Report Snapshot

Finding

With record domestic crush capacity and rising global protein consumption, U.S. soybeans can offset reduced China demand to other markets while leveraging biofuel growth.

Outlook

U.S. soybeans will continue to face price pressure near a $10/bu. average farm price amid global oversupply led by Brazil and reduced demand from China.

Impact

Without export diversification and domestic biofuel clarity (prioritizing domestic feedstocks over imported substitutes), U.S. soybeans risk drowning in oversupply, which will lead to stagnant prices.

The U.S. soybean market currently depends on clarification of domestic biofuel policy and China’s progress in meeting its soybean purchase commitments. Both factors will weigh heavily on old-crop prices and spring planting decisions.

Longer run, fostering alternative export outlets for soybean and soymeal and strengthening domestic consumption will be essential for U.S. farmers to maintain profitability and competitiveness in the global oilseed market.

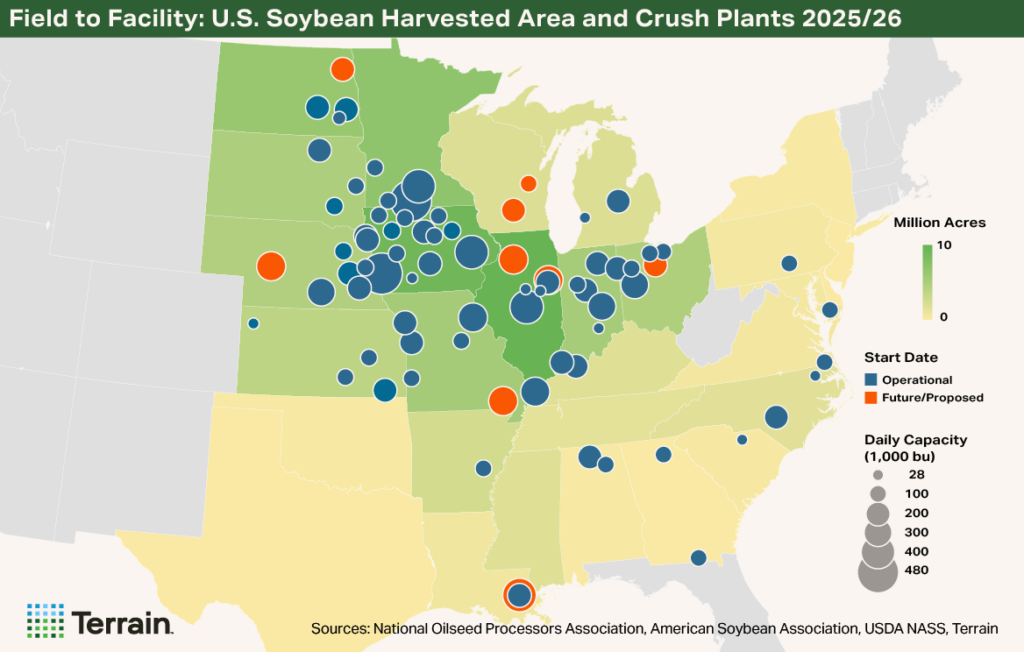

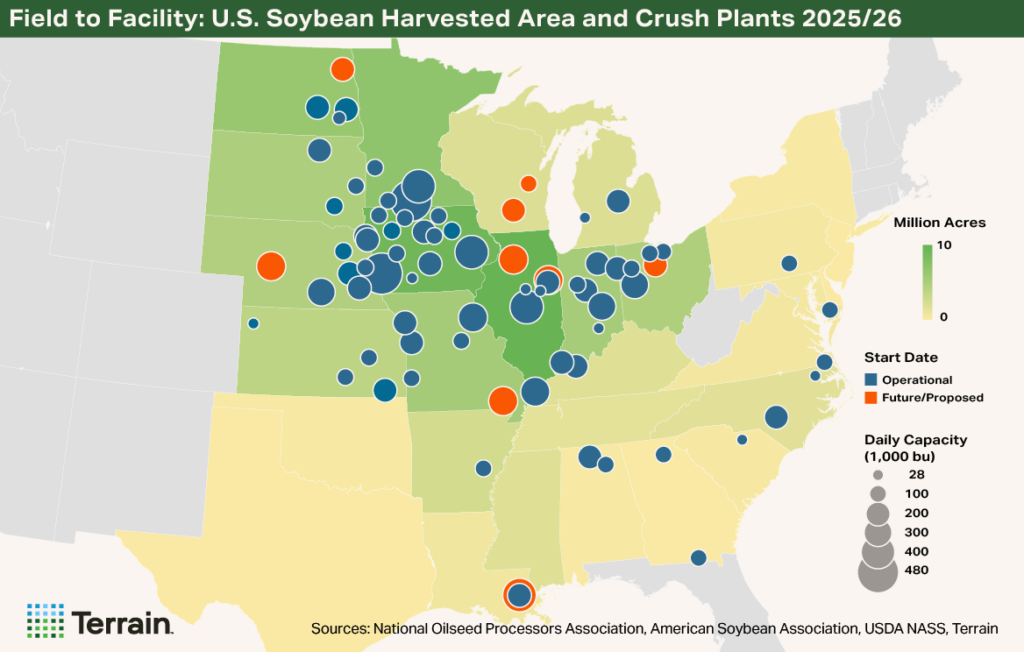

U.S. Is Crushing It

According to the USDA’s monthly Fats and Oils report, the October 2025 soybean crush hit a record 237 million bushels, a daily average of 7.65 million bushels, up 10% year over year (YOY). Two new plants — one in Nebraska and one in South Dakota — came on line this fall, supporting the USDA’s forecast of a record 2.55-billion bushel crush for 2025/26 (versus around 3 billion bushels in total U.S. capacity).

However, the National Oilseed Processors Association reported a slower crush pace in November at 216 million bushels. Soy oil stocks also increased in November, up nearly 16% from October, highlighting concerns over the fragile state of future use. Despite the decline in November, the industry should still reach the USDA’s 2.55-billion bushel crush forecast.

To secure soy oil’s role as the preferred feedstock in biofuel production, U.S. Congress must enforce 45Z tax credit restrictions to North America only, and the Environmental Protection Agency must finalize renewable volume obligations (RVOs) for 2026 to 2027, resolve small refinery exemptions (SREs), and cap renewable identification number (RIN) credits at 50% for imports.

As important as the soy oil component is to crush profitability, about 80% of a crushed soybean is soymeal.

These decisions will determine if the biofuel industry will prioritize soy oil as a feedstock and, thus, increase value to crush margins.

Meal Matters

As important as the soy oil component is to crush profitability, about 80% of a crushed soybean is soymeal. October stocks increased slightly YOY, underscoring the importance of finding export outlets for soymeal to support the future crush pace.

A record crush pace heading into spring could lower U.S. soymeal prices and boost price competitiveness in the global market.

Global soybean buyers are heavily concentrated among five countries, accounting for nearly 80% of global imports. In contrast, soymeal has a much broader and diversified customer base of nearly 80 countries, with the top 20 accounting for 80% of global utilization.

In 2024/25, U.S. soymeal exports rose 12% YOY, adding five new buyers and increased purchases from 30 other existing trade partners. While the USDA December WASDE confirmed that U.S. soymeal remains the most expensive globally, a record crush pace heading into spring could lower U.S. soymeal prices and boost price competitiveness in the global market.

New-crop 2025/26 soymeal sales are already up 8% YOY, but future export growth also hinges on competing with Argentina, the top global supplier. For 2025/26, the USDA projects Argentina’s soybean production to drop 5% to 48.5 million metric tons (MMT). With stocks at decade lows and crush expected to decline over 5%, this will reduce soymeal output by nearly 3% and soy oil by 13%.

As domestic crush sets new records, I expect U.S. soymeal exports to gain momentum.

Combined with Argentina’s unexpected soybean exports to China during the U.S. peak window, this creates an opportunity for the U.S. to backfill traditional Argentine markets — regardless of Argentina’s recent export tax reduction on soymeal from 24.5% to 22.5%.

As domestic crush sets new records, I expect U.S. soymeal exports to gain momentum, especially as global protein consumption continues to rise. As we move into the back half of the crop year, look to countries in the EU, Southeast Asia and the Middle East to increase purchases from the U.S. instead of Argentina.

Don’t Bet the Farm on China

The U.S. soybean industry faces a structural shift that short-term trade truces or temporary Chinese purchases cannot fix longer term. Persistent global oversupply, led by Brazil, and China’s declining demand require a strategic pivot toward other markets.

Farmers should be ready to reward market rallies related to headlines that China is buying U.S. soybeans.

As of the December WASDE report and current pace of export sales commitments for whole-bean soybeans, I estimate the USDA’s 2025/26 export forecast of 1.635 billion bushels is overstated by 150 million to 200 million bushels, even if China meets 440 million bushels or 12 MMT in the short term.

Unless domestic crush continues to break records, the export shortfall will put downward pressure on soybean prices. The shortfall will go directly to domestic ending stocks exceeding 400 million bushels.

Farmers should be ready to reward market rallies related to headlines that China is buying U.S. soybeans. Markets will be otherwise challenged if 2026 U.S. soybean acreage reaches the USDA’s preliminary baseline projection of 85 million acres (up 5% YOY). South America’s current weather outlook is favorable, and Brazil’s soy moratorium (rainforest deforestation) decision in late December could further boost global supply.

What to Watch

Farmers must stay agile, know their production break-even costs, and capitalize on price rallies amid volatility. Futures prices will likely continue to hover around $10/bu. to $10.50/bu. until China confirms a trade deal, South America has a weather threat, and/or biofuel clarity unfolds.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.