Election Won’t Erase Trade Volatility With China

U.S. government policy has an important influence on grain and other agricultural markets. Take, for example, the ethanol boom over 15 years ago or recent efforts to find low-carbon fuel like renewable diesel, increasing domestic soybean crush capacity.

Export markets are no exception.

The U.S.-China trade war in 2018 limited soybean exports, though levels normalized two years later, with record U.S. soybean exports in 2020/2021. Since then, exports to China — the largest importer of U.S. soybeans — haven’t quite returned to pre-trade war levels.

A March 2023 survey by Pew Research Center reveals that more than 80% of Americans have an unfavorable opinion of China and 62% view its partnership with Russia as a very serious problem for the U.S. Additionally, both the Trump and Biden administrations have imposed tariffs on Chinese imports. These factors help demonstrate that trade with China is a bipartisan issue.

Therefore, regardless of who is the next U.S. president, grain producers should be prepared for ongoing trade volatility with China. Also, given the inconsistency and instability of China’s demand, the U.S. soybean industry must seek alternative demand outlets to support prices.

Nurturing Domestic Demand

Even if a trade war doesn’t reemerge, China’s demand for soybeans will not be as robust as before, as the country’s demand for feed and general economy are showing signs of softening. Future U.S. soybean prices will be pressured unless there is a significant increase in crush demand in the U.S. to make up for the lack of exports. In this scenario, soymeal and soybean oil values would support prices.

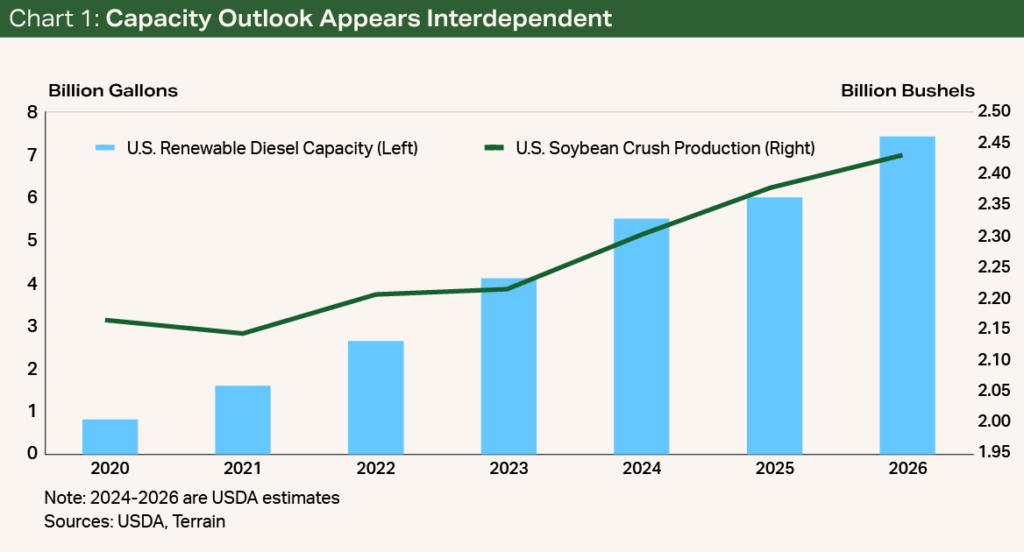

With multiple federal and state regulations focused on reducing carbon emissions, renewable diesel production and, therefore, soybean crush plants have expanded in the last few years, with 12 new crush plants slated to come on line by 2026.

While many feedstock options exist to produce renewable diesel, each is based on a carbon intensity score. Animal fats and used cooking oil have the lowest scores (given they are considered waste products) and, thus, the highest profitability with increased tax credits. Conversely, the benefit of soybean oil used as a feedstock in renewable diesel production is the sheer availability of the product here in the U.S.

However, it’s important to note that when a soybean is crushed, only 20% of the composition is oil, with the remaining 80% being soymeal. As the crushing industry has expanded, so have U.S. soymeal exports, increasing 8% in 2022/2023 per the USDA. We must generate significant demand for the additional soymeal if soybean oil is to continue to expand as the primary feedstock for renewable diesel (see Chart 1).

Policies that support U.S.-produced crushed byproducts would ensure domestic soybean demand and help our country’s low-carbon fuel initiatives.

While it is hard to predict how much global demand soymeal will generate as it becomes more accessible with lower prices (caused by an increase in supply), we do know that consumption grows with population and middle-class expansion.

Rather than focus on export soybean demand from China, the U.S. should foster new export relationships for soymeal and use soybean oil as the primary feedstock for renewable diesel. Policies that support U.S.-produced crushed byproducts would ensure domestic soybean demand and help our country’s low-carbon fuel initiatives.

Trade Volatility With China: The Road Ahead

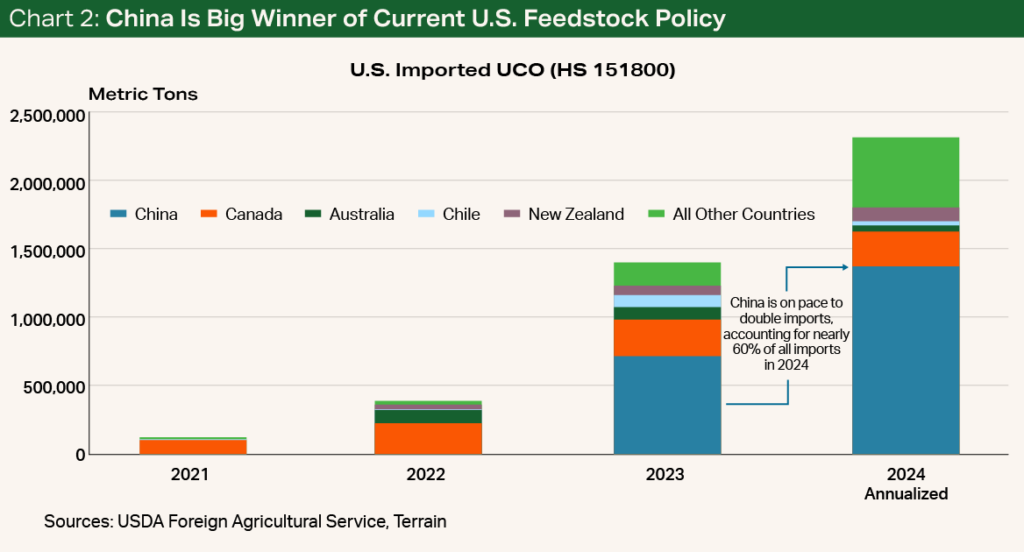

While China has not purchased U.S. soybeans in a big way thus far this crop year, the current U.S. trade policy and rules around feedstocks for renewable diesel have not benefited U.S. producers as expected with increased domestic crush. Rather, they have benefited China in a big way.

For example, used cooking oil (UCO) imported from China continues to pour into the U.S., decreasing demand for domestically produced soybean oil as a feedstock to the renewable diesel industry (see Chart 2). The spike in imports just so happened to coincide with the European Commission initiating an anti-dumping investigation into Chinese UCO imports. There are also concerns about fraud, namely that China is using imported Malaysian palm oil, which has been linked to deforestation, and rebranding it as UCO.

So far, China’s soybean import activity has been extremely quiet. Imports are down over 15% yearly through May 2024, according to the USDA’s Foreign Agricultural Service. While China may be focused on becoming self-sufficient for its domestic feed and protein needs, the Chinese Academy of Agricultural Sciences predicts that China will still need U.S. soybeans and sorghum exports by 2050. However, given the inconsistency in China’s demand, the country is unlikely to purchase U.S. soybeans at the same rate as it has in the recent past.

Additionally, China has made significant infrastructure investments in Brazil, the world’s largest soybean producer and a top competitor for U.S. soybeans. According to the U.S. House Foreign Affairs Committee, from 2005 to 2022, China distributed almost 120 loans totaling nearly $140 billion to South America, including Brazil. And in 2017, China Merchants Port Holdings Co. Ltd. bought a 90% stake in Brazil’s most profitable and second-largest port, TCP Participacoes. Not only has China continued to rely on Brazil for its soybean needs, but it also has expanded to corn imports.

These examples highlight why China is not a dependable trade partner with the U.S. and new trade partnerships need to be fostered to support long-term soybean demand.

The Evolving U.S. Soybean Market

While trade restrictions overall can disrupt and limit the global free market, I would argue that certain policy changes on import tariffs would be welcome news to U.S. grain producers. To help realize a lower carbon footprint, the U.S. should limit imports such as UCO from China and instead use soybean oil produced domestically as a renewable diesel feedstock.

I expect grain export markets to be more volatile in 2024 than in prior years, creating instability in grain prices.

If no policy action is taken, and imported UCO is substituted for domestic soybean oil, we could see crushers reduce their pace because of margin concerns. Soymeal prices could then spike.

Because it is a presidential election year in the U.S., I expect grain export markets to be more volatile in 2024 than in prior years, creating instability in grain prices. Developing alternative marketing plans and risk strategies by being willing to sell grain, especially if undersold given the old-crop carryout, will help producers weather the geopolitical storms ahead.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.