Report Snapshot

Situation

The USDA recently launched three disaster relief programs for farmers: Stage 2 of the Supplemental Disaster Relief Program (SDRP), the On-Farm Stored Commodity Loss Program (OFSCLP), and the Milk Loss Program (MLP).

Impact

Farmers have until April 30, 2026, to submit SDRP-2 applications for their uncovered, non-indemnified or quality losses. Applications for either the OFSCLP or MLP are due by January 23, 2026.

Almost a year ago, on December 21, 2024, Congress passed the American Relief Act, which included economic and disaster assistance for farmers. The Supplemental Disaster Relief Program (SDRP) is one of the programs to come out of this legislation. It has been rolled out in two stages:

- Stage 1 was launched in early July 2025 and covered in a prior Terrain report

- Stage 2 started November 24, 2025

The SDRP program was funded with $16.1 billion and has paid out $5.75 billion as of November 30, 2025, under Stage 1. Stage 2 is intended to compensate farmers for uncovered and non-indemnified losses on eligible crops, trees, bushes and vines, including quality-related losses. This stage builds upon the first and makes use of existing crop insurance, Noninsured Crop Disaster Assistance Program (NAP), and USDA Farm Service Agency (FSA) data where possible. Any missing data needed for crops eligible under this second stage will need to be reported at the time of enrollment in the program.

Eligible losses must be due to wildfires, hurricanes, floods, derechos, excessive heat, tornadoes, winter storms, freeze (including a polar vortex), smoke exposure, excessive moisture, and qualifying drought occurring in calendar years 2023 and/or 2024. Related conditions are also covered and include events like wind from a derecho, hurricane or winter storm and silting from flooding.

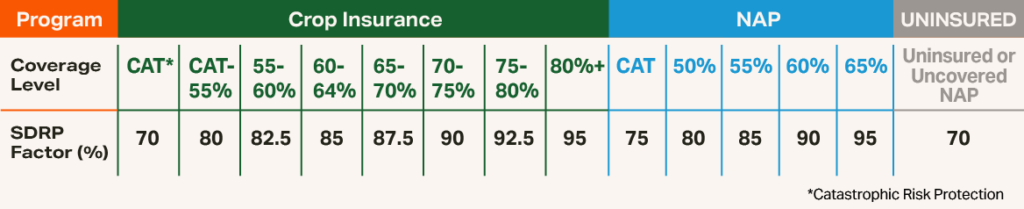

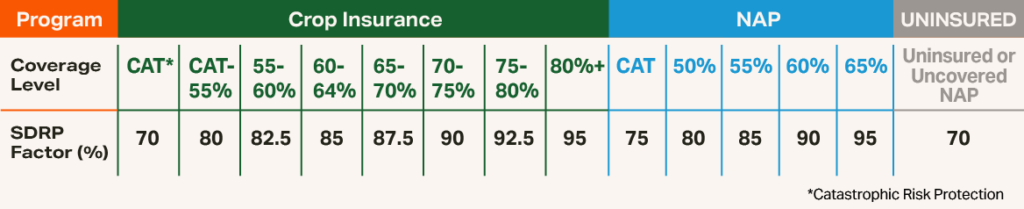

Program-eligible counties and SDRP factors are the same as reported originally in our SDRP-1 article with the addition of an SDRP factor of 70% for losses that were uninsured or uncovered by the NAP.

Existing data from either the crop insurance program or NAP will again be leveraged for this second stage but supplemented with other FSA-reported data. The FSA-reported data will be important for program applicants that are filing under Stage 2 because their losses were uninsured or uncovered and therefore may not be captured in crop insurance and NAP data.

This second stage will incorporate quality losses into the loss and subsequent payment calculations. This is done by reducing the production counted by a self-certified, but verified, percentage:

- In the case of crops, discounts applied at the point of sale due to a grade factor.

- In the case of forage, a reduction in nutritional value as measured by relative feed value, total digestible nutrients or other methods.

Two calculator tools are available from the FSA, one for crops and one for forages to help calculate and aggregate quality losses.

To receive payments, farmers will work with their local FSA office to fill out FSA-504 (SDRP Stage 2 Application) and may be submitted in person, online, electronically or by other means. Like SDRP-1, the following forms must be on file with the FSA (most farmers will have these on file with the FSA from participation in other programs):

- AD-2047 (Customer Data Worksheet)

- CCC-902 (Farm Operating Plan)

- CCC-901 (Entity Member Info)

- AD-1026 (Conservation Compliance)

- SF-3881 (Direct Deposit)

- FSA-510 (If requesting higher payment limits)

- FSA-578 (Report of Acreage), if applicable

The deadline for application for a payment under SDRP-2 is the same as that of SDRP-1, which is currently April 30, 2026.

Payment Limits

The same payment limits in Stage 1 apply to Stage 2.

There are two separate payment limits: one for specialty and high-value crops (combined) and another for other crops. Payment limits apply separately for each program year but apply jointly for Stage 1 and Stage 2 payments. (Note that if the payment limit was reached from losses covered under Stage 1, you will not receive a Stage 2 payment.)

- Up to $125,000 if less than 75% of average adjusted gross income is from farming.

- Up to $900,000 if 75% or more of average adjusted gross income is from farming (requires certification).

Other crops:

- Up to $125,000 if less than 75% of average adjusted gross income is from farming.

- Up to $250,000 if 75% or more of average adjusted gross income is from farming (requires certification).

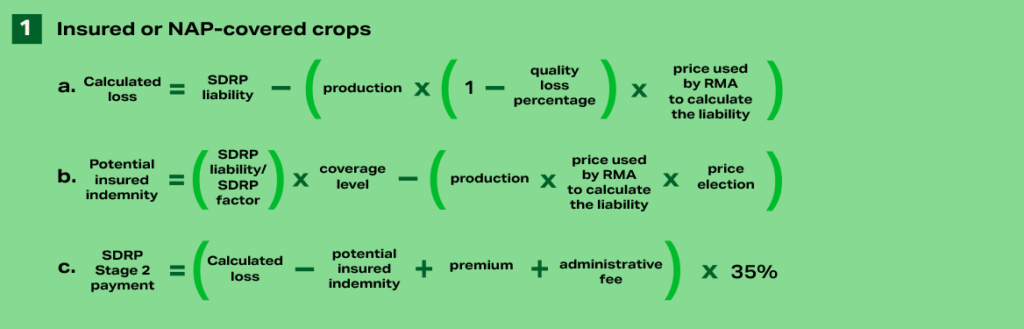

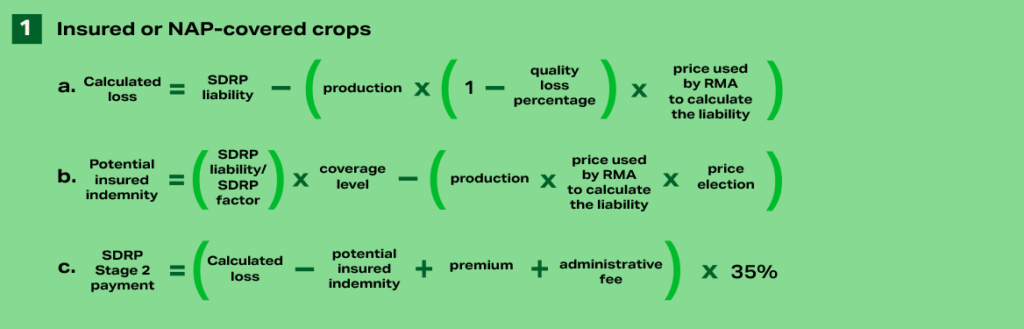

Calculating Payments

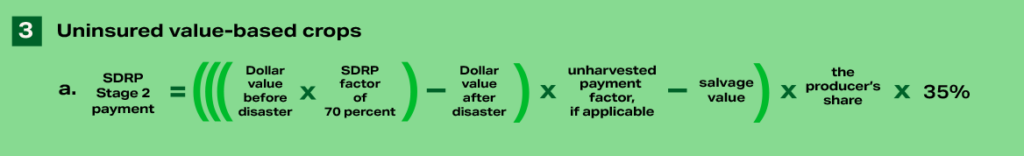

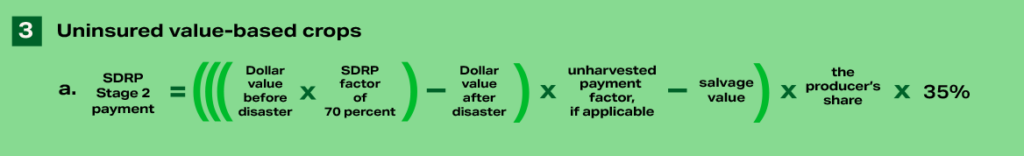

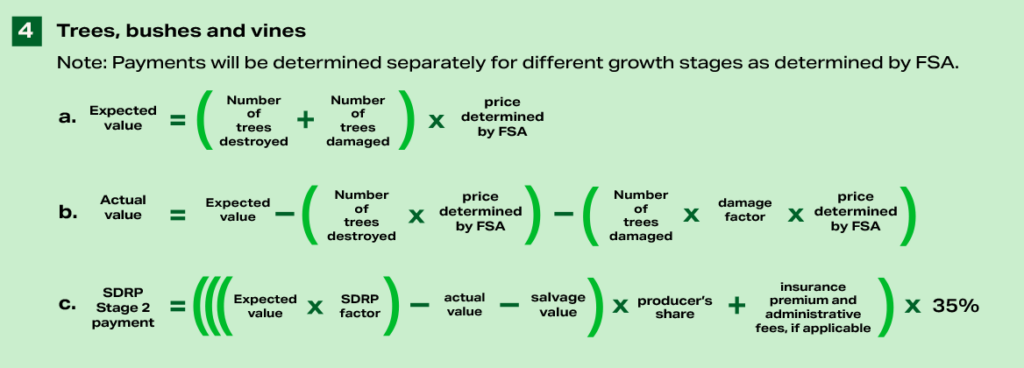

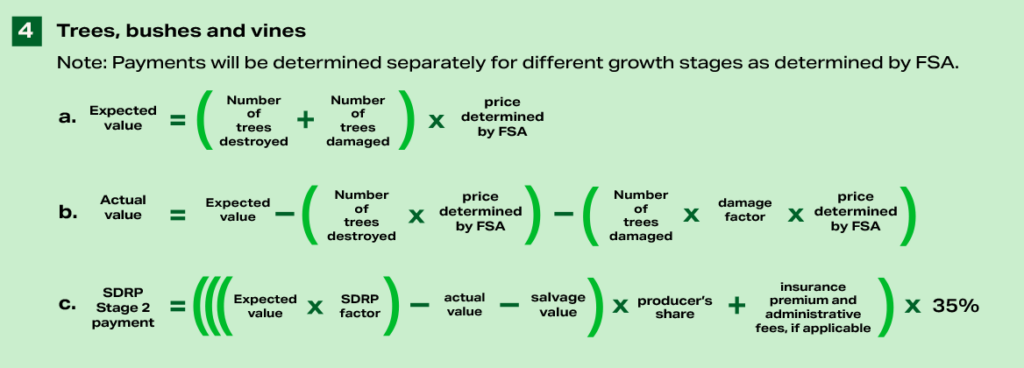

Several different payment formulas are used to determine SDRP-2 payments depending on whether the crop was insured/NAP covered; an uninsured yield-based crop; an uninsured value-based crop; or falls into the tree, bush or vine category.

Many of the items needed to calculate the SDRP-2 payments are highlighted below, but there are specific definitions or adjustments that may need to be applied in certain situations. Consult the applicable section of the Federal Register Notice or the local FSA office for direction.

Below are the examples of each of these provided by the FSA:

Future Requirements

Be prepared to purchase either federal crop insurance or NAP coverage for the next two available crop years at the 60% level or above and file the required reports. Failure to do so will require the farm to pay back SDRP program payments with interest to the USDA. Make sure to work with your crop insurance agent and the FSA for proper documentation.

Future Payments

Additional payment may be issued if funds remain after initial payments under SDRP-1 and SDRP-2. However, total SDRP payments and federal crop insurance indemnities are not allowed to exceed 90% of losses.

What Farmers Should Do Now

If the farm had uncovered or uninsured losses that are eligible to be covered under this program, collect any additional information needed to fill out the SDRP-2 application, especially information on quality losses or losses for crops not insured under the federal crop insurance program or NAP.

The checklist and quality loss calculator (crops and forages) tools available from the USDA may be helpful when collecting the necessary information. Work with the FSA to fill out the application and submit any required documentation well ahead of the April 30 deadline.

If the farm received a payment under either SDRP-1 or SDRP-2, don’t forget to purchase the required crop insurance for NAP coverage for the next two crop years.

This overview is intended to give a general understanding of how this program operates. For specifics on the application and other program details, contact the local FSA office or visit the official USDA SDRP page where a payment calculator tool and fact sheet are also available.

Other Programs Opened Alongside SDRP-2

On-Farm Stored Commodity Loss Program

The On-Farm Stored Commodity Loss Program (OFSCLP) will provide aid for losses of harvested commodities stored in on-farm structures in 2023 and 2024 due to qualifying disaster events. Qualified disaster events include wildfires, hurricanes, floods, derechos, excessive heat, tornadoes, winter storms, freeze, a polar vortex, smoke exposure, qualifying drought and related conditions.

Many producers who suffered losses while their commodity was stored in an on-farm structure could benefit from this program. This program is similar to the previous On-Farm Storage Loss Program that provided assistance for losses due to disaster events occurring in 2018 and 2019.

Up to $5 million will be used for this program, with a to-be-determined payment factor potentially applied to this program based on applications received.

Eligible commodities include wheat, oats, barley, corn, grain sorghum, long grain rice, medium grain rice, seed cotton, pulse crops, soybeans, other oilseeds, peanuts and all hay but exclude grazed commodities. These commodities must be produced, harvested and stored on a farm in the U.S.

A payment rate for each eligible disaster year will be determined by the FSA based on the National Agricultural Statistics Service’s (NASS) Marketing Year Average (MYA) price, or Risk Management Agency (RMA) pricing if NASS MYA prices are unavailable. These prices are multiplied by 75%, effectively creating a 25% deductible, before being multiplied by the farmer’s share of the quantity lost in storage less any salvage value or insurance compensation.

- Example: Given a corn NASS MYA price of $3.60/bushel, a 1,000-bushel volume, and a $500 payment received from a salvage grain buyer. ($3.60/bu. × 75% OFSCLP factor) × 1,000 bushels - $500 salvage payment = $2,200

To ensure the payments under this program remain at or below the $5 million authorized, the USDA may apply an additional payment factor to the loss claim amount if the total program claims exceed the $5 million authorized.

Payment limits apply separately for 2023 and 2024 and are either $125,000 or $250,000, depending on whether the farmer’s average adjusted gross farm income is more or less than 75% of the farmer’s average adjusted gross income.

The deadline for application is January 23, 2026, unless extended by the USDA.

Milk Loss Program

The Milk Loss Program (MLP) will provide compensation to dairy producers for milk that was dumped or removed from market without compensation in calendar years 2023 and 2024 due to a qualifying disaster event.

Up to $1.65 million is allocated for this program, based on both limited funding availability and expected demand based on prior MLPs.

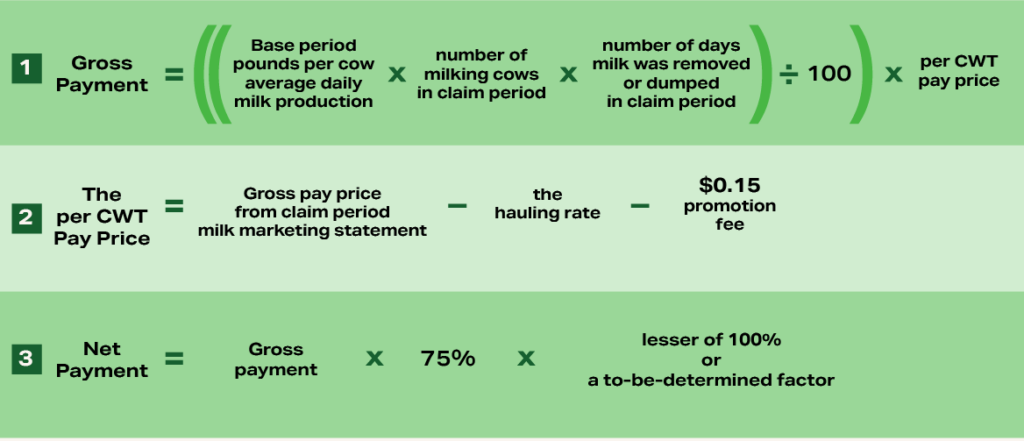

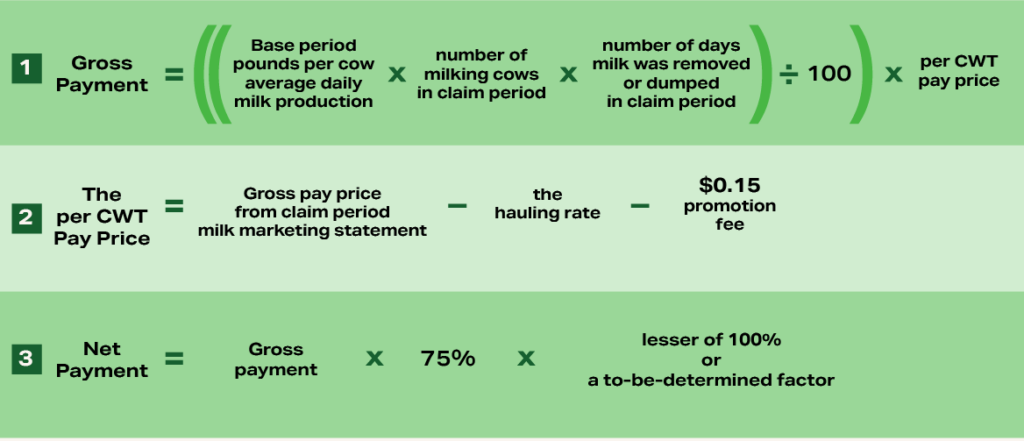

Payments are based on the value of milk dumped or removed during a given period and calculated as follows:

At the time of application, dairy producers will be asked to provide the milk marketing statement for the month prior to the month of loss (base period), the milk marketing statement for the affected month, and a detailed written statement of the circumstances of the milk removal.

The USDA expects claims to exceed the $1.65 million allocated for this program, so demand will be assessed as applications are received to determine if a payment factor will apply and when payments can begin to be made.

The deadline for application is January 23, 2026, unless extended by the USDA.

What Farmers and Dairy Producers Should Do Now

Farmers and dairy producers should determine if they qualify for either the OFSCLP or the MLP and, if so, submit their applications by the January 23 deadline. Make sure to talk to the local FSA office for help determining qualification and answering specific questions.

Endnotes

1 Specialty crops include fruits; tree nuts; vegetables; culinary herbs and spices; medicinal plants; nursery, floriculture and horticulture crops; and common specialty crops identified by the USDA Agricultural Marketing Service.

2 High-value crops include trees, bushes, vines, aquaculture, hemp, grass for seed, vegetable seed and tobacco.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.