Outlook • May 8, 2025

Ag Cycles in Opposite Ends of the Spectrum

Rural Economist: Spring 2025 | Theme 2

Key points:

- Cattle producers, on the upswing in profitability, have taken a conservative approach, so far, to herd expansion and other investment in their operations.

- Crop and hog producers, meanwhile, have faced a downswing, putting pressure on equipment sales, land values and, ultimately, Congress to shore up farm supports.

Often the highs and lows of the cycles can obscure our perception of the amount of risk, and potential return, in the market as sentiment and future outlooks can become overly bullish or bearish.

Most agricultural products are a "fungible commodity," meaning prices are driven by supply and demand for highly standardized products with a shelflife. These markets are also characterized by cycles that push the industry toward the lowest production costs. Often the highs and lows of the cycles can obscure our perception of the amount of risk, and potential return, in the market as sentiment and future outlooks can become overly bullish or bearish.

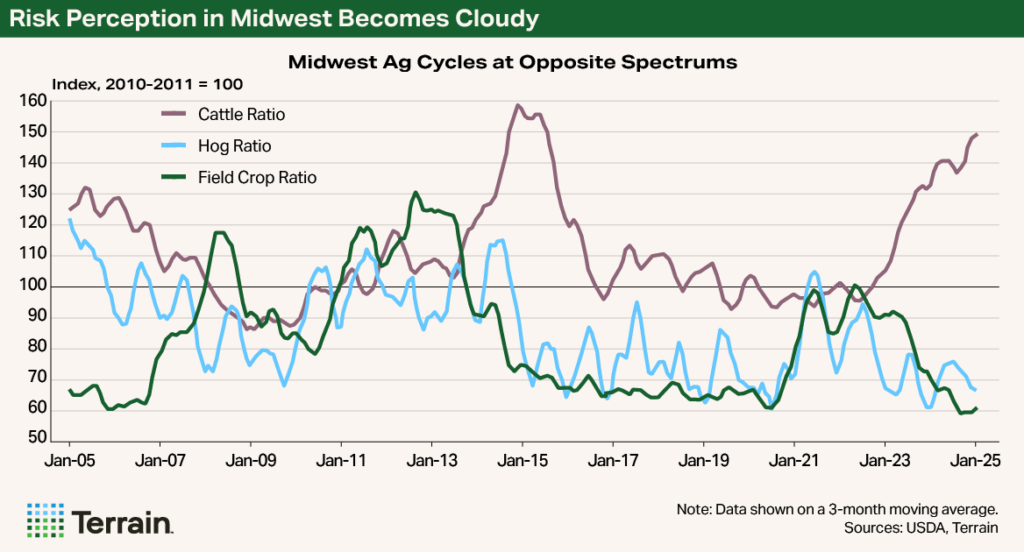

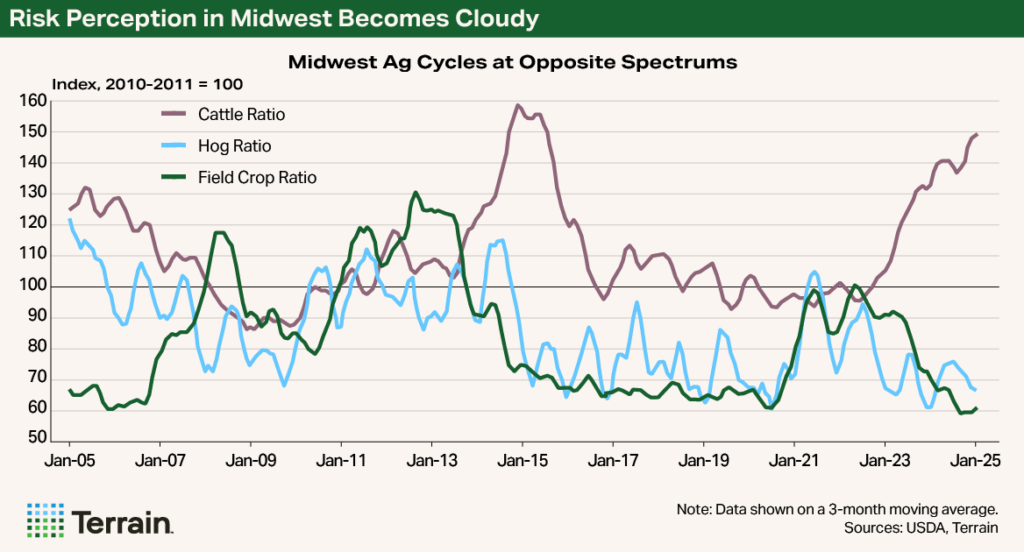

For example, the Midwest is currently experiencing both extremes of the agricultural cycle in field crops and cattle. The cattle price received-to-input cost paid ratio is at a record high, while field crops and hogs prices received-to-input prices paid ratios are at record lows. Farmers and ranchers in both industries view the current situtation as highly risky.

On the upswing in the cattle industry, the extreme in financial performance has yet to lead to over-investment, or strong herd expansion, due to the high cost of entry or expansion, a lack of available rangeland, improved efficiency in the beef herd, and average age of the rancher as outlined in the Spring 2024 issue of the Rural Economist. Many ranchers have also needed to solidify their financial position from several previous years of negative-to-thin profit margins, and nearly all ranchers have been leery from the market volatility observed from 2014 to 2016. In other words, many in the cattle industry have been downsizing, stabilizing or in some ways preparing for the other shoe to fall for more than a year. The risk of “irrational exuberance” is likely limited to some individuals and not the industry at large.

On the downswing, the hog industry has been feeling the pinch from poor consumer demand, oversupply in 2023, shackle space issues, labor costs, etc. In short, the industry has felt it from all sides. My conversations with hog producers suggest that optimism in 2023 likely hit a bottom. There may be continued consolidation opportunities in 2025, though the desire to expand seems limited.

Field crops are also on the downswing, as the price received-to-price paid ratio has recently hit lows. For some, strong yields in 2024 helped mitigate the impact of poor price ratios, with corn yields setting a record high and soybean yields being the fourth highest. However, financial conditions in regions with poorer yields—wheat-sorghum-heavy areas and in the cotton belt—have deteriorated quickly. Most 2025 cash flow projections for all regions indicate losses or near-breakeven conditions for producers. Some producers may be entering a third consecutive year of below-breakeven budgets.

As a result, balance sheets for field crop and hog producers have already tightened or they are beginning to do so. This is highlighted by the rapid decline in used machinery values, sharp declines in new equipment purchases, generally flat land values, increased borrowing needs, and new ad hoc financial support provided by Congress. While delinquency and farm bankruptcy rates remain historically low, the current economic headwinds across some sectors of agriculture could lead to an acceleration in these financial indicators.

Bottom Line: Field crops and cattle are on opposite ends of the spectrums for ag cycles and balance sheet concerns. As such, producers and investors should all take stock of their financial condition and playbook. Typically, when the industry reaches the high and low of the cycle, risk perception becomes the cloudiest.

The good news is that those who play the right hand at the top (cattle) and the bottom (field crops and hogs) stand to gain significant leverage when the markets turn—and one thing we know about agriculture is the markets will inevitably turn.

This article is part of The Rural Economist, a report that brings forward the trends that will impact agricultural investments tomorrow.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.