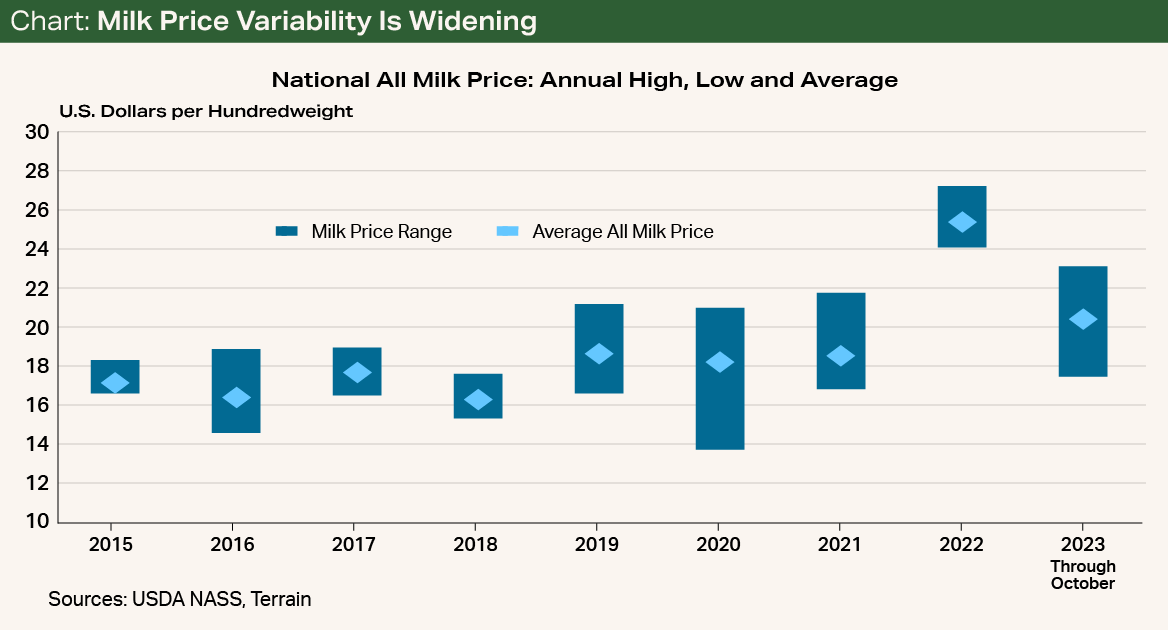

One lesson learned from 2022 and 2023 is that there is a wide price range within which milk prices are willing to travel. While it’s useful to forecast where the average might be in 2024 for budgeting and risk management purposes, these wide swings that have become the norm may very well continue.

Over the course of 2022/2023, the USDA national All Milk price peaked in May 2022 at $27.20/cwt and bottomed out at $17.40/cwt in July 2023 (see Chart). Depending on the regional milk market, some highs looked even better than the national average high, but some lows looked much worse than the average low.

Fortunately, the lows were relatively short-lived, and many producers received indemnity payments from insurance programs like Dairy Revenue Protection and Dairy Margin Coverage, which softened the blow.

2024 Dairy Predictions

Given the wild swings in price over the last two years, predicting what 2024 has in store is a challenge. Futures currently indicate a relatively flat curve, averaging around $18/cwt over the year for Class III and $19.60/cwt for Class IV.

I currently project Class III prices to average $17.50/cwt in 2024 and Class IV to average $18.75/cwt. Producers should see butterfat values average about even with 2023 and an improvement of about 4 to 5 cents in both the protein and other solids values.

I currently project Class III prices to average $17.50/cwt in 2024 and Class IV to average $18.75/cwt.

I expect total milk production for all of 2023 to be up slightly, by 0.25% compared with 2022. For 2024, I forecast an increase of nearly 1% from 2023 levels. Milk cow numbers have been on the decline, but the U.S. milk cow herd should level off near current levels before growing again in the second half of 2024. New plants coming on line during the year will need milk, which should act as a relief valve to the capacity limitations that had been preventing expansion previously.

A Variable, but Manageable, Year

While there is limited pressure one way or the other on milk prices for now, there are signs of relief in feed costs. Corn prices continue to fall with ample supplies, and as soybean biofuel plants come to fruition, soybean meal as a byproduct will be plentiful.

Interest expenses, meanwhile, will be higher than what producers have been accustomed to for the past several years. Even if there is some easing of interest rates in 2024, the baseline assumption should be to plan for a “higher for longer” scenario.

The strongest potential for a meaningful boost in demand would come from abroad, but exports are still hit or miss.

Higher rates appear to be having the intended effect of easing inflation, with broad inflation measures gradually descending. The dairy-specific consumer price index dipped slightly negative in September and October, meaning prices for consumer dairy products are lower than they were last fall.

Lower retail prices could help buoy domestic demand, but I don’t expect a dramatic surge. The strongest potential for a meaningful boost in demand would come from abroad, but exports are still hit or miss.

Slower exports in 2023 were a major contributor to the price weakness. But as we near the end of the year, the U.S. dollar is cooling off somewhat, which will make dairy products more affordable to importing countries. Still, the U.S. will be competing with Europe and New Zealand and ultimately will need to see demand rebound in areas like China and Southeast Asia, where economic woes have subdued activity.

2024 should be variable but manageable. Augmenting milk revenues with opportunities like beef-on-dairy cross sales and other non-milk revenue streams, as well as managing risk with hedging programs or insurance, will remain key to successfully navigating 2024.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.