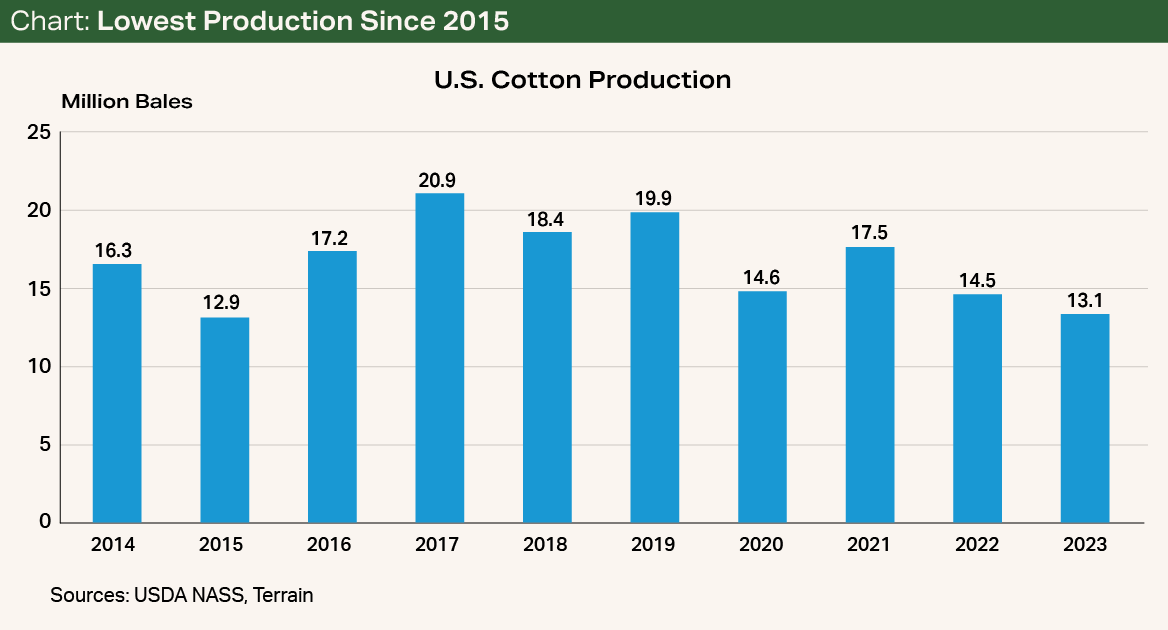

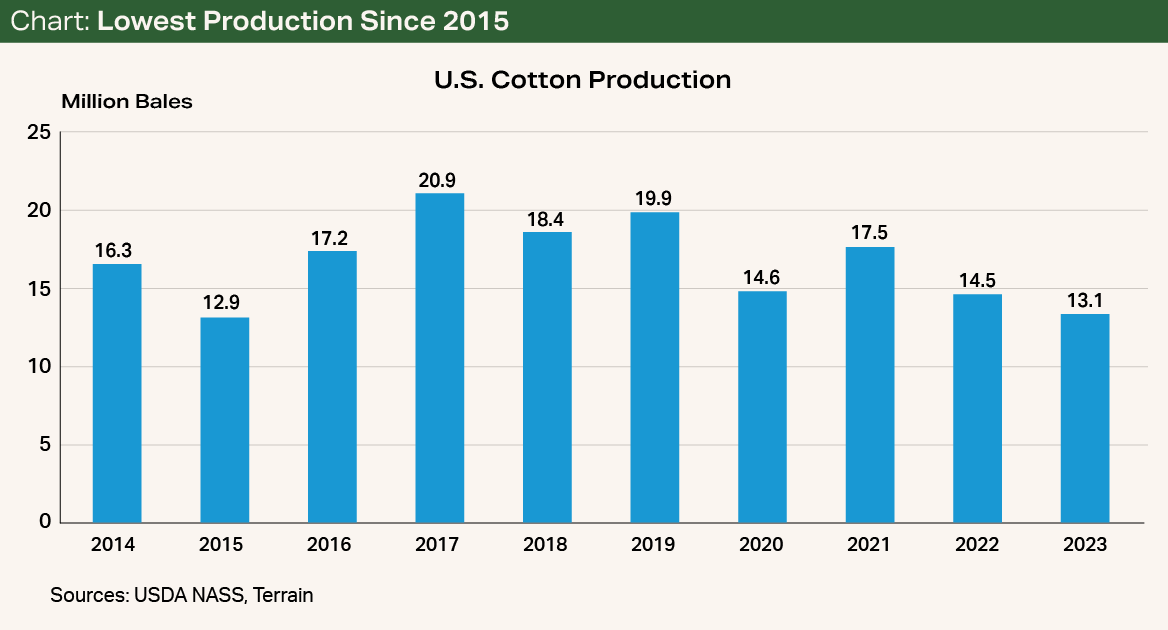

Cotton prices have been rangebound from the high 70s to high 80s for over a year, and they will likely stay in that range through the spring. Similar to last year’s cotton crop, reduced production — not necessarily strong demand — has supported price. The USDA forecasts this year’s U.S. cotton production will be 13.09 million bales, the lowest level since the 2015/2016 marketing year (see Chart).

Texas once again will drive the reduction in U.S. cotton production following last year’s disaster of a crop. I believe cotton prices will remain in their current range, spending more time in the high 70s and low 80s until the market has a better idea of next year’s U.S. and Brazilian cotton crops.

Panama Canal Concerns

The export sales pace has kept up with last year's while export shipments have fallen behind. One of the main drivers of the slowdown in cotton exports has been Panama Canal water levels. The Panama Canal is a major thoroughfare for U.S. cotton exports, the bulk of which are shipped to importers in East and Southeast Asia (China, Vietnam and Indonesia) as well as South Asia (Bangladesh and Pakistan).

Texas once again will drive the reduction in U.S. cotton production following last year’s disaster of a crop.

The Panama Canal has experienced an ongoing drought since early 2023, which has resulted in decreased capacity and fewer ships going through the Canal. This is concerning, as Panama water levels are still low as we near the end of Panama’s rainy season, which runs from May to January.

One of the main drivers of the slowdown in cotton exports has been Panama Canal water levels.

The reduced capacity of ships going through the Panama Canal has led to increased wait times and longer routes for vessels that choose to use the Suez Canal or navigate around the Cape of Good Hope along the southern tip of Africa. Both alternative routes increase transit times by as much as 14 days. An additional downside of the Suez Canal route is the proximity to the ongoing Israel-Hamas war.

Cotton shipments, which typically increase during the spring and summer, will be a closely watched export indicator.

A Key Consumer Spending Trend

Synthetic fibers have been a long-term enemy of the cotton industry. Since 2008, global consumption of synthetic fibers has climbed each year while global cotton consumption has remained relatively unchanged.

The price of polyester yarn is more affordable than cotton yarn at roughly half the cost. This trend needs to be monitored if American consumers start tightening their spending because of financial stress. So far, the average American consumer has surprised most economists with higher-than-expected spending, but cracks are starting to show with rising credit card delinquencies and the resumption of student loan payments.

Trading Considerations

Cotton trading on The Seam has been relatively consistent for the last month, ranging from an average premium over loan rate of 19 cents to 23 cents. For example, if a field had an average loan rate of 52 cents/lb., the grower would receive 72 cents/lb. gross on The Seam after a 20-cent premium over loan rate.

Although this isn’t the price farmers were hoping for after seeing cotton go over $1/lb. last year, it may be a price to take advantage of considering the narrow trading range, high interest rates and weak consumer demand.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.