Situation

Weekly barrow and gilt slaughter totals continue to trend lower from the peak set in late January. By late May, they were smaller by about 300,000 head per week. The year-to-date slaughter hog head count was up just 0.4% through the end of May 2024 compared with a year earlier.

Outlook

I expect inventories of available slaughter hogs to continue to decline to the seasonal lows of late June and early July, averaging about 0.5% below year-earlier levels. The decline is the result of breeding herd liquidation during Q3 2023.

A Pleasant Turn of Events

Sow slaughter during the first half of Q2 2024 was up about 4.4% versus a year earlier and is up 5.6% year to date through mid-May. If sow productivity and pigs saved per litter continue to increase at about 4% like they did in the last two quarters reported by the USDA, then pig crop and eventual slaughter hog numbers aren’t likely to decline very much, if at all, in Q4 2024 versus a year earlier.

The wild card to estimating breeding herd inventories will continue to be how much more gilt retention has been occurring since early March, when summer lean hog futures rallied through $100/cwt. The rally signaled the impending shift to profitability after hog producers had lost nearly $20/head during the 18 months from November 2022 through April 2024.

The March 1 USDA Hogs and Pigs report revealed that the breeding herd was down just 2.2% year over year and was 0.8% larger than I had forecast (with much of the error due to the number of gilts retained). The June 1 Hogs and Pigs report slated for release on June 27 will give us an idea of this activity among survey participants.

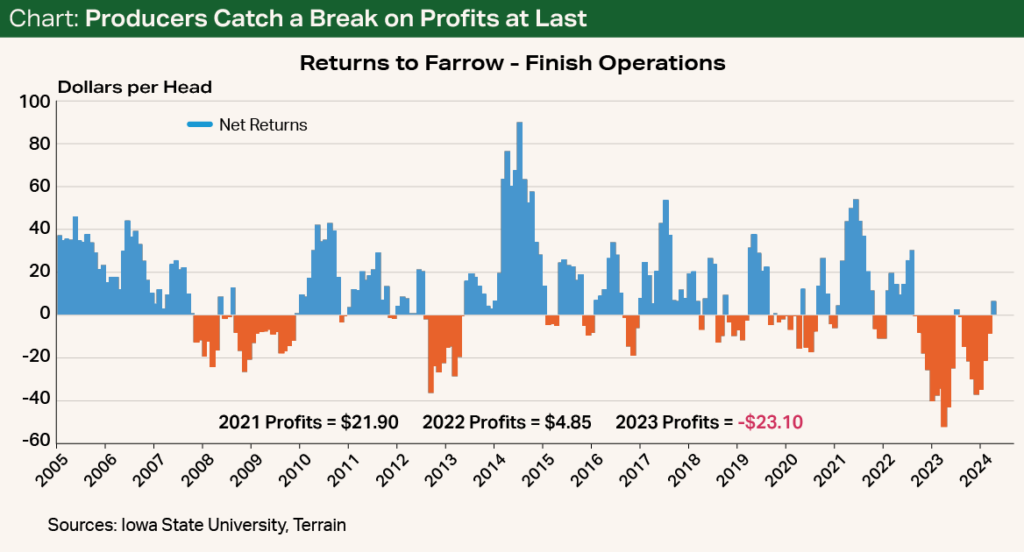

Iowa State University’s estimated returns to farrow-to-finish operations posted profits of $11.92/head for April 2024, marking an end to seven consecutive months of losses that averaged $21.69/head (see Chart). April’s swing to profitability for the average producer was a welcome shift from the all-time record-setting losses in April 2023 of $49.47 per market hog sold and $555 per sow farrowed.

Futures price action from March through May suggests producers can expect a solid six months of profitability.

Futures price action from March through May suggests producers can expect a solid six months of profitability. I expect that break-even selling prices will hover in the $85/cwt to $88/cwt range during Q3 2024 before declining to the low to mid-$80s for Q4 2024 (the lowest since Q4 2021) because of expected lower feed costs.

I expect that Q3 2024 prices for producer-sold barrows and gilts will range from $90/cwt to near $110/cwt.

Price Forecasts

I expect that Q3 2024 prices for producer-sold barrows and gilts will range from $90/cwt to near $110/cwt and average slightly below $100/cwt, outperforming Q3 2023 by 3% to 4%. My forecast for farrow-to-finish margins during Q3 2024 is $22/head to $26/head sold, using the Iowa State model assumptions.

I forecast Q4 2024 slaughter hog prices to average $80/cwt to $82/cwt, ranging from the upper $80s/cwt in early October to lows near year’s end in the mid-$70s/cwt. From a profitability perspective, this likely means small profits ($8/head to $12/head) early in the quarter, near breakevens during November, and small losses for December.

I project that 10- to 12-pound weaner pig prices in the cash market will spend the bulk of Q3 in a range of $45/head to $50/head before rallying to the mid- to upper $50s in Q4.

I expect the pork cutout to continue to benefit from stronger loin, rib and belly markets while butts, picnics and hams all trend between year-earlier and five-year average values on a primal basis. The strong U.S. dollar will likely continue to create headwinds for exports. For Q3, I see pork cutout values ranging between $117/cwt and $123/cwt. For Q4, I predict prices will be up 12% to 15% versus a year earlier, ranging between $97.50/cwt and $100.50/cwt.

I expect the pork cutout to continue to benefit from stronger loin, rib and belly markets.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.