The Rural Economist – Spring 2024

One of the benefits of working in the Farm Credit System is working closely with and for American farmers. Since fall, I have been to 10 states and countless farmer meetings. One of the early trips was to the Nevada Livestock Association conference in Winnemucca, Nevada. Reflecting on my travels, the people I’ve met along the way, and the conversations I’ve gleaned insight from, I laughed at the idea that I’ve really “toted my pack along the dusty Winnemucca road” and been (nearly) everywhere, as Hank Snow sang in 1962.

Where Will the Next Meal Go?

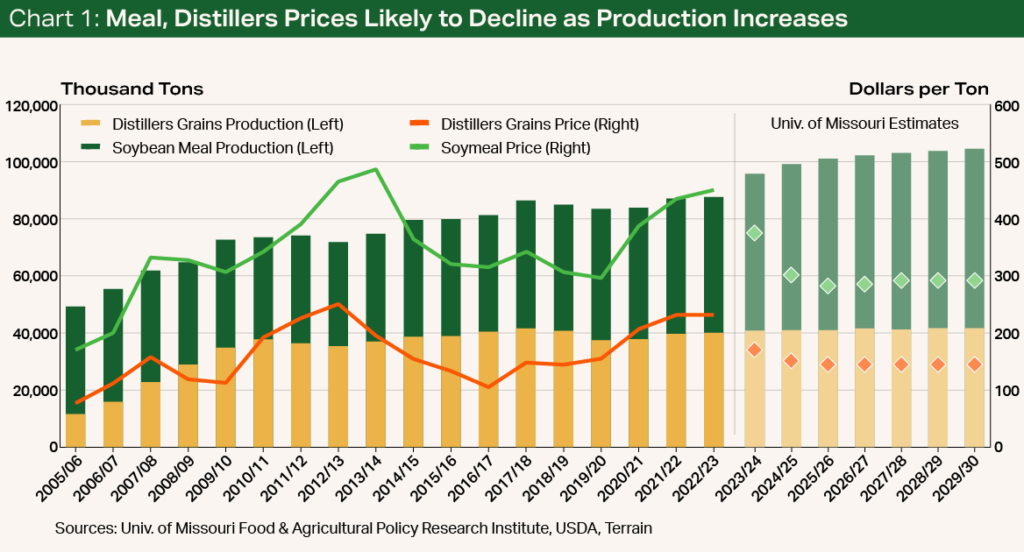

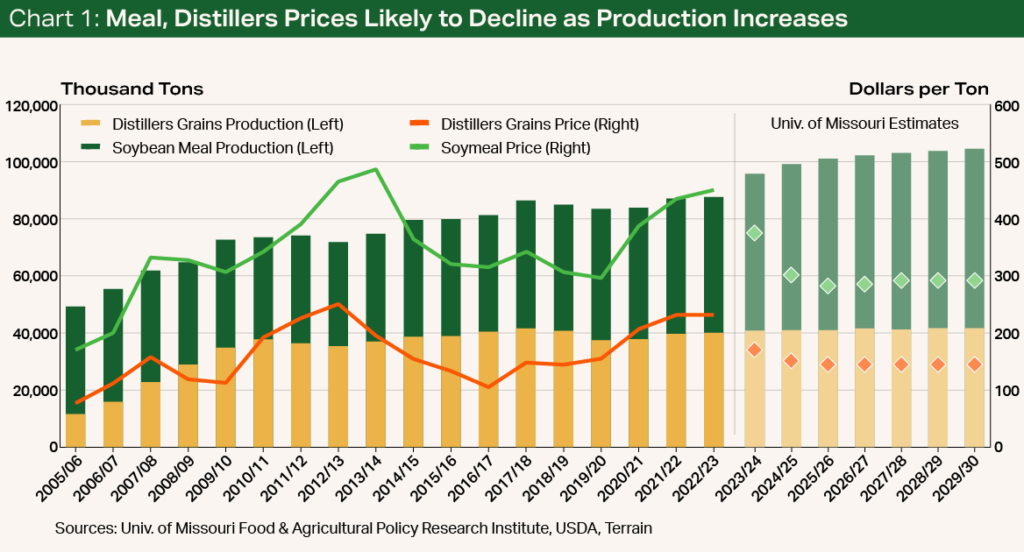

Midwestern soybean farmers will enjoy an expanded buyer pool this harvest as new soybean processing facilities come on line, with more slated to follow. Additional demand for renewable diesel, sustainable aviation fuel and other biofuel initiatives has driven the push for increased soybean crush capacity. While there are still many hurdles to realizing the potential demand, the expansion of crush facilities is likely to sharply increase the availability of soymeal. The University of Missouri’s Food & Agricultural Policy Research Institute expects soymeal production to increase 12% over the next three marketing years, and production of distillers grains to increase about 3%.

As more meal and distillers grains become available, total meat production (beef, pork, broiler and turkey) is projected to grow only slightly. The University of Missouri research institute estimates that total meat production in 2026 will be only 1.5% higher than in 2023. A rough calculation of the ratio between meat production and soymeal plus distillers grains shows a growing excess of meal for the next few years. (This is also true when factoring in milk production.) Therefore, the research institute estimates the price of soymeal and distillers grains will drop nearly 37% by the 2025/2026 marketing year (see Chart 1).

For the producers I’ve met with, now feels like the initial waves of the ethanol boom. They’re excited for increased domestic demand of soybeans (and hopefully stronger local bid prices), cheaper livestock feed, and local jobs for their rural communities at crush facilities. There are, however, familiar concerns of farmers being overpromised and facilities being overbuilt. These concerns aside, the changes to the meal complex in the next few years will likely be very disruptive, and those who can find the right products, outlets and services for the new meal complex stand to make a significant profit.

The ‘Cryptocurrency of Agriculture’

One farmer shared that the role of carbon capturing, carbon intensity scores, and the surrounding industries such as biologicals and methane digesters feel like the “cryptocurrency of agriculture.” He knows there is money to be made, agronomic advantages, programs in place and a role for his farm; however, the mixed messages, misinformation and disaggregation of solutions have led him to forfeit money for fear of playing the game wrong.

Purdue University’s monthly Center for Commercial Agriculture Producer Survey (Ag Economy Barometer) has reported that anywhere from 2.6% to 9% of producers have responded as being “actively engaged” in carbon capturing discussions. Moreover, in the September 2023 release:

- Only 2% of producers indicated they have signed a carbon capturing contract

- Nearly half reported that they were offered $10 to $20 per metric ton of carbon captured

- Around half of the producers who didn’t sign a contract cited payments being too low as the primary reason

In my travels, I’ve also observed that many farmers are more interested in programs that inset the value of their efforts to reduce carbon emissions into their bushels (or “data-enriched bushels”) than getting paid for carbon offsetting with a new agronomic practice. Insetting solutions are more complicated for all in the supply chain, but farmers who have invested heavily in technology and sustainable practices over the long haul are eager to see the payoff in more ways than just operational efficiency, improved soil health or reduced inputs. A win for this group may be gaining premiums through data-enriched bushels.

I expect the rebuild of the current beef herd to be much slower for four reasons.

Where’s the Beef?

Most in the industry know well the beef herd’s decline to its smallest size since 1961. But the potential to rebuild the beef cattle herd, and resulting impact on local communities, has been poorly considered. The last beef herd rebuild occurred from 2015 to 2019, when the industry grew the herd by just under 2.7 million head, up about 9.2% from 2014 levels. But I expect the rebuild of the current beef herd to be much slower for four reasons.

First, the rangeland available for beef production is shrinking. The 2022 USDA Census of Agriculture indicated that pastureland, excluding cropland and woodland, declined 2% from 2017, and 5% from the high in 2012, to the lowest recorded level since this acreage was first reported in 1997.

It is unlikely that more ground will come into pastureland, as large chunks of pastureland have been eaten up by urban development, converted into recreational land and solar farms, or placed into the Conservation Reserve Program. Total cropland acres have also declined. In short, there is a more limited supply of pastureland that could significantly move the needle on herd size.

Second, the U.S. beef herd has steadily become more efficient and reduced the need for a significantly larger herd. For example, the 2022 beef cow herd produced 8% more pounds per beef cow than the 2015 beef herd and 15% more than the 2000 beef herd. Moreover, even as slaughter weights of the animals have steadily increased, the yield (what is used for meat products versus other byproducts and waste) has remained stable over the last two decades.

Third, the cost of herd expansion has sharply increased. By my calculations, the average price of a bred heifer (a female that is pregnant with her first calf) in Kansas has increased 64% since the first quarter of 2019. Likewise, the average price for a Kansan rancher to sell a grown female calf for beef instead of keeping her as a breeding cow in the herd has increased 45% over the same period. Therefore, the cost of buying new cows or retaining your own heifers has significantly increased and blunted the potential for a quick herd rebuild. Keep in mind that interest rates have also more than doubled during this period.

Fourth, the older average age of ranchers, particularly those with large herds who are on solid financial footing, seems to be preventing herd growth. Ranchers I've met with who have the capacity to expand are reluctant to do so because of the amount of labor and financial resources involved. These older ranchers are looking to take on less financial risk, not more.

A smaller beef herd that builds very slowly is likely to be a financial headwind in the medium term for some rural economies. Slaughter facilities are greatly increasing their capacity, which will come on line during a period when fewer cattle are available for slaughter. This supply-demand tightness could:

- Drive local cattle bid prices higher (a short-term boon for some communities)

- Encourage less female calf retention, reducing local input purchases in the medium term

- Force packers to reduce costs as much as possible to maintain margins

- Force feedlots to operate at less than full capacity

These changes may temporarily increase the cash flow into rural communities. However, in the medium term, the reduction in labor and inputs to support the cattle herd and feedlots could reduce cash flow significantly.

No Longer China, China, China

For the last several decades, it was impossible to meet with farmers without talking about exports to China in great length, and for good reason. Export demand from China drove many agricultural markets to new price heights and allowed for expansion. At the same time, the agricultural community felt the pain as exports to China faltered from 2017 to 2020.

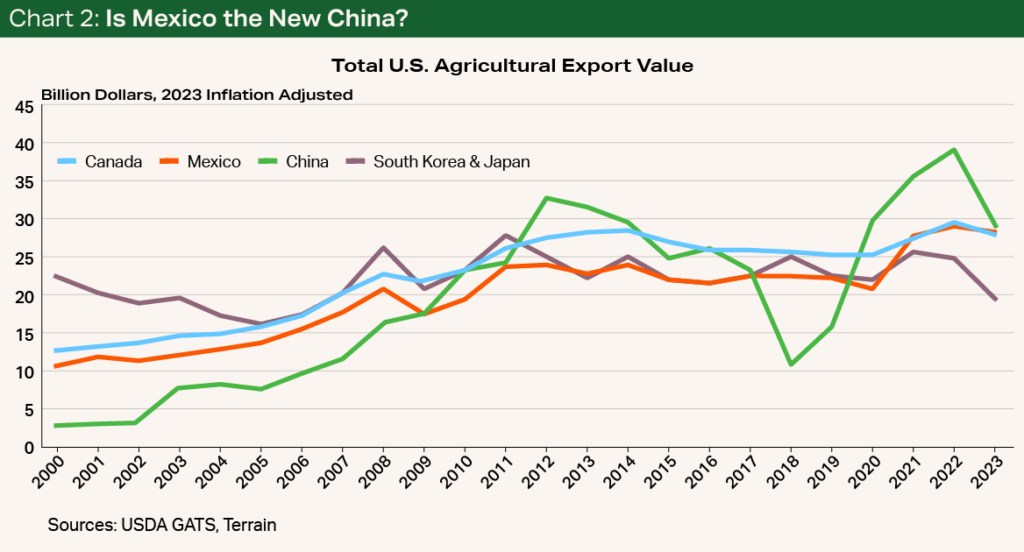

In recent discussions with farmers and agribusinesses, the role of Mexico and Canada has begun to crowd into the conversation about China. U.S. agricultural exports to Mexico grew 46% from 2010 to 2023, compared with just 25% for China and 20% for Canada, adjusted for inflation. Meanwhile, U.S. agricultural exports to South Korea and Japan, formerly top trade markets, declined 17% in the same period (see Chart 2).

In the next five years, the International Monetary Fund (IMF) projects the Mexican population to increase about 4%, compared with a slight decline in the Chinese population and a mild increase in Canada’s population. The IMF also expects nominal GDP in Mexico, Canada and China to grow about 5% annually over the next five years. The expected growth in Mexico’s population, GDP and GDP per capita as well as the country’s ease of transportation logistics and relative currency stability all signal increased trade opportunities for U.S. producers and agribusinesses.

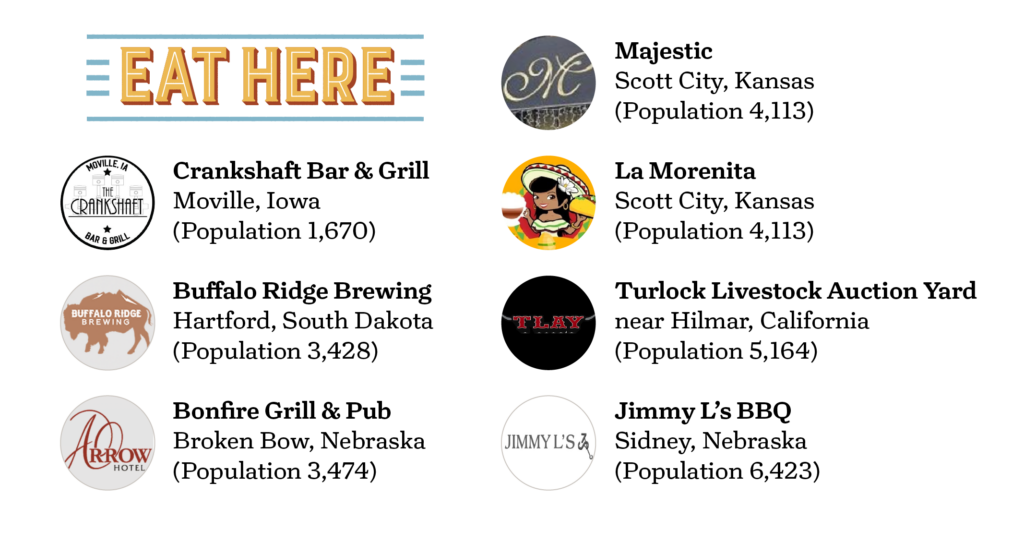

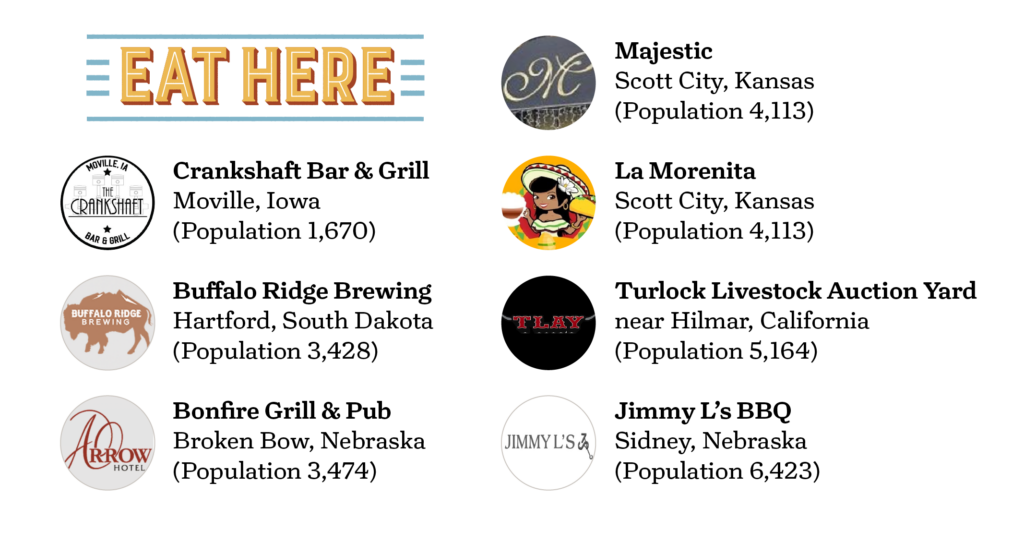

For Your Travels: One fun thing about traveling for work is sampling the local fare. Here is a short list of local restaurants I enjoyed in towns with a population below 6,500 that I visited in the first three months of 2024:

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.