Quarterly Reports • December 2023

Almond Prices Likely to Continue Slight Uptick

Situation

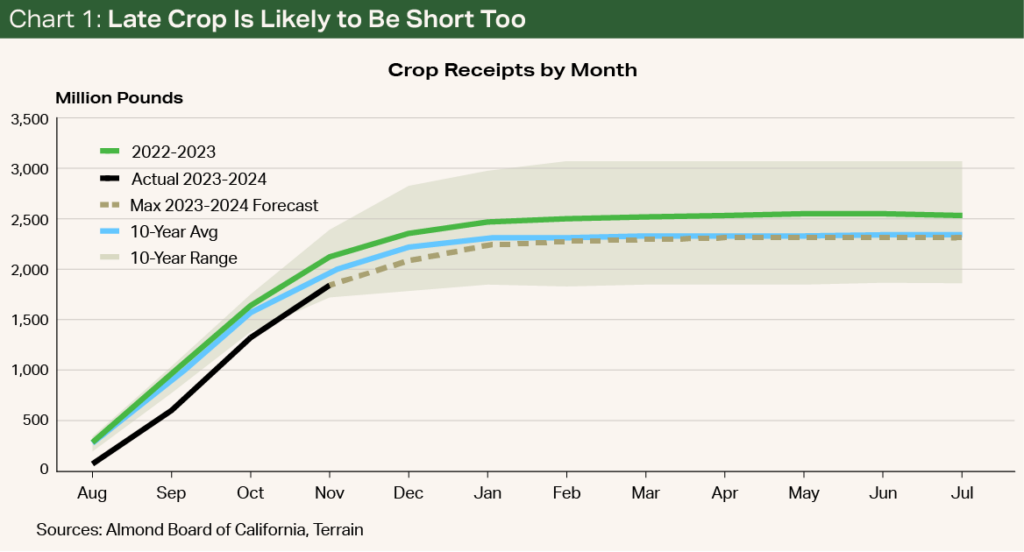

With rain hitting much of the Central Valley in recent months, many almond growers have had their harvest delayed. This lateness is reflected in the Almond Board of California’s cumulative crop receipts, which were 73% lower than last year in August, 36% lower in September, 19% lower in October, and 13% lower in November.

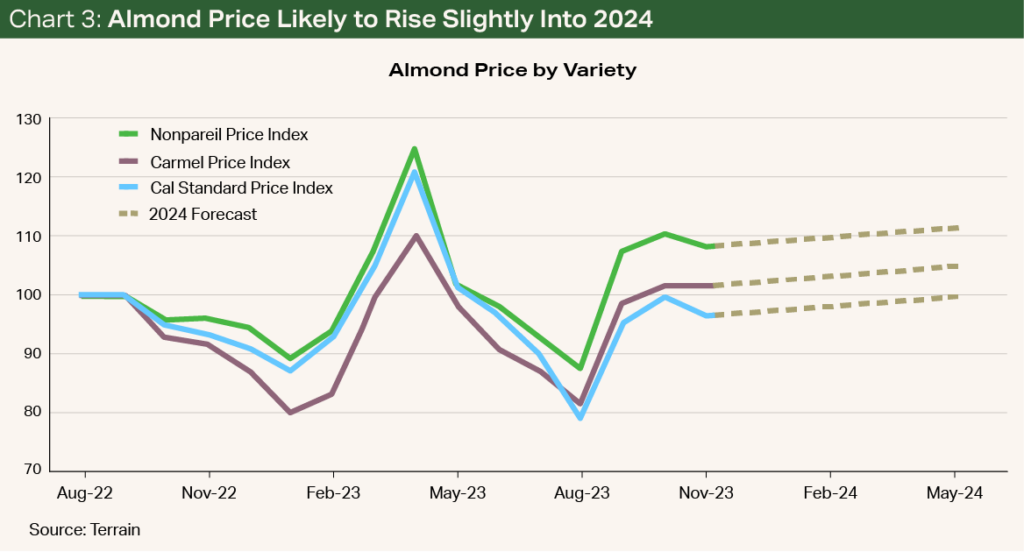

Whether the crop will catch up to the 2.6 billion-pound USDA forecast remains an open question, though many expect it to fall short. The combination of a smaller crop, strong shipments and commitments, and a more stable macro environment is likely to put upward pressure on prices into 2024.

A Better Supply-Demand Balance?

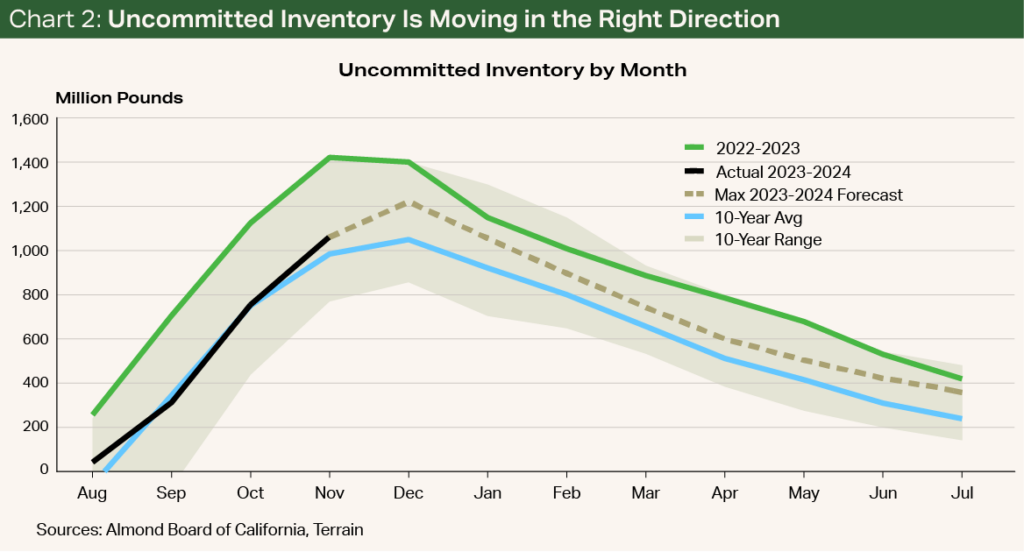

Though lower yields are hardly ideal, one benefit is that the industry could be pushed in the direction of a more normal inventory position. This is vital given the 800.3 million-pound carry-in caused by a record 2020 crop and shipping issues during the pandemic.

Though there are still many headwinds facing the industry, there are reasons to be cautiously optimistic as we move into 2024.

An improved inventory position, however, needs to be combined with strong shipments and commitments in order for prices to improve. So far, the crop year is off to a good start, with shipments 16.63% higher this past November than November 2022 and year-to-date shipments 9.55% higher. New sales have also been encouraging, implying strong shipment numbers in the months ahead.

Though there are still many headwinds facing the industry, there are reasons to be cautiously optimistic as we move into 2024. The combination of a potentially smaller 2023 crop, strong shipments and encouraging sales numbers is likely to push the industry toward a supply-demand balance that is better than last year. Ultimately, this could result in a higher almond price going into Q1 2024.

Production Outlook

The 2023 harvest is the latest in the last 10 years. This has made the already challenging task of forecasting the crop size even more difficult. More and more producers in the industry, however, are beginning to suspect the crop is likely to fall short of the USDA estimate.

One reason it may fall short is the exceptionally high damage due to navel orangeworm infestation this year. Whereas the rejection rate for all varieties was 2.06% in 2022, it is currently 4.08%, according to Almond Board position reports. This, combined with the fact that later harvests will only allow for more infestation, is likely to reduce the size of the marketable crop.

Taking these issues into consideration and utilizing position report data, I have produced a forecast for the 2023/2024 crop in the 2.1 billion- to 2.4 billion-pound range (see Chart 1).

This would imply a total estimated supply between 2.85 billion and 3.1 billion pounds, a considerable reduction from the 3.35 billion pounds given the USDA forecast. In order to be conservative, the 3.1 billion-pound supply is used for the analysis in the next section.

Inventory and Pricing Outlook

Given a smaller-than-projected crop, the industry can also expect an improved inventory position throughout the year.

So far, uncommitted inventory has hugged the 10-year average at the start of this crop year because of a late crop and strong shipments and commitments. This number will jump in the next few months as handlers receive more of the 2023 harvest. But if the industry can keep shipments and commitments at the five-year average, uncommitted inventory is likely to remain below last year throughout the rest of the crop year (see Chart 2).

Though meeting the five-year average for shipments and commitments is hardly a given, there are macroeconomic factors that seem to be working in the industry’s favor.

Though profitability is likely to remain low in historical terms, it is possible we’ve seen the bottom of the market.

Given the slowdown in inflation, the Federal Reserve has held off on interest rate increases, possibly signaling an end to the rate hiking cycle. This could improve the market through two channels:

- With a more predictable economic environment, consumer sentiment is likely to rebound from the low levels of recent years.

- With interest rates no longer rising, the dollar is likely to depreciate, making U.S. almonds more affordable to buyers overseas.

With the inventory position and macro environment tailwinds, prices are likely to increase going into 2024 (see Chart 3). This is likely to improve growers’ bottom lines compared with last year, even while the break-even price is undoubtedly higher for most growers because of cost increases. Though profitability is likely to remain low in historical terms, it is possible we’ve seen the bottom of the market.

Nevertheless, it is important to keep in mind that the market is still far from its destination.

Assuming the industry’s supply is 3.1 billion pounds and that shipments and commitments meet the five-year average, the carryout figure will come in at 605 million pounds. Though this would be a big improvement from the last few years, it is still higher than the 400 million- to 500 million-pound carryouts that were more typical before the pandemic.

A higher-than-normal carryout will continue to put downward pressure on prices. Still, there are reasons to be cautiously optimistic as we head further into this crop year.

Nevertheless, it is important to keep in mind that the market is still far from its destination.

Terrain content is an exclusive offering of American AgCredit, Farm Credit Services of America and Frontier Farm Credit.