Report Snapshot

Situation

Top U.S. dairy export destinations such as China, Japan and South Korea are experiencing aging and shrinking populations. Meanwhile, areas like Western Africa, Eastern and Southeastern Asia are due to see rising incomes and population growth in the years ahead, creating an opportunity for dairy demand growth.

Finding

The best strategy for continued growth in dairy exports targets regions with a relatively younger median age and incomes on the rise.

Impact

Navigating the unexplored territory of aging populations will require a different approach from what may have worked with existing trade partners over the past 20 years due to diverse cultures and dietary preferences.

Populations are aging and shrinking among some of the biggest dairy-consuming regions of the world, including our top dairy export destinations such as China, Japan and South Korea. Older consumers generally demand fewer dairy products. This doesn’t necessarily mean that total demand will slow, but it does mean the U.S. dairy industry needs to be strategic about where and how we target new demand opportunities.

Global population peak is still decades away, but Terrain's research finds that among some of our biggest export destinations, it has already happened. Additionally, we find that in most cases, long before that peak arrives, tastes and preferences begin to shift as populations age and incomes rise.

Understanding these trends is important for understanding the future opportunities and needs of export markets, which have grown to be a crucial outlet for U.S. produced milk.

Understanding these factors and targeting region-specific needs could strengthen the U.S. position in global dairy export markets.

In the years ahead, rising incomes and population growth in areas like Western Africa, Eastern and Southeastern Asia will create an opportunity for dairy demand growth. These regions underperform in per capita dairy consumption when evaluated on the age and income of their populations.

This growth, however, will require a different approach from what may have worked with existing trade partners over the past 20 years due to the diverse cultures and dietary preferences. Understanding these factors and targeting region-specific needs could strengthen the U.S. position in global dairy export markets.

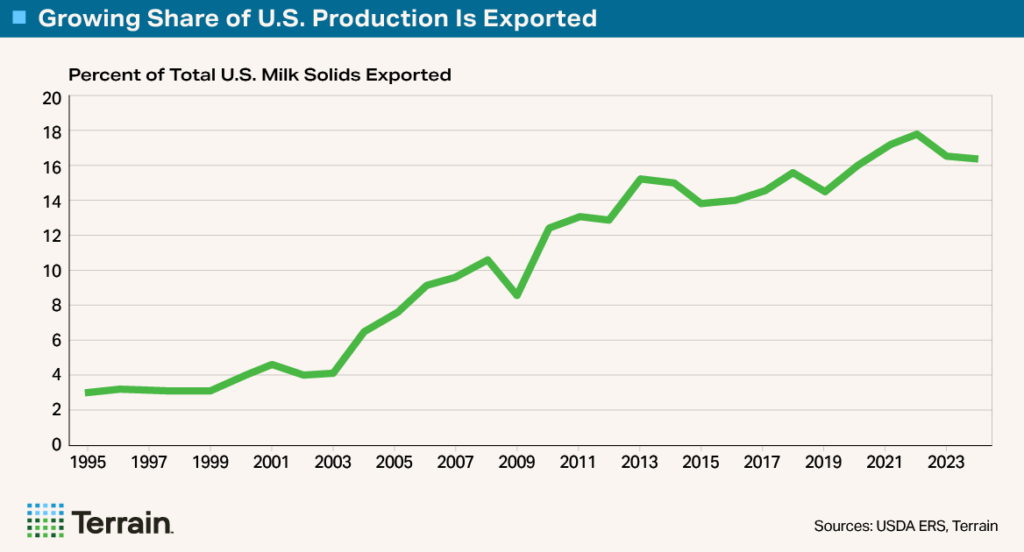

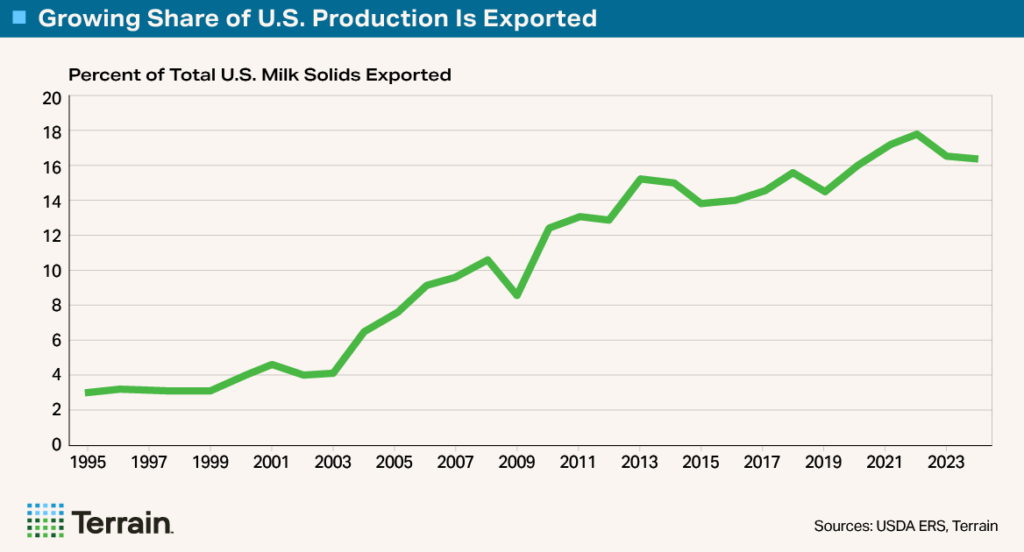

Growing Importance of Export Markets

Export markets have grown in importance in recent decades. Before 2000, dairy exports represented less than 5% of production annually. In the 2020s, so far, 16% to 18% of milk production has been exported. The share of value from exports, or the percentage of the average milk check from exports, has been in a similar range, peaking at 18% in 2022 and totaling over $9.5 billion. U.S. dairy farmers have benefited from the export growth, both in terms of clearing surplus milk from the market as well as gaining substantial income.

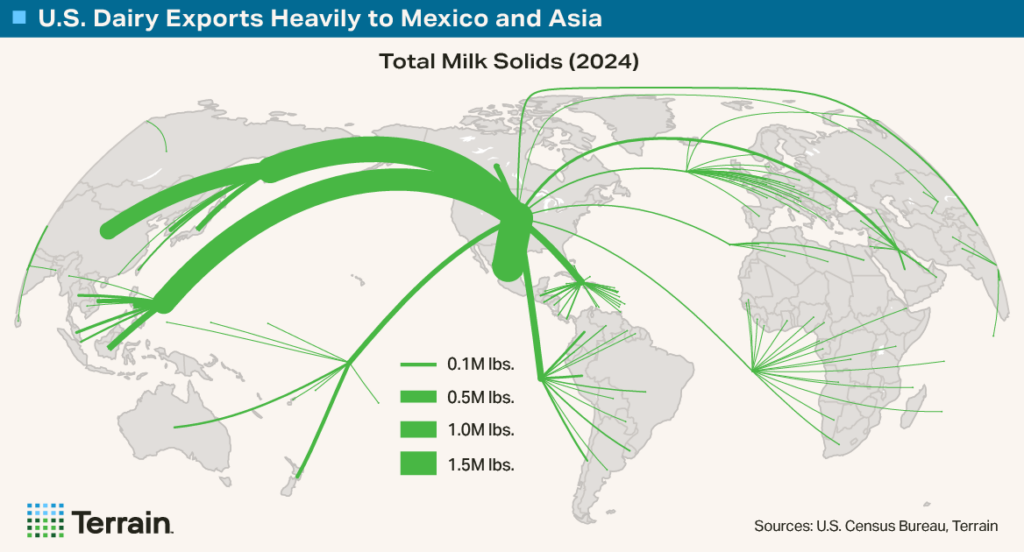

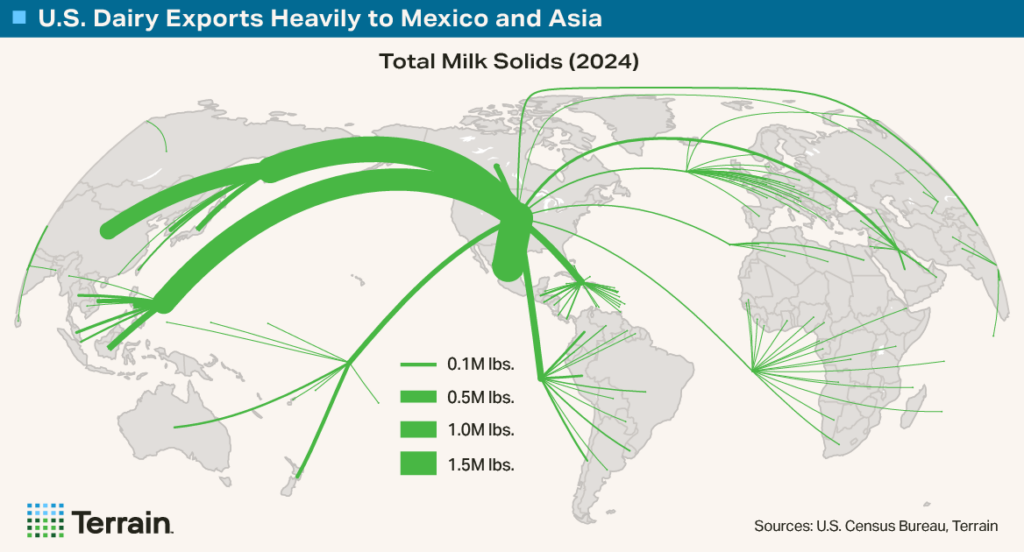

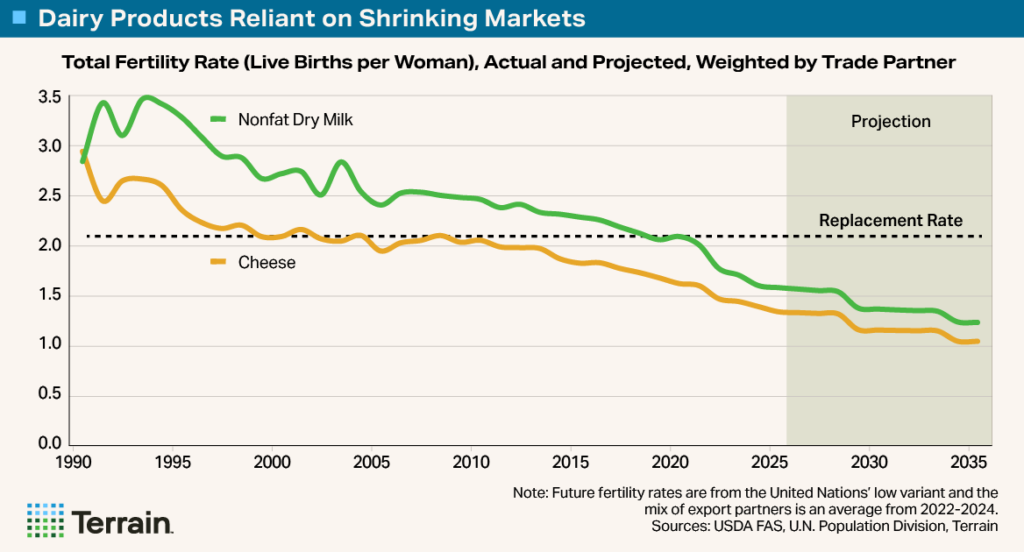

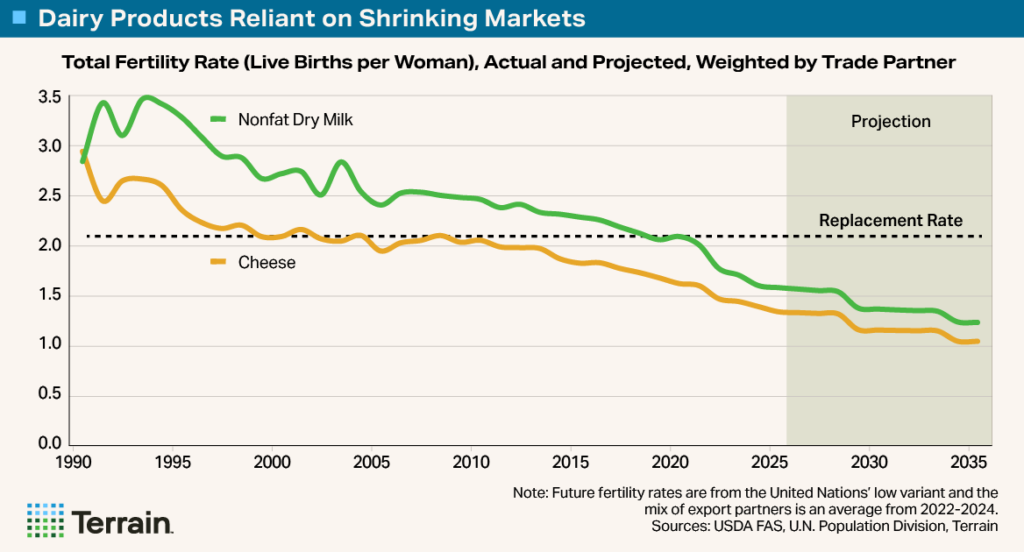

The U.S. dairy industry has developed a diverse portfolio of export destinations. In 2024, exports of dairy products from the U.S. found their way into 127 different countries, but on a total solids basis most of those exports were concentrated in Mexico, Eastern Asia and Southeastern Asia. While these markets have enabled strong growth in global market share for U.S. dairy so far, they have left us potentially overleveraged in shrinking markets, where the fertility rate is dropping below the replacement rate of just over 2 children per woman on average. When average fertility rates fall below this level, the population will begin to decline barring any changes in net immigration.

What Drives Demand?: Population Growth vs. Per Capita Consumption

To understand where opportunity for future global demand may be growing and where it might be slowing — or at least changing — it’s worth surveying the current landscape.

To divide the world into manageable regions, I used the United Nations M49 standard, breaking the world into 22 geographic areas. Data from the U.N. Food and Agriculture Organization food balances were used to determine total dairy and individual product utilization. U.N. data were also used for population data, including median age, and GDP per capita data were from the World Bank.

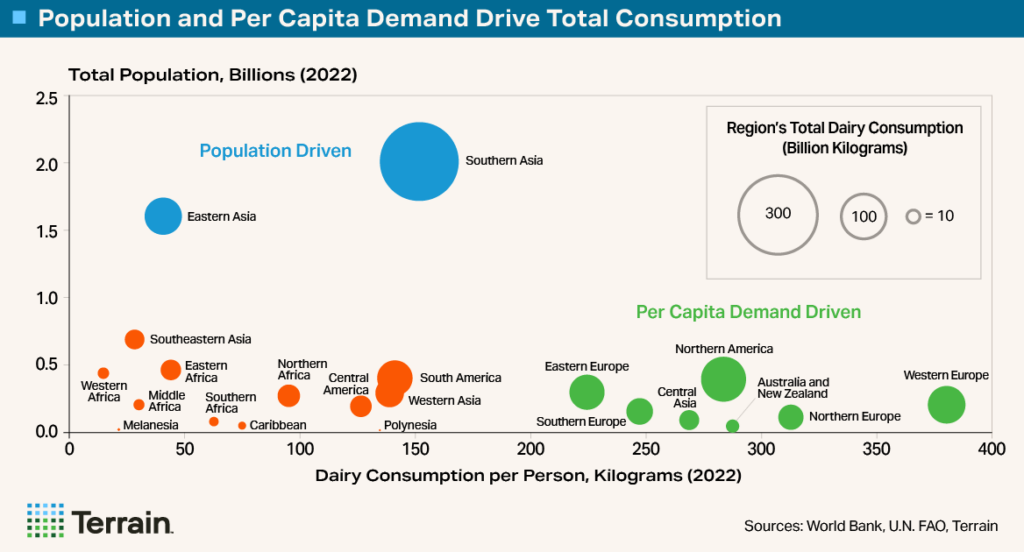

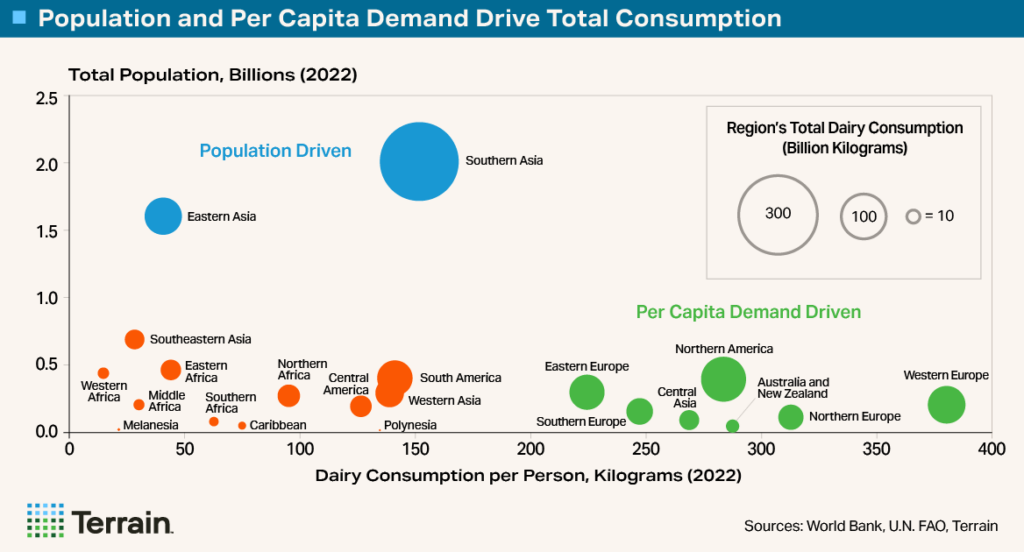

In terms of total milk consumption (including the conversion of all dairy products into a total milk equivalent), Southern Asia dominates among regions, powered by India and Pakistan. Importantly, about half the milk in the region is buffalo rather than cow’s milk, much of it is distributed through informal channels, and very little of it crosses borders.

Some of the most substantial growth in dairy consumption in recent history has come from regions where population is the main driver of demand.

Northern America and Western Europe come in second and third place, representing both major milk and dairy product consumers as well as global exporters. Meanwhile, Sub-Saharan Africa and the Oceanic regions of Melanesia, Polynesia and Micronesia are some of the lowest dairy-consuming regions of the world.

There are two primary levers that can drive total consumption: per capita consumption and population. A region with many people, each consuming small amounts of dairy, can consume the same amount as a region with fewer people whose diets prominently feature dairy.

Some of the most substantial growth in dairy consumption in recent history has come from regions where population is the main driver of demand. These populations are at the low end of milk per capita consumption, at least when compared with mature dairy regions like North America and Western Europe. But booming populations drive total demand higher.

Shifting focus to per capita growth in regions with large populations or that have mixed drivers (population and per capita demand) could provide the biggest win for total dairy demand growth into the future.

Eastern Asia, which includes China, has similar total milk consumption as Western Europe. However, on a per capita basis, each person within that massive population only consumes about 13% of what their Western European counterparts do. Importantly, this analysis does not look at feed use, so it does not include whey products consumed for pig feed.

Past wins are due to moderate demand improvements in booming populations, but the industry will need to be more strategic if it is to boost per capita demand going forward. Understanding some of the macroeconomic drivers of per capita demand can help shed light on the situation.

Is There Room for Dairy Demand Growth in an Aging World?

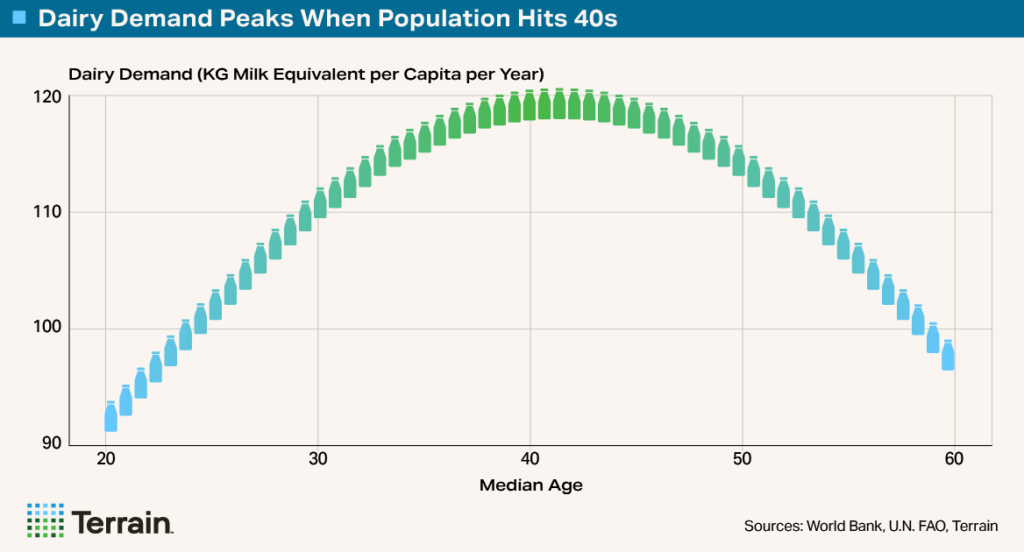

To understand how aging and incomes impact milk consumption, I developed a model to understand how total milk consumption (in all forms, per capita) is affected by demographic indicators, including the median age of the population and per capita GDP between the years 2010 and 2022.

It appears that dairy demand climbs as median age increases on the younger end of the spectrum before eventually peaking and declining as a population skews older.

In reality, the drivers of demand for dairy are a complex mix of social, geographic, cultural and historical factors that can be hard to quantify. Still, examining the data reveals useful insights.

First, demographics matter, but not in the simple sense that older populations consume less dairy. In fact, it appears that dairy demand climbs as median age increases on the younger end of the spectrum before eventually peaking and declining as a population skews older. Based on the model, this peak generally appears to happen when a country’s median age rises above 40.

Higher incomes tend to lead to higher dairy consumption.

The other important dynamic underlying these demographic shifts is income, as measured by per capita GDP. Higher incomes tend to lead to higher dairy consumption. The model suggests that every $1,000 increase in per capita GDP translates to about a 1.4% increase in total per capita dairy consumption. However, it’s likely that regions with low baseline per capita GDP and low dairy consumption would follow a different path with larger steps up in dairy consumption following modest income gains.

Taking these results together, the best strategy for continued growth in dairy exports targets countries that are growing in population, with a median age in the 30s.

Taking these results together, the best strategy for continued growth in dairy exports targets countries that are growing in population, with a median age in the 30s. In addition, since GDP is a significant predictor of dairy demand, countries with rising GDP per capita should be prioritized, with higher-GDP per capita regions presenting opportunities for higher-value products.

Lastly, the results of the model highlight that variation within a region over time was much less dramatic than variation between regions. This has two implications: First, dietary patterns within a region do not shift quickly. Second, these regions are distinct and unique and will require different approaches when looking to grow dairy consumption. Tailoring marketing strategies to match the unique differences of each region will be more beneficial than assuming that what worked for one region will work in another.

The dairy industry benefits from programs that focus on understanding and developing new export markets. These include efforts from the U.S. Dairy Export Council and programs such as the National Milk Producers Federation’s Cooperatives Working Together program and its successor, the NEXT program. Independent dairy processors and dairy brands have also developed their own international marketing efforts in recent years.

Regional Opportunity

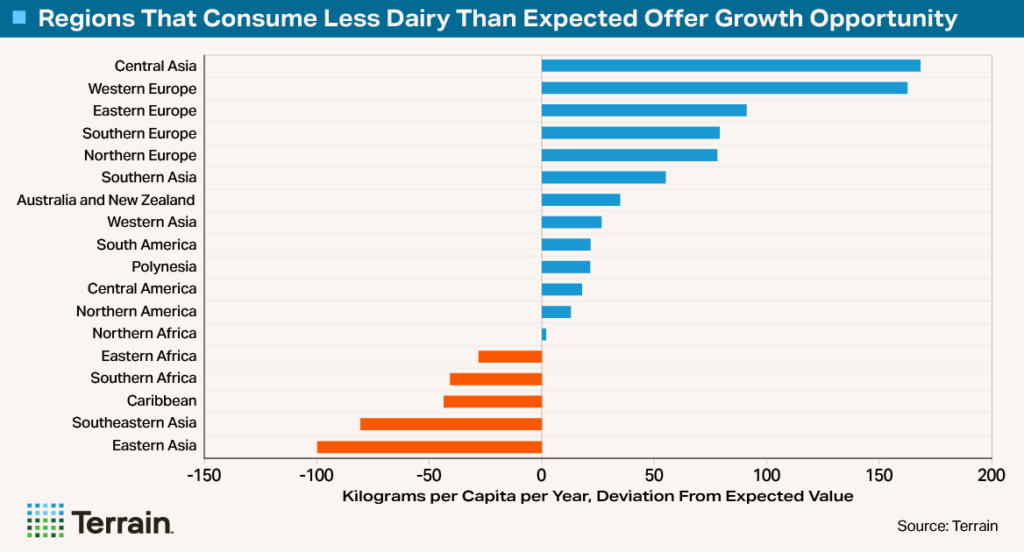

To understand where future opportunities might lie, we can look at which regions over- or underperformed in terms of total dairy consumption compared with what the model would predict based on their per capita GDP.

Traditional dairy-producing and -consuming regions like Northern America, Western Europe, Australia and New Zealand tend to perform in line with or better than expectations. Other regions — including Africa, the Caribbean and Eastern and Southeastern Asia — under-consume dairy compared with what the model would predict.

This suggests that the reasons for lower milk consumption could be engrained cultural and dietary differences, but it also suggests that efforts to understand these differences and find where tastes and preferences could shift will pay off.

Last, in the case of Southeastern Asia and Eastern Asia, population growth has driven dairy demand the past several years, but plenty of opportunity remains in continuing to drive per capita consumption.

Rising Incomes Drive Demand Toward Cheese and Butter

Drilling down to individual dairy product demand, there is a pattern of increasing demand for higher-value products like cheese and butter, which increase with age and income as measured by GDP per capita.

Total cheese demand for a given region increases as both median age and income rise. Butter demand, meanwhile, is not as sensitive to the age of a population but strengthens as incomes rise. Fresh milk and yogurt consumption increases with age, but as with total dairy demand, the rate of increase declines as median age climbs.

Neither fresh milk nor yogurt consumption is influenced by income. Fresh milk and yogurt consumption likely depend more on cultural and dietary factors like lactose tolerance, which would make a region either a consumer or non-consumer of these products with minimal change as incomes rise.

Global demand will continue to increase but in ways that differ from the growth of the past 25 years.

Industry Investments in Global Marketing Programs Matter

As the U.S. dairy market has matured, global demand has offered an opportunity for the sector to continue to grow. Global demand will continue to increase but in ways that differ from the growth of the past 25 years. Modeling the factors that drive dairy demand is a useful starting point, though we have limited historical experience with aging populations.

Income and age are important, but the relationships to dairy demand are not linear. For example, when a region’s median age is low, dairy demand growth is strong. As median age increases, demand growth peaks and declines.

Navigating some of the unexplored territory of aging populations will require different approaches to new and existing partners. Current demand centers may see a shift toward higher-value products, and it will take significant effort to tailor marketing approaches to develop new markets where population is growing and/or income is increasing.

As an industry, investment in these marketing efforts pays off, and the growth potential that it will enable will allow for continued expansion of the U.S. dairy sector. Aging and declining populations do not spell the end of dairy growth, but assuming that we can rely on the same markets and strategies that drove growth over the past 25 years could put that potential expansion at risk.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.