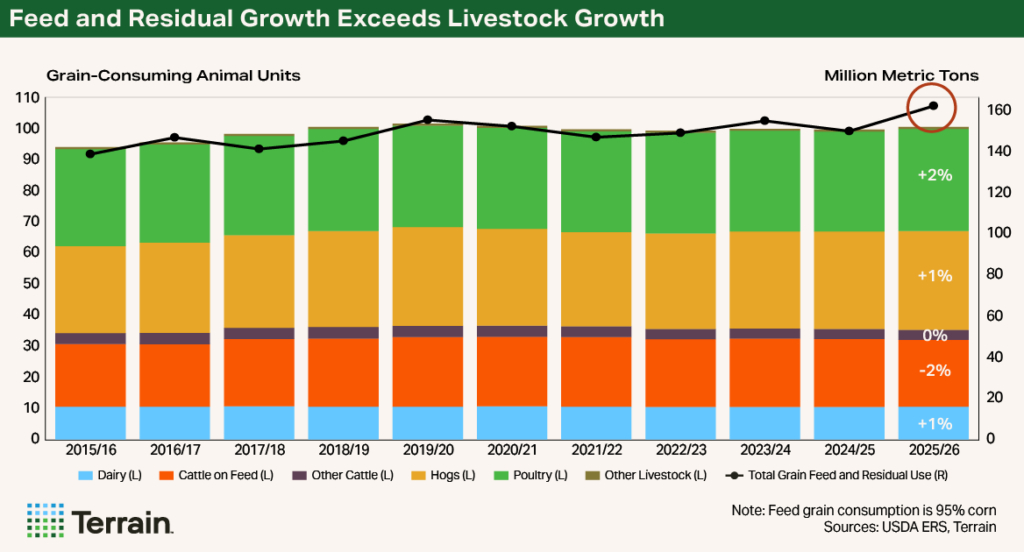

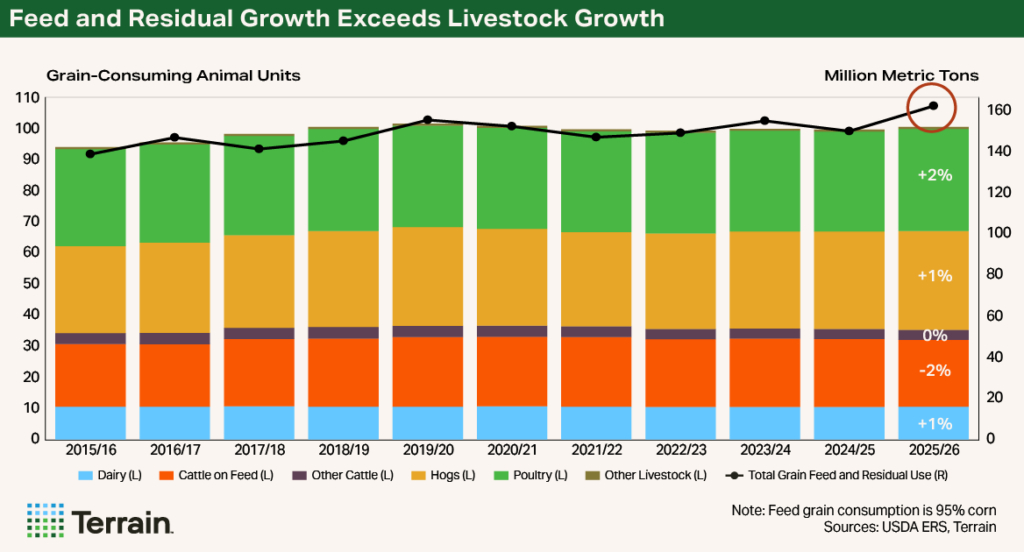

Feed and residual use of corn is projected to rise significantly in 2025/26, helping to avoid even more burdensome stocks. The USDA forecasts feed and residual use at 6.1 billion bushels, up from an estimated 5.5 billion bushels last year for an increase of nearly 11%. Meanwhile, both aggregate livestock product production and grain-consuming animal units are expected to rise about 1%.1 Part of the increase in projected feed use of corn is explained by lower projected feed use of other grains, but even when accounting for that there remains a notable divergence of up to 350 million bushels.

With the expected tight storage situation this year across parts of the central U.S., from the Mid-South through the corn belt and into the Northern Plains, the chance for higher loss from temporary or alternative storage arrangements means there could be higher-than-normal loss or “residual” use. Whether that could add up to a few hundred million bushels or not remains to be seen.

Corn use for ethanol is expected to increase 3% to 5.6 billion bushels, supported by a favorable outlook for margins at least over the next quarter.

Ethanol Eagerness

Corn use for ethanol is expected to increase 3% to 5.6 billion bushels, supported by a favorable outlook for margins at least over the next quarter. Several developments on the policy front could influence ethanol use, and thus corn use for ethanol, in the future.

First, California now allows the sale of E15. In September, the California Legislature passed a bill authorizing E15 sales. That bill, Assembly Bill 30, was signed by Governor Newsom on October 2. While sales are allowed immediately, some infrastructure upgrades are necessary throughout the state. As one of the largest state gasoline markets, this could represent a significant potential increase in domestic ethanol use. Similarly, a push for year-round E15 is once again occurring at the federal level.

Second, ethanol has been featured in trade talks, most recently with the U.K. and EU. Any new export outlets, or higher volumes to existing customers, would support U.S. ethanol volumes and help increase the amount of corn used for ethanol.

I currently project the season average cash price to be $4/bu., with a range from $3.80/bu. to $4.20/bu.

The upcoming joint review of the United States-Mexico-Canada Agreement (USMCA) has the potential to affect U.S. ethanol exports, so staying alert to these review proceedings may be warranted. Canada is currently the largest buyer of U.S. ethanol, taking about one-third (or about 351 million gallons) of U.S. exports in the first half of 2025.

Balancing the Bushels

Yield uncertainty means price uncertainty, and that is where we sit at this point in the marketing year, with harvest underway and a few months to go before final yield estimates are known.

I currently project the season average cash price to be $4/bu., with a range from $3.80/bu. to $4.20/bu. If we see yield estimates reduced in upcoming USDA reports, I expect possible reductions in residual use, potentially leaving the stock position relatively unchanged and resulting in prices still in the $4/bu. range. Even further cuts to yields — for example, into the lower 180 bu./ac. range — would begin to offer some upside potential for prices and could push the season-average price closer to the upper end of my range.

Beyond the 2025 Harvest

It may feel early to consider marketing plans for the 2026 crop, but when considering the outlook for farm input prices, trend yields, and the current futures market price levels, there could be an opportunity to protect a significant portion of downside risk at current market price levels for some farmers.

That far out, farmers may want to consider strategies that secure current price levels without significantly limiting upside price potential. By my estimates, average corn returns look better than average soybean returns for 2026. Further shifts towards corn in the crop area mix, like we saw this year, or even higher expected supplies out of South America next spring, could weigh on those prices and erode potential returns for next year.

1Grain-consuming animal units are a standardized estimate of the livestock sector, adjusting for relative grain consumption across species, that is specific to grains and used as an indicator of feed use. For more information: https://www.ers.usda.gov/sites/default/files/_laserfiche/outlooks/36619/41018_fds13esa.pdf or https://www.ers.usda.gov/data-products/feed-grains-database/documentation

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.