Situation

Farmers and bankers alike report that the combination of higher interest rates, high equipment costs and subdued farm income will drive down demand for farm equipment. However, sales of four-wheel-drive tractors and combines are likely to hit a record high in 2023.

Outlook

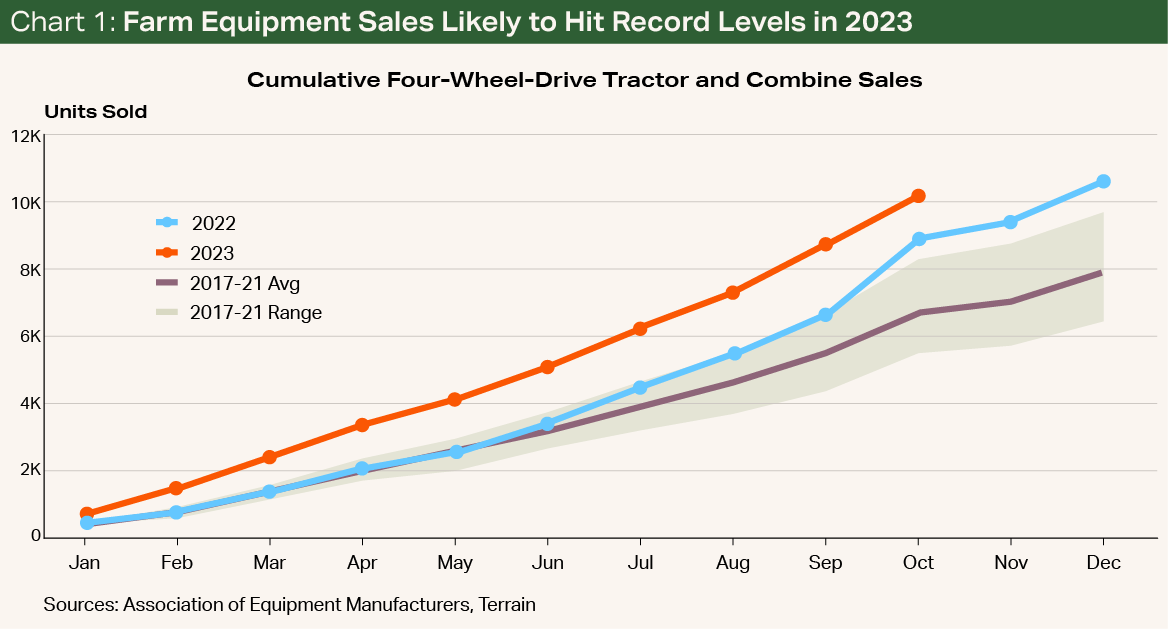

Cumulative sales of four-wheel-drive tractors and combines are likely to hit record levels in 2023, despite surveys suggesting otherwise. Looking toward 2024, I expect equipment sales to slow as interest rates and lower commodity prices begin to weigh on decisions.

The Data Says Higher Sales?

Sales of big-ticket items such as four-wheel-drive tractors and combines can be a useful bellwether for industry-wide farm income.

For instance, in 2019, net cash income on U.S. farms increased about 2.6% from 2018, when adjusting for inflation, and total sales of four-wheel-drive tractors and combines increased only 1.5% from 2018.

Sales of big-ticket items such as four-wheel-drive tractors and combines can be a useful bellwether for industry-wide farm income.

Comparatively, U.S. net cash income increased 23% in 2021 and 25% in 2022 on a year-over-year basis, while sales of four-wheel-drive tractors and combines increased 22% and 9%, respectively. While sales in 2022 were smaller on a percentage basis, the total volume of sales broke previous records.

This brings us to the curious case of 2023. Year-to-date sales of four-wheel-drive tractors and combines in 2023 are up a little more than 14% from a year ago and will break all recent records for the most units sold (see Chart 1). However, the USDA forecasts net cash income in the U.S. farm sector to decline by 24% from 2022.

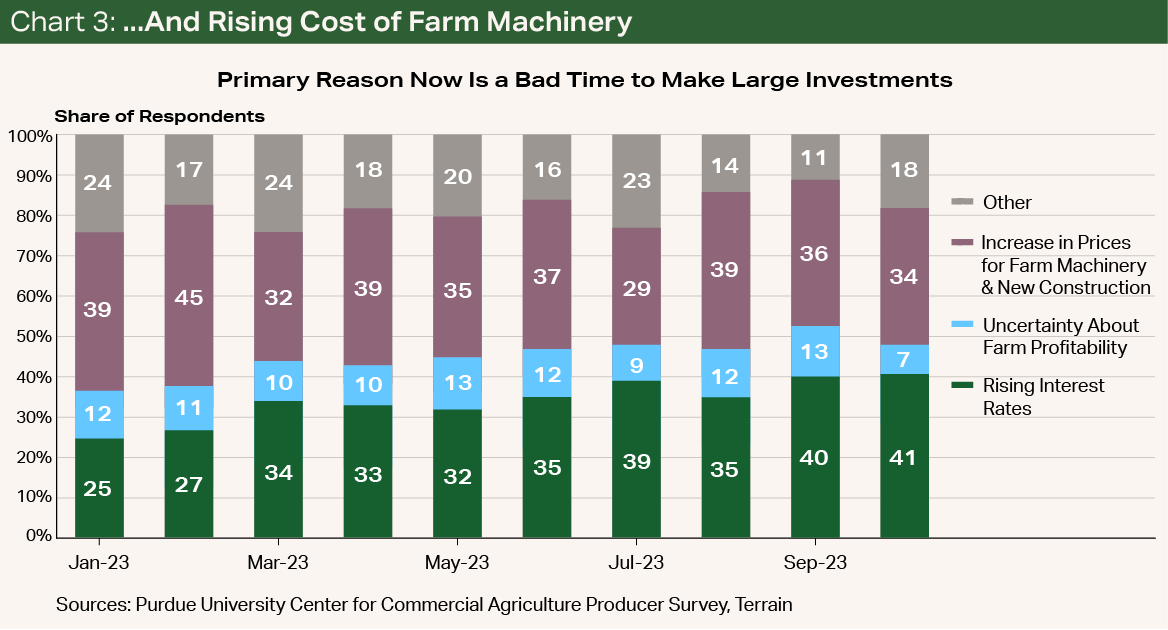

Agricultural bankers and farmers alike have also reported an expectation that capital spending will decline, adding to the disconnect. Agricultural bankers in the Federal Reserve Districts of Kansas City, Minneapolis and St. Louis have reported declines in both capital spending and farm income in 2023. Likewise, according to the Purdue Agriculture Producer Survey (Ag Economy Barometer), 78% of farmers reported in October that “now is a bad time” to purchase large farm investments like buildings and machinery.

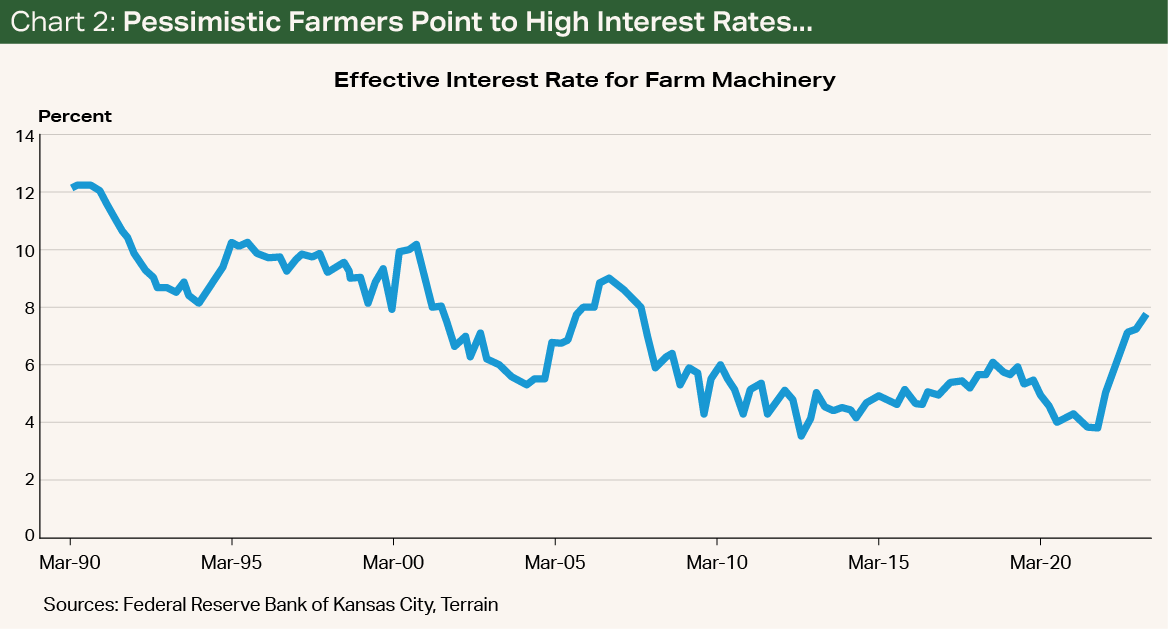

The majority of farmers who reported that “now is a bad time” to purchase large farm investments cited interest rates and the rising cost of farm machinery (see Charts 2 and 3). The hard data matches farmers’ concerns, as the National Survey of Terms of Lending to Farmers reported that the average effective interest rate for farm machinery was 7.77% in the third quarter of 2023, the highest recorded rate since 2007.

Agricultural bankers and farmers alike have also reported an expectation that capital spending will decline, adding to the disconnect.

The survey also indicated that the number and volume of new loans for farm machinery ticked up in the third quarter compared with a year earlier, but both metrics have been in decline on a four-quarter moving average. The decline in the rolling average of farm equipment loans combined with strong equipment sales likely indicates strong cash sales and/or dealer financing earlier in 2023.

Additionally, the U.S. Bureau of Labor Statistics’ producer price index for agricultural machinery, including tractors, has increased 32% since January 2020. Though the pace of the increase in farm machinery prices has slowed in 2023, with annualized growth around 2%, it is still consistent with farmers’ concerns.

Behind the Data Disconnect

There are a few potential reasons for the disconnect between sales, income and surveys.

Orders for equipment may have been decided, or placed, in late 2022 or early 2023 when the farm income picture looked a little brighter. At the start of January 2023, the corn futures contract for December was above $6/bu., as opposed to around $4.50/bu. at the time of writing this outlook.

Additionally, because of supply logistics and available inventory, many farmers may have had to delay their purchase of equipment into 2023. Moreover, there are still many farmers, and custom harvesters, with strong financial positions who purchased multiple units, often at a discount, in 2023 without borrowing money.

Looking Forward

Looking ahead to 2024, I expect sales of four-wheel-drive tractors and combines to decline from the torrid pace of 2023. Net cash farm income is expected to be lower heading into 2024, and interest rates are likely to remain elevated.

I expect sales of four-wheel-drive tractors and combines to decline from the torrid pace of 2023.

The combined impact of lower income and higher interest rates would argue for a smaller group of farmers able to purchase four-wheel-drive tractors and combines than in 2023. Additionally, given the volume of purchases in 2022 and 2023, many farmers have recently upgraded a portion of their inventory, which should reduce the amount of needed purchases in 2024.

For farmers still looking to buy equipment in 2024, they may find more deals offered by the manufacturer or manufacturer financer as new sales slow.

Farmers not looking to purchase equipment in 2024 could view market conditions as an excellent opportunity to reassess their capital replacement plan and their farm equipment debt with their Farm Credit lender to best position themselves for future growth.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.