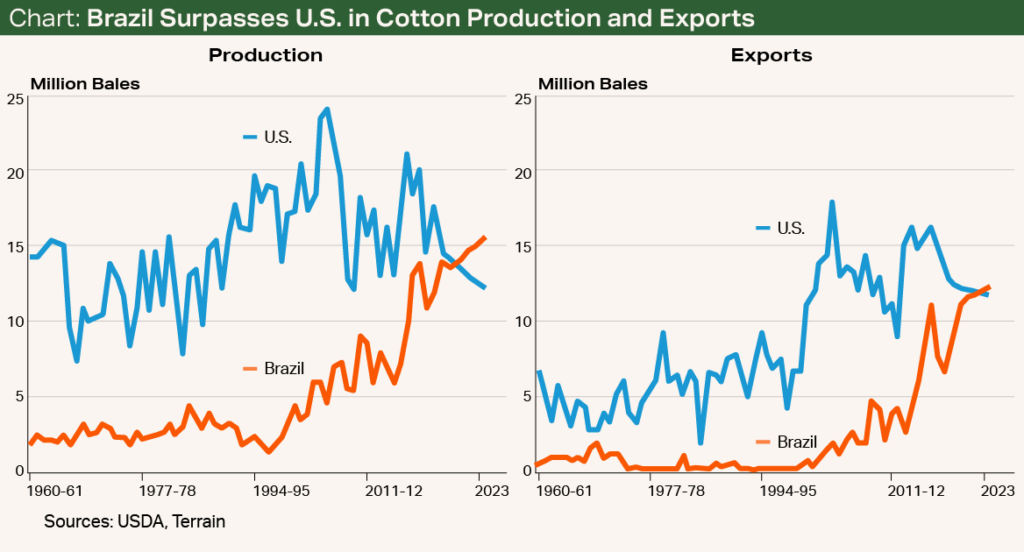

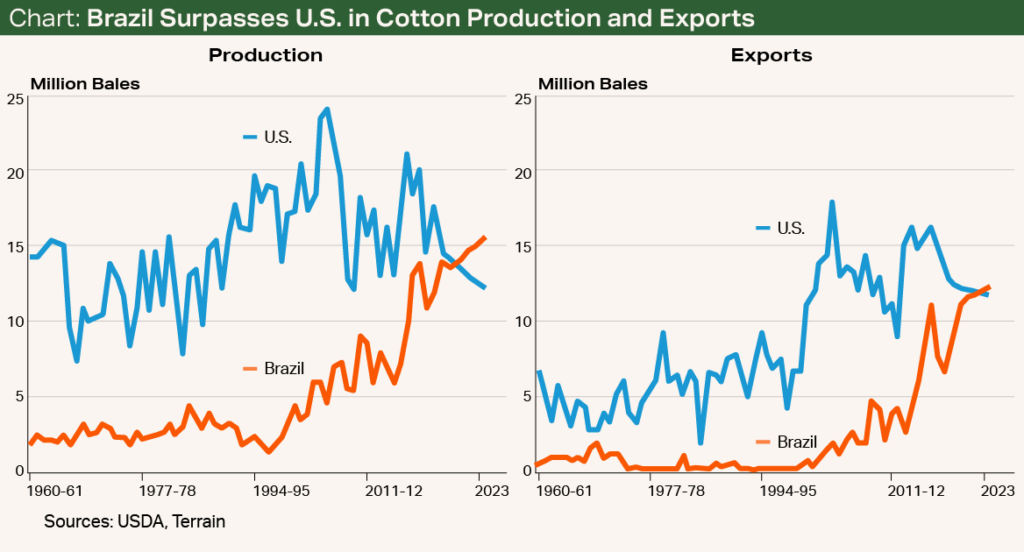

In September, I wrote a Quarterly Outlook titled “Brazil Is Cotton’s Heir Apparent” that described the merits of Brazil overtaking the U.S. as the world’s largest cotton exporter. The most recent report from the World Agricultural Supply and Demand Estimates (WASDE) confirms that this has indeed taken place, as the USDA lowered the 2023/2024 U.S. cotton exports figure from 12.3 million to 11.8 million bales and increased Brazil’s exports from 12.1 million to 12.4 million bales.

Many readers may have overlooked this tidbit in the lengthy report, but for U.S. cotton producers, this should be an alarming statistic.

First, Some Context

To provide some context on the competitiveness of Brazil, in the 2022/2023 marketing year, the country overtook the U.S. as the world's leading corn exporter. Additionally, Brazil has been the world’s leading soybean exporter since 2017.

Just 20 years ago, Brazil produced approximately 3 million bales. About 10 years later, the country produced 7.5 million bales, and in the 2023/2024 marketing year, it produced 14.57 million bales (see Chart).

Mato Grosso is the major cotton-growing region in Brazil. Over 70% of Brazil’s cotton comes from this one region. Currently, 13% of total acreage in Mato Grosso is used for farming and 25% is pasture, according to the University of Illinois' Farmdoc. The remaining acreage is tied up in conservation units, preservation area and Indigenous lands. The expansion potential in Mato Grosso comes from the transitioning of pastureland to cropland. There is the potential for doubling the farmland in Mato Grosso over the next decade.

Brazil’s cotton production will continue to increase as margins for cotton become more attractive than for corn.

Another factor to consider in Brazil’s cotton acreage and production expansion is the transition from a “safrinha,” or second corn crop, to a safrinha cotton crop. Brazil plants cotton as a second crop following soybeans. As Brazilian growers decide on which safrinha crop to grow, either corn or cotton, profitability will be the main factor.

Brazil’s cotton production will continue to increase as margins for cotton become more attractive than for corn because of falling grain prices. For perspective, Illinois farmers have a lower direct cost of production per bushel of corn than Mato Grosso farmers. If farmers in the corn belt aren’t making money growing corn, it is likely that farmers in Mato Grosso aren’t either.

If farmers in the corn belt aren’t making money growing corn, it is likely that farmers in Mato Grosso aren’t either.

Now, the U.S. Price Outlook

The most recent WASDE report shows a decrease in U.S. old-crop cotton exports, leading to an increase in beginning stocks of 2.85 million bales. New-crop cotton acreage and production were held constant as well as all demand components, resulting in ending stocks of 4.1 million bales for the 2024/2025 new-crop marketing year.

This is a dramatic increase from the ending stocks of 2.85 million bales for the 2023/2024 old-crop marketing year. The increase is due to a poor export program and increased production mainly in Texas from a lower abandoned acreage than the last couple of years.

Price expectations for ending stocks of 4.1 million bales are in the 70-cent range.

Price expectations for ending stocks of 4.1 million bales are in the 70-cent range. Any market rallies back to 80 cents or above are hedging opportunities.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.