Upland cotton prices have been range-bound for nearly a year, trading between the mid-70s and mid-80s. Prices finally broke above 88 cents on September 1 and have found support in the high 80s so far in September.

The price movement has been supported by a smaller crop coming out of key production areas in the Southwest. Texas had difficulty getting a crop planted because of excessive rains in the Panhandle at planting. The price also favored alternative crops at planting for corn more than for cotton. Take a look at the previous quarterly outlook for an explanation of the corn-cotton price ratio.

The USDA predicts 2023 cotton acres at 10.23 million, down 25.6% year over year (YOY). This reduction in U.S. cotton production has been supportive of prices. Ending stocks were reduced to 3 million bales, down 29.4% YOY. This tighter carry-out scenario is necessary to support prices because of the poor export pace.

Similar to other commodities, cotton has been trading a supply story, which isn’t as supportive of prices long term as a demand story. The value of the U.S. dollar continues to increase, putting downward pressure on cotton exports, which are at an eight-year low.

On the global front, production is down to 112.4 million bales, more than 4.4 million bales lower than the USDA forecast two months ago. This decline is mainly weather related. The U.S. alone had a decrease of 3.37 million bales, owing mostly to lower planted acres than originally expected. The USDA projects consumption at 115.9 million bales, up 5 million bales YOY.

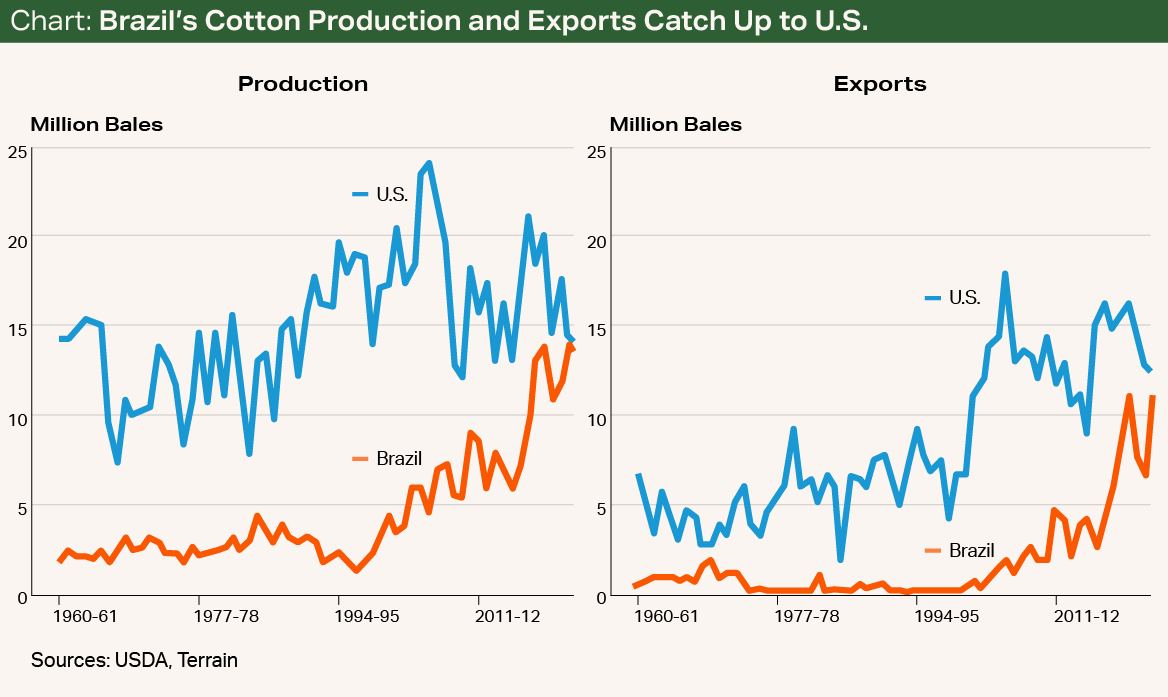

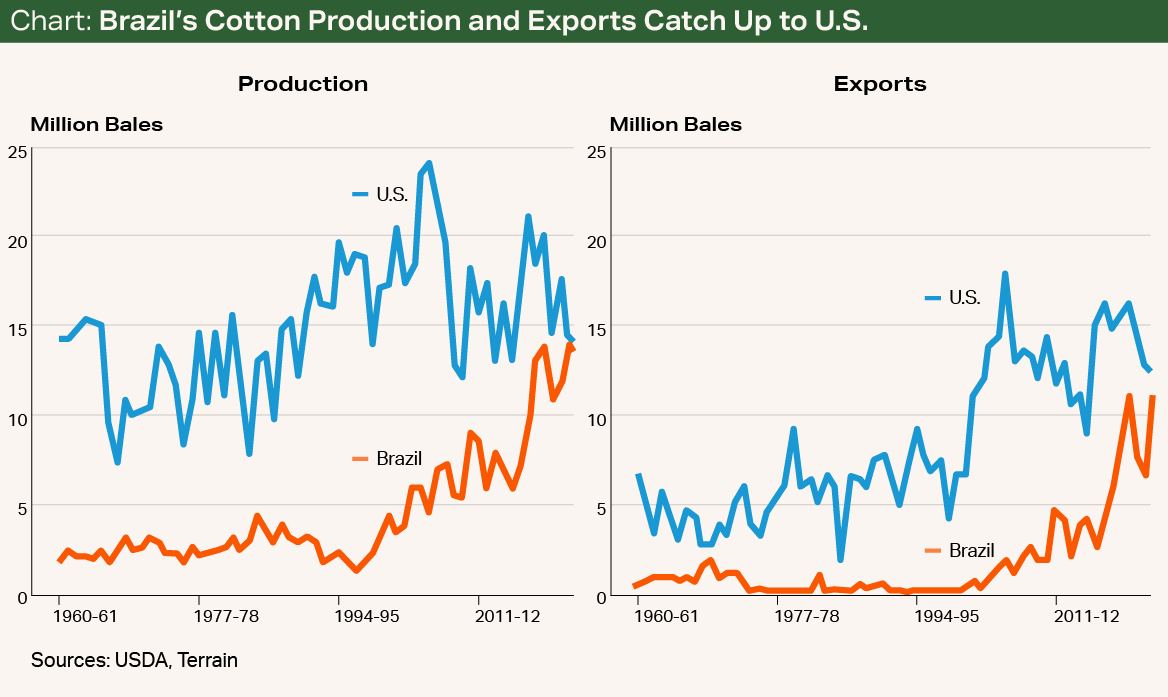

The U.S. has dominated cotton exports for many years, but similar to defeats in corn and soybeans, Brazil is challenging the U.S. as the top global cotton exporter (see chart). In the 2023/2024 marketing year, the USDA projects the U.S. will export 12.3 million bales and Brazil 11.8 million bales.

Brazil cotton production will continue to increase as margins for cotton become more attractive than for corn because of falling grain prices. Brazil plants cotton as a second crop, known as “safrinha,” following soybeans. As Brazilian growers decide whether to grow corn or cotton as a safrinha crop, profitability will be the main factor.

Mato Grosso is the major cotton-growing region in Brazil. Over 70% of Brazil’s cotton comes from this one region. Currently, 13% of total acreage in Mato Grosso is used for farming and 25% is for pasture. The remaining acreage is tied up in conservation units, preservation areas and indigenous lands.

The farmland in Mato Grosso could potentially be doubled over the next decade by transitioning pastureland into crop land. Just 20 years ago, Brazil produced approximately 3 million bales. About 10 years later, the country produced 7.5 million bales, and in 2022/2023, Brazil produced 14.4 million bales — just shy of the U.S.’s 14.47 million bales.

There is no question who the world’s largest cotton exporter will be in the next few years. This has both a positive and negative effect on the cotton market. The positive is that there will be more market stabilization. As fun as $1.20/lb. cotton sounds, it has the negative effect of driving textile mills away from cotton apparel and toward synthetic fiber competition. The obvious concern with Brazil’s rise in cotton dominance is greater global supply of cotton and decreased demand for U.S.-grown cotton.

As producers look to open bolls and defoliate cotton, they should take advantage of the profitable prices that are currently offered. Futures prices rarely reach 90 cents, and when they do, it doesn’t last long. Cotton trading on The Seam has been priced at 22 cents to 28 cents over loan rate. This has equated to an average gross price of 74 cents to 82 cents for cotton traded on The Seam in September.

August 30 was a high-volume trade day, with 15,262 bales traded at a premium of 32 cents over loan rate, equating to a recent high average gross price of 86 cents. This may be a resistance point where many farmers will sell cotton at. The weak export/demand story adds to the importance of taking advantage of current prices.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.