Report Snapshot

Situation

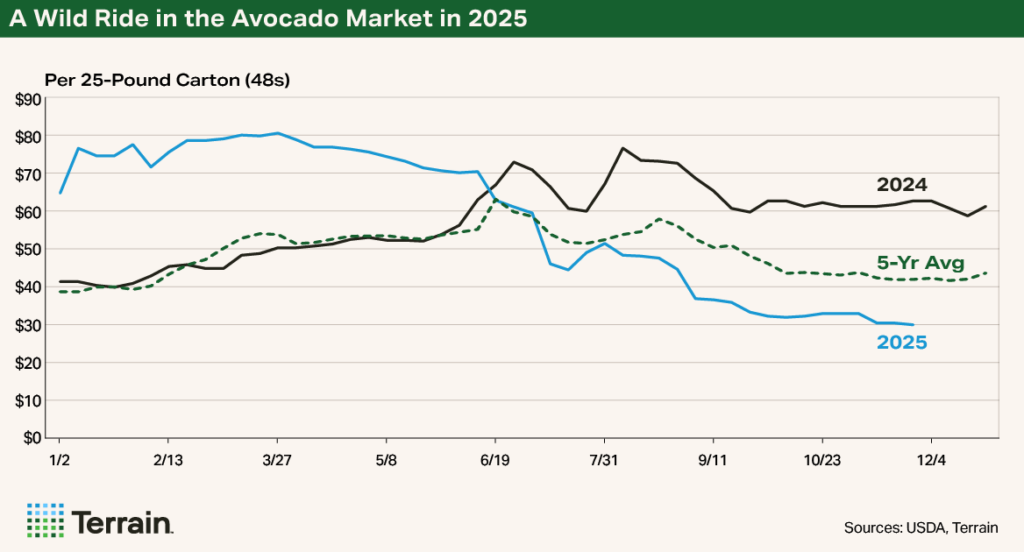

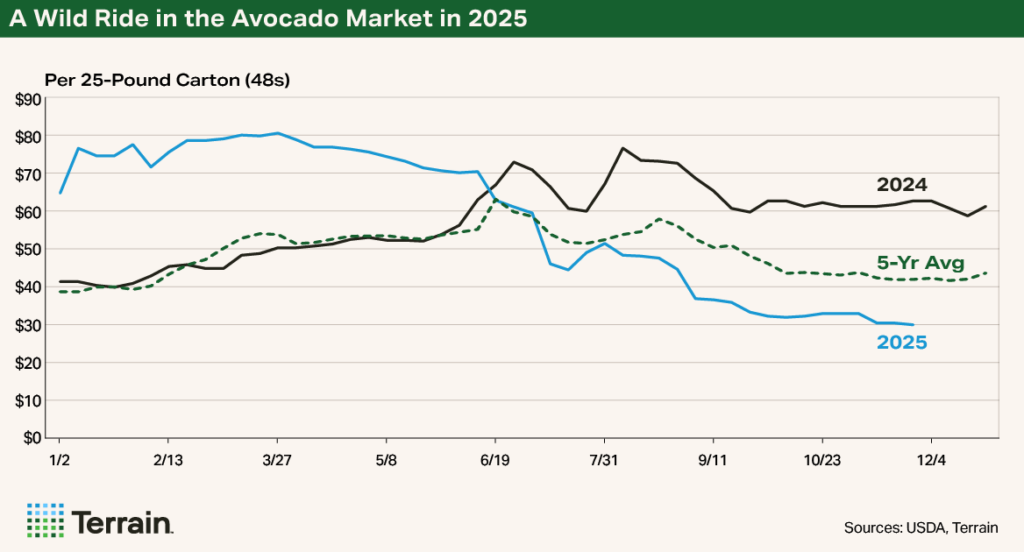

In 2025, avocado prices experienced dramatic fluctuations. Prices began the year at nearly twice their usual rate but fell significantly during the latter half of the year.

Finding

California avocado producers can reflect on lessons from the wild ride of 2025 — primarily, how important it is to get the timing of harvest right. By following the volume data and anticipating shifts in supply closely, growers can help optimize their overall return.

Avocado shipping point prices in 2025 were unusually erratic.

Avocado shipping point prices in 2025 were unusually erratic. From January to early July, they consistently exceeded last year’s figures and the five-year average, with 25-pound cartons (48s) reaching $80, compared with the usual $40 to $60 range. By midsummer, however, prices collapsed and continued to decline the rest of the year. This roller-coaster pattern was largely the result of demand competing with supply throughout the season.

On the demand side, the avocado consumer proved remarkably resilient.

Solid Demand

On the demand side, the avocado consumer proved remarkably resilient. Unit sales surged across nearly every U.S. region (California being one of the few exceptions, ironically). High-frequency retail data from the Hass Avocado Board show that monthly unit sales broke records throughout the year. These shorter-term data are consistent with longer-term USDA Yearbook trends. Per capita demand was just 2.1 pounds in 1980 and now stands at 9 pounds per person.

The trend is further supported by robust seasonal demand during key events such as the Super Bowl and Cinco de Mayo. In 2025, heightened demand during these pivotal periods coincided with limited supply, resulting in sustained elevated pricing.

Furthermore, consumers exhibited a continued willingness to purchase products at increased price levels, contributing to the ongoing upward trajectory in prices.

Supply Issues From Mexico

Strong demand met relatively low volumes entering the U.S. from Mexico at the beginning of the year. Whereas around 60 million pounds of avocados typically enter the U.S. each week from January through April, that number was closer to half that in some weeks in early 2025. Drought in Michoacan, Mexico’s primary growing region, impacted the total crop volume as well as fruit size. I expect that Mexico’s crop will return to normal at the beginning of 2026, given that drought conditions have improved.

High demand alone could explain elevated prices, but when combined with sharply reduced Mexican shipments, the market moved from expensive to very expensive. Prices doubled their typical levels in the opening months of the year.

Increased Summer Supply

The next key question is why prices took a sharp dive from mid-June onward. Despite the low volumes coming from Mexico earlier in the season, volumes picked up when Mexico harvested its summer crop (the “flora loca”), which occurred right when California volumes were peaking.

Volumes from Peru also came into the U.S. earlier this year and at higher levels. Whereas volumes usually don’t ramp up until mid-June, they were nearly at their peak by then in 2025. In addition to increased levels entering early, they stayed high for longer, remaining elevated relative to previous years into October. Cumulative volumes to date are 55% higher than last year, accounting for nearly 10% of total volumes in late summer, versus 6% to 7% in recent years.

The primary lesson from 2025 is how important it is to get the timing of harvest right.

Follow the Volume

California avocado producers can reflect on lessons from the wild ride of 2025.

The primary lesson from 2025 is how important it is to get the timing of harvest right. While some of this is out of growers’ hands and largely determined by location, farmers often have flexibility on when to harvest given that avocados don’t ripen on the tree. By following the volume data and anticipating shifts in supply closely, growers can help optimize their overall return.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.