Is the Feedlot Sector Charged for Change?

Article originally published in the August 2023 issue of the National Cattlemen magazine.

By Matt Clark, Rural Economy Analyst

With the California Air Resources Board (CARB) recently adopting the new Advanced Clean Fleets (ACF) rule, I looked at what a transition to zero-emission heavy and medium trucks would mean for the feedlot sector in Kansas and Nebraska, should similar regulations ever reach states other than California. I identified several implications for the sector, primarily for hauling costs and changes in basis.

The ACF provides the framework to phase in zero-emission trucks for government-owned fleets, drayage fleets and high-priority fleets, and ultimately a hard deadline for manufacturers to sell only zero-emission medium- and heavy-duty trucks in California. The ACF framework will force compliance with the 2020 California Executive Order N-79-20, which states, “It shall be a further goal of the State that 100 percent of medium- and heavy-duty vehicles in the State be zero-emission by 2045 for all operations where feasible and by 2035 for drayage trucks.”

Though the ACF is not aimed at agriculture, portions of the agricultural supply chain in California will soon begin the process of transitioning to a zero-emission fleet, and eventually California producers will not have the option of purchasing new internal combustion medium- and heavy-duty trucks. Although California is currently the only state to have adopted such rules, it is worthwhile to consider the potential impacts if other states were to follow suit. In this hypothetical, my case study of Kansas and Nebraska feedlots uncovered meaningful implications for the sector.

Charging Needs Will Feed Into Hauling Costs…

The first impact to consider is hauling costs. My colleague Don Close has estimated that the typical steer travels about 1,250 miles over its lifetime, which adds about $14 per hundredweight (cwt) to the cost of production over its lifetime. Over half of the travel and costs occur when the animal is a calf, and only 10% to 12% of the travel and costs occur as the animal moves from the feedlot to the packer.

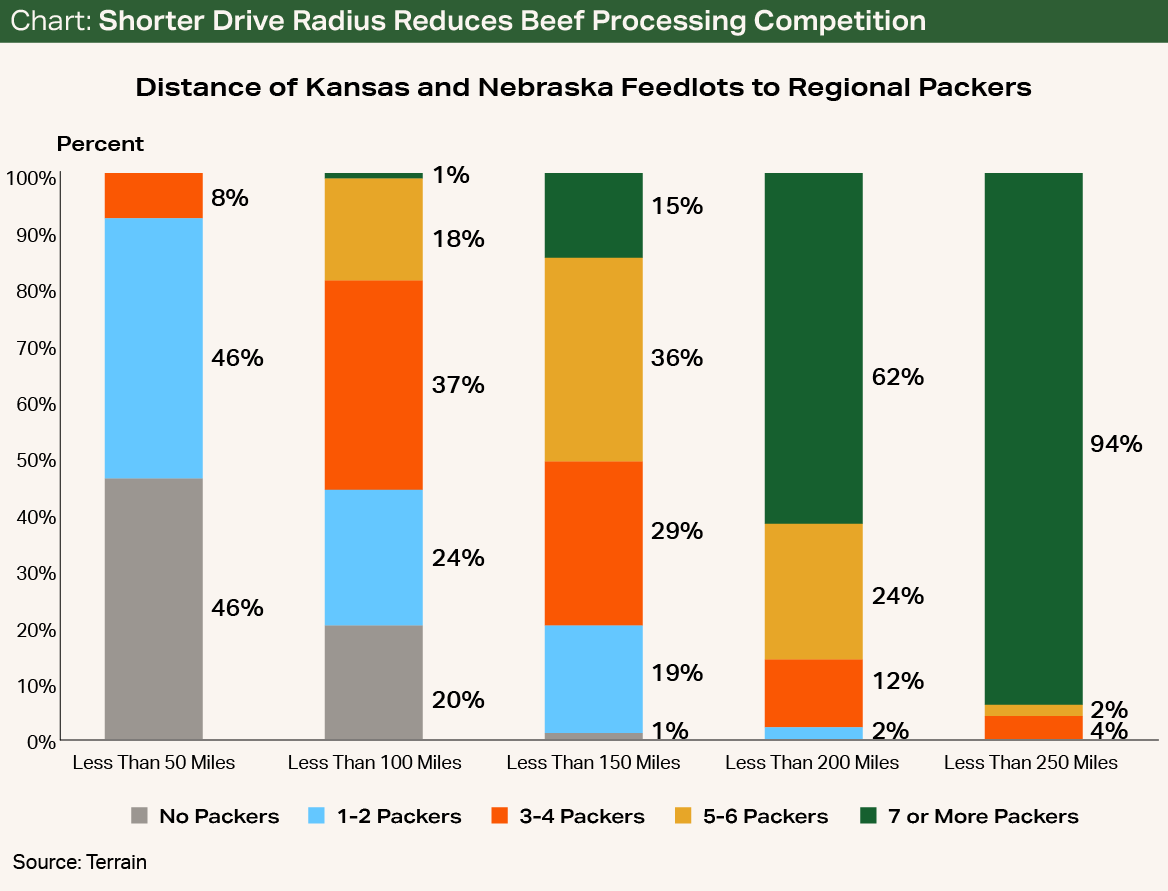

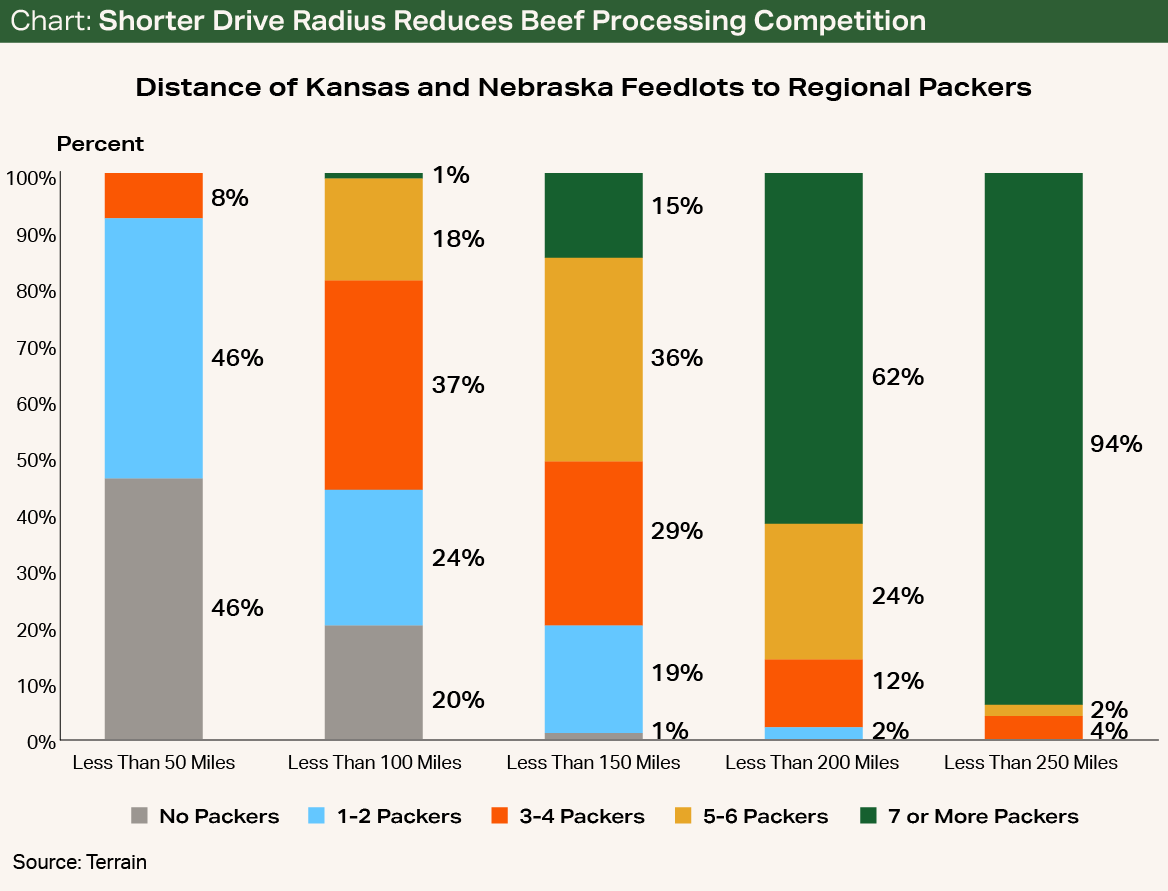

Hauling costs for other segments of the cattle industry, which travel far greater distances and from very rural areas, are likely to be much higher.

Because of the physical permanence of feedlots and packers, I was able to determine that 80% of feedlots in Kansas and Nebraska have at least three packers within a 150-mile drive distance. Therefore, the changes in hauling costs for the feedlot sector will primarily stem from the increased underlying costs of purchasing new zero-emission trucks and infrastructure (charging stations, for example) during the transition. Recent analysis published by the science news blog Next Big Future shows that most zero-emission large-class trucks have an upfront cost of $300,000 to $500,000, compared with $130,000 to $160,000 for diesel trucks. Hauling costs for other segments of the cattle industry, which travel far greater distances and from very rural areas, are likely to be much higher.

…And Pricing Dynamics

The second impact to consider is changes to basis. The changes to the cattle basis market are likely to be more significant than hauling costs because current zero-emission trucks have a more limited range than traditional diesel trucks. A tighter drive radius will place a much greater premium on cattle located close enough that a trucker could make a round trip from feedlot to packer without stopping to charge the vehicle (see chart).

The extreme dependency could put those feedlots at a sharp basis disadvantage due to the lack of available pricing options…

Additionally, the 20% of feedlots that have fewer than three packers within a 150-mile drive radius will become extremely dependent on those packers to purchase their cattle. The extreme dependency could put those feedlots at a sharp basis disadvantage due to the lack of available pricing options and increases the vulnerability to supply chain shocks. Feedlots outside a reasonable round trip without stopping to “refuel” will also likely need to invest in on-site infrastructure to “fuel,” or charge, zero-emission trucks to ensure the stability of their supply chain. This added investment may also change the local pricing dynamics for their cattle.

From California to Your State?

Currently, no zero-emission regulations for medium- and heavy-duty trucks exist outside California. However, given the cattle industry’s reliance on trucking, it is important for the industry to monitor the regulatory environment and consider the potential impact if regulations were expanded to other states.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.