Although staying alert to corn prices may not be much fun right now, paying attention and being ready for the little moves up will be essential.

From early November to the end of February, the corn market had been on a bearish skid amid a negative news cycle fueled mainly by large corn stocks outweighing modestly positive demand. Moreover, the USDA’s initial read on 2024 acreage and yield was largely considered bearish, and market speculators piled into a record level of net short positions.

The bearish sentiment became so negative that the March 2024 futures contract briefly dipped below $4/bu., and cash bids in parts of the U.S. followed suit. The market has recouped a small amount of the losses since the beginning of March.

What’s Poking the Bear

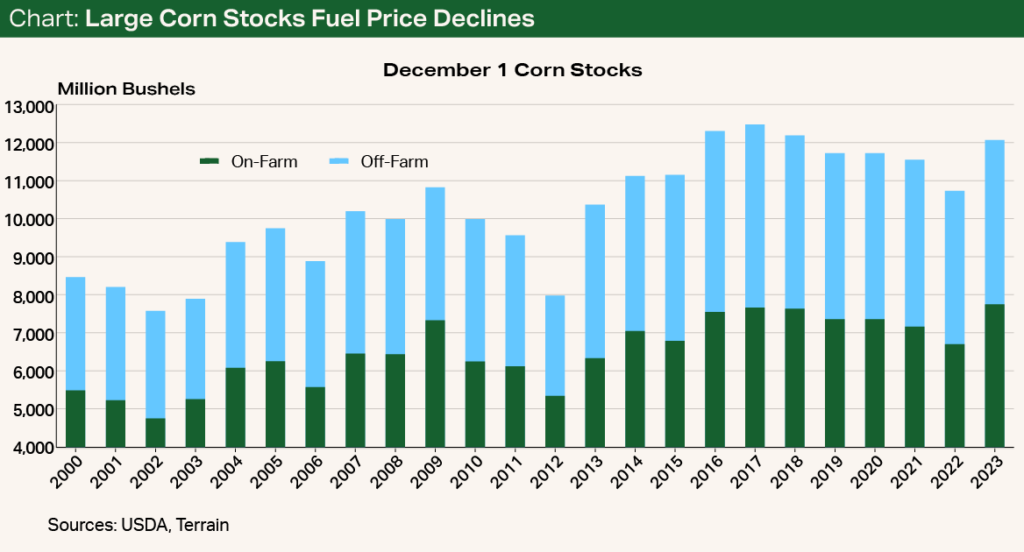

Large corn inventories, or stocks, have been the key driver of the declines in corn prices. The USDA’s December 1 Grain Stocks report showed corn stocks in storage totaled 12.2 billion bushels, nearly 13% higher than a year earlier and the highest December reading since 2018 (see Chart). Corn stored on-farm came in at 7.83 billion bushels on December 1, 2023, the highest ever recorded.

About a month after the corn stocks report was released, the USDA announced its first look at 2024 corn acreage and yield at its Agricultural Outlook Forum. The initial estimate came in at 91 million acres of corn, down from the 2023 crop of 94.6 million acres. However, because of its extremely strong yield estimate of 181 bu./ac. for the 2024 crop, the USDA estimates total corn production will decline only 2%.

The USDA’s own season average estimate for 2024 is $4.40/bu., down sharply from a year ago.

The small decline in 2024 corn production combined with large carry-in stocks from the 2023 crop has led most analysts to call for higher 2024 ending stocks and lower corn prices. The USDA’s own season average estimate for 2024 is $4.40/bu., down sharply from a year ago.

Some Good News

The big question now is not what got the market to this point, but where to go from here, particularly for those with old-crop corn to sell.

So far, though, decent demand has kept prices from deteriorating further.

The thin shred of good news is that the market has already absorbed several haymakers and demand for corn has been positive. Corn prices, cash and new crop, have followed the bearish sentiment downward and are expected to stay below the 2023 highs in the near term. So far, though, decent demand has kept prices from deteriorating further.

For example, in March the USDA reported in the World Agricultural Supply and Demand Estimates that total corn demand for the current marketing year is more than 6% better than the previous year because of strong exports, feed and food consumption, and ethanol demand. Ethanol production since September is up about 4.3% from year-ago levels, adding demand support.

Be Ready to Hit the Right Opportunity

For growers with corn left to sell, I have a few cursory thoughts.

First, don’t beat yourself up. No one ever prices the market to perfection.

The market will price itself every day, and being ready to “get a hit” when the market offers an opportunity is paramount.

Second, to borrow a baseball euphemism, don’t forget that every pitch is a strike until proven otherwise. The market will price itself every day, and being ready to “get a hit” when the market offers an opportunity is paramount.

At this point in the calendar year, most farmers will have already made prepay decisions, worked with their tax accountant, worked with their Farm Credit lender on loan renewals, paid land rent, and so forth, so price targets likely will have already been set or thought through.

At the moment, staying active in marketing may feel like drudgery with the current low prices. But the drudgery will be essential to finding and executing on the right opportunity.

Prices are likely to remain subdued in the near term, but potential bumps from factors such as South American weather, La Niña patterns, planting intentions and the March stocks report could provide much-needed pricing opportunities, albeit at a lower level than earlier in the marketing year.

Terrain content is an exclusive offering of American AgCredit, Farm Credit Services of America and Frontier Farm Credit.