Can Macroeconomics Explain the Almond Market’s Improvements?

Article Originally Published in the February Issue of the Almond Advantage Magazine

Describing the last few years in the almond market as challenging would be an understatement. Prices throttled by excess supply have been met with tariffs, increased regulation, continued challenges of the Sustainable Groundwater Management Act (SGMA), and an inflationary environment that has raised prices for nearly every farm input.

The industry today looks markedly different from a year ago and is poised to overcome many of the short-term challenges of the past four years. The carry-in has returned to normal levels, shipments ended last crop year higher than the previous, and prices have been steadily increasing since the spring of 2024.

Macroeconomic factors can also help us understand the market given how reliant the industry is on exports. Three global metrics correlate with important industry trends to tell the story of improving conditions in the almond industry. These metrics aren’t always directly tied to almond prices as much as factors like carry-in inventory, but they do provide signals for how at least exports may perform.

Though challenges remain, it is highly likely that the worst is behind the industry and we can continue to expect improvements in the almond market.

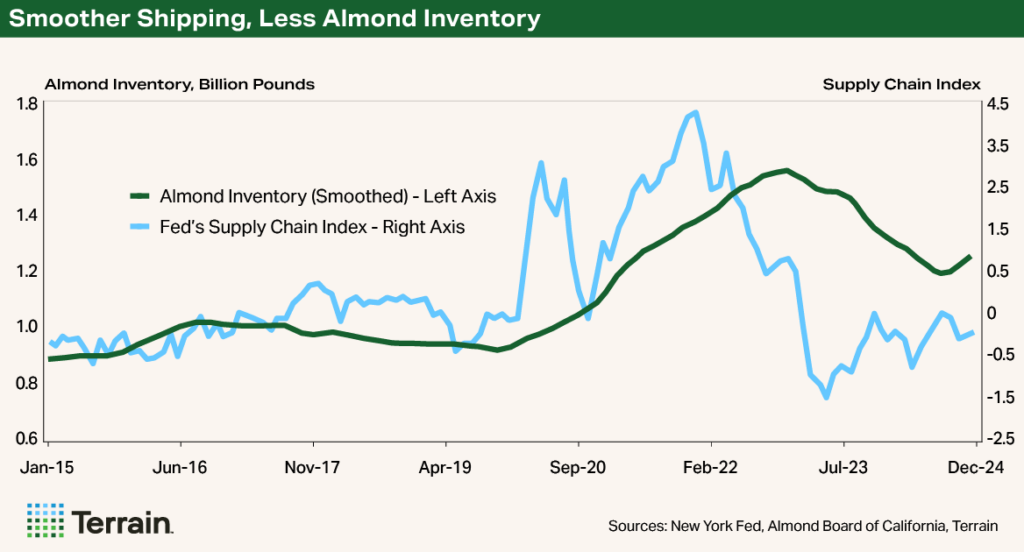

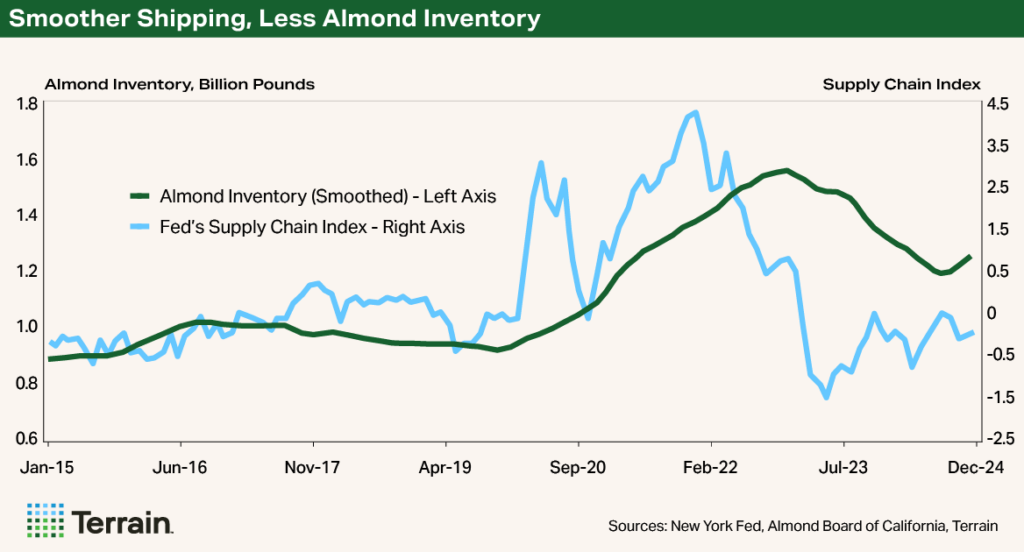

Metric No. 1: Federal Reserve’s Supply Chain Index

The primary cause of the adverse conditions in recent years has been on the supply side. As the pandemic hit, inventory built up because of product not leaving the ports, putting downward pressure on almond prices. Carry-in peaked at 25% in 2023/24, compared with a historical average of 15%, according to my analysis of Almond Board of California data.

The situation is well captured by the Federal Reserve's Global Supply Chain Pressure Index (GSCPI), which tracks global supply chain pressures — a critical indicator for the almond industry given it exports over 70% of its production, as reported by the Almond Board of California. Unsurprisingly, more supply constraints mean more inventory.

While the GSCPI shows how we got to a new low in profitability, it also demonstrates why the market has improved. With almond inventories declining, the supply-demand ratio is back in balance, with carry-in at approximately 15% of supply. Although tensions in certain parts of the world could cause the GSCPI to rise, it is unlikely to hit the levels that were so detrimental to the almond market in recent years.

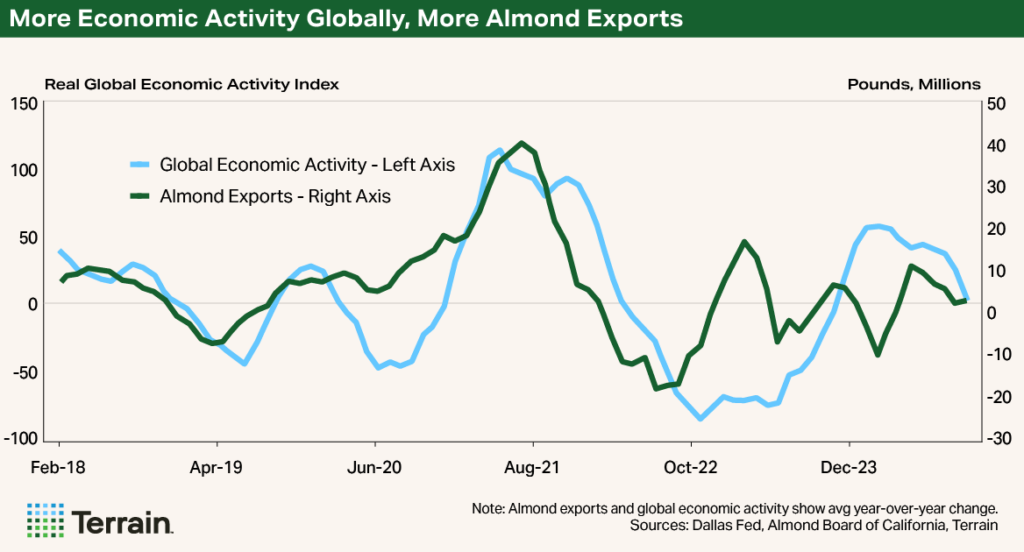

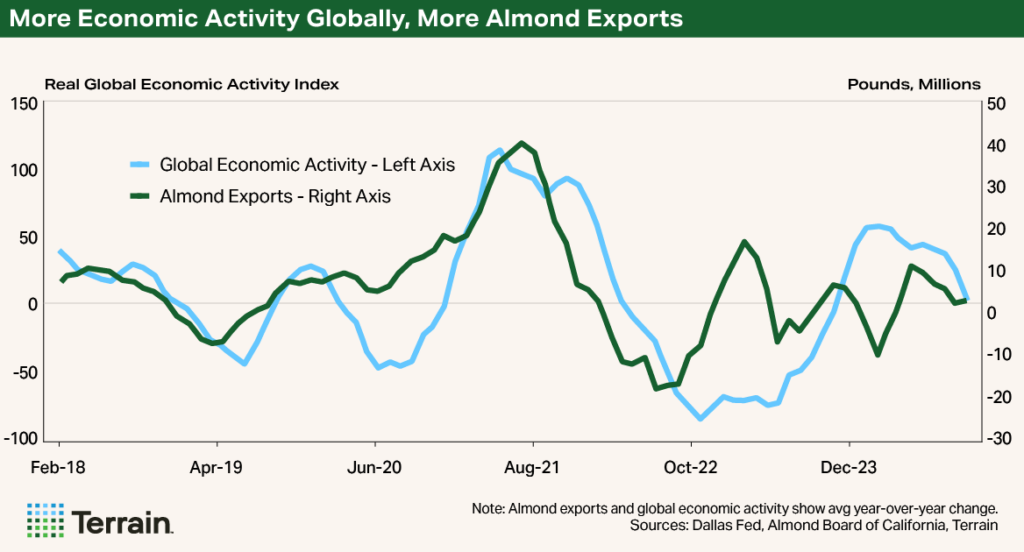

Metric No. 2: Global Economic Activity Index

While inventory has been the primary challenge in the almond industry, demand has also played a part. The pandemic’s unprecedented negative impacts on incomes globally affected commerce, and the U.S. almond industry hasn’t seen strong year-over-year growth in shipments.

The Global Economic Activity Index (GEAI) measures the degree of commerce at the global level by tracking the volume of raw material movement. While the GSCPI and GEAI are related, the former is a supply indicator and the latter is a better indicator of demand.

In the case of the GEAI, as real economic activity rises, almond exports increase accordingly. Although economic activity has decreased from its post-pandemic peak — when lockdowns were lifted and governments implemented stimulus packages — it has generally become less volatile. The reduction in volatility signifies stabilizing economic conditions, which should benefit almond exports.

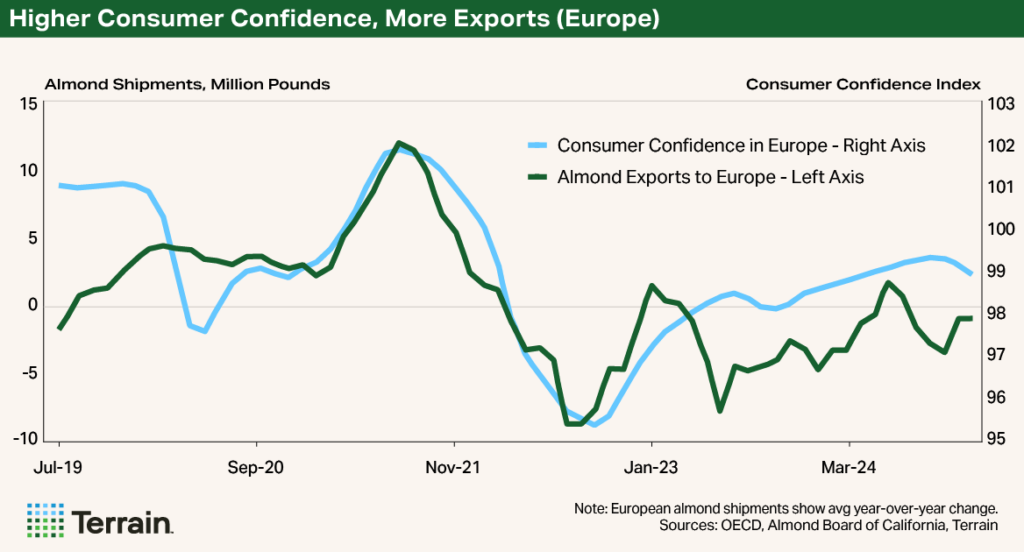

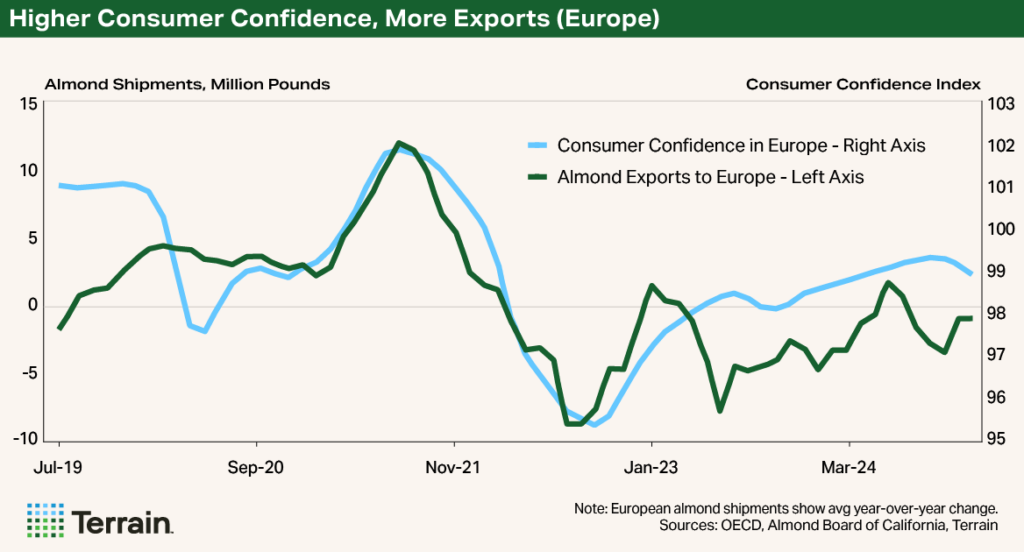

Metric No. 3: Consumer Confidence Index

Another important metric for demand is consumer confidence. When consumers are more confident in their own economic situations, buyers are more likely to anticipate future almond sales at the retail level and begin to stock up.

One of the most common leading indicators is the Consumer Confidence Index (CCI) from the OECD. The index is compiled through surveys asking households about their economic outlook, unemployment and savings. During the pandemic, consumer confidence nearly everywhere reached new lows amid high levels of uncertainty.

In the case of Europe, one of the almond industry’s largest markets, as the CCI improves, more exports tend to follow as buyers anticipate increased future demand. Though consumer sentiment remains well below pre-pandemic levels, it is moving in the right direction, which is encouraging for almond exports. A similar trend has occurred in the domestic market, as covered by an October 2024 Terrain report available on www.terrainag.com.

Better Years Ahead for Growers

The industry's challenges are not entirely resolved. Other macro factors such as tariffs and a strong dollar could work against the positive notes. Furthermore, increased regulatory costs, SGMA and the long-term outlook for global population decline (covered in Terrain’s “The Big Shrink” series at thebigshrink.terrainag.com) will affect the almond market in important ways.

Nevertheless, we have overcome many of the market obstacles encountered in the post-pandemic era. The macro indicators in this article should give growers confidence in the improving market conditions for this crop year and next.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.