Quarterly Reports • November 2022

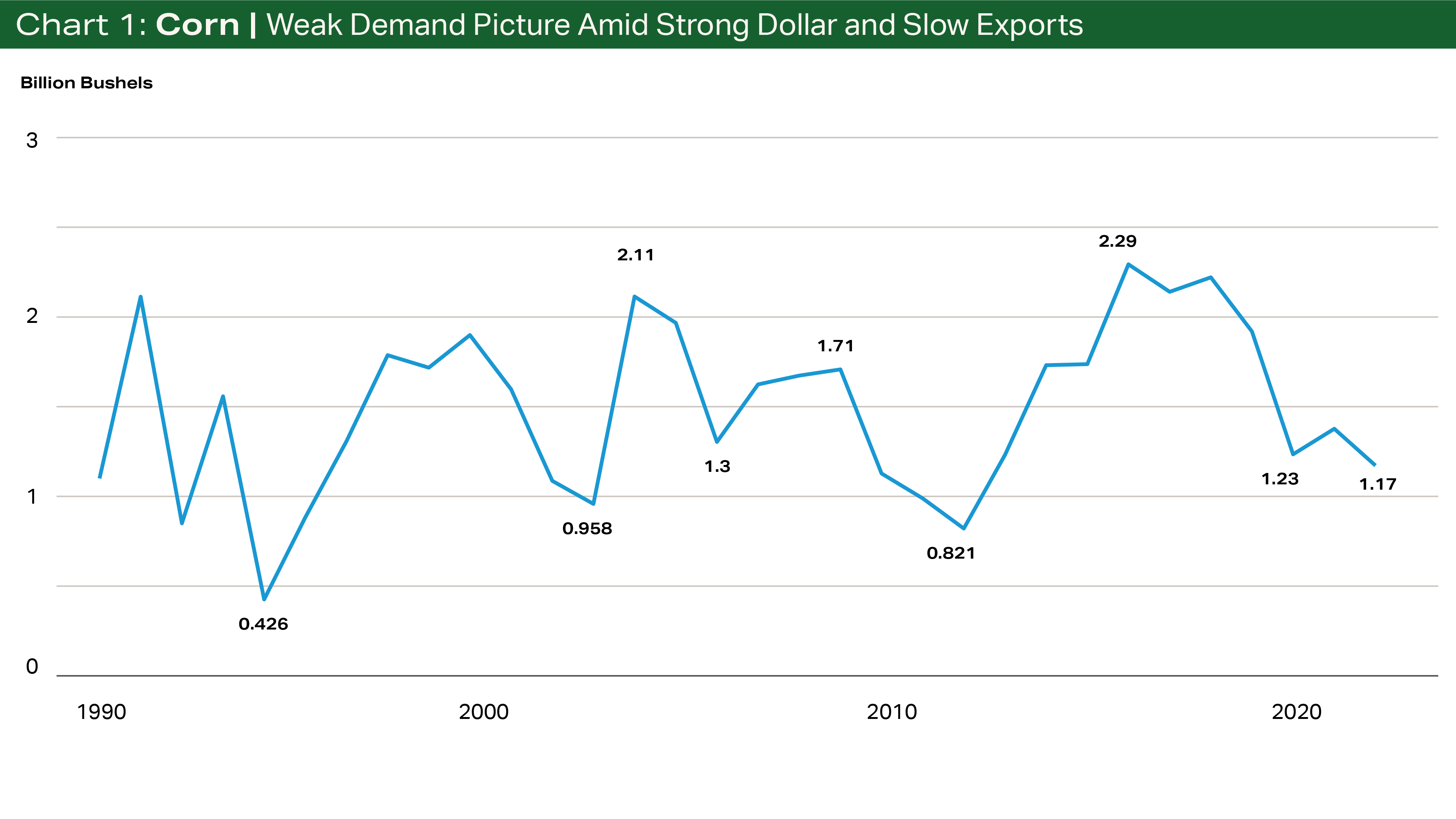

Corn: Weak Demand Picture Amid Strong Dollar and Slow Exports

The corn crop has continued to shrink through harvest, providing support to offset declining demand due to weak exports as well as lower cattle numbers in early 2023. Even with the weaker-than-expected demand, the overall stocks situation remains tight on a historical basis.

Ethanol demand is also under pressure. Quickly weakening global growth rates have weakened oil demand, causing OPEC+ to cut production in an attempt to defend $90/barrel Brent oil prices. But with high corn prices and moderate gasoline prices, the demand for ethanol is also not positive for overall corn demand.

As we move through Thanksgiving, the market will begin again talking about the battle for acres in 2023 planting. There are many factors that will make this more opaque than normal.

I expect to see corn acres between flat to 1 million acres higher compared to 2022, based on “normal” planting weather. Remember that 2022 corn planted acres were reduced by weather.

Expect old crop prices to remain heavily focused on exports, oil prices and prospects of the grain corridor. Interest rate increases in the U.S. have led to the strongest U.S. Dollar in 20 years, as yield-seeking investors flood to USD assets. Other nations’ weak domestic economies are preventing their central banks from raising rates at the same pace. The high dollar makes U.S. export prices less competitive on world markets, hurting sales.

New crop prices will be driven by the competition for acres, and right now, the demand picture for corn remains weaker than for soy, and the risk to planting wheat is very, very low. As always, springtime weather will override all the planning in the winter, but the market will have to make decisions, and none of the crops are oversupplied at present by historical measures.

From a marketing context, note that even with the Mississippi water levels, corn futures prices are already inverted May-July. There is an old saying that inversions always start at the back and move forward. To be honest, I am having some trouble reconciling this with the export pace and issues above, but I always put more weight in prices, especially spreads, than fundamentals. If you are planning on storing corn this fall, locking in spreads from December to March if there are carries, even May, is advisable.

Also, forget about the high basis levels we saw in August and September when it comes to marketing on the sell side. They were anomalies created by the big July ‘22-December ‘22 price inversion. Sales made in the early or middle part of the marketing year will most likely be the most profitable this year, especially as higher interest rates mean that storage charges are much higher than even last year’s.

Terrain content is an exclusive offering of American AgCredit, Farm Credit Services of America and Frontier Farm Credit.