Quarterly Reports • September 2023

Cheap Russian Wheat Puts Lid on U.S. Wheat Prices

Situation

Global wheat production is down, yet prices keep falling. Among the major price drivers are low-priced wheat coming out of Russia and the corn market slide. For planting decisions, consider how wheat profitability compares with other rotation options.

Background

The 2023 winter wheat harvest was marked by short wheat, low yields, and a race to the finish before weeds took over throughout the Plains. Insurance claims were abundant, and many farmers had little to sell at harvest.

For producers with grain above and beyond their contracted bushels, Hard Red Winter (HRW) harvest prices were over $8 futures for most of June and all of July.

Since the September Kansas City wheat contract posted a high of $9.29 on July 25, the market has been in a downhill slide. And there doesn’t seem to be any news that can correct this negative trend.

From the breaking of the Black Sea grain corridor agreement on July 17 to the escalation of the war in Ukraine by drone attacks on export terminals, an oil tanker and a warship, wheat prices have been headed in only one direction.

Profitability Considerations

As farmers prepare for planting season, it is important to take a look at cost of production and potential profitability of the 2024 wheat crop.

An expected cost of production on wheat, for example, at about $268/ac. would require 40 bu./ac. to cover cost of production at a July 2024 cash price of $6.70. Kansas has a 10-year average yield of 42.6 bu./ac., which does not spell much profitability for the wheat state.

For this reason, I believe U.S. winter wheat acres planted for grain this fall will be down. There was an insurance guarantee of $8.79/bu. on HRW in the fall of 2022 that attracted additional acres to wheat. Wheat acres were up 11% from the previous year at 37 million acres. In the five years prior to 2023, winter wheat plantings ranged from 30.5 million to 33.7 million acres.

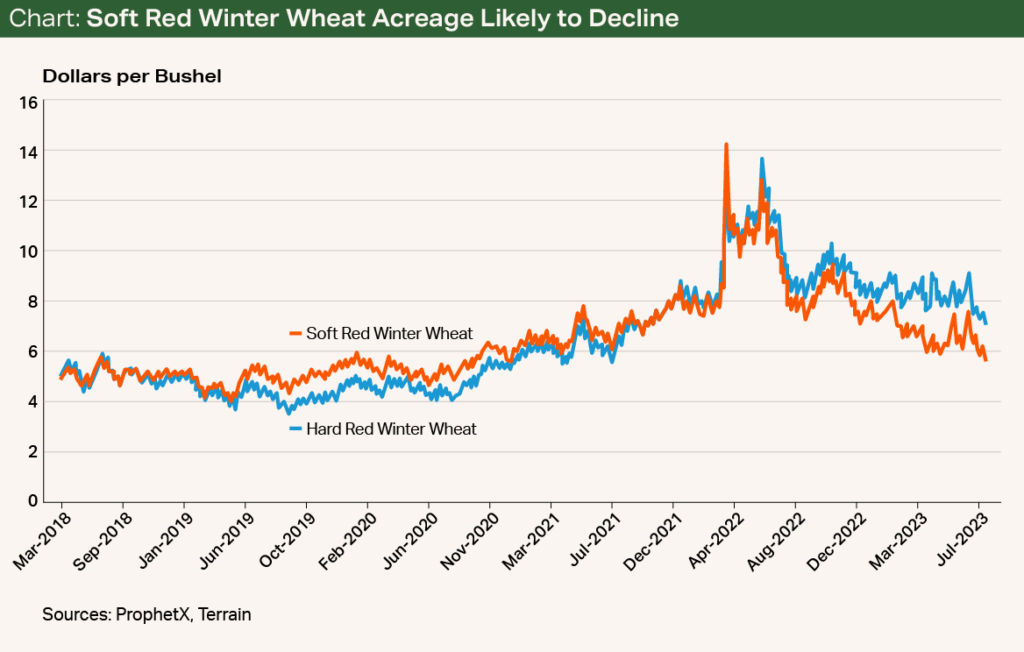

I expect to see 2024 winter wheat plantings to fall in this range, especially when considering the steeply discounted Soft Red Winter (SRW) price.

SRW new crop prices are more than $2/bu. cheaper than they were at this time last year, which should discourage SRW acres in 2024.

In the four years prior to the Russian invasion of Ukraine on February 24, 2022, SRW traded at a premium of 37 cents/bu. to HRW. Currently, SRW is trading at a discount of $1.53/bu. to HRW, mainly because of differences in production — SRW had a large low-protein crop this year while HRW had a short high-protein crop.

SRW new crop prices are more than $2/bu. cheaper than they were at this time last year, which should discourage SRW acres in 2024 (see chart).

The moisture situation in the heart of the HRW growing region has improved since last year at this time, but it isn’t adequate across the region to get wheat established this fall.

The short HRW crop last year is reflected in U.S. wheat exports, which are at a 52-year low. The USDA cut 2023/2024 wheat export expectations by 25 million bushels to 700 million bushels in the August World Agricultural Supply and Demand Estimates (WASDE) report.

This cut was warranted considering wheat exports are lagging the five-year average export pace for this time of year. The U.S. wheat price remains uncompetitive globally. U.S. HRW export bids are still $100/metric ton higher than in Russia and France, partly because of a surplus in those countries.

Still, when you consider the circumstances of the top global wheat exporters, the situation appears bullish.

All Hope Is Not Lost

Still, when you consider the circumstances of the top global wheat exporters, the situation appears bullish.

Russia is currently the global low-cost supplier of wheat. The country has come off of two years of large wheat inventories and effectively set the floor for global wheat prices. Although the market has become numb to news coming out of the Black Sea, the fact remains that two of the world’s largest grain exporters are at war.

As for the world’s third-largest wheat exporter, Australia’s Department of Agriculture, Fisheries and Forestry (DAFF) predicts Australian wheat production will face a 34% reduction compared with last year due to lower rainfall driven by an El Niño weather pattern.

…India may import wheat from Russia in a new trade agreement after banning all Indian wheat exports in 2022. This would help alleviate the global market from Russia’s stockpile of cheap wheat.

Additionally, the Agriculture and Agri-Food Canada (AAFC) forecast reduced Canadian wheat output in the 2023/2024 marketing year to 33.2 million metric tons — 2% lower year on year — based on rising temperatures and lower soil moisture levels.

In addition to production challenges with most of the major wheat exporters, India may import wheat from Russia in a new trade agreement after banning all Indian wheat exports in 2022. This would help alleviate the global market from Russia’s stockpile of cheap wheat. Global wheat inventories could continue to decline to the lowest level since 2014.

If the corn market continues its downhill slide, so will wheat prices for both old crop and new crop.

Outlook

Domestic and global wheat supplies are tight enough for price sensitivity to production hiccups, but I expect price action in the fourth quarter to be led by low-priced wheat coming out of Russia and the EU. Wheat price movement tends to track closely with corn prices. If the corn market continues its downhill slide, so will wheat prices for both old crop and new crop.

Terrain content is an exclusive offering of American AgCredit, Farm Credit Services of America and Frontier Farm Credit.