Report Snapshot

Situation:

With adequate supplies of old crop corn in storage and new crop corn-planted acres exceeding 95.2 million acres, U.S. corn could re-test sub-$4/bu. at harvest if yields are strong.

Outlook:

U.S. demand has been robust, with rising exports and growing ethanol and feed demand. There will still be opportunity for prices to increase to or above $5/bu. post-harvest in 2026 as global demand continues to outpace supply.

Many Reasons for Higher Corn Prices

The U.S. and global corn balance sheets tightened, according to USDA’s June World Agricultural Supply and Demand Estimates (WASDE). Larger exports (raised 50 million bushels to 2.65 billion bushels) lowered old crop ending stocks from 1.415 billion to 1.365 billion bushels (a bit lower than trade expectations). Additionally, USDA forecast export demand to increase in 2025/26 to 2.675 billion bushels.

New crop global ending stocks were lowered by 2.6 million metric tons (MMT) to 275.2 MMT. Ongoing conflict tensions between Russia and Ukraine, as well as drought issues in the region (including portions of China), may impact both wheat and corn production, providing increased opportunities for U.S. corn exports to backfill.

But the managed money funds and future contract prices continue to be unimpressed with the friendly news.

Bears in the Cornfield

The new crop December 2025 future contract has been trading mostly sideways between March and early June, between $4.35/bu. to $4.67/bu. Speculation for ballooning supplies in Brazil prompted prices recently to test a new low around $4.19/bu.

The assumption of large new crop U.S. corn supplies – given that farmers said they would plant more corn acres this year and USDA’s expectations for record U.S. corn yields – prompted managed money to short the corn market in early May and increase their short positions for all of May and June.

However, not all of the U.S. planting season has gone well. Excessive moisture during the latter half of June in the East could cause some prevent plant acres and/or corn acres to flip to soybeans, casting some doubt on USDA’s current new crop production estimates. The August WASDE new crop report will shed more light on what changes occurred due to the wet weather in the East (as the June 30 planted acres report reflects survey responses between May 30 and June 16, not reflecting the entire month of June).

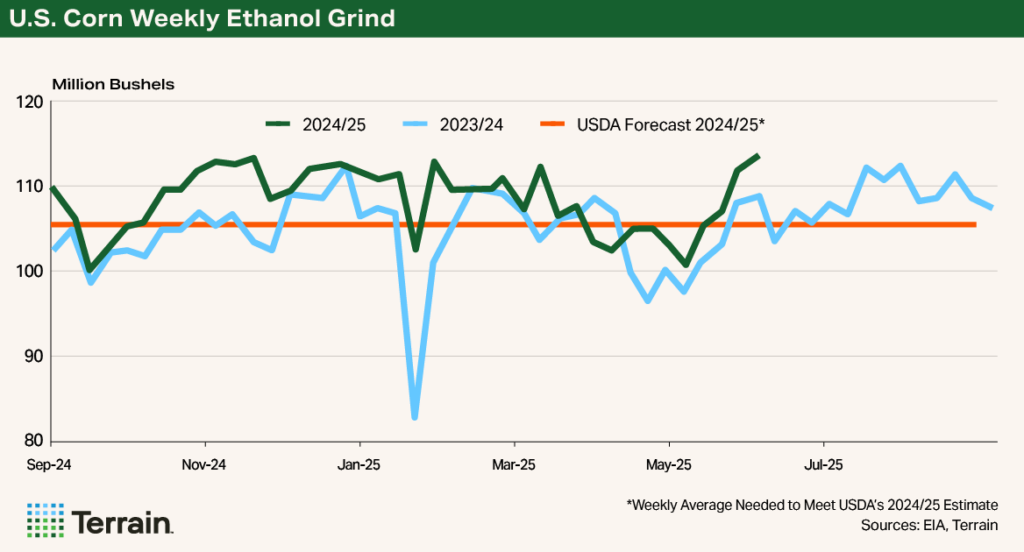

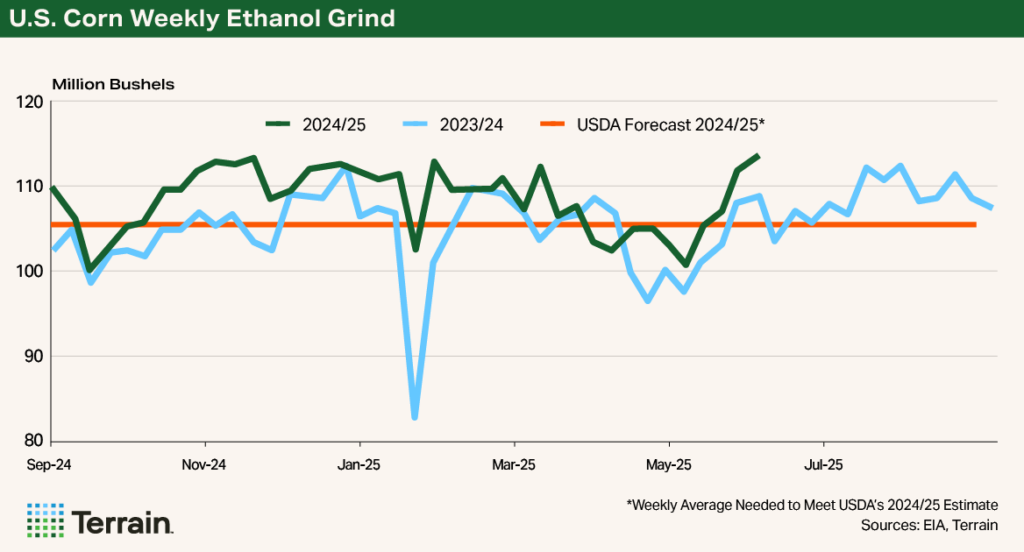

U.S. Ethanol’s Accelerating Demand

Domestic ethanol demand has positive prospects going forward. On June 6, weekly ethanol production hit a record and, in most weeks this crop year, production has outperformed last year’s.

On June 13, 2025, the Environmental Protection Agency announced proposed renewable fuel standards for 2026-27.1 The proposed requirement satisfied by conventional corn-based ethanol would be flat at 15 billion gallons, and small refinery exemptions (SRE) would not reduce total renewable fuel standards. This means non-exempt refineries will have to have higher compliance, thus supporting future ethanol production.

While the rule is expected to be finalized later this year, and it does not address outstanding SREs, the move reinforces confidence for the future production of domestic biofuels, including ethanol.

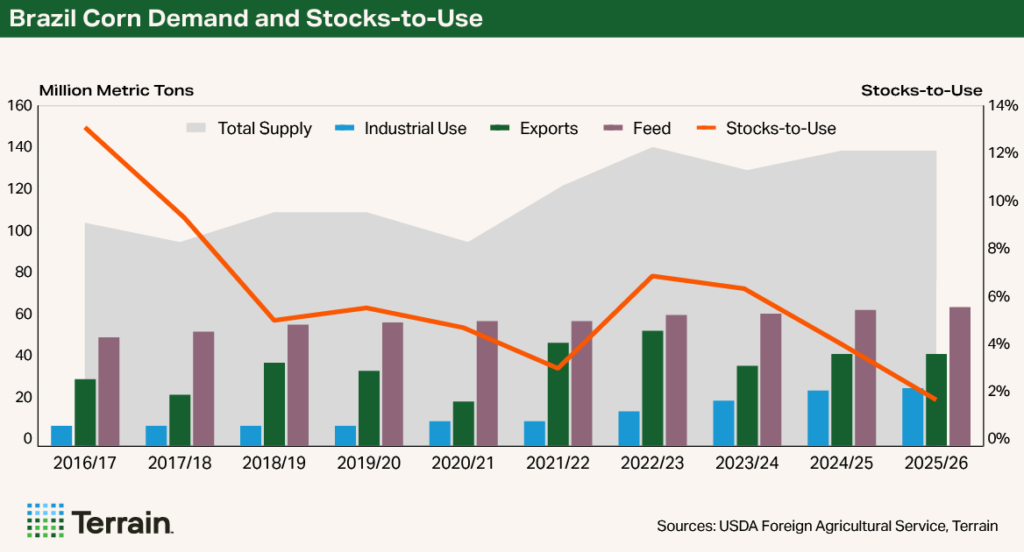

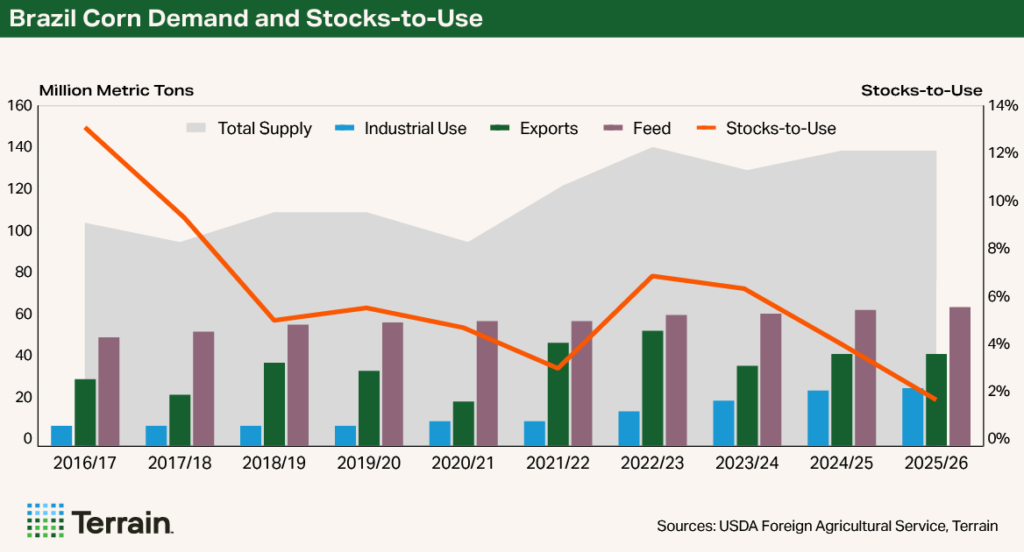

Ethanol’s Eating Brazil Corn Too

The U.S. is not the only country maintaining or expanding support for corn-based ethanol. Brazil, our largest global corn export competitor, is also using increasing amounts of corn for ethanol. In late June, Brazil’s National Energy Policy Council approved increased ethanol blend from 27% to 30% starting August 1, 2025. This will be supportive for additional domestic consumption of corn going forward, potentially limiting their corn exportable supplies.

Brazil’s domestic consumption has risen more than 50% in the past decade, thus tightening available stocks for exports. Brazil has become the second-largest ethanol producer, doubling corn ethanol production in the past five years (corn for industrial use has increased from 11.5 MMT in 2020/21 to 26.5 MMT in 2024/25). Their tight stocks and record-tight stocks-to-use at 2% are expected to continue in 2025/26, driven by increased feed use, too. This could cap Brazil’s export potential, putting the U.S. in an excellent position to increase exports as we move into 2026.

Excessive moisture in Brazil has also slowed their second crop corn harvest pace, (according to CONAB – as of June 21, 10.3% harvested area versus 28% last year), which could extend the U.S. old crop export window, further drawing down the U.S.’s old-crop stocks. Argentina is reinstating its corn export tax of 12% (was reduced to 9.5% January to June to incentivize farmer selling and thus exports) effective July 1. Combined with the weaker U.S. dollar, U.S. corn exports could remain strong during South America’s normal peak export window this summer. The U.S. reciprocal tariff pause ends July 9, so any new trade agreements or an additional pause can also influence price direction.

Weather Likely to Be Market’s Lone Friend Before Harvest

Given that price rallies this summer will be tied to a very unpredictable variable – weather – farmers should know their break-even levels and consider forward selling in increments when prices go above that threshold. Reward any weather scares this summer if they come, given the bearish new crop supply outlook.

Farmers should also consider risk management strategies that limit downside risk while leaving upside potential open. If the U.S. has favorable weather this summer and USDA’s current record yield forecast is achieved, expect prices sub-$4 near harvest time. However, I still do expect price rally opportunities into 2026, primarily driven by increased global demand supportive of U.S. exports in the second half of the new crop year.

Endnote

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.