Quarterly Outlook • November 2022

Drought-forced Cattle Movement Expected to Impact Markets into 2023

Report Snapshot

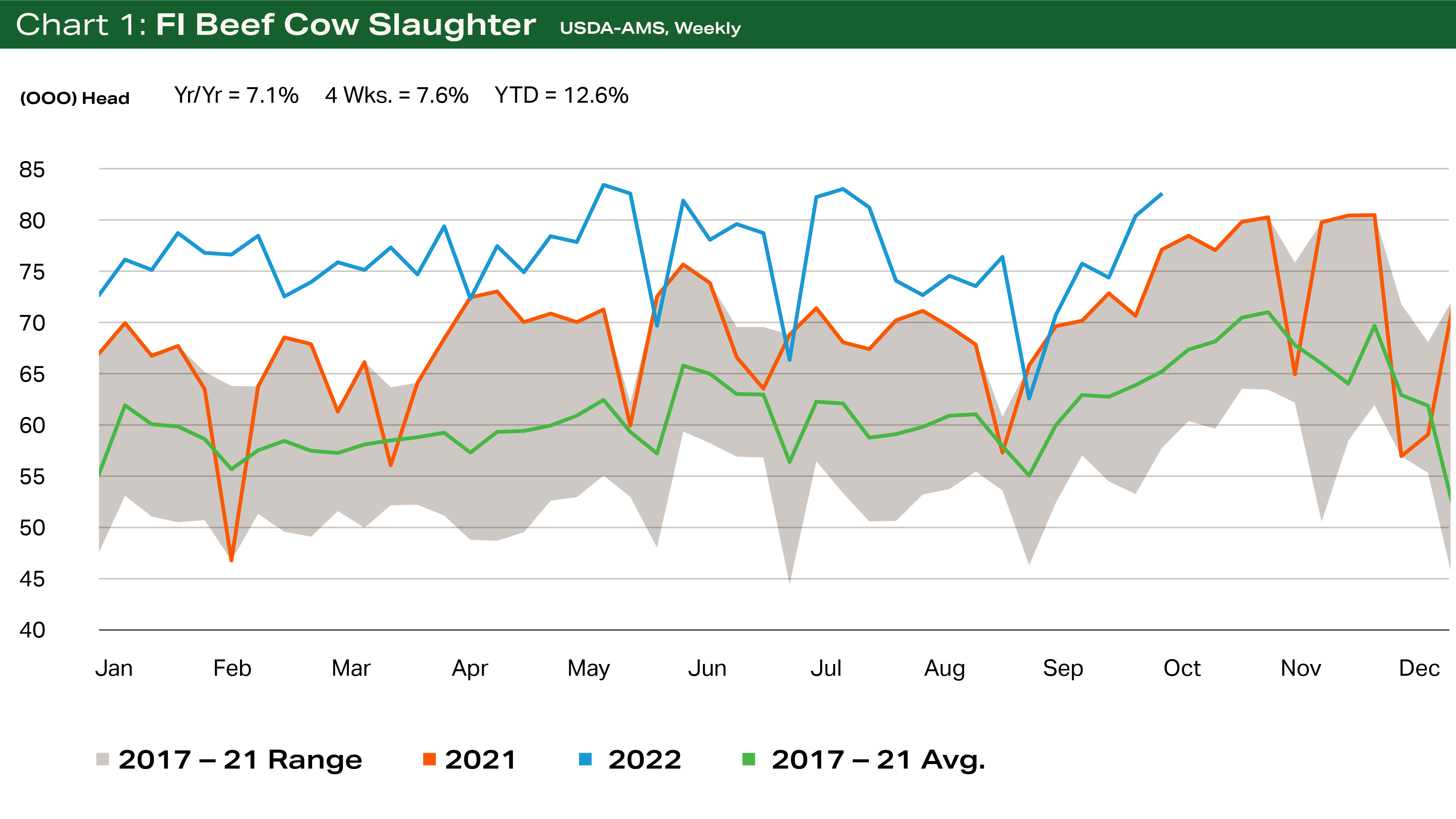

Drought is driving beef cow herd liquidation at the most aggressive pace since 1984 with beef cow slaughter up 14.7% versus a year ago.

Drought continues to force feeder cattle and calves off rangelands and into feedlots, bolstering fed cattle and beef supplies in late 2022 and the first half of 2023.

Fed cattle prices are expected to rally into the mid-$150 range by late Q4 2022, while wholesale beef prices struggle with consumers trading down to lower priced beef items and into other proteins.

Foreign animal diseases remain a threat to global markets and U.S. cattle and beef prices.

The expected continuation of La Niña sea temperature conditions along the equatorial Pacific Ocean isn’t good news for much of the U.S. cattle-producing community. According to NOAA, the pattern is likely to last into its third winter season, bringing with it dry winters across the West and ongoing drought in the Central Plains and western Corn Belt.

Late summer rainfall has improved drought conditions in parts of Arizona and New Mexico, but these areas are still abnormally dry to having severe drought. While La Niña conditions are drying for much of the U.S. west of the Mississippi River, they continue to support wet conditions and far better than average growing conditions in Australia.

Here in the U.S., the current drought has forced many Plains and Southwest state producers to make hard decisions around destocking operations as rising corn and soybean prices compound the impacts of reduced hay production on supplemental feed and production costs.

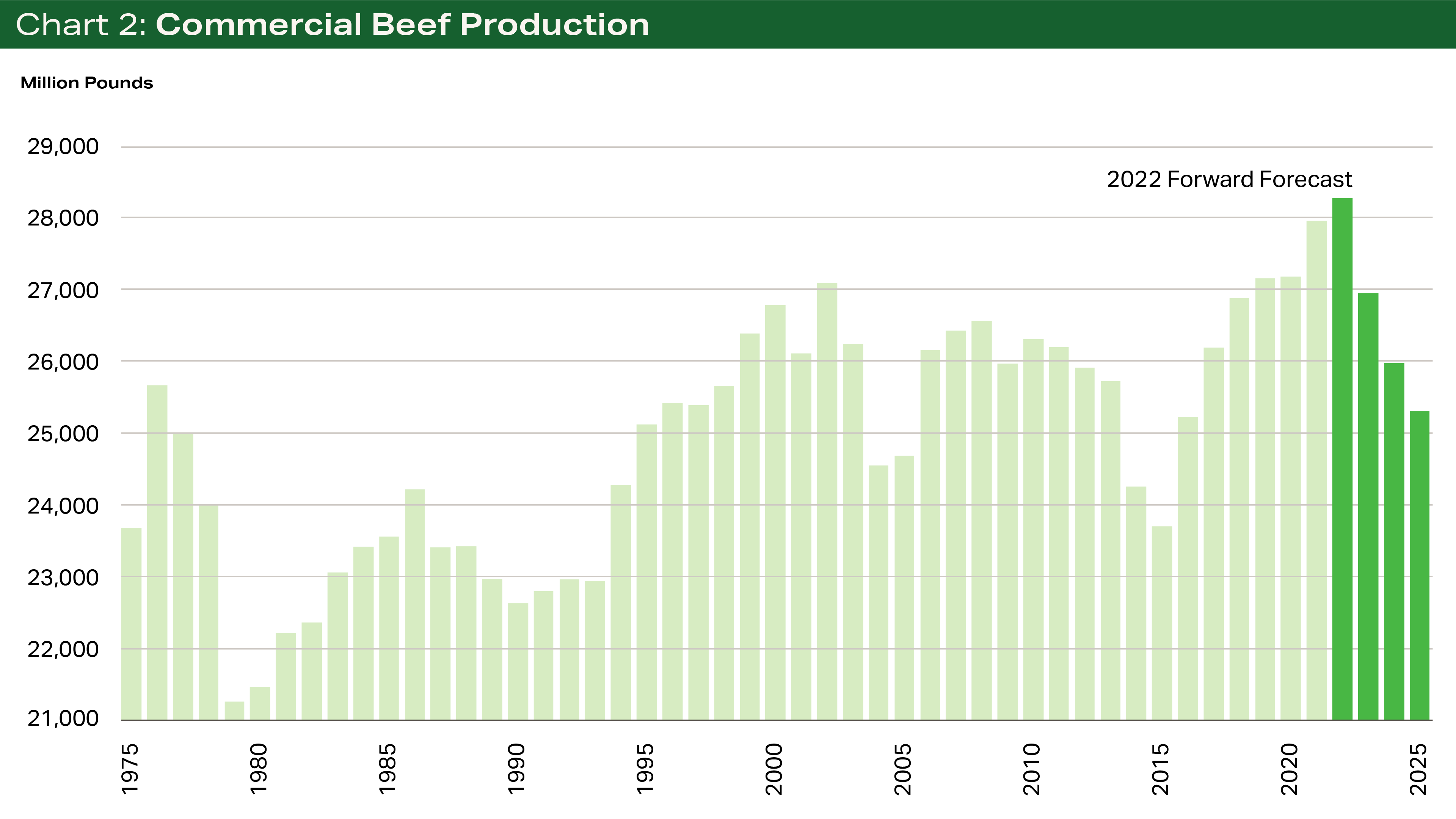

As a result, beef cow slaughter has remained at a rapid liquidation pace for the past 16 months and is up 14.7 percent on a year-to-date basis. This is expected to remove nearly 525,000 mature beef cows from the breeding herd in 2022.

On a culling rate basis, this is likely the most aggressive liquidation the industry has seen since 1984. Combined with the reduction in replacement heifers, the beef cow herd is expected to shrink by 1.2 million to 1.3 million head during 2022, pushing the inventory to its lowest level since 1962.

Calf crop totals will be further reduced by drought stress at the cow herd levels, declining body condition and declining reproductive efficiency. Adding insult to injury, cow-calf producers in drought areas are likely to produce a higher percentage of drought-stressed calves that research indicates have a higher likelihood to be poorer performers in the feedlot, both from a growth and quality-grade perspective.

The current drought will have a profound effect on the beef production system. Near term, placements of cattle into feedlots are expected to remain large, at or above last year’s levels due to limited grazing opportunities heading into winter. Available fed cattle supplies are expected to continue to tighten, at least seasonally, through November.

Feed yards in the Southern Plains are expected to regain their marketings and narrow the spread in fed cattle prices with the Corn Belt feeding areas. This is expected to push five-area average prices into the mid-$150s/cwt.

Feedlot demand for replacement cattle remains robust, driving feeder cattle and calf prices, and resulting in fed cattle breakeven prices pushing higher. The rally in spring 2023 live cattle futures contracts has been enough to make cattle appear to be able to be hedged with a profit.

Risk factors for the fed cattle market

The two greatest risk factors to the fed cattle market during the next three-to-six months are the lagging performance of the boxed beef market and impacts of foreign animal diseases.

A nonexistent spring rally in wholesale beef cutout values was mainly driven by inflation, which limited demand and drove some consumers to trade down in the beef case. This is likely already in play given the lack of a grilling season rally for steak items from the rib and loin primals. Trimmings and ground beef prices continue to lend solid support for chuck and round primals, somewhat easing the sting of cow-calf producer herd liquidation by keeping 90-percent lean trimmings above $265/cwt for the past 14 months.

Foot-and-mouth Disease in Indonesia and lumpy skin disease (LSD) in Indonesia and Vietnam are causing concern. The Australian beef sector is located close to the main Indonesian cattle areas in Java and Sumatra. Australia continues to ship cattle to Indonesia, and at the same time Indonesia and Bali are tourist destinations for many Australians. Authorities fear these travelers may transport FMD back to Australia and infect animals there.

Discovery of FMD in Australian livestock would immediately result in trade bans and closed borders for Australian beef, sending shockwaves through international markets as imports scramble to replace their imports with beef from other markets such as Brazil, New Zealand, and the United States.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.