Report Snapshot

Situation: Farmers are facing another year of tight profit margins as they make their 2026 planting decisions. Terrain’s early projections for corn, soybeans, wheat and sorghum suggest a landscape marked by strong production potential but larger carryover stocks, and varied demand signals across domestic and international markets.

Outlook: For the 2026/27 marketing year, we forecast that:

- Corn acres decline to 94 million, but large carry-in stocks and trend-line yields suggest the stocks-to-use ratio will remain elevated and continue to pressure prices.

- Soybean acres rebound to 85 million. Combined with trend-line yields and above-average carry-in stocks, total supply increases more than 7%, suppressing prices.

- Wheat supplies remain flat as carry-in stocks mostly offset a decline in acres and yields, but prices may improve as the market comes into alignment.

- Sorghum production declines about 4% as acres dip and yields move closer to trend; however, total supply increases 16% as the largest stocks in decades overwhelm the market and keep prices flat.

As the agricultural sector turns its attention to the 2026/27 marketing year, producers and market participants face another season of shifting acreage decisions, evolving global trade dynamics, and uncertainty around input costs and weather.

Terrain’s early projections for corn, soybeans, wheat and sorghum suggest a landscape marked by strong production potential but larger carryover stocks, and varied demand signals across domestic and international markets. Together, these forces will shape supply balances, price direction and profitability prospects in the year ahead.

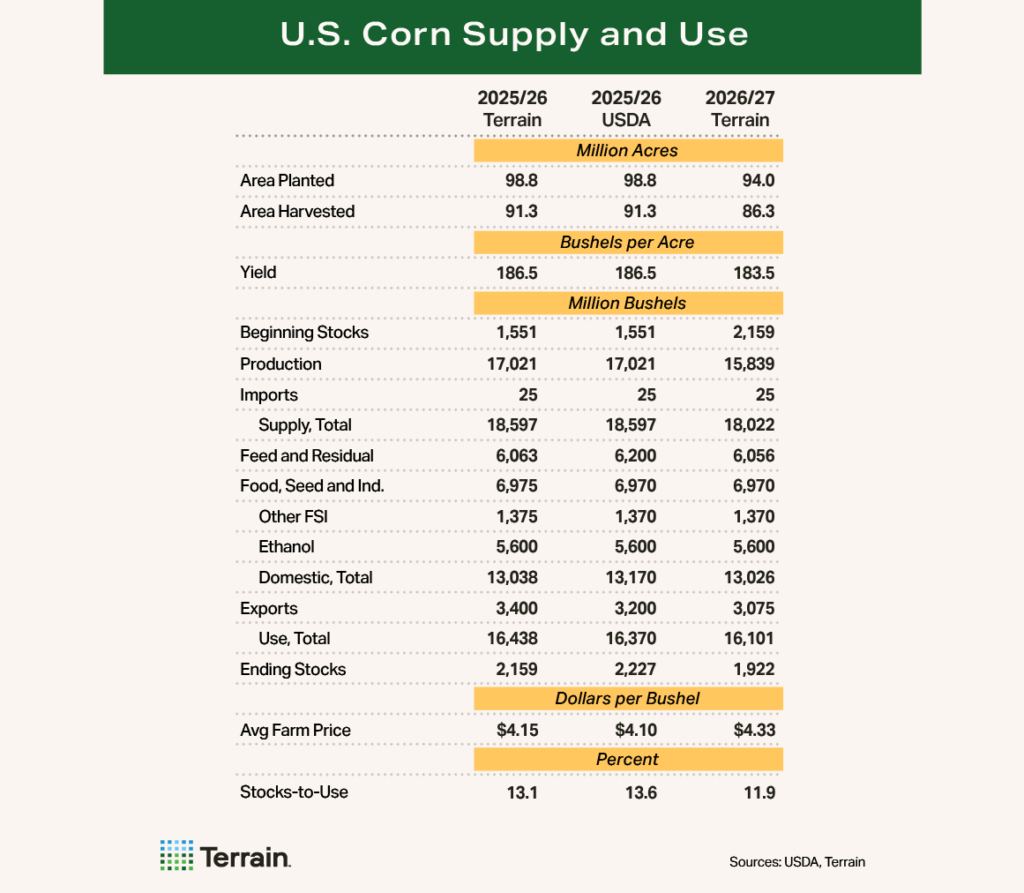

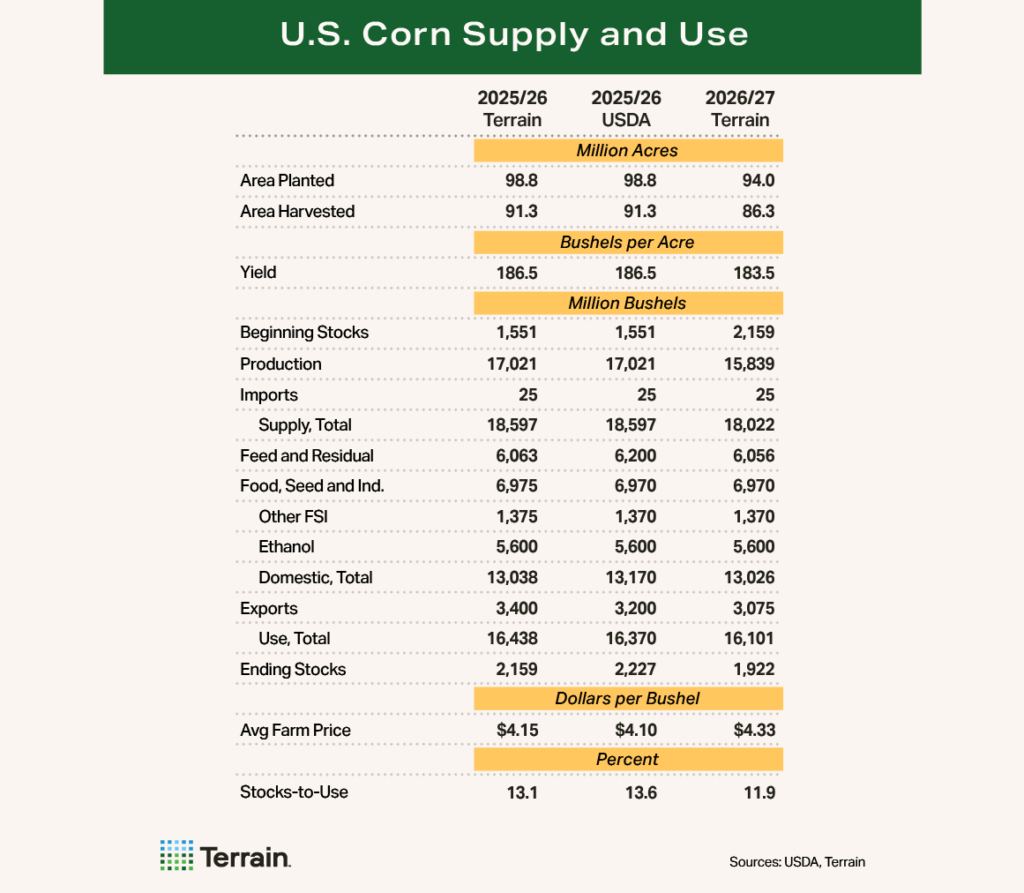

Corn

Early projections for the 2026/27 U.S. corn balance sheet indicate another year of large supplies, steady demand and continued pressure on prices. Terrain projects planted area to fall to 94 million acres — 4.9% below 2025/26 but still above the 10‑year average of around 91.9 million. With a trend yield of 183.5 bu./ac., production is projected to exceed 15.8 billion bushels, potentially the second‑largest crop on record after the 2025/26 crop.

Early projections for the 2026/27 U.S. corn balance sheet indicate another year of large supplies, steady demand and continued pressure on prices.

When combined with Terrain’s expected 2025/26 ending stocks of over 2.15 billion bushels and modest imports, total supply for 2026/27 is projected at just over 18 billion bushels. Strong yield potential and large carry‑in stocks suggest availability will remain high entering the marketing year.

We expect domestic use to hold steady, supported by consistent livestock feed demand and industrial use shaped by ethanol margins and evolving biofuel policy.

Exports remain a key variable, but corn prices near $4/bu. should support global demand. Argentina, Brazil, Ukraine and the U.S. account for about 90% of global corn exports. The combined stocks‑to‑use ratio for Argentina, Brazil and Ukraine has fallen to 4.7%, the lowest since 1983/84. This tightening suggests large‑volume importers may rely more on the U.S. in 2026/27.

South American competition remains strong, but Brazil is consuming a growing share of its own crop as its ethanol and livestock sectors expand. In 2025/26, Brazil used 74% of its production domestically — well above recent averages — limiting exportable supplies. China’s import needs, however, have moderated, adding uncertainty to global trade flows.

We project U.S. ending stocks for 2026/27 to remain above 1.9 billion bushels, reinforcing expectations of a well‑supplied market. With ample inventories, our projected average farm price is $4.33/bu., favorable for buyers. Two wild cards are better-than-expected demand strengthening or weather reducing supply.

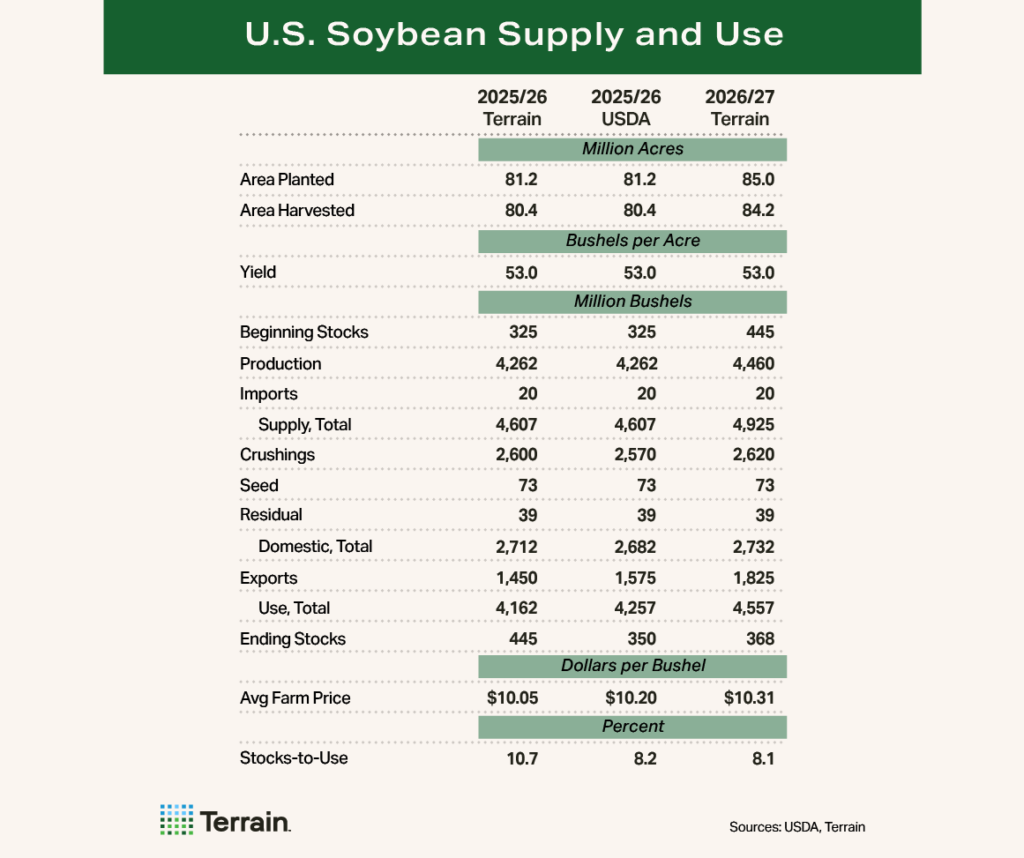

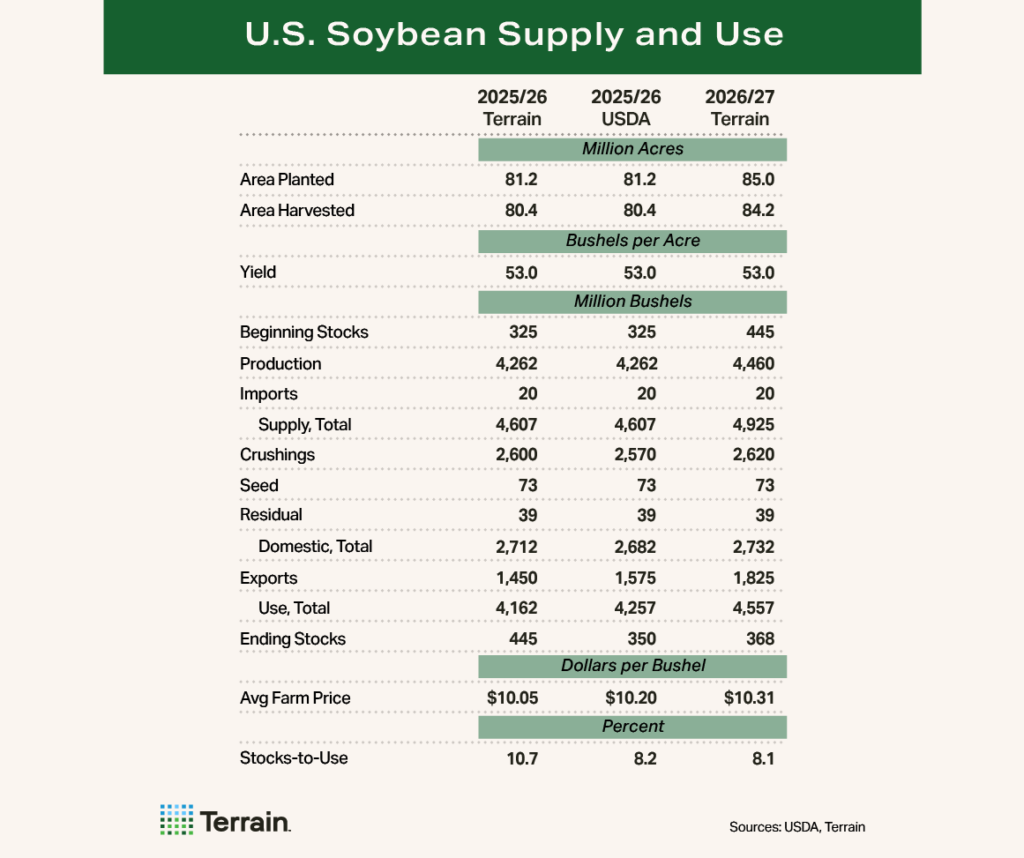

Soybeans

The early soybean outlook for 2026/27 is for a recovery in acres and higher production. Although we expect higher total use (foreign and domestic) and lower ending stocks compared with the abundant 2025/26 estimates, ample supplies from production and beginning stocks will continue to pressure prices.

The early soybean outlook for 2026/27 is for a recovery in acres and higher production.

Terrain projects planted area to rebound in 2026 to 85 million acres, up 4.7% from 2025, as expected market prices currently favor more soybean acres relative to last year. Assuming a trend yield of 53 bu./ac., we forecast total production to rise by almost 200 million bushels to 4.46 billion. Total supplies are set to increase by 318 million bushels as our forecast of larger 2026/27 beginning stocks (mostly from lower 2025/26 exports) contributes to total supply.

We expect domestic use to increase by 20 million bushels to 2.62 billion. However, higher crush is possible if crush margins, biofuel policy, soybean meal demand, or a combination of these factors, supports higher crush volume.

Terrain forecasts exports to increase 25.9% to 1.825 billion bushels, with the assumption that China meets its purchasing goal of 918 million bushels (25 million metric tons). The increase in exports to China will likely be offset slightly by lower shipments to other destinations.

Ending stocks are forecast to tighten over the 2026/27 marketing year. Still, they could be around 370 million bushels if trend yields are achieved again next year, even if our export forecast for 2025/26 is realized.

Our projected 2026/27 average farm price of $10.31/bu. reflects the relatively comfortable stocks situation as well as continued competition from Brazil. However, U.S. average soybean prices have a considerable range of possibilities at this stock level and remain heavily influenced by South American supplies, trade relations with China, and biofuels.

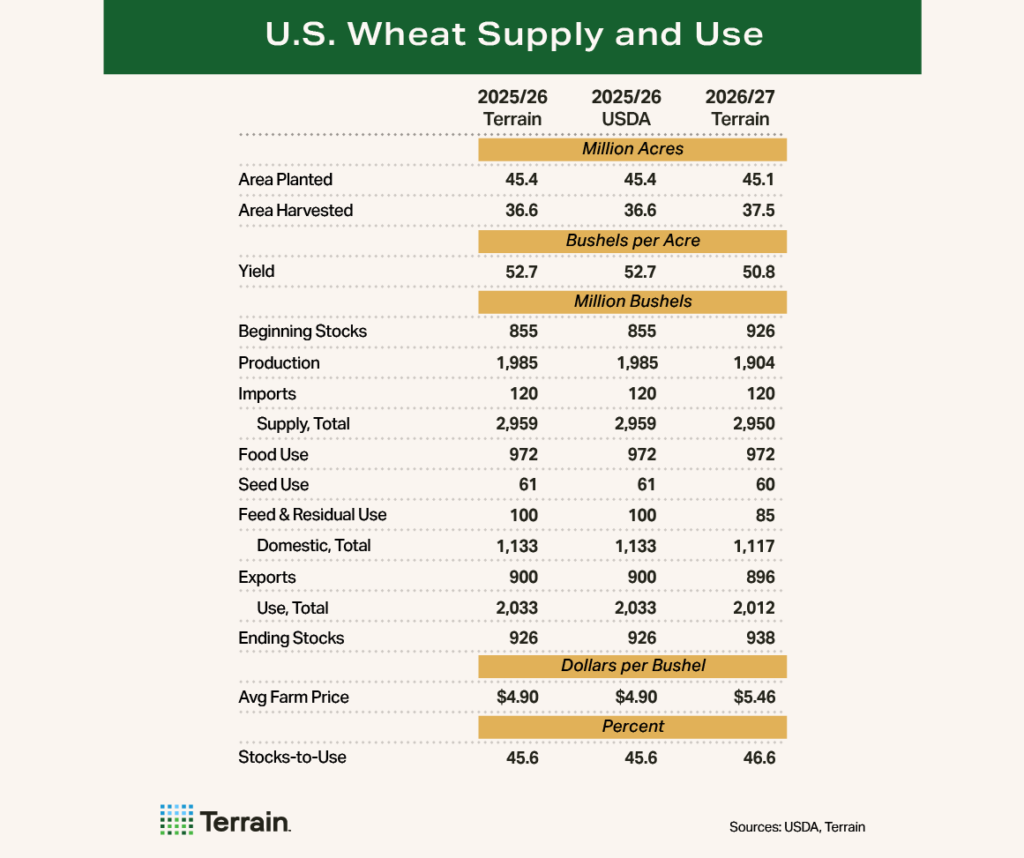

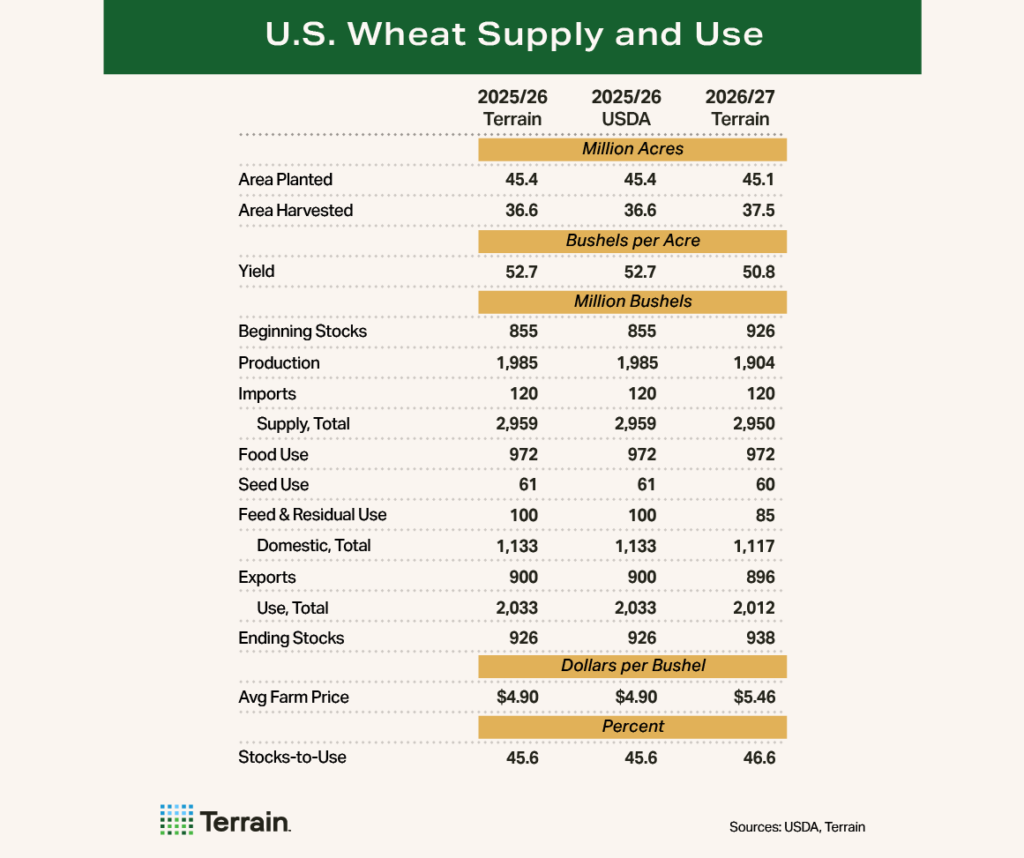

Wheat

Terrain’s projected planted area for all wheat in 2026/27 is 45.1 million acres, down about 0.5% from 2025/26. This would be the second-smallest planted acres since 1919, when the USDA started tracking them.

We forecast the average farm price for all wheat in 2026/27 will rise to $5.46/bu.

We expect all-wheat yields to decline to just under 51 bu./ac., in line with long-term yield trends. The combination of lower planted acres and yields results in an expected production decline of 4% from the previous year. However, total all-wheat supply in 2026/27 is little changed from the previous year, as the decline in production is fully offset by large carry-in stocks.

We project all-wheat use to decrease from the 2025/26 marketing year. Food use, which accounts for nearly 50% of total wheat use, will likely remain flat. Exports, which account for about 45% of total wheat use, are expected to dip. Lower exports are justified by the large global stocks excluding China and the U.S., which hit a record high in 2025/26. Moreover, ending stocks for top exporting countries (Argentina, Australia, Canada, the EU, Russia and Ukraine) are at their highest levels since the 2010/11 marketing year. We expect feed and residual use to decline slightly.

Terrain expects the stocks-to-use ratio to nudge higher as total supply remains flat and total use declines about 1%. Despite this, we forecast the average farm price for all wheat in 2026/27 will rise to $5.46/bu. The improvement mainly reflects better price alignment with stocks, rather than structural changes in the market. For example, the price for all wheat classes hit at least a five-year low in 2025/26, and the expected wheat price for all classes in 2026/27 is still below the five- and 10-year averages. Prices are likely to stay at these levels unless exports can significantly pick up market share from other major exporters.

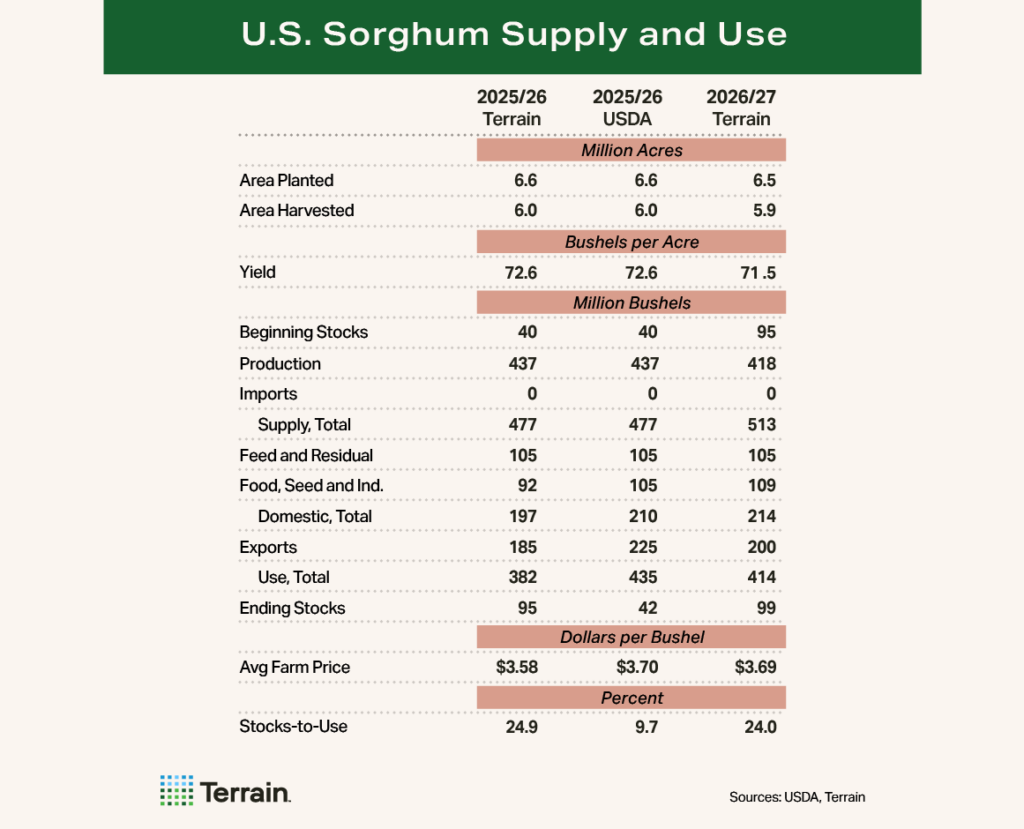

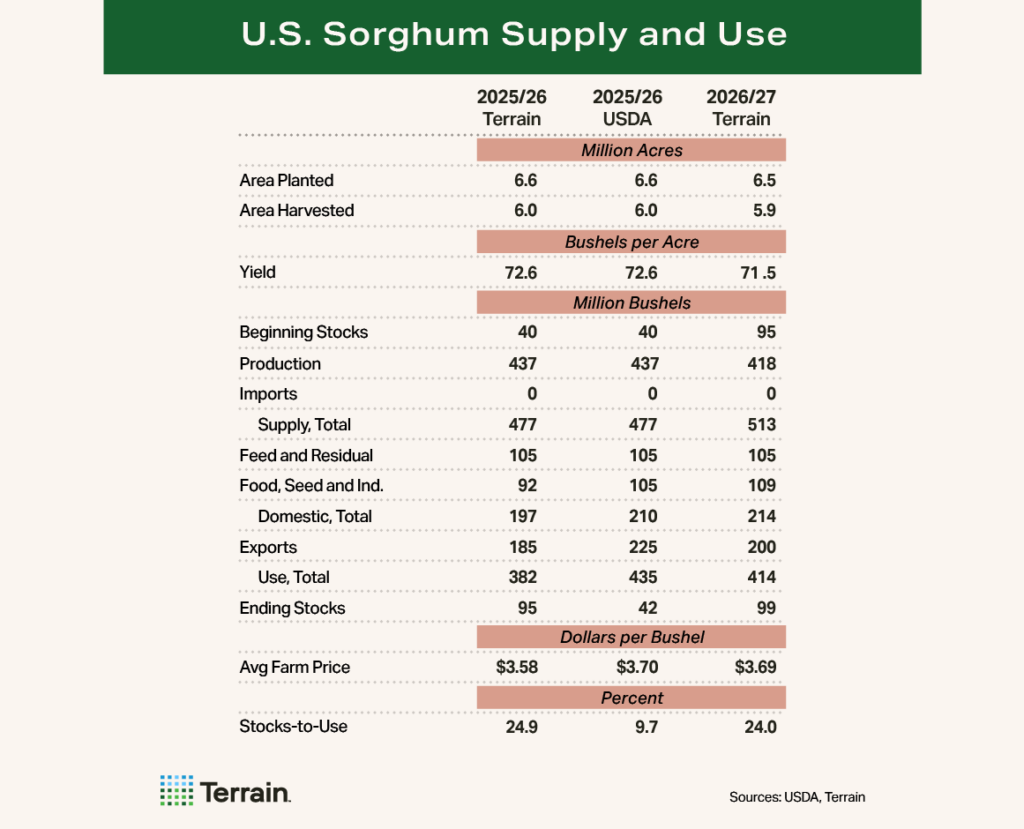

Sorghum

For 2026/27, Terrain expects a slight reduction of sorghum planted area to 6.5 million acres due to lower prices relative to other crops. Harvested area will also decline modestly to 5.9 million acres. National average yields are expected to fall to 71.5 bu./ac. as yields move back closer to trend.

For 2026/27, Terrain expects a slight reduction of sorghum planted area to 6.5 million acres due to lower prices relative to other crops.

On the demand side, Terrain forecasts sorghum exports to drop to 185 million bushels in 2025/26. Historically the largest buyer of U.S. sorghum, China’s reduced purchases are driving our expectations for a lower 2025/26 export number. After a six-month hiatus, China resumed sorghum purchases in late November. If this pace accelerates, U.S. exports could rebound in 2026/27 to around 200 million bushels, which would be in line with the five- and 10-year historical averages.

With overall increased supplies, we expect ethanol use to increase 4% in 2026/27 to around 108 million bushels. We agree with the USDA that in 2025/26 feed use will be 105 million bushels and we expect flat demand in 2026/27.

Terrain expects old-crop 2025/26 ending stocks to be over 50 million bushels higher than the USDA’s current January World Agricultural Supply and Demand Estimates (WASDE) forecast, which will lead to higher beginning stocks for 2026/27 and continue to pressure prices. Terrain expects the 2026/27 national average farm price to be $3.69/bu. without significant purchases from China.

Conclusion

As the 2026/27 marketing year approaches, crop producers face strong production potential but pressure from large carry-in stocks; variable global demand; and price environments that favor buyers across major crops.

Profitability in this environment will hinge on disciplined planning, timely decision-making, and continuous monitoring of market signals.

Corn and sorghum are poised to remain well-supplied. Soybean ending stocks could tighten but face heavy competition from South America. Wheat continues to operate within a global marketplace flush with stocks. Profitability in this environment will hinge on disciplined planning, timely decision-making, and continuous monitoring of market signals.

Focusing on concrete actions that strengthen marketing and operational resilience can help producers and market participants navigate these dynamics effectively. Producers who act early and manage risk intentionally will be best positioned to protect margins and capture opportunities in a year where prices may move quickly.

- Consider securing profit on a portion of 2026/27 production to lock in defensible margins while leaving room to act on higher prices during volatility spikes.

- Reassess break-even budgets now using current input quotes and updated yield expectations to guide acreage decisions and ensure that marketing plans reflect an accurate cost structure.

- Prepare to capitalize on volatility by establishing and executing marketing strategies ahead of key risk windows, including South American weather, U.S. planting progress, early-season crop condition reports, and the U.S. summer weather market. In an environment of heightened geopolitical uncertainty, be ready to respond quickly, as rallies or opportunities may emerge even if they are short-lived.

Given our outlook, it is paramount for producers to work with their Farm Credit lender and crop insurance agent to protect cash flow and liquidity. Having an active marketing plan can help producers take advantage of any market-changing rallies.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.