Report Snapshot

Outlook:

The One Big Beautiful Bill Act, signed into law on July 4, 2025, updated farm bill program reference prices, modified the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs, added base acres, raised commodity loan rates, enhanced premium support for crop insurance, and modified other programs such as the sugar program and dairy margin coverage

Impact:

These changes have implications for farm decisions ranging from risk management choices to financial management and tax accounting.

Following months of negotiations and passage through the budget reconciliation process in both the House and Senate, H.R. 1 - One Big Beautiful Bill Act (OBBBA)1 makes significant changes to agricultural policy, tax law, disaster assistance, conservation, energy policy, rural development and more.

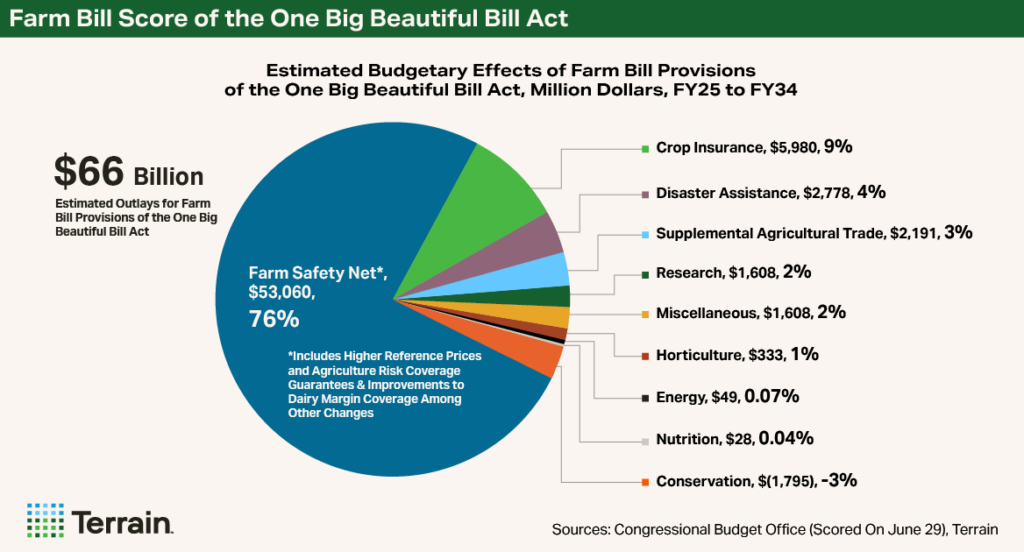

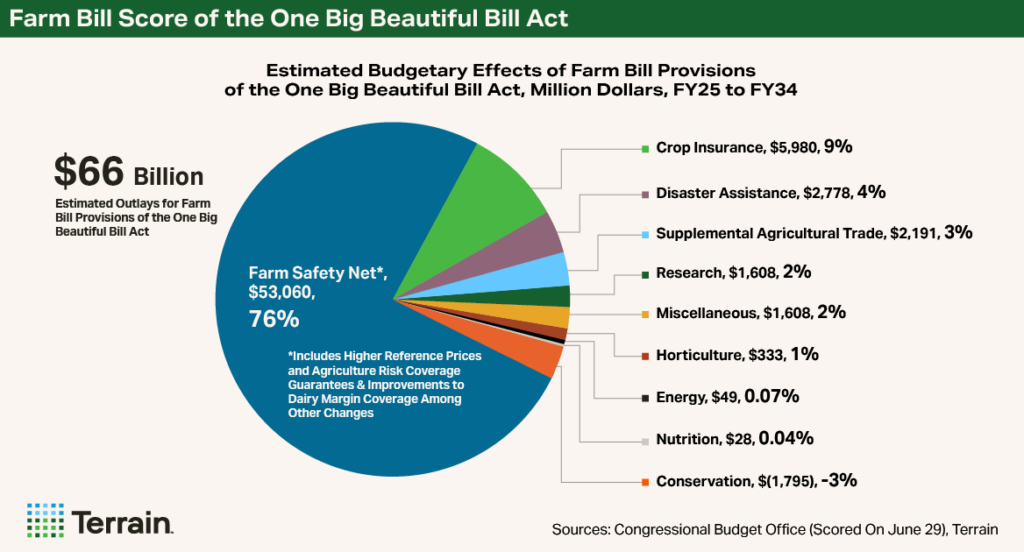

For farmers, this law represents the most substantial investment in farm bill programs since the 2002 farm bill, investing nearly $66 billion across commodity support programs, trade promotion programs, conservation and crop insurance among others.

Commodity Programs

Changes to Reference Prices

There are two reference prices that are important for the functioning of the Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) programs:

- Statutory reference price

- Effective reference price

The statutory reference price is the minimum price these programs operate against. The effective reference price is a formula price that incorporates both the statutory reference price (as a floor) and recent market prices, which allow the level of support for these programs to rise following periods of higher prices. (For a detailed overview of ARC and PLC, see this explainer).

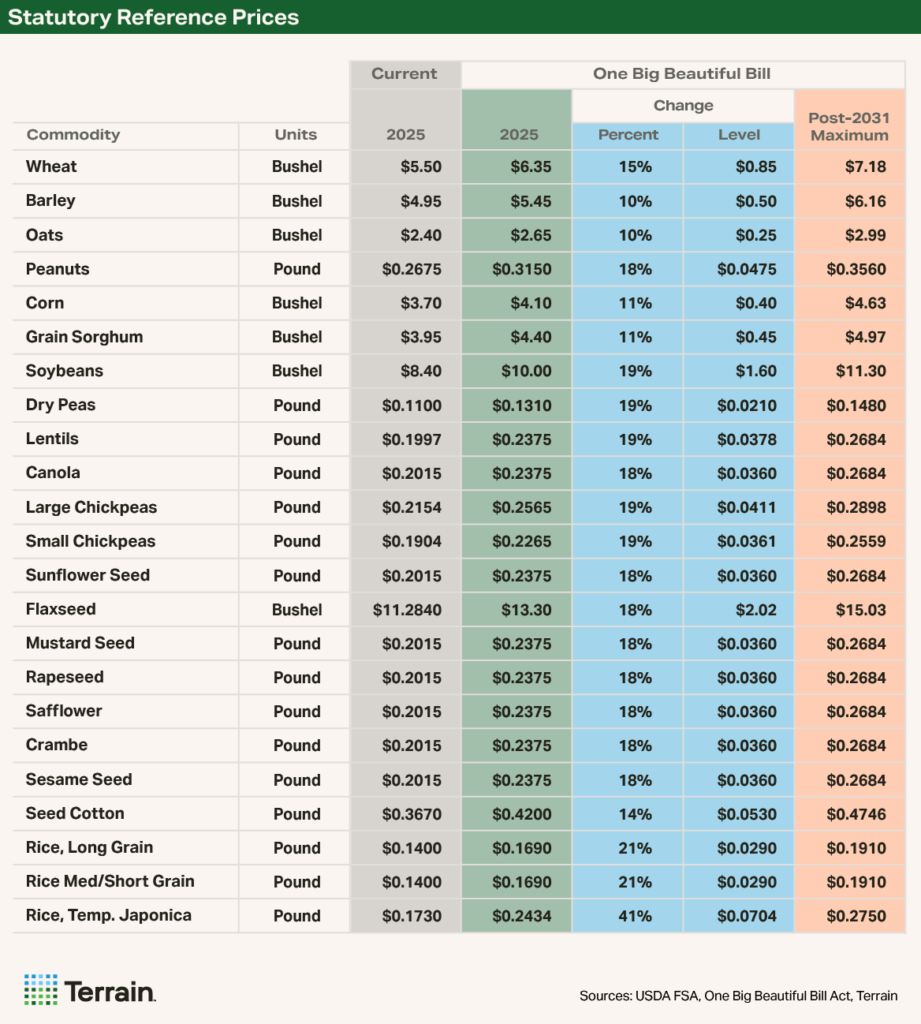

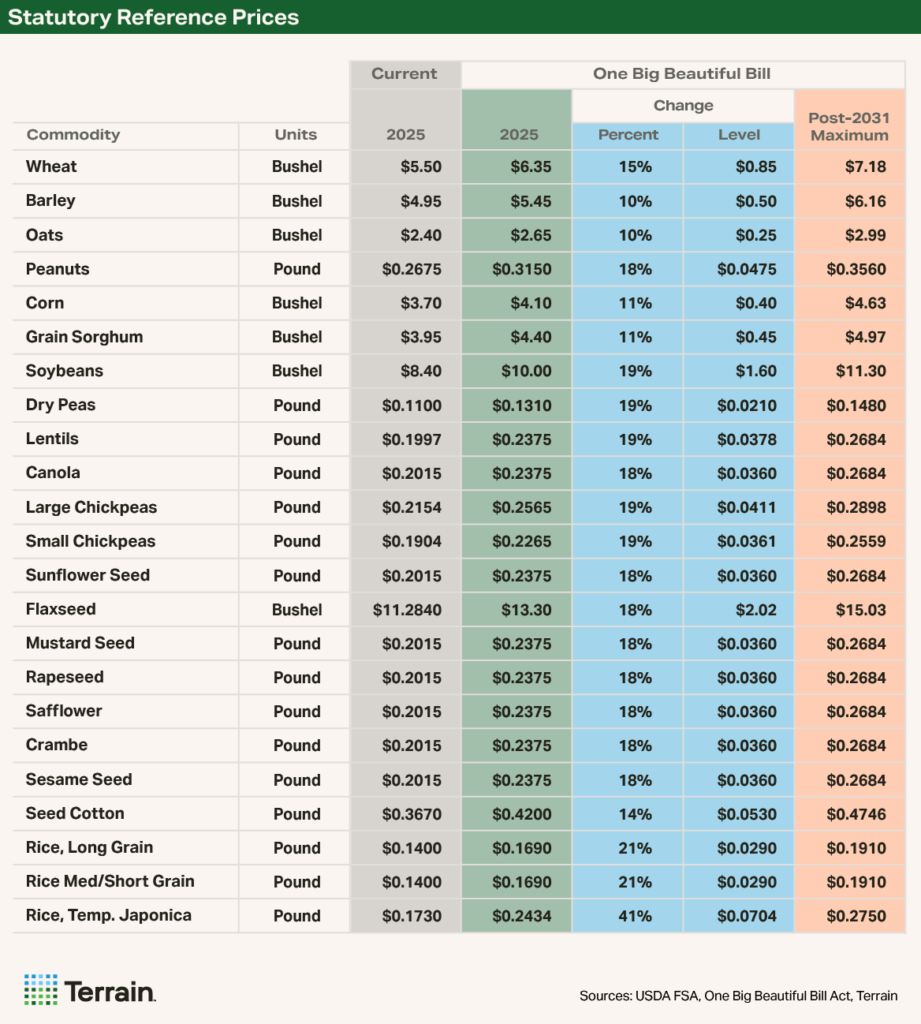

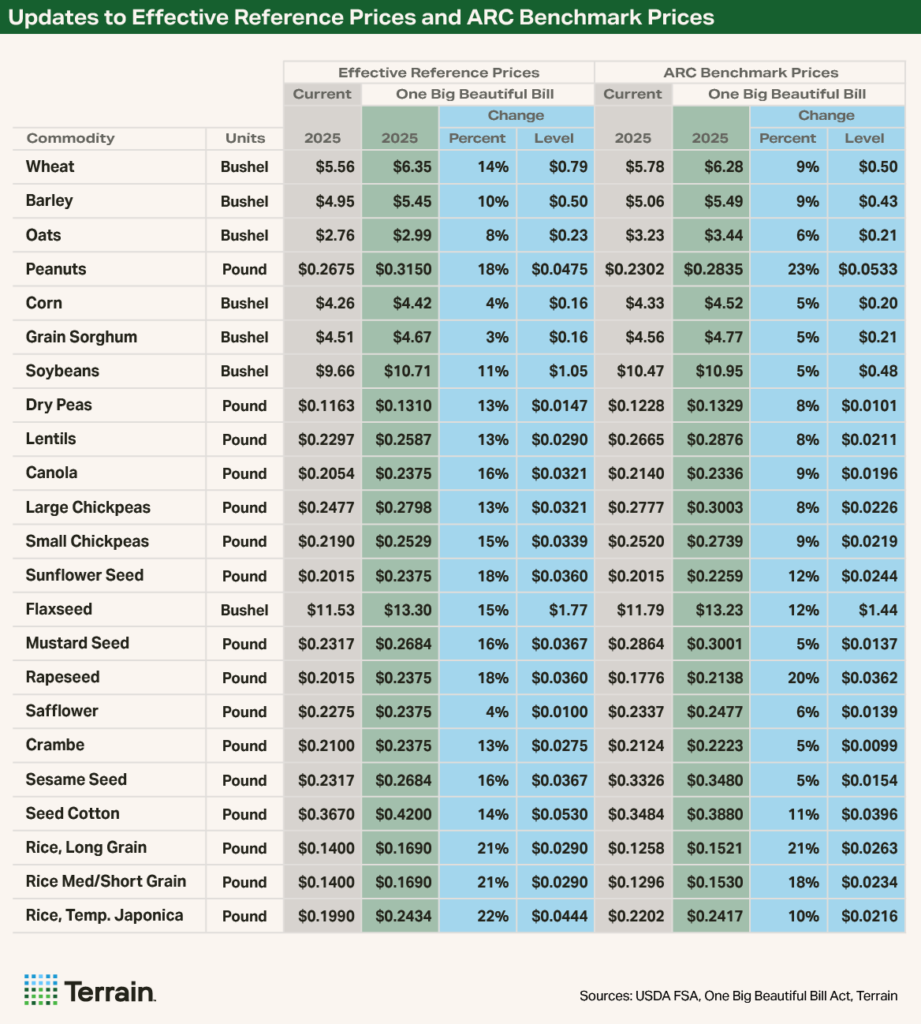

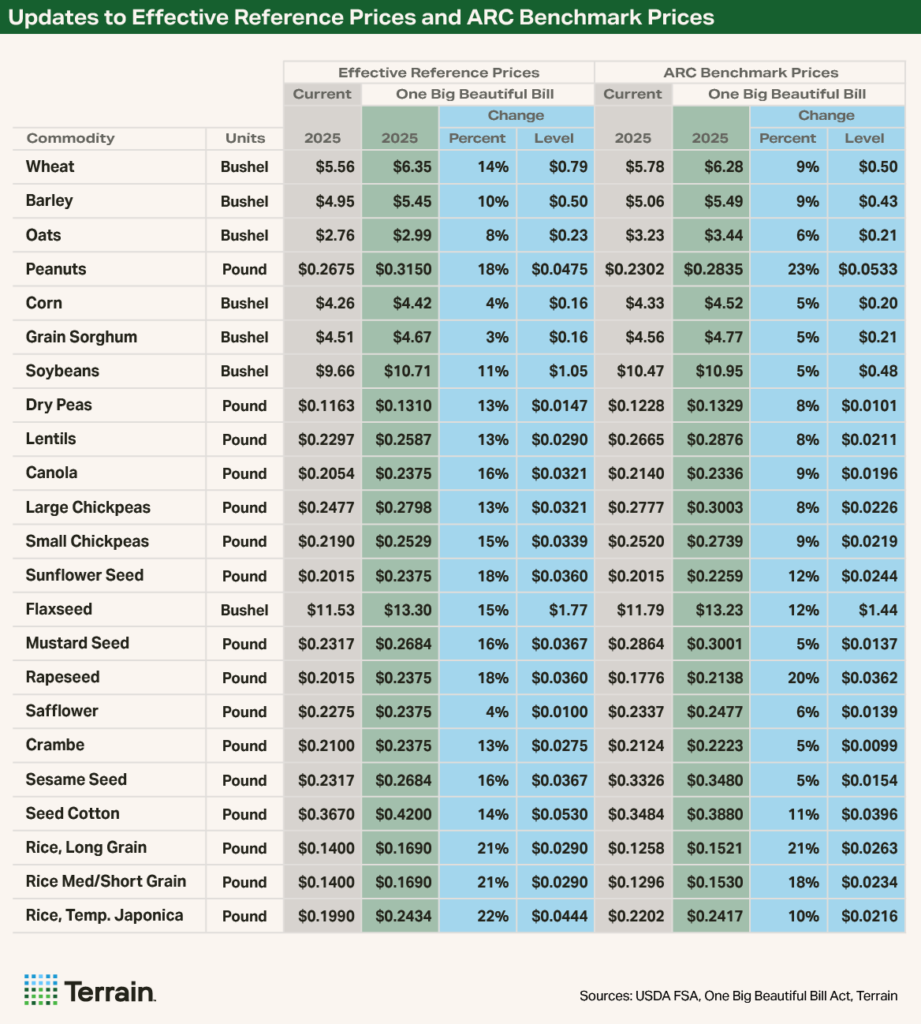

The OBBBA raises statutory reference prices and modifies the formula for the effective reference price for covered commodities under PLC and ARC programs, effective with the 2025 crop year.

For the 2025 program year only, farmers will receive the higher of either the ARC or PLC payment they would have received regardless of their current program election. This decision was made to ensure farmers received the highest level of potential support following the OBBBA improvements. In 2026 and later years, the decision will revert to an annual decision submitted through the USDA Farm Service Agency (FSA).

In general statutory reference prices have been increased anywhere from 10% to 41%. Unless changed in future legislation, these statutory reference prices will be adjusted higher starting in 2031, by 0.5% per year, capped at 113% of the 2025 reference price.

The Effective Reference Price formula has been updated with that formula now based on 88% of the historical Olympic average price instead of 85% under previous law. This change is designed to have Effective Reference Prices respond sooner coming out of a high price environment.

Changes to the ARC programs

The changes to both the stautatory and effective reference prices also affect the ARC programs. The higher of the marketing year average price or the effective reference price is used to calculate the 5-year Olympic average price that is the major component of the ARC benchmark price.

In addition, the maximum payment for the ARC program has been expanded to 12% of benchmark revenue, up from the current 10%. And OBBBA decreased the deductible from 14% (86% coverage) to 10% (90% coverage). This larger maximum payment and higher coverage will provide slightly larger payments in times of revenue shortfalls as well as make those payments trigger sooner.

Previously, farms enrolled in ARC were prohibited from purchasing Supplemental Coverage Option (SCO) crop insurance policies. Now, farmers can enroll in either ARC or PLC while still choosing to purchase SCO through crop insurance. This change removes this cross-program restriction, allowing choices for farm programs to be separate from that of crop insurance for almost all crops. Note that SCO is an area-based insurance plan, however, and is less responsive to individual yield declines on the farm.

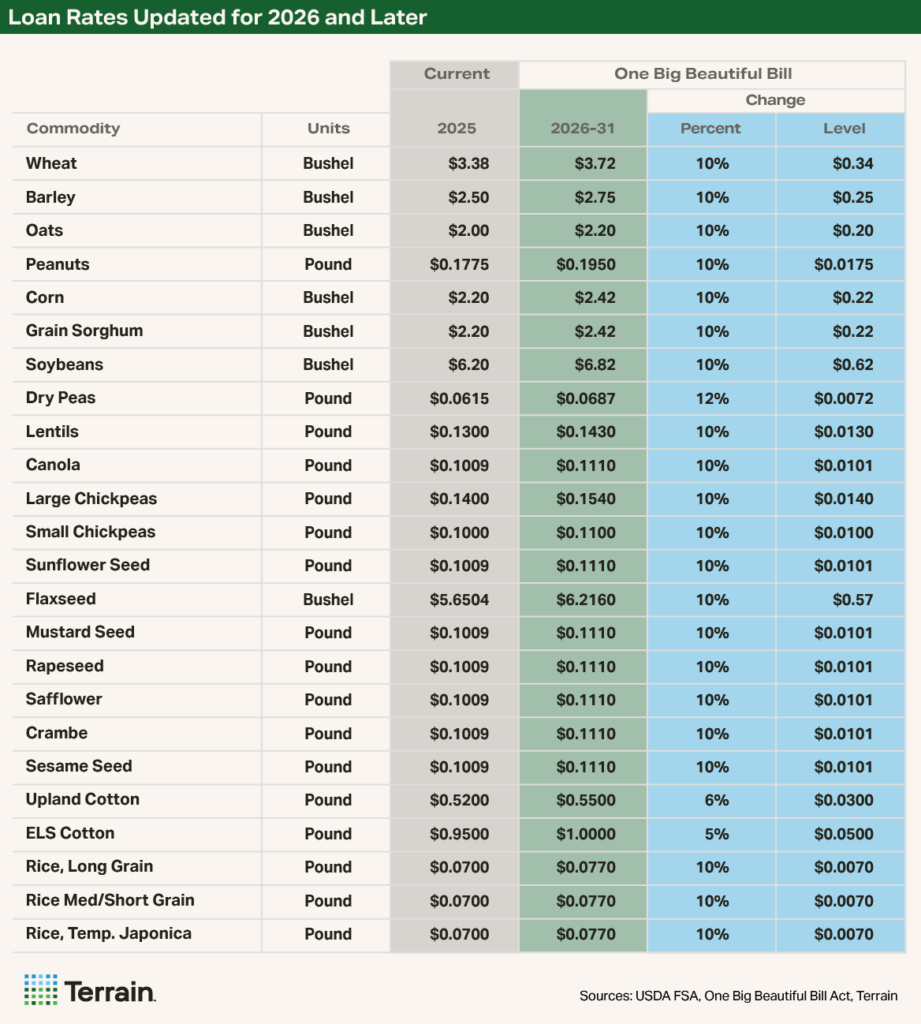

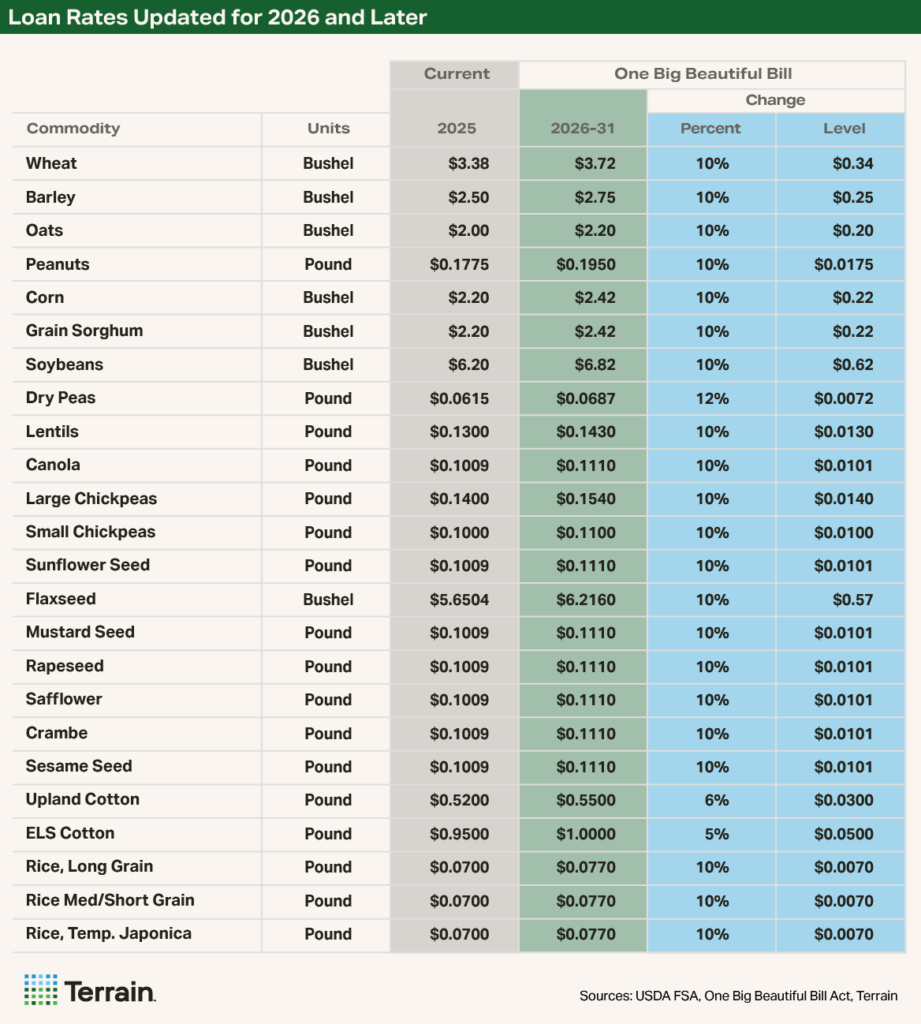

Marketing Loan Rates Increased

Rates for USDA’s nonrecourse marketing assistance loans2 are increased for 2026–2031, allowing farmers to borrow a higher share of the value of crops placed under loan. These updated marketing loan rates are for the 2026 and later crop years, meaning the marketing loans available for the 2025 crop will be at the existing rates.

Base Acres Expansion

Farmers with eligible base acres may enroll in ARC and PLC. To address concerns from young, beginning and small farmers without base, or for farmers with insufficient base, the OBBBA provides up to 30 million new base acres nationwide, based on recent planting history (2019–2023) for both covered and certain noncovered commodities. These new base acres are expected to be allocated proportionally among covered crops based on planting history.

These additional base acres would be available for the 2026 program year and not be part of the change for the current 2025 program year.

An appendix following the article provides an example of how the base acre additions may impact an individual farm.

Sugar and Cotton Program Changes

The loan rates for raw cane sugar are increased from $0.1975/lb. to $0.24/lb. and from $0.2538/lb. to $0.3277/lb. for refined beet sugar for the 2024 crop year (2025 fiscal year). These apply for the remainder of the current fiscal year, unlike the loan rates for other crops which are effective for the 2026 crop year.

Other sugar-related provisions in OBBBA include changes to beet sugar allotments to prioritize processors with available sugar, adjustments to the reallocations of Tarriff Rate Quota shortfalls, and mandating a study on defining refined sugar for import purposes.

For cotton, storage payments are reinstated at up to $4.90/bale (California and Arizona) or $3.00/bale (all other states) for 2026–2031. To help incentivize domestic cotton use, the Economic Adjustment Assistance for Textile Mills is raised 2 cents per pound, to 5 cents per pound, beginning August 1, 2025.

Dairy Margin Coverage Updates

The Production history for the Dairy Margin Coverage (DMC) program is now the highest annual milk marketings for the participating dairy operation during either the 2021, 2022 or 2023 calendar year. For new operations, two options are given for establishing a replacement production history based either on extrapolated year-to-date figures or a combination of the operation’s herd size and national average herd data.

The lower-priced Tier 1 coverage is also expanded to 6 million pounds, up from the current 5 million pounds, offering lower DMC premiums for an additional 1 million pounds of milk for dairy farmers.

Payment Limits Increased

The annual payment limit for commodity programs is raised from $125,000 to $155,000 per person/entity and is indexed to inflation as measured by the Consumer Price Index for All Urban Consumers (CPI-U) after 2025. These updates serve to make these farm programs more relevant to larger farm operations.

Adjusted Gross Income (AGI) Limitation

The AGI limit remains, but an exception is made for those deriving at least 75% of their income from “farming, ranching, or silviculture activities.”

Disaster Assistance for Livestock and Tree Crops

A number of the disaster assistance programs for livestock and tree crops were updated to expand either the coverage or scope of these programs.

The Livestock Indemnity Program (LIP) saw payment rates increase to 100% of the market value for predation losses and 75% for weather or disease with new payments authorized for unborn livestock losses. The Livestock Forage Disaster Program (LFP) is updated to provide more flexible eligibility for drought losses and provide one monthly payment to eligible producers with grazing land in counties rated D2 (severe drought) for at least four consecutive weeks and two payments if a D2 drought persists during any seven of eight consecutive weeks within the normal grazing period.

Updates were also made to two other programs: Emergency Assistance for Livestock, Honey Bees and Farm-Raised Fish (ELAP), and Tree Assistance Program (TAP).

Crop Insurance

Several updates were made to one of the most important risk management tools used by farmers: crop insurance. For beginning farmers and ranchers, the period in which they can receive special crop insurance benefits is doubled from 5 years to 10 years. The amount of premium assistance is increased for the first four years, and these new additional premium assistance rates are: 5% in the first two years, 3% in the third year, and 1% in the fourth year. This is in addition to the 10% already provided, bringing total assistance in the first year to 15%, then declining to 10% in year 5 where it remains through year 10.

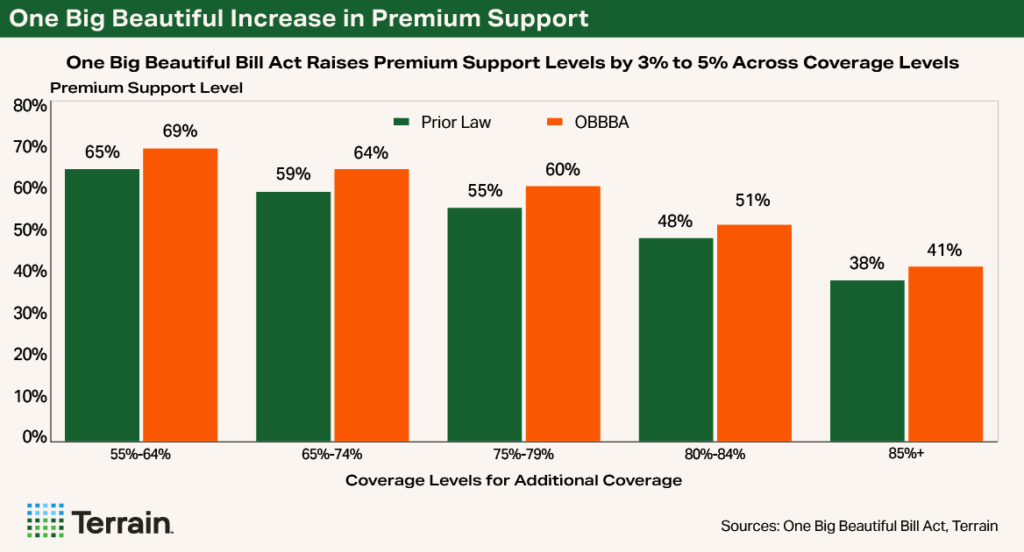

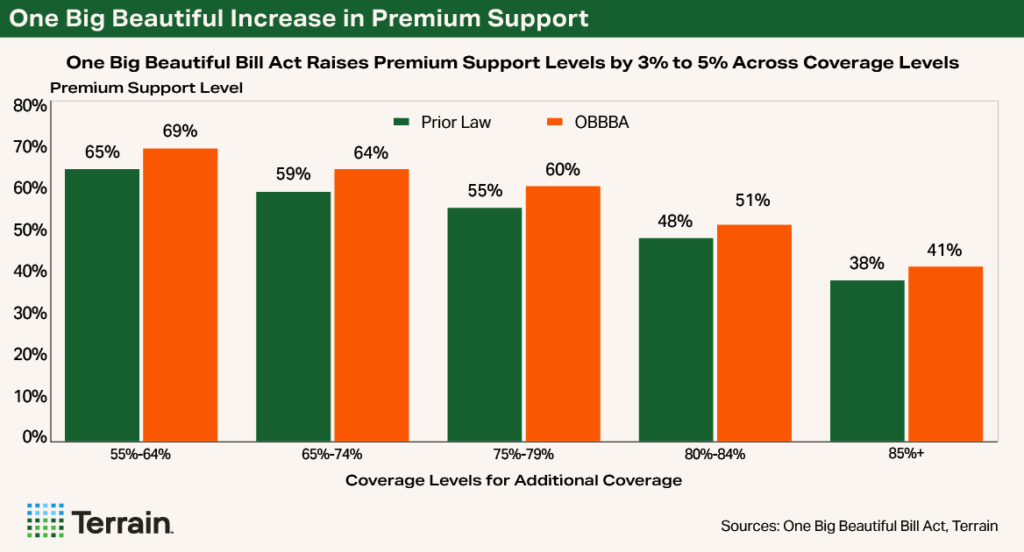

The maximum coverage levels for area-based coverage are changed to 95% for area plans, 90% for aggregated individual plans, and 85% for individual plans. SCO is expanded up to the 90% coverage level, with indemnities now beginning to trigger following a 10% loss instead of 14% previously. The premium support level for SCO policies is also increased from 65% previously to 80%, making the premium on these policies more affordable for farmers.

While the area-based plans are more affordable, the tradeoff for farmers is that their individual farm’s yield risk may not correlate with the area’s risk – reducing the risk management effectiveness. Careful consideration of area plans of insurance versus more tailored coverage may help to enhance risk management efforts.

For farmers, these higher levels of premium support are expected to reduce the farmer-paid premium cost. For example, when these increased premium support rates are applied to the 2024 national average farmer-paid premiums for corn, the savings are estimated to be between $1 and $3 per acre assuming all other choices remain constant. For soybeans, these savings are estimated to range from less than $1 at the lower coverage levels to almost $2 at the 75% coverage level. Crop insurance premiums depend on many factors, and the final savings will depend on premium rates and other policy-specific choices.

A new pilot program is established for contract poultry growers to evaluate the feasibility, effectiveness and demand for an index-based insurance policy to insure against extreme weather-related utility (natural gas, propane, electricity, water, etc.) costs.

Conclusion

The One Big Beautiful Bill Act brings significant changes to farm programs, crop insurance, disaster assistance, tax policy and other programs that affect the agricultural sector.

These changes impact many areas of farm operations, from risk management decisions to operational decisions, as well as accounting impacts to both cash flow and balance sheets. Consider these changes with your accountants, crop insurance agents, and Farm Credit lenders as you consider the impacts of these changes to your operation in 2025 and future years.

Appendix: What Base Acre Changes Could Mean For An Example Farm

An example farm planted corn, soybeans and one other, eligible, non-covered crop between 2019 and 2023.3 They plant a rotation of corn (in 2019, 2021, and 2023) followed by half soybeans and half another eligible non-covered commodity (in 2020, and 2022). The farm is 100 acres and over the 2019-2023 period they average 60 acres of corn (100 acres in 2019, 2021, and 2023 divided by 5 years), 20 acres of soybeans (50 acres in 2020 and 2022 divided by 5 years), and 20 acres of the eligible non-covered crop (also 50 acres in 2020 and 2022 divided by 5 years).

For the purposes of adding base acres, this farm could add the lesser of 15% of the total farm size (15 acres), or the average planted acres of the eligible non-covered crops (20 acres), to the number of eligible acres from the 2019-2023 period that was planted to covered crops (which averaged 80 corn and soybean acres). In this example, they are able to count a maximum of 15 additional acres, making their effective farm size, for the purposes of adding base acres, 95 acres.

This example farm currently has 55 base acres made up of 25 base acres of corn, 10 base acres of soybeans and 20 base acres of wheat. The potential additional base acres are the difference between the current base acres (55 acres) and the effective farm size calculated above (95 acres). This means 40 base acres potentially could be added. If the farm had unassigned generic cotton base (this example does not), those base acres would be added to this total to be re-allocated. A farm cannot have more base acres than it has total acres, but this requirement is not a limiting factor in this example.

There is a hard maximum of 30 million acres allowed to be added under OBBBA. If there are more than 30 million acres eligible to be added nationwide, the base acres allowed to be added may be prorated.

In this example, I used a prorating factor of 60% for illustrative purposes only. The USDA will determine the number of acres eligible to add and subsequently this prorating factor, if one is needed.

After prorating, 24 base acres (60% of the 40 potential acres) are the amount eligible to add for this example farm. These base acres get allocated proportionally to the plantings of covered commodities on the farm over the 2019-2023 period. For this farm, there were 80 acres planted on average to covered commodities (60 acres of corn, 20 acres of soybeans, and no wheat). The distribution of planting of covered crops are as follows: 75% corn, 25% soybeans, and 0% wheat. In this example, 18 base acres are added for corn (75% of the 24 additional base acres), 6 for soybeans (25% of the 24 additional base acres, and zero for wheat since there was no wheat planted during this period.

In this example, there are now 79 total base acres (55 prior base acres plus 24 new base acres), bringing that total closer to actual planted acres.

USDA FSA is tasked with making these allocations and many other decisions such as assigning program yields (for PLC), determining how generic cotton base acres are incorporated in the above allocation, defining eligible non-covered crop, determining how those count in the above calculation, and likely more. Farm owners will eventually be notified of their eligibility and of the base acres FSA proposes to allocate to each covered crop on each farm.

Endnotes

2 Nonrecourse refers to a type of debt where the creditor may only look to the collateral – the crop grown – to satisfy an unpaid loan, and not the debtor's personal assets.

3 That would be a crop deemed eligible by the Secretary for the purposes of adding base acres (excluding trees, bushes, vines, grass, and pasture) and not one of the 22 covered commodities found here: https://www.fsa.usda.gov/resources/programs/arc-plc

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.