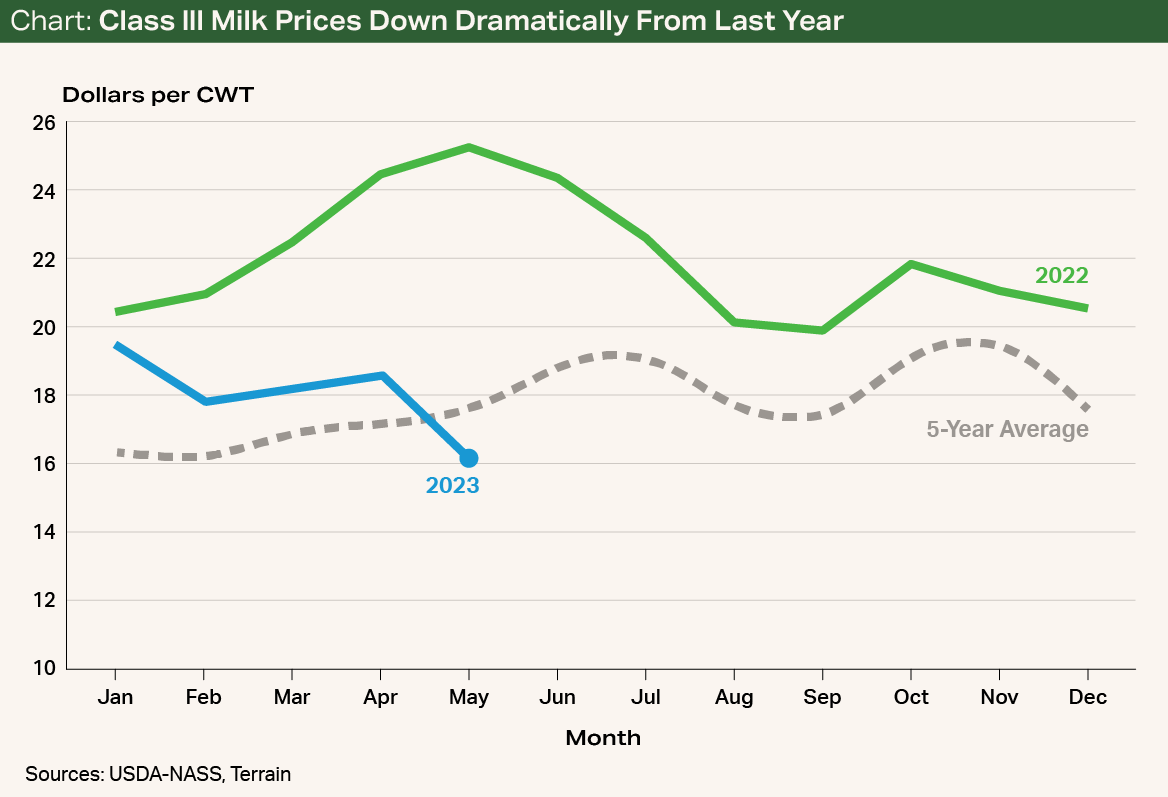

Milk prices have plummeted in June, putting a damper on “dairy month” celebrations. The difference is staggering when you compare milk checks hitting mailboxes now to those at the same time last year. All-milk prices were setting records above $27/cwt in April and May of 2022. Prices in April 2023 fell to $20.70/cwt, a 23% drop. Prices in May and June are projected to fall further still, likely down another $2. The May Class III milk price of $16.11/cwt was down almost 36% compared to last year (see chart).

While the dramatic decline from last year’s record highs is painful, these price levels are still near their long-term averages. Over the past 10 years, the average all-milk price in Q2 has been $18.72/cwt. Still, that comparison is cold comfort to producers who are facing significantly higher costs of production. Current milk prices are well below break-even levels for almost all producers at this point, and for most have been there through the entire first half of the year. Producers who took advantage of the Dairy Revenue Protection program or other forms of risk management have fared better up to this point, but many are less protected heading into the third quarter.

Faced with negative milk profitability and high cull values, a contraction in the milk cow herd will likely be the catalyst for milk prices to turn around in the second half of the year. The USDA’s most recent tally counted 9.43 million milk cows in May, and I project that number to fall by another 20,000 to 30,000 head by the end of the year to end near 9.4 million.

The USDA’s most recent tally counted 9.43 million milk cows in May, and I project that number to fall by another 20,000 to 30,000 head by the end of the year to end near 9.4 million.

Milk production in the U.S. remains up marginally (0.6% year on year in May) against last year, but is still down year to date through May compared to two years ago. April 2023 was marked by floods in California and a tragic fire in Texas, both of which negatively impacted production. Production gains should remain minimal through the end of the year, and could dip into negative territory in some months. I project full-year milk production in 2023 to be 0.5% above 2022, a slightly tighter forecast than the USDA’s most recent projection of 0.8%. Both forecasts are below trend, but could still turn out to be more than markets need.

On the surface, demand has appeared to hold up so far this year, but that will be put to the test. U.S. dairy exports maintained reasonable strength through the first quarter, but are showing some signs of a slowdown recently. Dairy exports benefited from trading at a discount to our EU and New Zealand competitors in 2022 and carried some of that strength into this year with sales that were contracted earlier. However, prices in the rest of the world have fallen in tandem with the U.S. and there is no longer a competitive price advantage.

U.S. domestic demand for dairy is up 1.4% on a total solids basis through Q1 2023. While consumers are still facing higher prices, the dairy Consumer Price Index has cooled off from its peak of 16.4% YOY in November to 4.6% in May. Supply chains, hesitant to hold excess inventory in the current high interest rate environment, continue to reduce prices to keep product moving rather than allowing inventories to build.

The remainder of 2023 will be a challenge. Prices have dropped lower and remained there longer than anticipated coming into the year. I expect June to be the low point for prices this year, but without a major surge in demand, a price rebound could underwhelm and may remain at or below break-even levels for most producers.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.