Quarterly Outlook • November 2, 2022

Wheat Fall Planting: Will High Insurance Guarantees or Drought Win?

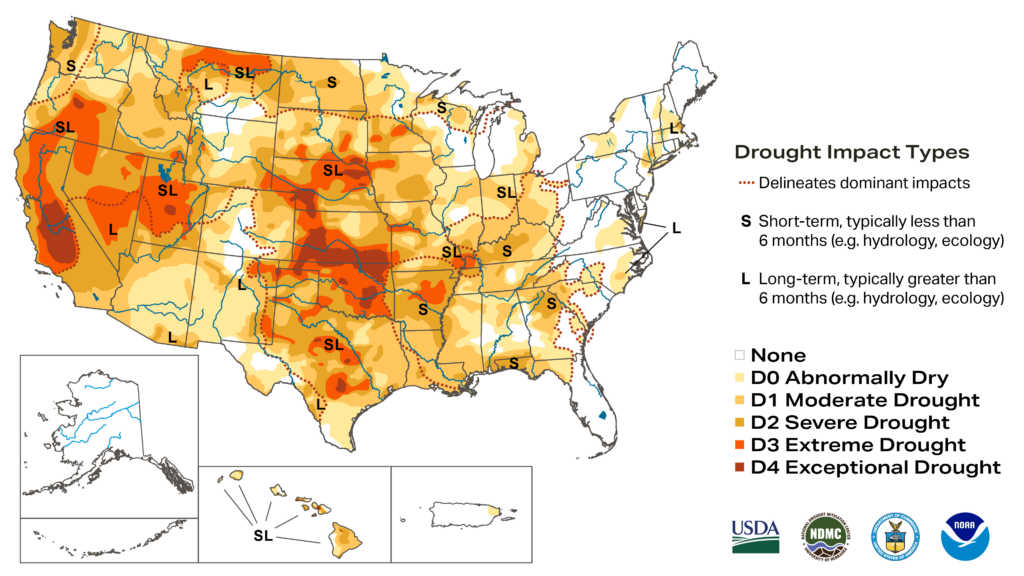

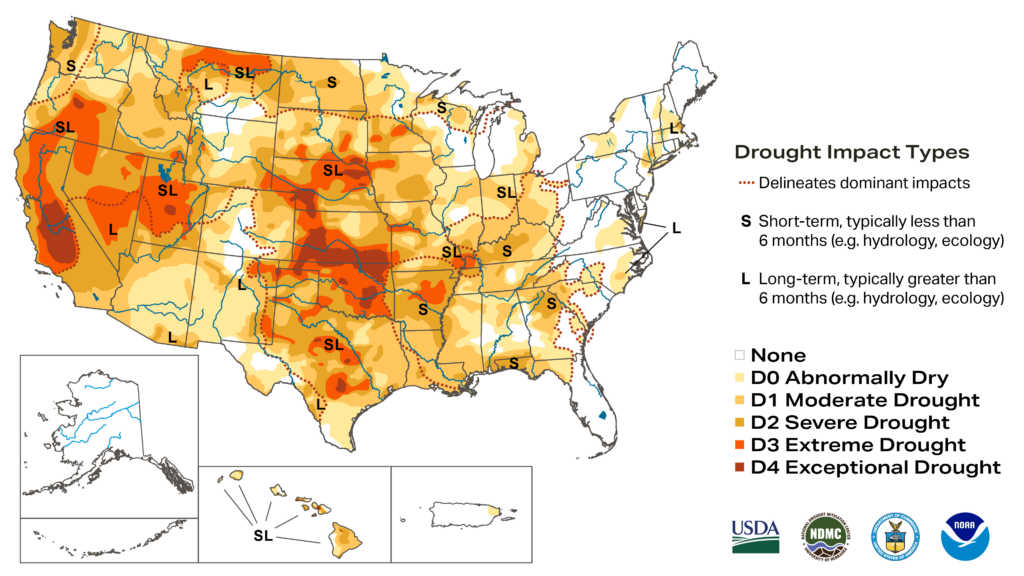

Dry planting conditions and high nitrogen prices for winter wheat have not offered an ideal planting season in the High Plains. The only potential saving grace is that the crop insurance planting price is $8.79 per bushel, which will help assuage many farmers worries about the poor soil moisture at planting. I expect to see a small decline in hard red wheat planted acres this fall.

Wheat exports so far this year are on track, which is especially positive given the strong U.S. Dollar. Historically, strong USD hurts wheat more than corn or soybeans as there are more competitors in the wheat market. With the complexities surrounding Russian and Ukrainian wheat exports, that historical pattern is probably less likely to hold.

The Ukrainian-Russian grain export agreement expires in late November, and forecasting politics is even more difficult than forecasting prices. While both have had large impairments to their ability to export in 2022 due to the war, the global situation is tight enough that any uncertainty about renewal will send prices higher. Ultimately, I believe the agreement will continue to be renewed, as Russia’s only allies—China and India—will demand it be so due to their own food needs and the needs of their own national allies, but I won’t be surprised to be wrong.

With the severe drought in the U.S. Great Plains, 2023 wheat prices will be very sensitive to weather pattern changes, both up and down. We are already hearing talk of La Nina in 2023, though it’s much too early to predict whether it could matter for yields.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.