Report Snapshot

Situation:

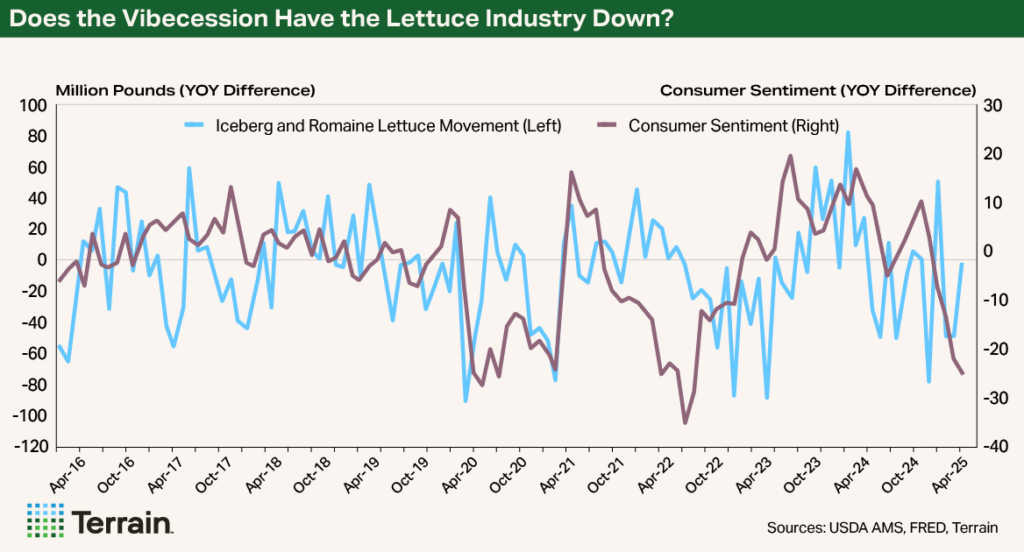

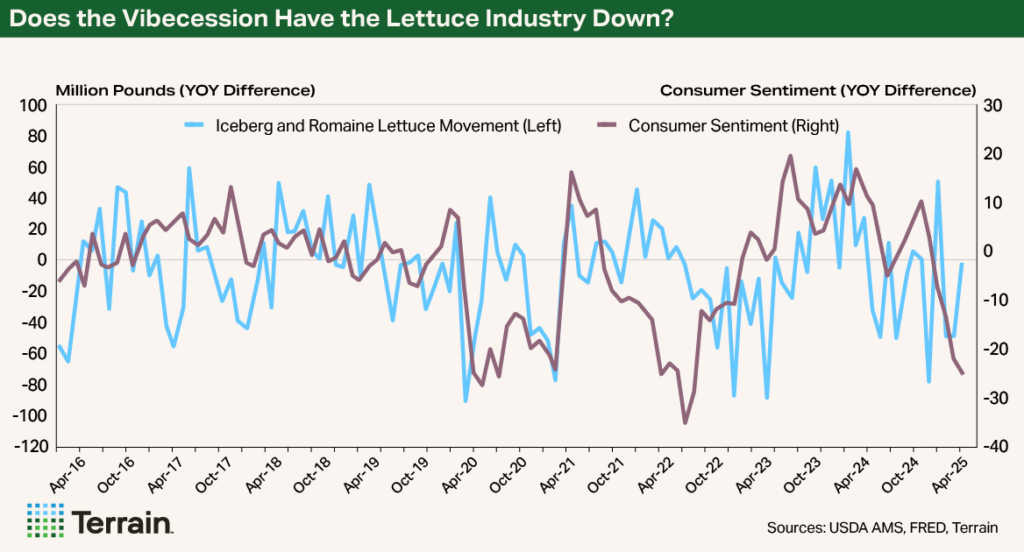

Lettuce prices have fallen below their five-year averages in 2025, likely due to lower movement. Consumer sentiment, which has seen near-record lows, seems to be playing a role in lower lettuce demand.

Outlook:

Long-term prospects for romaine and leaf lettuce remain positive.

Lower Sentiment, Lower Lettuce Demand

In some ways 2025 has been standard in the lettuce industry. From early March, production shifted from Yuma, Imperial Valley and Southern California to Central California and in particular the Salinas Valley where Monterey County leads in production, with leaf and head lettuce being the second- and third-most valuable crops (as of 2023). By late April, over 95% of production came from Central California, where the season is in full swing.

In other ways, however, 2025 has been less than ideal. Lettuce demand, indicated by movement, is down compared to 2024 and five-year averages. Cumulative lettuce movement from January through May is 1.98 billion pounds, about 5% lower than the five-year average and about 4% below this time in 2024, according to USDA-Agricultural Marketing Service data.

- Cumulative iceberg movement is the primary driver for the lower numbers, with movement being 12% under the five-year average and nearly 6% under this time in 2024.

- Romaine movement is very slightly above what it usually is, but romaine still is being sold at much lower shipping point prices.

In addition to lower overall movement, average shipping point prices for iceberg and romaine are below last year and five-year averages.1 The romaine price in 2025 thus far is $14.55 per carton (12 3-count), whereas last year’s price and the five-year average are $27 and $23 per carton, respectively. It’s a similar story for iceberg which has had an average price of $13 per carton (24s film wrapped) whereas last year’s average and the five-year average are $24 and $18 per carton, respectively.

A recent USDA report finds a similar trend among other fresh vegetables.

Because of limited public data on lettuce acreage and yields, it can be challenging to know what’s caused lower movement and pricing from industry data. An economy-wide variable, however, appears to be a useful explainer. Though the link isn’t perfect, consumer sentiment, which captures how Americans feel about the economy, appears to track closely with lettuce movement in recent years.

Consumer sentiment in recent years has been a whirlwind. Despite the recovery from the pandemic recession, sentiment has never fully rebounded. Sentiment had been stuck in a “vibecession” before it took a sharp decline recently with growing concerns over actual recession risk.

As households feel more insecure about their finances, it’s possible that would-be lettuce consumers are trading down toward cheaper, more shelf-stable items. There is some evidence consumers will shift from fresh produce in tough economic times. This is especially true as retail prices for romaine and iceberg remain elevated, according to the Bureau of Labor Statistics.

Long-Term Trends Compound Current Challenges

There are structural changes to consider when thinking about what the lower shipping point prices mean for grower margins.

One is the increase in input costs for many producers. According to a 2023 UC Davis Cost Study, total per-acre costs hover around $17,000 with growing and harvest costs being $7,400 and $9,393 per acre, respectively. Higher regulatory costs also contribute to higher costs of production. A recent study from Cal Poly found regulatory costs increased from $109 per acre in 2006 to $1,600 per lettuce acre in 2024.

Another is the broader shift in demand from head lettuce (including iceberg) to leaf and romaine lettuce. For decades, head lettuce has been experiencing a decline in domestic demand, whereas leaf and romaine have been experiencing a steady increase in aggregate and per capita terms, according to USDA. This could imply more structural challenges to iceberg growers but opportunities for romaine and leafy lettuce growers going forward.

Lettuce Outlook: More of the Same

Looking ahead, it is difficult to see demand and prices improving with sentiment remaining dampened. The last consumer sentiment reading was one of the lowest on record and, given the degree of uncertainty in the broader economy, and ongoing geopolitical risks, it seems probable that consumer sentiment could be slow to recover.

Any drag on consumer demand and shipping point prices could affect growers’ margins this year, especially considering how costly production costs have become.

On the upside, growers focused on romaine and leaf lettuce have growing per-capita demand working in their favor over the long haul.

Endnote

1 Average price was calculated taking the average price of “Mostly Low Price” and “Mostly High Price” from the USDA AMS database.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.