Quarterly Outlook • March 2024

Margins Improve, but Not Enough to Spur Milk Production Growth

Milk production started the year with a steeper-than-expected decline in January.

Margins are improving with lower feed costs, and new plants under construction are looking for milk supply. However, high expansion costs, expensive replacement heifers, and enticing beef-on-dairy cross revenues continue to hold back production growth at the national level.

The number of milk cows in the U.S. fell by 28,000 head in January compared with December. Cow numbers increased slightly from January to February by 10,000 head but remained 89,000 head below last year. Through mid-March, dairy producers sent nearly 100,000 fewer cows to slaughter in 2024 than in the same period last year, but even that was not enough to stem the tide. Producers wanting to maintain or increase their herd are left with the option of holding on to older cows for longer or buying $2,500+ replacements.

The spread between Class III and Class IV milk prices remains wide and will be a defining feature of milk markets through the rest of this year.

The further the milk-cow herd declines, the bigger the hill left to climb back to normal levels of growth. Given the downward revisions to the USDA’s 2023 cow numbers and the steeper-than-expected drop in January, I now expect production to increase 0.5% year over year (YOY) in 2024, down from my previous forecast.

A Wider-Than-Normal Milk Price Spread

The spread between Class III and Class IV milk prices remains wide and will be a defining feature of milk markets through the rest of this year. Federal order minimum prices for February were reported at $16.08/cwt for Class III and $19.85/cwt for Class IV, a difference of $3.77.

Class III has historically been higher than Class IV, but since 2022, the inverse has been true in all but two months. I expect that pattern to continue for at least the remainder of 2024. Not only is the spread inverted, but it’s wider than normal, averaging $1.50 before 2022 and $2.50 since.

To adapt to this wide gap between the two influential milk prices, producers should consider how their milk is priced by their cooperative or buyer and factor that into risk management plans. Producers with prices more correlated with Class IV markets may see more opportunities to de-risk some portion of their production through programs like Dairy Revenue Protection.

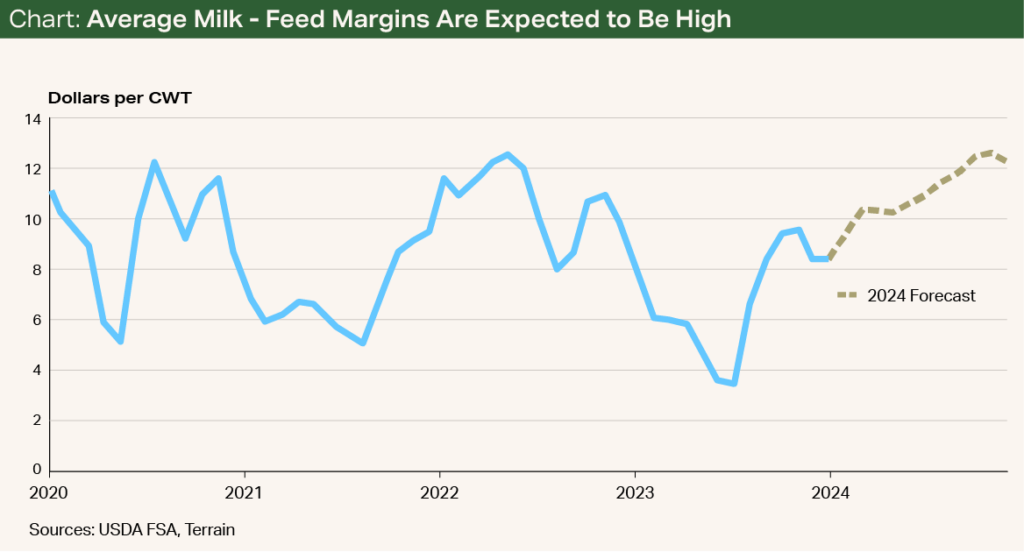

Those tied to Class III might be better served by watching more closely for upside surprises in Class III values to opportunistically lock in some protection. Producers who use the Dairy Margin Coverage program to insure against margin pressure now have through April 29 to make coverage decisions for 2024. However, low futures prices on the feed and strong Class IV milk futures are suggesting milk minus feed margins will be high this year and unlikely to trigger any payments (see Chart).

Exports Key to Higher Cheese Prices

Cheese markets are working out how to incorporate expectations of new cheese plants coming on line in the next year or so. Some downward pressure on prices reflects fears of a cheese surplus, but that surplus is beginning to seem less imminent as completion timelines get pushed further out and producers’ eagerness to fill those plants appears lackluster.

There are dairy expansions underway to provide milk to the new large-scale plants, including Hilmar in Dodge City, Kansas, and Leprino Foods in Lubbock, Texas, but high cow costs, construction costs and interest expenses are making it harder to find the milk than initially anticipated.

To see any meaningful increase in cheese prices, and by extension Class III milk prices, exports will need to pick back up.

To see any meaningful increase in cheese prices, and by extension Class III milk prices, exports will need to pick back up. There have been fleeting moments of price competitiveness during Q1 that opened some export opportunities for the U.S., but the price advantages were neither strong enough nor long-lasting enough to book substantial sales volumes.

Domestic consumer demand has remained stable, but some large food companies and restaurant chains are mentioning signs of pushback against higher prices.

McDonald’s has acknowledged slowing business from low-income consumers, while PepsiCo revised growth projections downward following a decline in net income that it has attributed to pushback against higher prices. Kraft Heinz saw sales fall 7.1% from a year ago in the most recent quarter, attributing the decline to inflation pressure as well as cuts to SNAP program benefits last year.

Buyers for these companies will be pressuring sellers for some price relief. If they succeed, it could weigh on dairy commodity prices and ultimately milk prices at the farm.

I expect Class III milk prices will average $17.15/cwt in 2024, down slightly from my prior forecast.

Price Outlook

Cheese prices will likely remain rangebound, barring any major export developments. Butter prices have been climbing since the start of the year, but cream availability is plentiful for churning. Nonfat dry milk prices have been steady, and whey prices have fallen from recent highs after climbing since the beginning of the year. I expect Class III milk prices will average $17.15/cwt in 2024, down slightly from my prior forecast. Meanwhile, I predict Class IV prices will average $19.75/cwt, up slightly from last quarter’s estimate.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.