Report Snapshot

Situation

California almond prices have risen in the past year. Costs, however, have risen in nearly every category as well, impacting overall profitability for producers who are establishing an orchard or farm an existing one.

Finding

For farmers considering establishing an orchard, knowing your break-even year and break-even price is incredibly useful for understanding the return on investment and risk. For farmers with an existing orchard, knowing the break-even price is important for cash flow planning and can guide decisions around making expansions.

Outlook

With fewer almonds being planted, there could be real opportunity for farmers wanting to plant now, and having a cost or yield advantage has never been more important.

After years of excessive carry-ins in the almond industry, supply is now manageable. As a result, almond prices have crept up slowly. Whereas the low in 2022 was $1.40 per pound, prices in the spot market are currently $2.57 per pound,1 an impressive rise.

Price increases, however, have not necessarily brought us back to the boom times of the 2010s. Though caution should be taken in comparing cost assessments throughout the years, a UC Davis cost study from 2016 put total operating costs in the north part of the Central Valley at $2,251 per acre. In 2024, the UC Davis study estimated total operating costs at $3,807 per acre, a 69% increase.

These developments prompt important questions about the evolving economics of almond production for growers with different cost structures:

- How has the break-even year to get a positive return in orchard establishment changed?

- What is the break-even price point for existing orchards?

New Orchard Break-Even Year

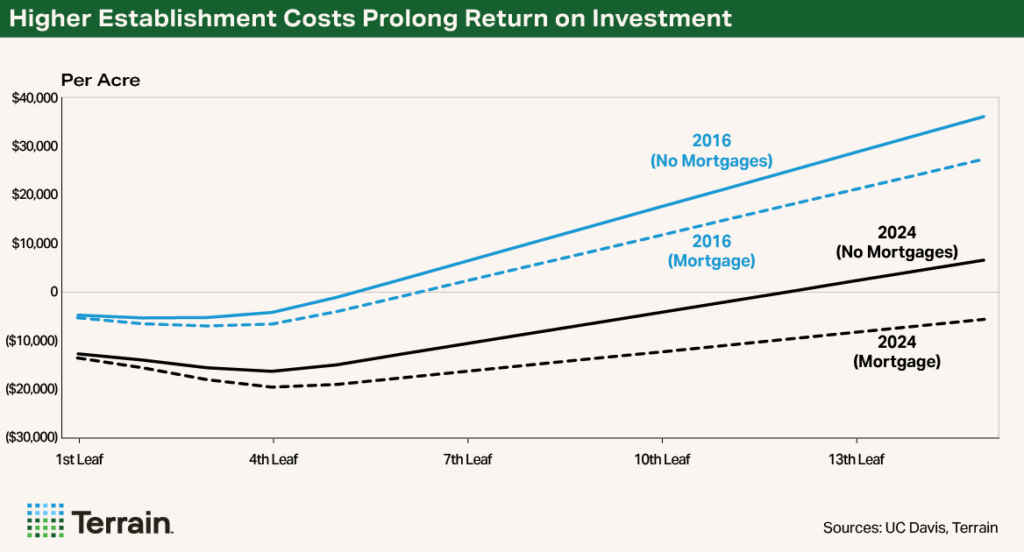

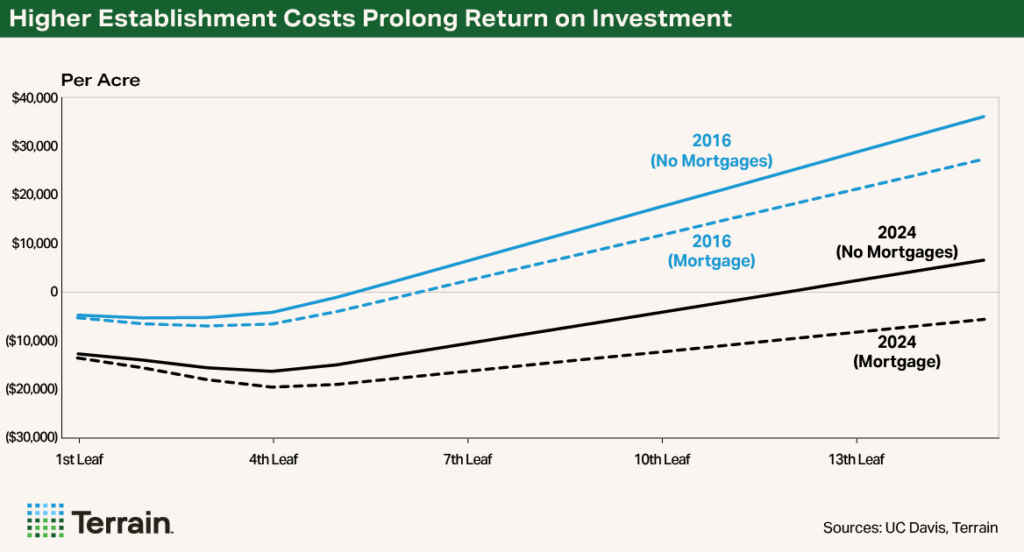

Let’s start with the break-even time after orchard establishment. Evaluating this investment requires many assumptions. For this brief analysis, I assume the following:

- Yearly operating costs cited in the UC Davis cost studies for northern San Joaquin Valley in 2016 and 2024.2

- A price of $2.70 per pound in both years.

- A land purchase price of $10,000 per acre (100 acres total).

- Yields of 500 pounds per acre in third leaf; 1,000 pounds per acre in fourth leaf; 1,900 pounds per acre in fifth leaf; and 2,200 pounds then on.

- A 30-year mortgage rate of 4% in 2016 and 7% in 2024.

The most striking result from this exercise is how much longer it takes to return a farmer’s investment in 2024 than in 2016, assuming the same price of almonds. In 2016, the breakeven of a farmer’s investment occurs around the sixth year with no land debt and the seventh year with land debt. In 2024, the breakeven occurs in the 12th year with no land debt and there isn’t a breakeven until the 20th year for farmers with land debt.

The large increase in cost and delayed break-even year explain the sharp drop in new plantings of almonds in recent years.

The large increase in cost and delayed break-even year explain the sharp drop in new plantings of almonds in recent years as growers reassess the decision to plant or replant. Whereas new almond plantings were once well over 100,000 acres per year, they were under 30,000 acres in 2023.

Break-Even Price

For existing orchards, my analysis shows the break-even price above operating costs for a 2,200-pound yield was $1.02 per pound in 2016 and $1.73 per pound in 2024. Including mortgage debt from the establishment analysis brings the break-even price to $1.29 per pound in 2016 and nearly $2.10 per pound in 2024, a 63% increase.

Having a cost or yield advantage has never been more important, as the risk profile has increased.

Know Your Breakeven

For farmers considering establishing an orchard, knowing your break-even year and break-even price once in production is incredibly useful for understanding the return on investment and the risk associated with it. With fewer almonds being planted, there could be real opportunity for farmers wanting to plant now. Having a cost or yield advantage has never been more important, as the risk profile has increased.

For farmers with an existing orchard, knowing the break-even price is important for cash flow planning and can guide decisions around making expansions. Despite increasing prices, margins can still be thin if you’re not managing your costs carefully.

ENDNOTES

1 U.S. Standard Sheller Run assuming a 45-cent margin off the free aboard ship price.

2 Reviewing the UC Davis cost studies will clarify what they cover. While the studies are useful for identifying trends, each study is distinct and not perfectly comparable. All assumptions should be revaluated grower to grower.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.