Production Forecast

Year-to-date (YTD) U.S. cattle slaughter through November 2023 was down about 4.9% year over year (YOY), resulting in lower beef production by about 5.5% YOY. YTD cattle slaughter has averaged about 13,000 head per week below the previous five-year average.

I expect cattle slaughter and beef production to be down 3.5% to 4% in Q1 2024 versus a year earlier before moderating to a decline of around 2% in Q2 2024. For 2024, I project annual cattle slaughter and beef production will be down 3.5% to 4% versus 2023.

Price Forecast

Feeder cattle and calf prices rallied throughout the summer and peaked in September. Declining cost-of-gain projections and a further tightening of feeder cattle and calf supplies outside of feedlots supported the rally.

September feedlot placements were surprisingly large. This led to the market’s realization that herd expansion wasn’t happening at any significant rate, and that slaughter and beef production for the first half of 2024 would likely be larger than what the market forecasts had anticipated.

For 2024, I project annual cattle slaughter and beef production will be down 3.5% to 4% versus 2023.

In early November, cash fed cattle prices broke below the $180/cwt to $190/cwt range they had been in since early June. Live cattle futures had turned lower a month earlier, flipping basis from futures higher than cash prices to lower, and eventually dragging cash prices lower.

The break in live cattle futures prices has been particularly volatile, with four sharply down days during the decline that began in mid-September.

Given downside risk, I expect prices to fall to at least $170/cwt before year’s end.

The nearby, or front month, December live cattle futures contract moved through chart support at $169/cwt during the first full week of December. I expect the next move to test support near $165/cwt and then potentially test support near $160/cwt.

In early December, the 5-Area live cattle prices looked to be supported near $175/cwt, but downside pressure from futures drove prices below that level. Given downside risk, I expect prices to fall to at least $170/cwt before year’s end.

Increasing packer margins may provide a little upside potential by helping improve slaughter hours and fed cattle marketings. I expect this support to last only as long as the seasonally stronger holiday demand.

Another sharply lower move in 5-Area live cattle prices could drag beef prices lower as meat buyers retreat to the sidelines and wait for a bottom to be established before committing to late-winter and spring purchases.

The post-Thanksgiving futures meltdown has removed nearly all hope of a retest of the record highs set in June 2023 at just below $190/cwt. I expect seasonal price pressure early in 2024, driven partly by the slow marketing pace during Q4 2023. However, the continued tightening of underlying supplies for Q1 and early Q2 2024 will likely limit the pressure.

As spring grilling season approaches, beef prices will continue to rally, helping fed cattle prices attempt to retest the record prices of Q2 2023.

Supplies of market-ready cattle could be further reduced by El Niño-fueled wet weather and resulting poor pen conditions in January through March. As spring grilling season approaches, beef prices will continue to rally, helping fed cattle prices attempt to retest the record prices of Q2 2023.

Q1 2024 projections:

- I expect feeder cattle and calf prices to trade at $230/cwt to $245/cwt for 700- to 900-pound steers and $270/cwt to $295/cwt for 500- to 600-pound steer calves, depending on quality.

- Price gains for feeder cattle during this period will be hard-fought because fed cattle profits are forecast to turn to losses in late Q4 2023, the result of record feeder cattle prices during early Q3 2023.

- I expect the lack of beef replacement heifer retention to continue to bolster cattle-on-feed numbers, but the trend for the smaller slaughter totals due to declining calf crops totals will resume.

Breeding Herd Liquidation Marches On

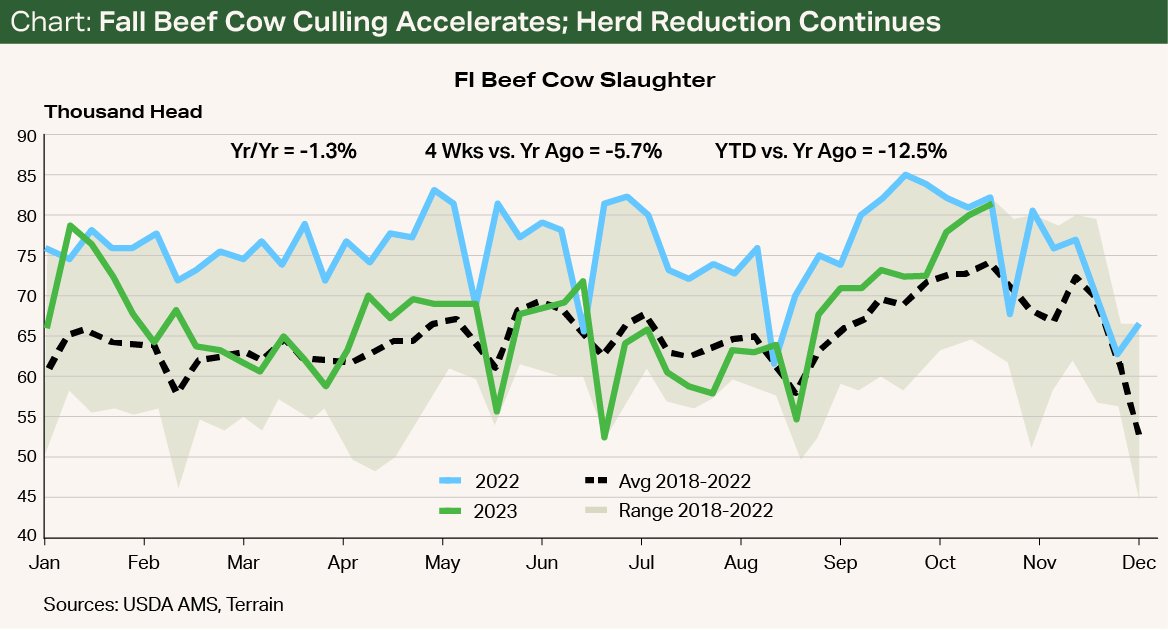

Beef cow slaughter totals have dramatically exceeded my expectations since mid-October and have returned to year-earlier levels or higher.

The beef cow slaughter for the week ending November 18, 2023, was the third-largest weekly total since fall 2014 (see Chart). The two larger weeks occurred in the middle of October 2022.

My earlier forecast of a 470,000-head reduction in beef cow numbers for the January 1, 2024, USDA cattle inventory report may very well be 100,000 head too small. The current trend puts weekly beef cow numbers about 10,000 head per week above the previous five-year average and my earlier forecast.

Anecdotes from cow-calf producers of poor cow breed-back and conception rates are becoming more widespread, especially among operations in the northern plains.

Operations in eastern Montana, northeast Wyoming, western North and South Dakota, and the northern tier of counties in Nebraska seem to be hardest-hit, with 15% or more open cows and some reports of 30% that didn’t conceive.

The still-active herd culling and lack of heifer retention will mean tighter numbers (and higher prices) for at least another year beyond my previous expectations.

While there are some operations that have been able to buy bred cows or have forage resources to begin developing heifer calves to breed in the summer of 2024, many appear unable or unwilling to do so.

The still-active herd culling and lack of heifer retention will mean tighter numbers (and higher prices) for at least another year beyond my previous expectations. It is now very likely that beef cow inventories will be smaller for the January 1, 2025, inventory report and only about 1% larger for the 2026 report.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.