Outlook

The U.S. dollar is expected to remain elevated above the pre-COVID average in 2023, but it is expected to remain below levels observed in mid-2022. The U.S. dollar is also expected to remain relatively stable in the near term against the currencies of many of the major U.S. export partners for agriculture.

Impact

In the very near term, I expect that the U.S. dollar will remain relatively stable, with perhaps some slight softening. I also expect that in 2024, the U.S. Federal Reserve will have a less aggressive monetary policy and a less rosy economic outlook than it does currently. These and other factors could lead to additional softening in the U.S. dollar, which would be a tailwind for exporters of U.S. agricultural goods.

Background

The U.S. dollar has remained surprisingly strong during the past year and a half. Its record strength in 2022 was difficult for U.S. exporters. While the U.S. dollar has softened from the peaks in 2022, it remains relatively strong compared to recent averages. As the marketing year nears the end for many U.S. agricultural commodities, export market strength (and thereby exchange rates) will again be the focus of much discussion.

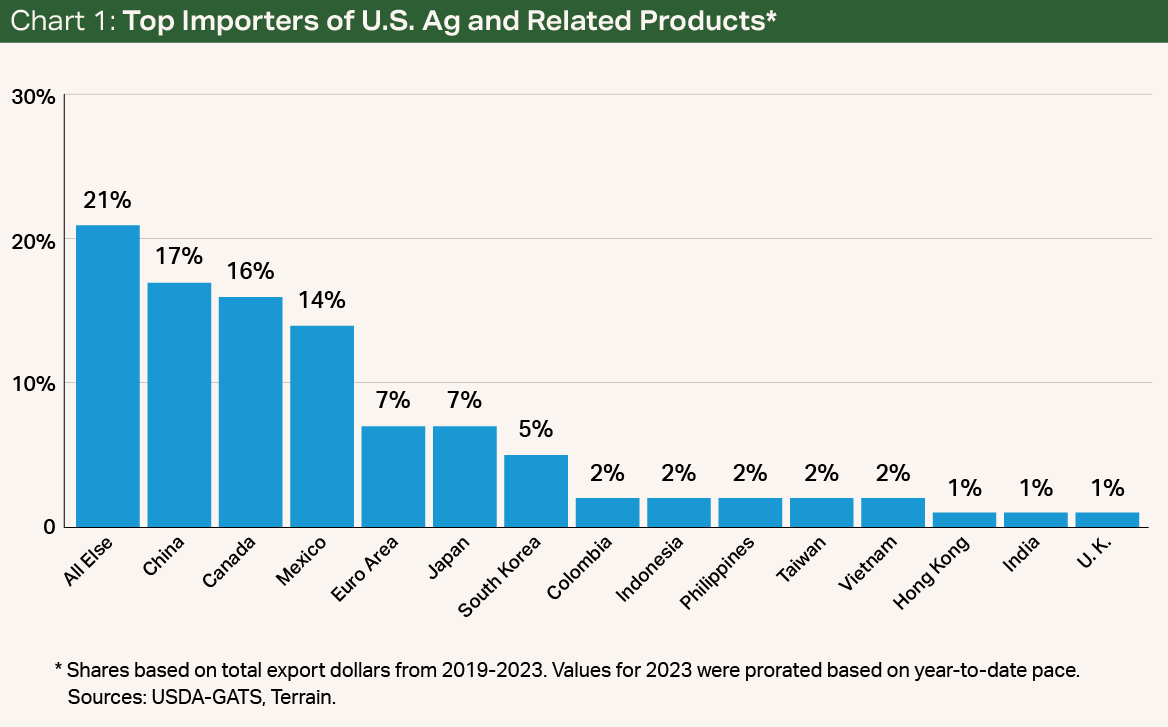

When discussing exchange rates, it is important to establish which currencies are most impactful to U.S. agricultural exports. U.S. agriculture enjoys a wide base of trade partners, with the Global Agricultural Trade System tracking around 190 trade partners for U.S. agricultural and related goods from 2019 through April 2023. However, roughly 14 trade partners account for about 79% of total exports.

Countries using the euro are recorded together as the “Euro Area” for discussion purposes. Chart 1 depicts the relative weight of each of these partners and their currency. Keep in mind that the “All Else” category represents about 160 trade partners.

After factoring out the U.S., the top 14 trade partners for U.S. agriculture represent around 70% of global GDP, 56% of global population and more than 85% of non-U.S. dollar currencies held in global reserves. Therefore, the exchange market is active enough on many of these currencies to establish a baseline by which to compare the relative exchange rates.

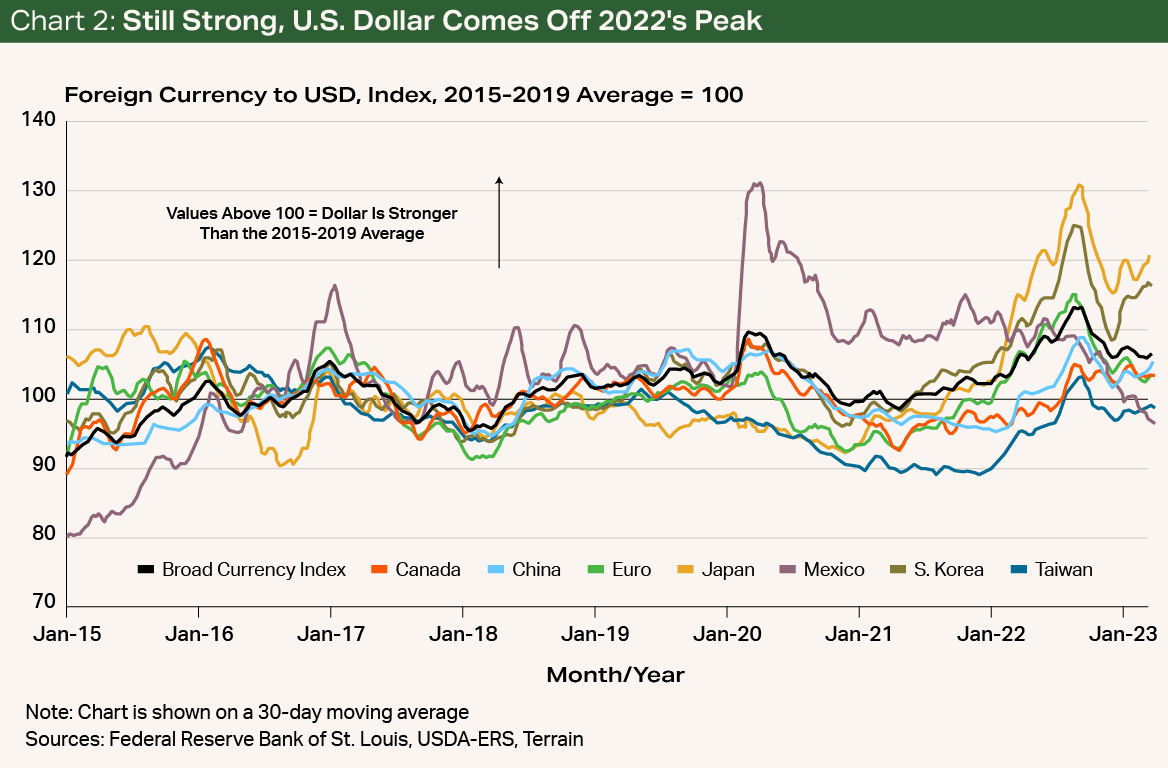

Chart 2 represents the value of top trade partners’ currencies against the U.S. dollar. In this chart, a value above 100 indicates that the U.S. dollar is stronger than the respective currency relative to the average exchange rate from 2015 to 2019.

Notably, the U.S. dollar has remained relatively strong against other currencies, with the exception to recent softening against the Mexican New Peso and the New Taiwan Dollar. The U.S. dollar has also remained strong relative to the Federal Reserve’s nominal broad U.S. dollar index, which is meant to reflect a large basket of currencies. However, it is important to note that the U.S. dollar has softened modestly from the peaks observed in mid-2022, representing a boost for U.S. exporters.

The impact of exchange rates on agriculture is felt most acutely in commodities that rely heavily on export markets such as almonds, cotton, soybeans, walnuts, etc. For commodities that are mostly exported, as opposed to consumed in the U.S., exchange rates are one of many factors that influence price. All else being equal, a stronger U.S. dollar lowers the purchasing power of importers and can blunt demand for American goods.

Looking Forward

Exchange rates are notoriously difficult to forecast over the long term. In a perfect world, exchange rates are a simple function of a country’s supply of currency, inflation, interest rates, and the economic and political health (or a blend of the monetary and fiscal policies that drives the return-on-investment versus safety of the asset). However, economic literature repeatedly proves that the U.S. dollar and other currencies can be more volatile than what is seen in economic models. In other words, the real world gets messy.

I do expect that the U.S. dollar will remain relatively stable, with perhaps some softening, compared to the currencies of its top agricultural trade partners in the near term. In the short run, it is also unlikely that the U.S. dollar will sharply increase back to the peaks observed in mid-2022. Taking a longer view, the strength of the U.S. dollar will be extremely important to monitor, as the U.S. Treasury is expected to issue close to $1 trillion in Treasury Bills over the coming months. Additionally, I expect that in 2024, the Federal Reserve will have a less aggressive monetary policy and the economic outlook is somewhat less rosy than current conditions. These and other factors could lead to additional softening in the U.S. dollar, which would be a tailwind for exporters of U.S. agricultural goods.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.