Outlook • May 8, 2025

The Changing Funding Structure of Rural America

Rural Economist: Spring 2025 | Theme 3

Key points:

- Bank deposits have grown at lower levels in areas with declining populations.

- In partnership with traditional agricultural lenders, alternative capital pools and consolidated lending institutions could offer more ways to meet farmers’ and ranchers’ financing needs.

Traditionally, access to funding has been tied to physical access to brick-and-mortar financial institutions. Research by Van Leuven, Lamber, Conroy, and Thomas (2024) found that farming-dependent counties had a strong financial institution service presence, but brick-and-mortar availability has declined in sparsely populated counties.

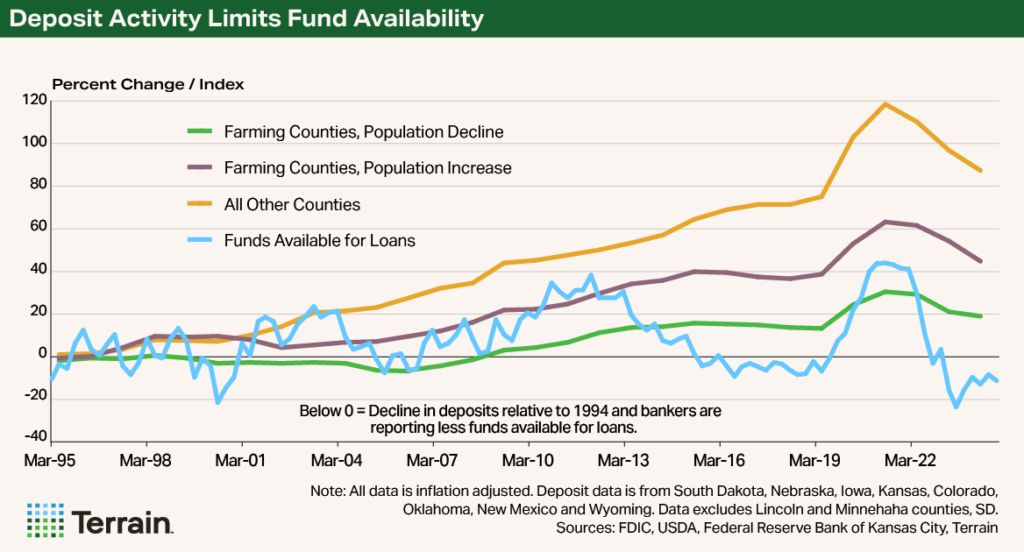

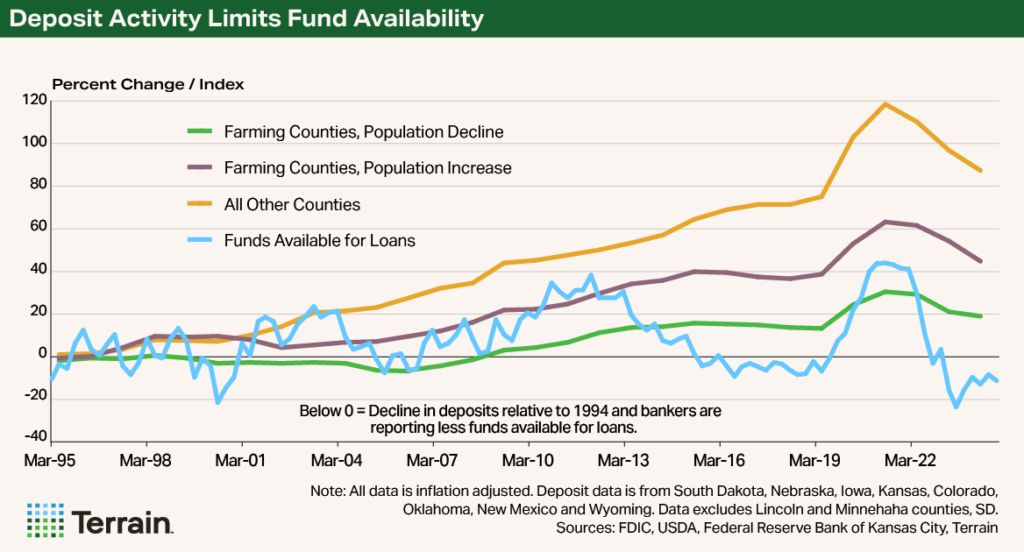

However, funding availability may be a better measure of financial “access” for many rural farmers. In 2024, bank deposits in Midwest counties that are farming dependent and experiencing population decline were only 19% above 1994 levels when adjusted for inflation to $28 billion. Deposits in farming dependent counties with population growth were up 44% from 1994 to $16 billion, and deposits in all other counties were up more than 87% from 1994 to $659 billion.

Comparatively, farmland values have increased by 164%, tractors by 64%, and corn production costs by 33%, accounting for inflation. Consequently, agricultural bankers report significantly fewer funds available for loans, due to the disparity between deposits and input costs.

The gap in deposit growth and farm input cost increases likely has been a contributing factor to financial institution consolidation.

The gap in deposit growth and farm input cost increases likely has been a contributing factor to financial institution consolidation. For example, the total number of FDIC institutions in farm-dependent counties has declined 6% since 1994, compared to a 10% increase in all other counties in the sample set. Likewise, data from the Federal Reserve Bank of Kansas City indicated that the total number of agricultural banks, that is banks with at least 25% of their loans in agriculture, in the U.S. has declined about 66% from 1994 to 2024.

If the gap in financial institution deposit growth and increasing financial needs continues, farmers may need to increase their use and interest in alternative capital pools as they search for additional borrowing capacity.

Bottom line: Given the rapid increase in farm input costs and farm scale, financial needs in agriculture have rapidly increased. Needs have outpaced deposit growth in many rural, farming-centric areas. As the financing industry adapts to this environment, there will be more opportunities for partnerships among traditional lenders – such as Farm Credit institutions, Farmer Mac and commercial banks – as well as other finance sources.

This article is part of The Rural Economist, a report that brings forward the trends that will impact agricultural investments tomorrow.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.