Outlook • May 23, 2025

How Many Beef Cows Does the U.S. Industry Need?

Article Originally Published in the May Issue of the National Cattlemen Magazine.

Key Takeaways:

- The national cow herd does not need to grow back to the size it was at the 2019 peak. A larger-than-now but smaller-than-before national cow herd could balance cattlemen’s profits with consumer demand.

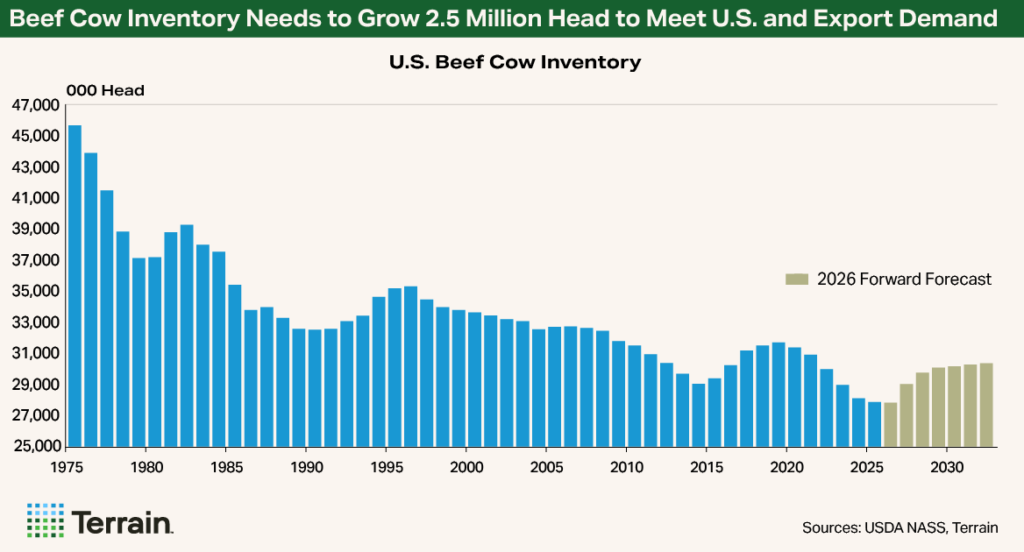

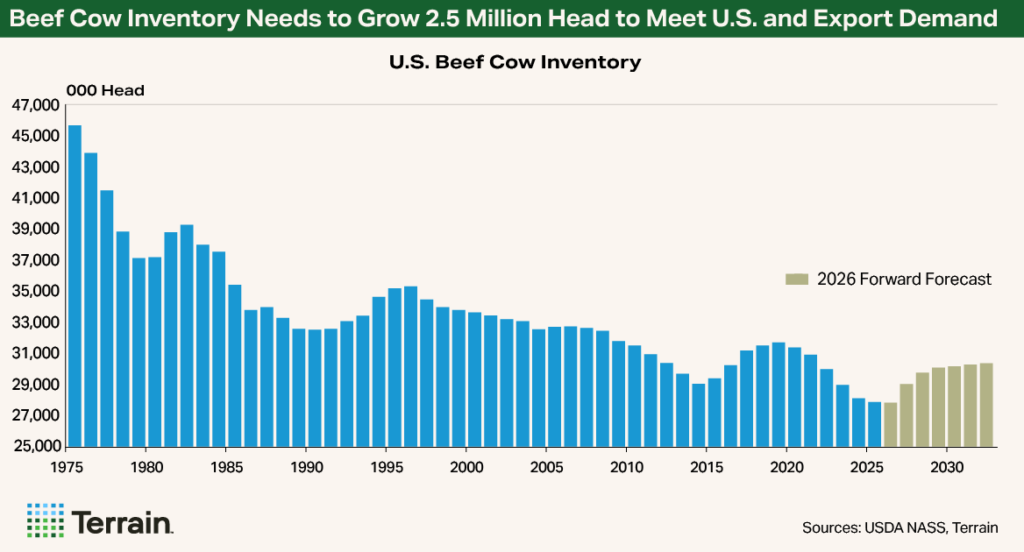

- An additional 2.5 million beef cows would produce enough calves and beef to keep domestic per capita beef supplies consistent with recent levels and grow supplies for export growth.

- Continued strong beef prices in 2025 may get ranchers’ financial positions and balance sheets to the point where retaining heifers feel like a good decision.

The USDA January 2025 Cattle Inventory report confirmed what many industry analysts and cattle producers suspected: beef cow numbers continue to shrink and beef replacement heifer retention has yet to begin.

U.S. beef cow numbers on Jan. 1, 2025, totaled 27.86 million head and were the smallest reported since 1961. The herd has dropped 3.6 million head since the current cycle’s peak at the beginning of 2019. The drop has coincided with drought conditions across the western and central plains, poor profitability for many ranchers due to rapidly escalating costs, retirements, limited labor availability and limited grazing resources.

These factors have also played into why herd rebuilding hasn’t happened in a notable way yet. Given these challenges, I’ve started to wonder—how many more cows do we need to add when we rebuild?

Maintaining Per Capita Supplies

How many cows the industry needs is a question of how many calves will it take to keep beef supplies at a level where prices stay fairly constant, as happened in 2003 to 2007 and 2016 to 2019.

I think most in the industry could find a way to be happy if consumer beef availability was equal to the 58.5-pound per capita average of the past five years. The volume was created with a couple of record beef production totals, as well as a strong export market. The volume delivered strong profits and prices for the cattle supply chain.

Keeping per capita beef supplies isn’t as easy as it sounds. We need to grow supplies for domestic population and export growth – after what will be a 2-billion-pound gap caused by the heifer retention required to grow cow numbers. To keep per capita beef supplies at that 58.5-pound level in 2027, we’d need about 28.8 billion pounds of total net beef supplies.

It would require an additional 2.5 million beef cows to produce enough calves and beef to meet these needs. This herd size is more than 1 million fewer cows than the 2019 peak and would be slightly larger than what we had in 2022 and 2012.

What Will Incentivize Rebuilding?

For the beef cow breeding herd to begin the rebuilding process, heifer calves must be retained at the ranch level. Shrinking cow slaughter alone is not enough.

In 2024 beef cow cull slaughter removed about 2.9 million head from the breeding herd, while beef replacement heifers that calved during 2024 only added an estimated 3.0 million head—a slight net-positive only in the impossible event that there are no other cow losses.

Looking ahead to 2025, beef cow slaughter is expected to decline and remove about 2.65 million cows from the herd, while my forecast shows the number of beef replacement heifers bred during the summer of 2024 and calving this spring to total only 2.7 million head. This portends another year of possibly stable, but likely declining, cow numbers for Jan. 1, 2026.

So far in this cattle cycle, the profit signal has not been large enough to offset the challenging factors listed at the beginning of this article in order to elicit existing ranchers to grow numbers or to attract new cow-calf producers.

A Larger-Than-Now, But Smaller-Than-Before Herd

Buoyed by consumer demand, beef prices should stay strong. During 2024, real (deflated) per capita consumer expenditures for beef, using the USDA all-fresh retail beef prices, was up 4.5% compared to a year earlier, and demand was up 4.0%. Similar gains for the industry have been occurring monthly for more than 30 months.

Strong beef prices may get ranchers’ financial positions and balance sheets to the point where retaining heifers may feel like a good decision.

The national cow herd does not need to grow back to the size it was previously to sustain the industry into the future. A larger-than-now but smaller-than-before national cow herd could balance cattlemen’s profits with consumer demand.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.