Report Snapshot

Situation

January will offer markets more certainty on the 2025 crop’s production levels. Meanwhile, exports remain robust and strong ethanol margins support domestic use.

Finding

Competition from other cheap feed grains, primarily sorghum and wheat, will likely dampen upward price movements.

Outlook

Stable to slightly higher prices may be ahead for corn markets as strong demand meets the prospect of slightly lower corn acres in 2026. However, planting delays or weather challenges for South American corn production could add volatility to corn prices in the months ahead.

Assuming trend yields for next year, market prices for corn are in the range of breakeven (or better) for many farmers.

Corn markets are likely to remain well-supplied until next harvest even if the USDA cuts the 2025 crop’s yield in January. Growth in domestic use and exports supports U.S. prices while competition from wheat and sorghum for feed weighs on prices. Uncertainties about expected foreign supplies are likely to contribute to price volatility in the months ahead.

As we indicated last quarter, at least small profits are projected for some farmers in 2026. However, volatility from weather, trade and policy means risk management remains important. Assuming trend yields for next year, market prices for corn are in the range of breakeven (or better) for many farmers.

Domestic Use Tackles Record Supplies

The amount of corn used to produce U.S. ethanol is expected to remain stronger than a year ago, as ethanol margins are currently forecast to remain positive. Further, corn use for ethanol through the first two months of the 2025/26 marketing year is on pace to hit the currently forecast use of 5.6 billion bushels. Relatively cheaper sorghum prices in parts of the U.S. incentivize sorghum use for ethanol over corn, potentially adding some downside risk to corn use for ethanol.

The USDA’s feed and residual use estimates may be overstated. Despite only a 1% increase in animal units, corn feed use is projected to increase 11.6%, likely exceeding reality. Downward revisions in January could boost ending stocks unless offset by stronger exports or ethanol demand, or a reduction in total production.

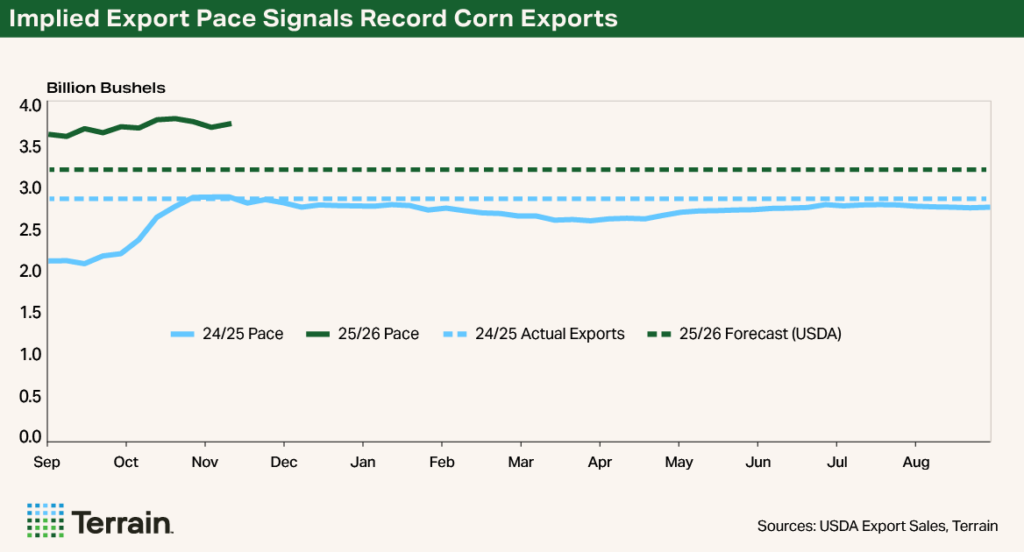

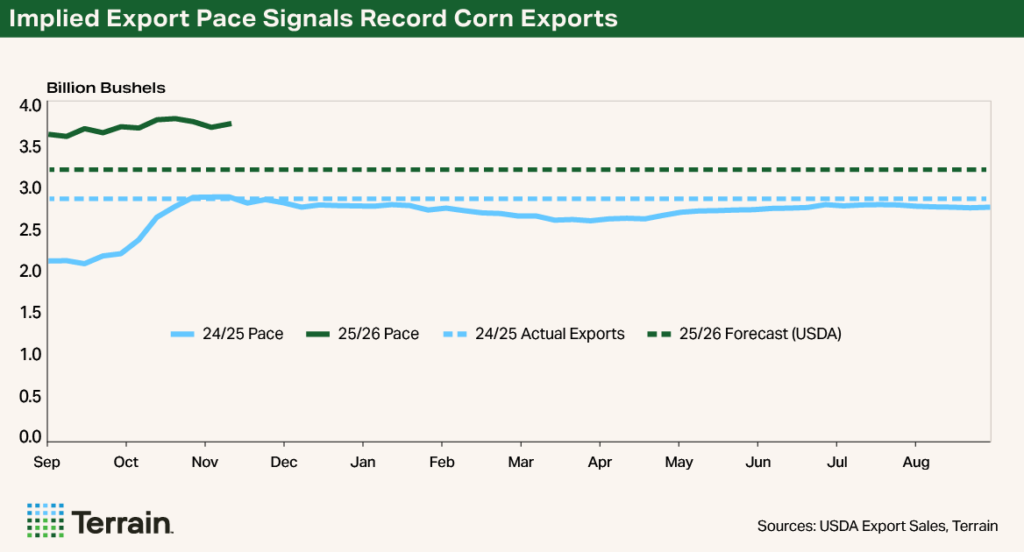

Corn’s Export Explosion

Exports remain one of the bullish factors supporting corn prices. The USDA’s record forecast for 2025/26 exports was again revised higher to 3.2 billion bushels in December. Though a few weeks of export sales data are missing because of the government shutdown, total export commitments as of November 13 were a record 1.6 billion bushels — almost 50% above the five-year average and 30% above last year.

Assuming a seasonal pace of commitments, current commitments would imply exports of about 3.7 billion bushels, a record by a wide margin, if realized. However, when adjusting for the regions driving this pace, some of the buying likely happened earlier than typical as a result of low prices at the start of harvest. If that is the case, actual exports are likely to be closer to the USDA’s current estimate of 3.2 billion bushels, which would still be a record.

Given this record start to the marketing year, and weather uncertainty for South American production, any continued strength in export commitments will likely support prices. Watch export sales data as they catch up in the weeks ahead for pricing opportunities.

Wheat and Weather Weigh on Corn

Northern hemisphere corn supplies are relatively certain at this point. Market attention is turning mostly to expectations of southern hemisphere production (Argentina and Brazil’s second crop corn) and potential U.S. corn acres in the spring.

USDA projections for Argentina’s corn production remain at 53 million metric tons (MMT), and CONAB has maintained its projection of Brazilian corn production at about 138.9 MMT, offering steady expectations of South American production.

Weather over the next several months in Brazil remains key to maintaining the current balance between corn and soybean markets, and may offer pricing opportunities for unsold 2025 corn if weather turns unfavorable for Brazilian production.

I project the 2025/26 season average cash price for the 2025 harvested crop to be $4.15/bu., with a range of $4/bu. to $4.30/bu.

Corn faces increased global competition for feed this year, especially from wheat. World wheat production is projected to be 4.6% higher this year than last, with an extra 8 MMT (almost 300 million bushels) of wheat projected to go for feed this year over last. These supplies will continue to weigh on any corn price rallies in the months ahead unless adverse winter conditions diminish the expectations of the 2026 global winter wheat crop.

Price Projections and Farm Program Payments

I project the 2025/26 season average cash price for the 2025 harvested crop to be $4.15/bu., with a range of $4/bu. to $4.30/bu. However, final U.S. production numbers from the USDA, Brazil’s second corn crop, more corn acres than currently expected this spring, or other factors could influence prices in the final two-thirds of the marketing year.

An unchanged U.S. production estimate would likely lead to some weakness in nearby corn futures in the months ahead, as there would be an increased likelihood of ending stocks exceeding the USDA’s estimate.

Although Brazil’s soybean planting pace was slightly delayed, localized issues could add pressure to the second corn crop. Any delays in soybean harvest, issues planting the second crop, or unfavorable weather during the second crop growing season would likely lead to higher corn prices, at least temporarily.

Lower soybean prices and, consequently, higher expected U.S. corn acres in 2026 could push the season average price toward the lower end of my expected range.

At $4.15/bu., 2025 farm program payments (paid in late 2026) are expected to average at least $32.80 per corn base acre at the national level, and range from a minimum of $14/base ac. to $25/base ac. for individual counties in major corn-producing states based on average enrolled program yields. The average payment projected at this price level for these major states ranges from $26/base ac. to $36/base ac. and totals about $3 billion. These estimates account for the 85% payment factor but not sequestration.

Remember for the 2025 program year, with payments in the fall of 2026, farmers will receive the higher of the Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC) payment regardless of election. Instead of allowing re-election for program participation, Congress elected in the One Big Beautiful Bill Act to pay the higher of ARC or PLC benefits for the 2025 program year only. For 2026, this will return to an annual election.

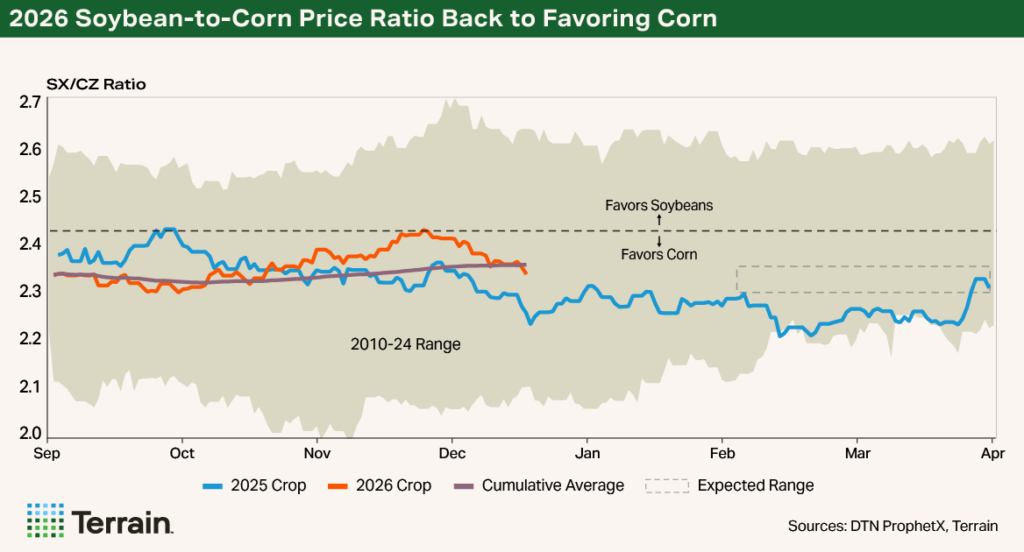

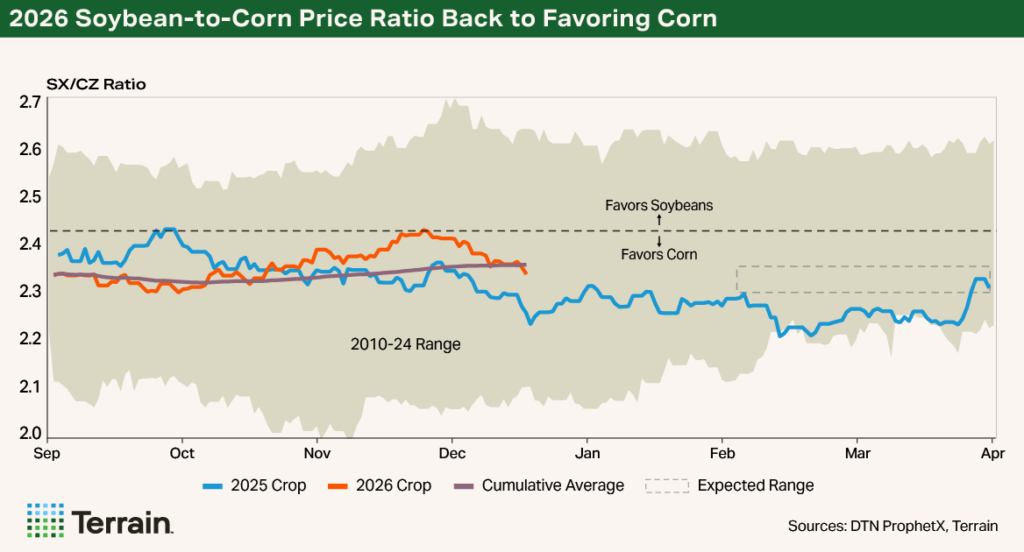

I project 2026 corn acreage at about 94 million acres.

2026 Profitability Considerations

Markets appear to have moved back toward favoring corn over soybeans, as futures prices for corn have gained relative to soybeans in recent weeks. I project 2026 corn acreage at about 94 million acres, with the potential to be even higher if U.S. soybean exports fail to materialize, ending stocks grow, and futures prices for soybeans fall as we move into spring.

While input prices have risen slightly since our Q4 2025 outlook, I forecast current market revenues are near 90% of projected full economic costs for 2026 at trend yields. For some farmers, this offers the potential to lock in profits, since many producers will be at or near break-even levels as we approach 100% of economic costs.

I encourage farmers to consider risk management strategies that protect downside risk without significantly limiting upside potential as we look to 2026.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.