At its Agricultural Outlook Forum in February, the USDA estimated 87.5 million planted acres of soybeans in 2024, which threw the market a slight curveball. The estimate would represent the third-largest soybean acres on record and the ninth-largest year-over-year (YOY) increase since 1980.

Many have asked if soybean acres can really hit the USDA’s initial estimate and take a bite out of King Corn’s acreage.

Moreover, the difference between corn and soybean acres would be the seventh narrowest since 1980. In my conversations with farmers, mostly across the western portion of the corn belt, many have asked if soybean acres can really hit the USDA’s initial estimate and take a bite out of King Corn’s acreage.

Within the Realm of Possibility

There are four reasons I believe the USDA’s soybean acreage estimate of 87.5 million acres is feasible, though certainly large.

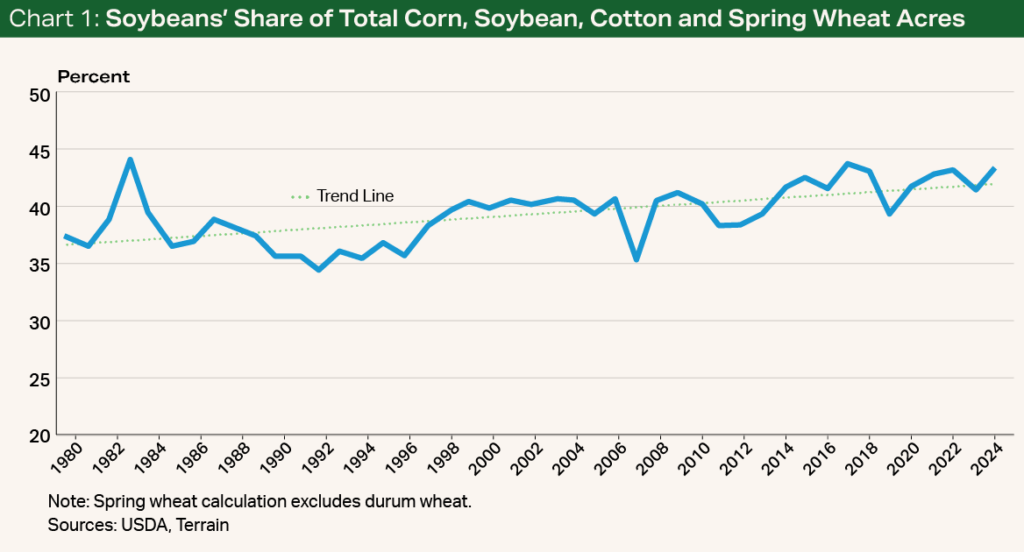

First, soybeans have steadily gained a higher share of acres. The initial 2024 estimate of acres would give soybeans about 44% of all acres planted to corn, soybeans, cotton and spring wheat. This share would be only slightly above the historical trend line of increasing soybean acres (see Chart 1).

Second, 87.5 million acres of soybeans would not be a record and would be only 3% above the 10-year average.

Third, domestic soybean consumption (and demand) has steadily increased over the last several years. The most recent World Agricultural Supply and Demand Estimates forecasts domestic consumption for the current soybean crop will be nearly 5% higher than a year earlier, helping to somewhat offset laggard export numbers.

The domestic soybean crush has also steadily increased, and several new crush plants could begin purchases in the new marketing year. The improving domestic demand situation could argue for increased soybean acres as end users seek to “buy acres” with stronger local cash prices relative to corn.

The stronger-than-average price ratio would argue for an increase in soybean acres.

Fourth, at the beginning of March, the ratio of November 2024 soybean prices to December 2024 corn prices was about 2.7, which is much stronger than the 30-year average of slightly below 2.5. By mid-March, the ratio was closer to but still above the 30-year average. Although the research is somewhat mixed on this subject, the stronger-than-average price ratio would argue for an increase in soybean acres.

Still, There Are Hurdles

However, many farmers I have spoken to are quick to point out that the cost-return benefit of planting more soybean acres is not clear. Soybean prices have slipped alongside corn as weak export demand, a strong U.S. dollar, and robust South American production have weighed on prices.

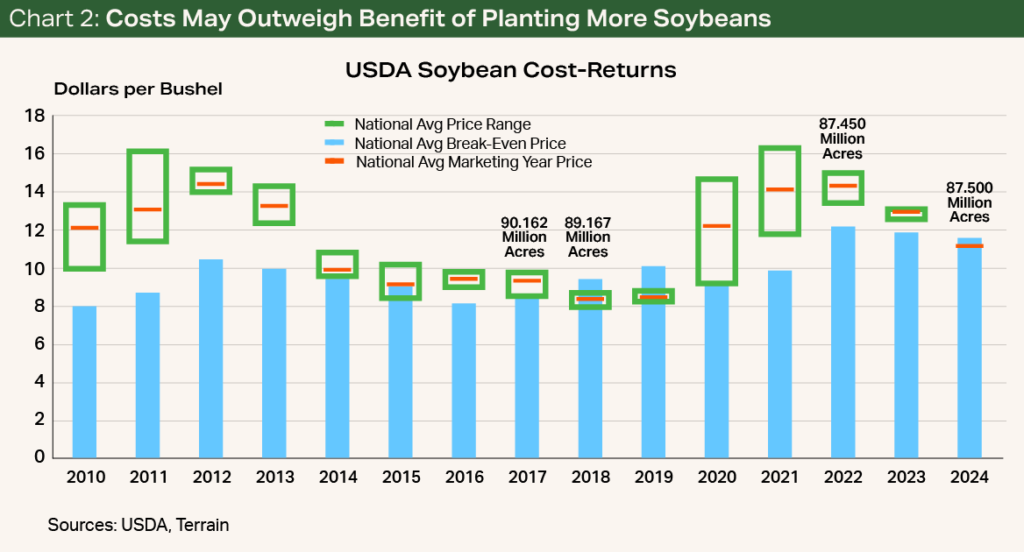

Additionally, the USDA’s cost-return budgets indicate that the current break-even costs, after factoring out labor opportunity costs and using the USDA’s estimated yield of 51 bu./ac., are slightly above the USDA’s estimated season average price of $11.20/bu. (see Chart 2). The tighter financial outlook may prevent farmers from disrupting their long-term crop rotation plans in favor of more soybeans.

In my conversations with farmers, there is also a sense that soybean yields are less reliable than corn yields, so some farmers will be less likely to take acres away from corn in favor of a bet on soybean yields.

Overall, though, it is entirely possible that farmers plant 87.5 million acres of soybeans in 2024. Farmers looking to start pricing their 2024 soybean crop should pay close attention to incoming market estimates, weather events, South American production, and export purchases, all of which may provide some pricing opportunities after the market absorbed the initially bearish news of 87.5 million acres.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.