Production Forecast

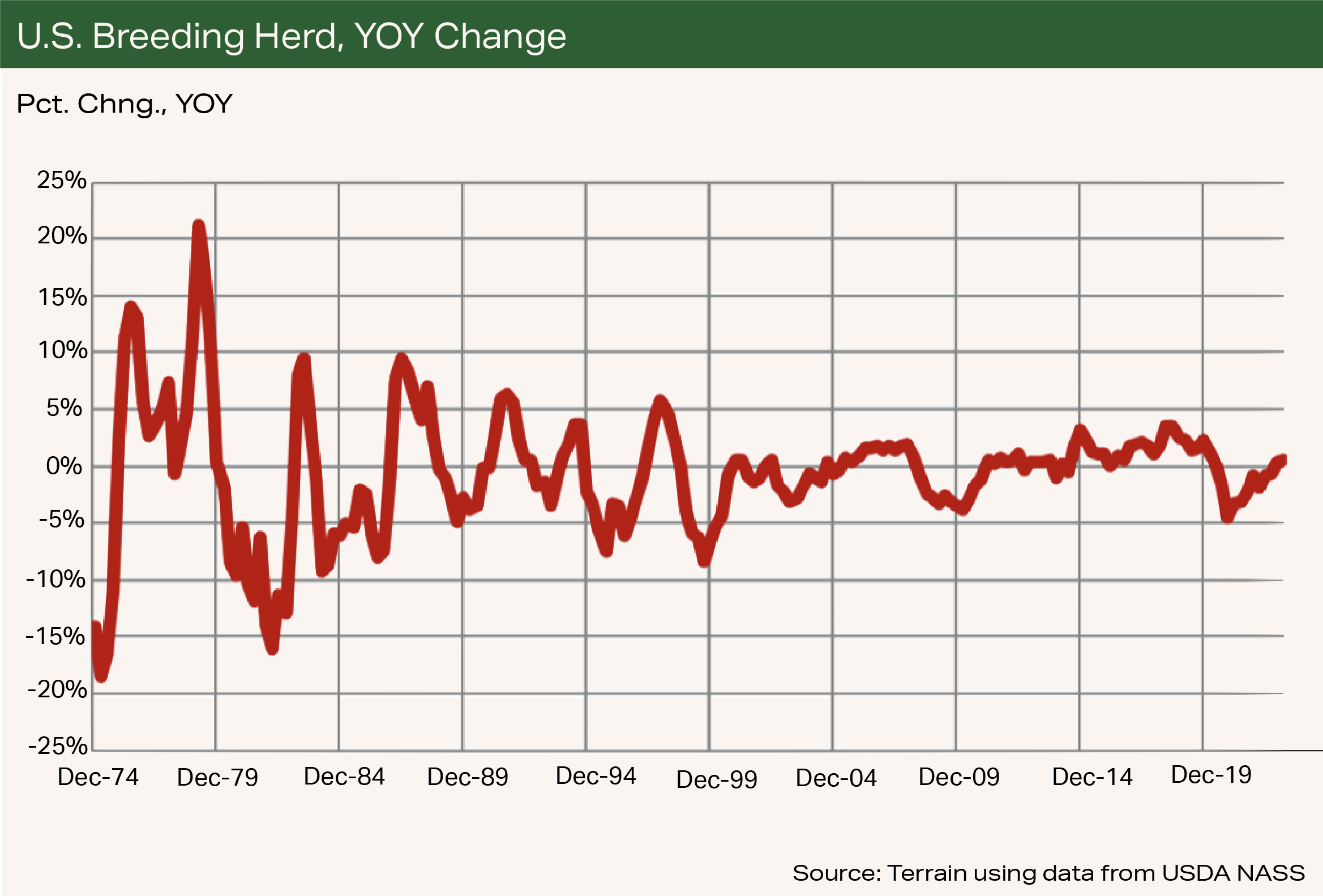

I expect both hog slaughter and pork production during Q2 2023 to be near even levels versus a year earlier. Q3 2023 slaughter and production may see slight gains year-on-year (YOY) as pigs saved per litter rebounds with warmer weather. Very few changes in breeding herd populations are expected until a ruling from the U.S. Supreme Court is heard on California Proposition 12 (Prop 12).

Price Forecast

We expect the gradual tightening of supplies to underpin prices, but the shortening of supply isn’t likely enough to spark anything larger than a seasonal rally in cutout values or hog prices. During Q2 2023, cutout values have potential to rally into the $90/cwt to $95/cwt range while producer-sold, negotiated hogs could get into the low-$90s/cwt.

Total hog and pig numbers were slightly larger on March 1, 2023 than a year ago (up just 0.2% YOY), while the breeding herd was 0.48% larger than a year earlier. This resulted in a 0.35%, or 111,000-head, increase in the pig crop YOY for the December-through-February quarter. Up just 2%, only the 180-pounds-and-heavier market hog weight group was larger. All the other categories were nearly even and suggest that the largest slaughter totals of the first half of 2023 are likely behind us.

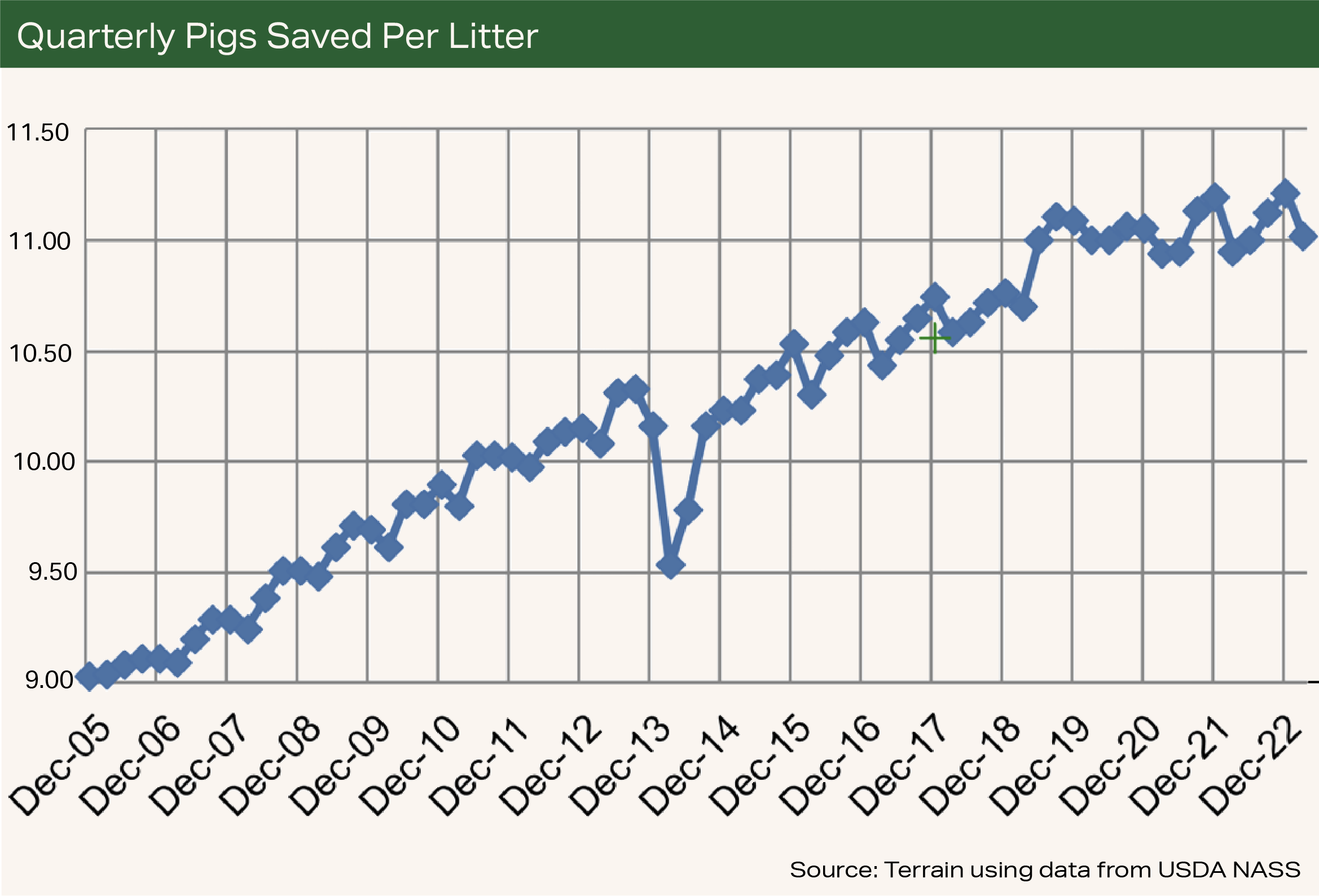

Like last quarter, the only inventory trend pointing toward growth was continued YOY recovery in pigs saved per litter. Pigs saved averaged 11.02 pigs, up from 10.95 pigs saved for the same period in 2022, but down 0.2 pigs per litter from the September-through-November quarter. This tick down from fall to winter correlates well with the reports from the Swine Health Information Center of seasonal resurgences of both PRRS and enteric corona virus infections in sow farms and wean-to-finish facilities.

I expect Q2 2023 hog slaughter to trend slightly lower on a weekly basis as numbers begin to tighten. The March 1 USDA hogs and pigs report showed that the only increase in numbers were in the 180-pounds-and-heavier group (+2.0% YOY). Hogs in that group will be nearly all slaughtered by early Q2 2023. All the groups smaller than 180 pounds were all down, within a range of -0.1% to -0.3%.

I don’t expect this gradual decline in seasonal slaughter, however, to add much spark to the mostly rangebound market we have all witnessed so far in 2023.

A rally in cutout values, driven by stronger consumer interest in grilling and smoker items, is in the works. It’s aided by high beef prices. Retail poultry prices have remained sticky, but this could change rapidly as quarterly poultry costs get adjusted lower and the spot breast market continues to struggle at levels down 50% from a year ago. Until then, loin chops, pork tender loins and back ribs all look attractive to consumers relative to ground beef, steak and even chicken breast.

Pork demand will likely have to contend, though, with a projected spike in feature activity on breast meat at some point this spring or early summer. Retail grocers have been banking fairly large margins on breast meat and other broiler chicken items. Grocers will have a sizeable promotion budget with which to attract customers. Pork doesn’t appear to have accumulated much frozen inventory, outside of bellies, over the winter to add to promoted volumes.

Primal cut carcass value contribution remains a significant headwind for the pork cutout. Only the ham and picnic primals have year-to-date (YTD) average prices above year-ago levels, +8.8% and +16.8%, respectively. On a YTD basis, loin primal values are down 15.2%, belly primal values are down 45.1%, butt primal values are down 7.0%, and the rib primal is down 27.1%. All combined, so far this year, the pork cutout has averaged 17.0% below a year ago. I find it unlikely that hog slaughter numbers will contract enough to make for a seasonally strong rally into summer.

I am cautiously optimistic that exports can rebound. Current price on U.S. hams should have Mexican buyers very interested, and loin prices should remain attractive to Japan and Korea, potentially boosting volumes to Asia.

If the U.S. Supreme Court strikes down California Prop 12, all my expectations stay in place. If the court lets the law stand and California buyers of pork products toned to comply with the law, the market fallout will be dependent upon when compliance will be mandatory.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.