Corn prices continued to drift lower in the fourth quarter of 2023 as the larger harvest and mediocre demand took their toll. By the end of the year, the corn export pace had picked up, and with OPEC+ attempting to lift oil prices, the outlook for prices in early 2024 is improving.

Corn exports were weak for the first part of the 2023/2024 marketing year. By early November, exports had accelerated enough to catch up, and as of early December, the pace of sales was slightly exceeding the historical pace implied by USDA export estimates. Export shipments were slow, but that may be an artifact of the recent surge in sales contracts.

Exports have also benefited from a decline of the U.S. dollar, which has been fueled by growing expectations that interest rate cuts occur sooner rather than later in 2024. The weaker dollar is helping to make U.S. exports more competitive.

Since harvest, basis levels in the central and western corn belt have been average to 15 cents stronger than historical levels, though these are pretty soft compared with the past few years. I expect them to remain there for the first quarter of 2024, as long as the Mississippi River remains open.

In general, supplies are adequate to return cash market behavior closer to long-term normal levels.

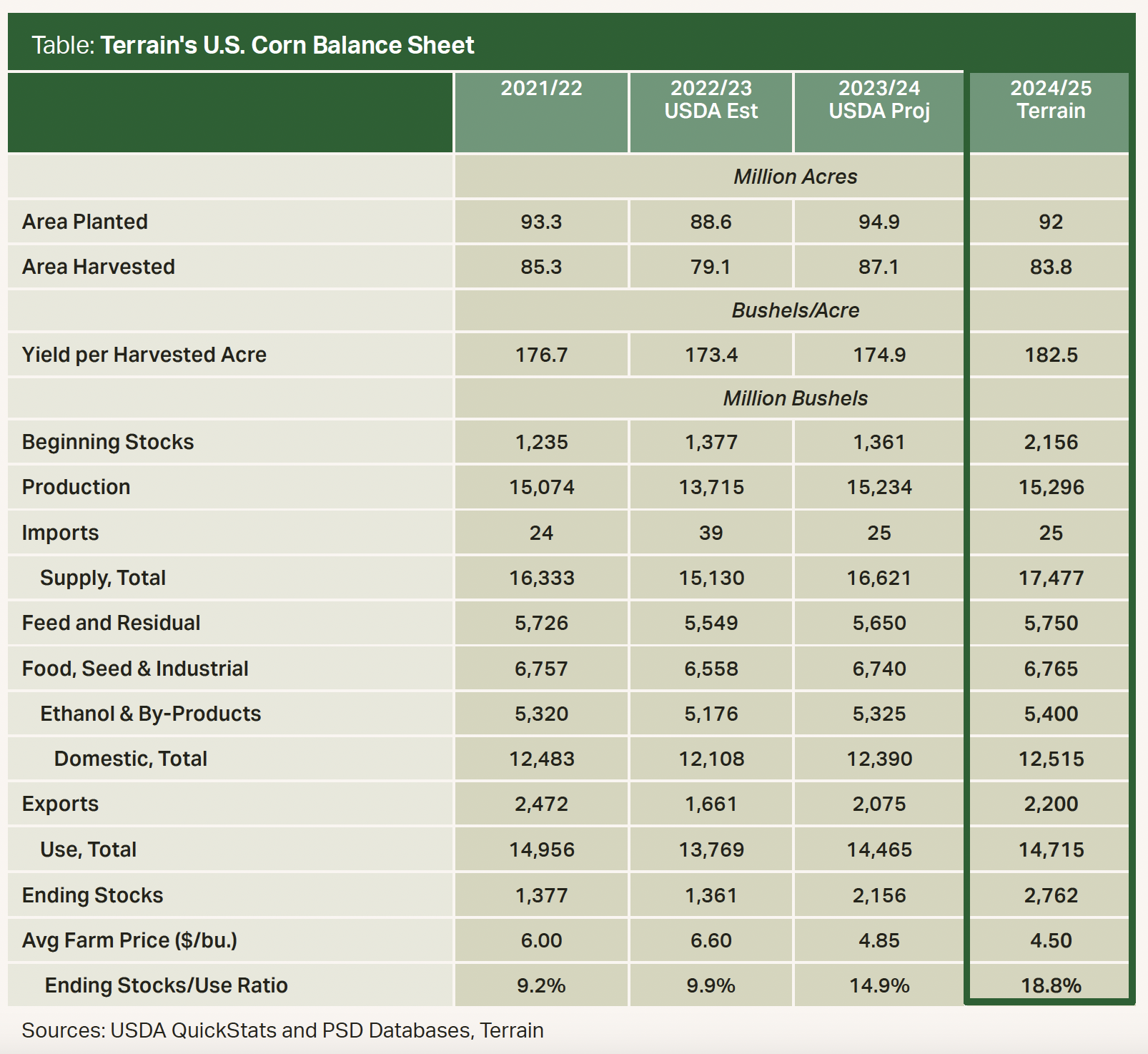

Terrain’s trend-line yield in 2024 is 182.5 bu./ac., but acres are forecast to decline on lower prices, to 92 million acres planted and 83.8 million acres harvested.

The current basis levels have resulted in relatively slow farmer selling, but the selling has matched demand.

There have been reports of locally stronger basis through harvest, but these are mostly in low-yield pockets or where end users seem to have delayed purchases, hoping that prices would fall further. In general, supplies are adequate to return cash market behavior closer to long-term normal levels.

High interest rates should disincentivize storage, though many farmers I’ve spoken with still seem to be optimistic on the opportunities for storage profits.

The market does continue to offer carry spreads to May, which should be breakeven or profitable with modest basis improvement. Beyond May, basis will have to provide more of the price improvement.

2024 Harvest Predictions

Discussions of the next crop year naturally begin in the first quarter. While last year’s yield fell short of expectations, the rise in planted acreage over 2022/2023 resulted in a harvest very close to the USDA’s original forecasts.

Terrain’s trend-line yield in 2024 is 182.5 bu./ac., but acres are forecast to decline on lower prices, to 92 million acres planted and 83.8 million acres harvested (see Table).

This would result in a harvest nearly identical in size to 2023’s, but with total availability 1.2 billion bushels higher due to the higher stocks being carried over from 2023/2024. This total supply is 500 million bushels higher than even in the 2016/2017 and 2017/2018 marketing years.

In 2024/2025, lower prices caused by the higher availability should result in higher usage across all categories. However, feed use increases will be limited by herd size, and ethanol demand is limited by gasoline demand that has not yet recovered to 2019 levels.

The net result will be higher ending inventories and lower prices for the year, with a possibility of cash prices close to $4 at harvest.

This outlook is significantly more bearish than December 2024 futures prices, and I cannot account for the difference. Futures prices would require either planted acreage falling below 90 million acres, yields that are again below 175 bu./ac., or a major decline in South American production.

The net result will be higher ending inventories and lower prices for the year, with a possibility of cash prices close to $4 at harvest.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.