Outlook • October 2023

Low Profitability Likely to Continue for Nut Crops in 2023/2024

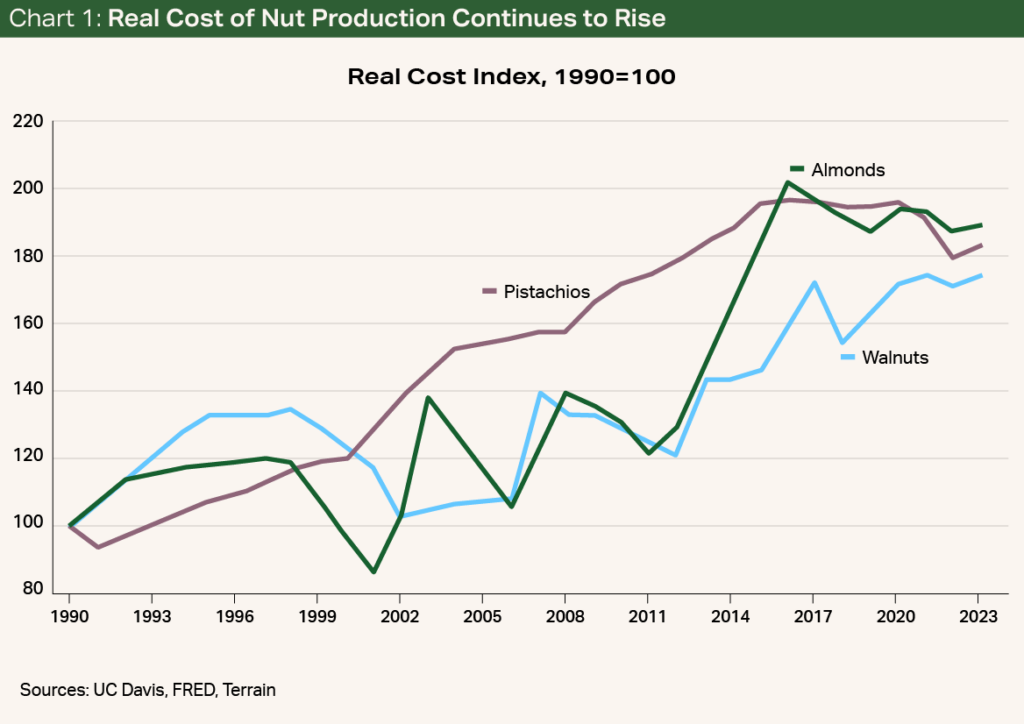

With harvest well underway for California nut commodities, growers are wondering what their return will be on the 2023/2024 crop. Profitability has been dropping in recent years given increases in production costs (see Chart 1) and low prices of nut commodities.

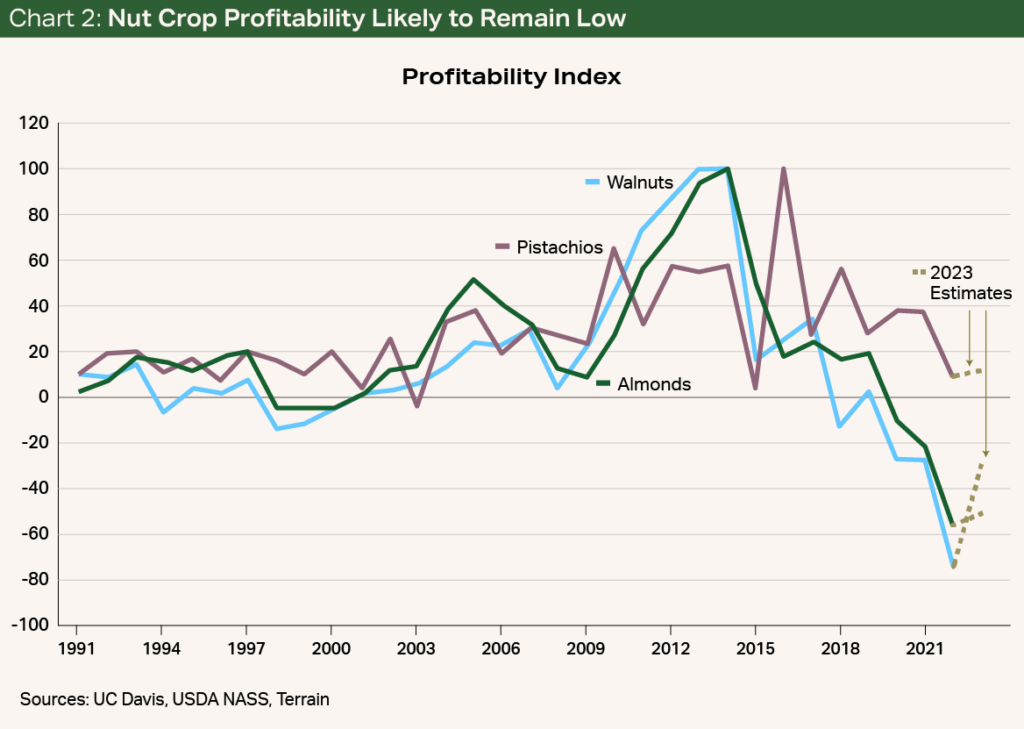

While pistachio growers have largely remained profitable, almond and walnut growers saw anything from break-even levels to losses of up to $1,500 per acre on last year’s crop. On top of cost increases, each market has faced its own obstacles to profitability.

Though there may be a slight increase in the almond price going forward, high levels of carry-in are likely to continue to keep profitability low.

Good News, Bad News for Almonds and Walnuts

The almond market is uniquely challenged by a backlog of inventory. Whereas a typical carry-in is in the 400 million- to 450 million-pound range, the current carry-in is 800 million pounds. This drastic increase was initially driven by COVID-19-related shipping delays and has yet to return to more sustainable levels.

In recent weeks, the price of almonds has rebounded slightly. This price increase can be attributed to expectations of a lower marketable supply, both because acreage has been pulled out of production and because of widespread navel orangeworm damage on this year’s crop.

Though there may be a slight increase in the almond price going forward, high levels of carry-in are likely to continue to keep profitability low.

While the drop in profitability among almond farmers was sharp last year, it was even sharper for walnut growers. This was partly due to a buildup of inventory but also a heat wave that swept the Central Valley in September 2022 and greatly hurt the quality of the crop. The surge in China’s walnut exports since 2017 worsened this and has continued to put downward pressure on prices.

Though the walnut market will still face competition from China and Chile, the 2023/2024 crop year is likely to improve greatly from the lows of last year.

Though the walnut market will still face competition from China and Chile, the 2023/2024 crop year is likely to improve greatly from the lows of last year. Among other factors, global inventory is low and the quality of the 2023/2024 crop in California is expected to be high. Though the walnut market is unlikely to completely return to pre-pandemic conditions, we can expect a much-needed uptick in profitability from last year.

Better News for Pistachios

While the almond and walnut markets have struggled with some of the worst years on record, the pistachio market has fared much better. Part of this can be attributed to the crop’s especially strong demand growth. Yet all signs point to a 2023/2024 crop that will be in the 1.4 billion- to 1.5 billion-pound range, a record for the industry.

While higher yields increase farmer profitability, they can also lead to lower prices, which will reduce it. Overall, pistachio profitability is likely to be somewhat constant in the 2023/2024 crop year.

There are numerous obstacles that continue to impact California’s main nut crops. From the increased cost of growing to the continued issues with quality and inventory, the last few years have posed unprecedented challenges to growers’ bottom lines. Though some of these challenges have crept into the new crop year, it is likely to be a more profitable year than the last (see Chart 2).

Overall, pistachio profitability is likely to be somewhat constant in the 2023/2024 crop year.

Terrain content is an exclusive offering of American AgCredit, Farm Credit Services of America and Frontier Farm Credit.