There has been little change in the trajectory of the U.S. wine market over the past three months.

The good news is that the contraction in wine sales does not appear to be steepening. The less good news is that there are no tangible signs of improvement either — the market seems to have settled into a state of steady decline.

The post-pandemic new normal for wine remains elusive. But, given continued economic uncertainty and headwinds that consumers are facing, I do not see any compelling reasons to expect a major change in market dynamics anytime soon.

Retail Sales Trends

Off-premise retail sales for the 12 weeks ending August 5 were off 4% by volume versus the same period last year, while value was flat, based on my analysis of NIQ data. SipSource figures, which include the on-premise channel, indicate that distributor depletions fell by 6% on a year-over-year basis for the three-month period ending in July.

Retail sales continue to decline across the price spectrum. The recent pattern remains intact: The middle tier ($11 to $30) continues to hold up better than the lower and upper ends. Some consumers are trading down from the upper to the middle tier, but price taking also explains part of the stronger performance, as it has pushed some lower-tier brands above the $11 threshold.

Imports continue to slowly take share from domestic wines. While no major category is growing in absolute terms, sales of sparkling and white wines are still outpacing those of red varietals and rosé, which represents a continuation of a trend that has been in place for some time.

Direct-to-Consumer Trends

The direct-to-consumer (DtC) channel is still struggling as well. Based on my analysis of data from Sovos/ShipCompliant and Wines Vines Analytics, DtC shipments fell 9% by volume and 4% by value for the three months ending in July relative to the same period in 2022.

Shipments by California wineries are roughly in line with the overall trend, and volume declined in each of the state’s primary DtC regions (Napa, Sonoma and the Central Coast).

The shipment statistics provide only a partial view of the DtC channel. But data from Community Benchmark suggests that the slump is not limited to shipments: Among the 500-plus wineries Community Benchmark tracks, tasting room sales fell 10% in dollar terms during the first half of the year versus a year earlier and average visitor counts dropped 12%.

Outlook

There are multiple drivers of the wine market’s malaise, including post-pandemic normalization, changes in demographics and consumer preferences, and shorter-term economic forces.

Demographics and consumer preferences tend to evolve slowly, so the economy is likely to be the definitive driver of change in the near term.

Despite the Federal Reserve’s ongoing monetary policy tightening regime, the U.S. economy continues to defy expectations and there is still no recession in sight. GDP growth came in at a respectable 2.1% in the second quarter and unemployment remains below 4%. Inflation continues to abate, though it is still well above the Fed’s 2% target.

Demographics and consumer preferences tend to evolve slowly, so the economy is likely to be the definitive driver of change in the near term.

Even so, consumer sentiment slipped in August following a rise earlier in the year as households continue to feel pressured by inflation and are concerned that the job market is softening. Confidence indicators still sit at levels typically associated with much weaker economic conditions. Despite weak confidence, consumer spending remains robust, though this has not benefited the wine market.

The economy and consumers will continue to face headwinds going forward. For one, households have now spent much of the excess savings they built up during the pandemic. And it will become more difficult to fund purchases using credit cards, as interest rates have risen sharply and are now expected to stay higher for longer, with progress on inflation likely to slow from here.

Student loan payments will also resume in October, which is likely to depress spending. The overall impact is expected to be modest, but wine may be more vulnerable; compared with people who have less than a college degree, college graduates are overrepresented in the wine consumer base.

Given this backdrop, I do not see a compelling reason to expect a major shift in the trajectory of the wine market in the near term — in either direction. Wine has had its ups and downs before. It will rise again, but it is not possible to say when.

In an environment characterized by shrinking wine sales, producers will need to focus on understanding what consumers want and double down on their efforts to attract new customers to their brands.

In an environment characterized by shrinking wine sales, producers will need to focus on understanding what consumers want and double down on their efforts to attract new customers to their brands. It will also be important to carefully consider price increases before enacting them, at least until consumers’ heightened sensitivity to pricing begins to recede.

Grape Market

Given a lack of movement in either consumer demand or expectations regarding the size of the grape crop, there has been little change in the state of the grape market since last quarter. Activity on uncontracted fruit remains slow and pricing subdued, though market dynamics vary widely by region, varietal and quality tier.

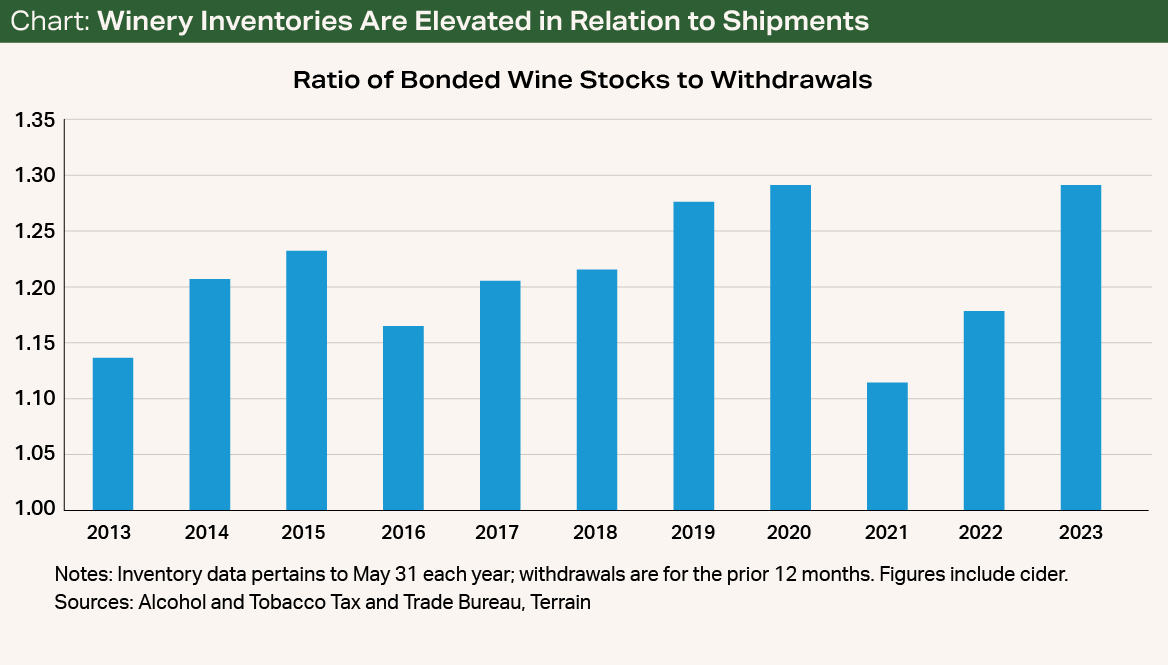

There is also plenty of bulk wine available at reasonable prices to satisfy immediate needs for most varietals and appellations. Based on the latest Alcohol and Tobacco Tax and Trade Bureau (TTB) data, which runs through May, wine inventories remain stable overall — and look reasonable relative to historical averages. However, in relation to shipments, which have fallen alongside retail sales, winery inventories look long (see chart).

The 2023 vintage has proven to be the coolest in recent history. Harvest has begun in some areas, but the grape crop is still generally running two to three weeks behind schedule, depending on the site and varietal.

There are still no firm indications of size yet, but there is also nothing to suggest at this point that the crop will turn out to be smaller than average. Growers have been combating powdery mildew in many areas, and rains associated with Hurricane Hilary have exacerbated disease pressures, particularly in the southern valley. These issues have already led to the rejection of some fruit and will reduce the tonnage that is ultimately crushed.

The delayed harvest also increases the risk of crop damage from fall rains, and potentially wildfires, and will lead to a compressed harvest and all the complications this entails.

An average-size crop would be a double-edged sword. On the positive side, it would help to alleviate the inventory issues that some smaller producers have been struggling with following three consecutive short crops. But given weak case sales trends, a return to average would be challenging for growers with uncontracted or excess fruit and potentially dampen activity and pricing heading into 2024.

Given weak consumer demand trends, growers should think carefully before deciding to make bulk wine with excess fruit, as this could be a risky proposition should the wine market continue to contract.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.