Outlook • December 3, 2025

Progress Remains Elusive in the Wine Market

Winescape Winter 2025/2026 | Market Happenings

Report Snapshot

Situation

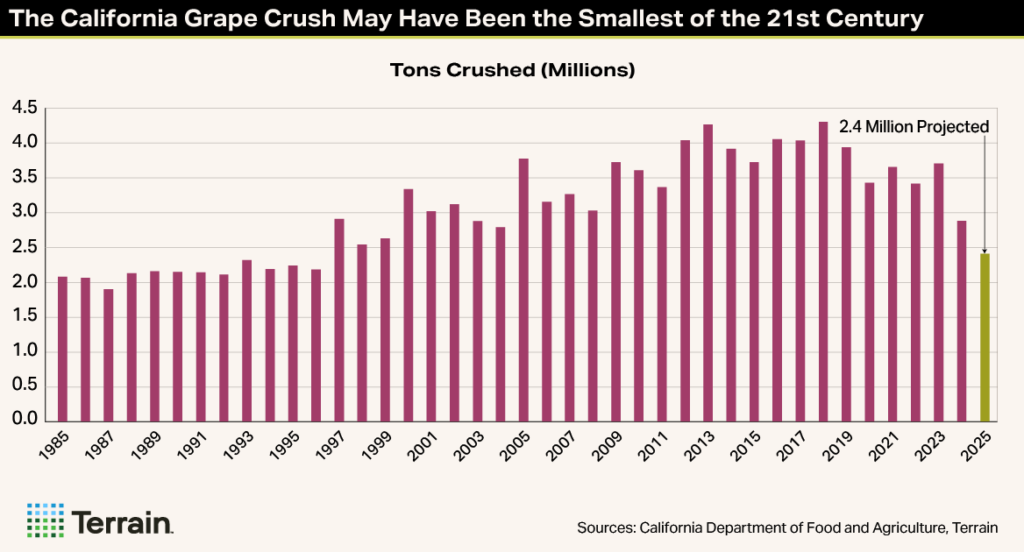

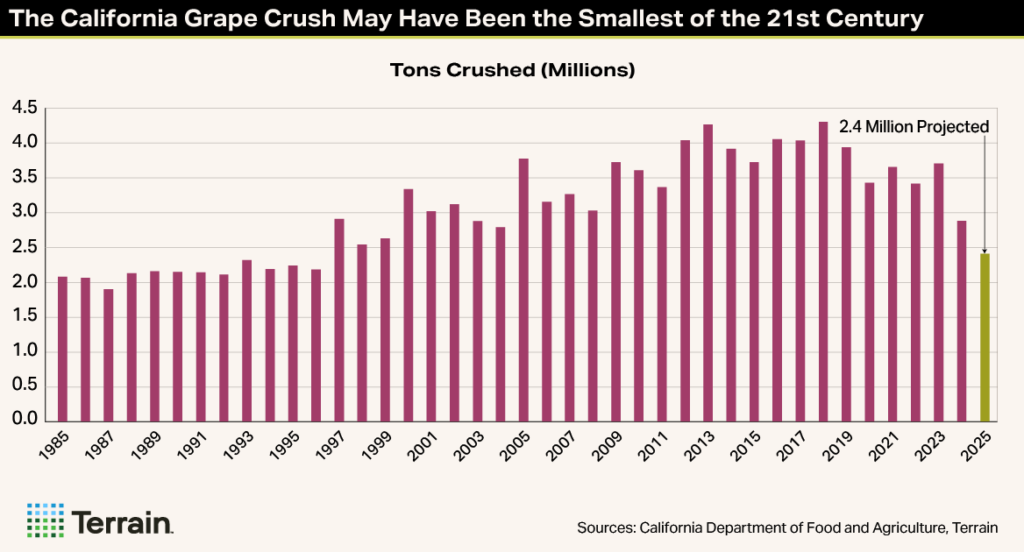

Wine sales continued to fall across all channels and price points in the third quarter. Improvement was evident in some segments of the industry, but the rate of decline accelerated in others. Industry experts expect the 2025 harvest to come in below 2.5 million tons, which would be the smallest of the 21st century. Even with a lighter crop, there wasn’t enough demand to absorb all the grapes grown.

Finding

The grape glut ultimately traces back to declining wine sales. The glut will eventually be corrected by an increase in demand, a decrease in supply or a combination of the two. I believe the slump in wine sales is primarily structural, so most of the adjustment will likely come on the supply side. It is not beyond the realm of possibility that there is a shortage of grapes next year, but we’ll have a better sense of the situation over the coming months.

Outlook

Given my outlook for sluggish economic growth, I don’t expect a material change in the trajectory of wine sales in the near term. Fourth-quarter retail sales figures will likely be weak, in part because the year-ago comparison was the strongest of 2024, but also because of weaker consumer sentiment heading into Q4 2025. I expect the grape market to be in a better position overall next year, but perhaps not yet strong enough to generate profitable prices for all growers.

Sales Volume Trends by Channel and Segment

Change vs Year AgoTrendMarket Update:

DtC Sales Still Struggle; Export Sales Lack Clarity

There was no material change in the complexion of the wine market in the third quarter. Wine sales continued to decline across all channels and price points. Improvement was evident in some segments of the industry, but the rate of decline accelerated in others.

Based on my analysis of NIQ data, off-premise wine sales fell 5% year over year in both value and volume. The decline was a bit steeper than in the second quarter but shallower than in the first.

The three-tier market remains distinctly bifurcated at the $15 price mark.

Depletions are still lagging retail sales due to inventory reductions by retailers. According to SipSource data, depletions fell 7% YOY in terms of revenue and 10% YOY by volume in the third quarter, a steeper decline than in the first six months of the year. Depletions to off-premise accounts fell at a slightly faster rate than those to on-premise accounts, a trend that has been in place throughout 2025.

It is possible that the retail and depletions figures overstate the actual decline in wine sales to some extent. This is because both data sets fail to capture at least some private-label sales, which have purportedly been taking market share from branded wines.

The overall sales figures also obscure an important dynamic: The three-tier market remains distinctly bifurcated at the $15 price mark.

Sales of wines priced at $15 and above haven’t been all that bad. Sales of these wines are down just 1% in volume in NIQ outlets year to date — a slightly better performance than in 2024 — though they have deteriorated a bit in value due to discounting. The $15 to $20 price point continues to be the sweet spot.

Conversely, sales of brands priced below $15 were off 6% in both value and volume during the first nine months of 2025, versus a 5% drop in volume and 3% decrease in value in 2024. The depletions data paint a similar picture.

In terms of the direct-to-consumer (DtC) channel, sales are clearly still fading, though the datapoints send mixed signals regarding the magnitude. Similarly, it is difficult to tell whether the pace of decline is accelerating or moderating.

Data from Wine Business Analytics and Sovos/ShipCompliant indicate that DtC “shipments” fell 21% in volume and 14% in value during the third quarter YOY, the weakest quarterly reading this year. Conversely, Community Benchmark reports a decline in total DtC revenue of less than 4%, the smallest quarterly decline thus far in 2025. I put more weight on the Community Benchmark numbers, because they include carry-out sales.

However, the Community Benchmark figures for the first nine months of 2025 are slightly worse than the full-year figures for 2024. The data also indicate that visitor counts have continued to decline across the West Coast in 2025. The erosion in sales and visitor counts is likely attributable in part to rising prices. Based on the DtC shipment data, average bottle prices were 7% higher in Q3 2025 than during the same period last year. The cost of wine, tasting experiences and travel may need to come down to stimulate DtC sales and visitation.

We don’t yet have a full account of Q3 2025 wine exports due to the government shutdown. However, based on the first two months of the quarter, there doesn’t look to have been much improvement.

Wine shipments to foreign markets fell 33% in value and 12% in volume in July and August versus the same period last year. This compares with YOY declines of 38% in value and 26% in volume in the second quarter.

Declining export value continues to be driven by provincial bans on American alcohol in Canada. Canadian exports fell 94% YOY for the July to August period, just a tick better than a 95% drop in Q2.

A final point to note is that domestic wines have yet to take market share away from imports, despite the imposition of tariffs in April.

Wine Market Outlook:

Expect More of the Same

To the extent that the wine sales slump has been driven by the economy, there is not likely to be much improvement in the near term, as we expect slightly below-average economic growth. The government shutdown disrupted data collection, making it hard to even decipher where the economy stands today.

Overall, though, the economic backdrop wasn’t all that bad during the first nine months of 2025. The worst-case scenarios relating to tariffs seem to have been avoided, as their impact has been diluted by carveouts, new trade deals and, in some cases, circumvention.

Following a rocky start to the year, which included a GDP contraction in the first quarter followed by a rebound in the second, the economy appears to have been relatively stable in the third quarter. The Q3 GDP report has been delayed, but third-party estimates suggest growth was solid.

However, there were signs of labor market softening, and inflation ticked up. Unemployment came in at 4.4% in September, its highest level in four years but still low by historical standards. Consumer prices rose 3% YOY in the third quarter, up from a 2.7% increase in Q2, but wage gains continued to outpace inflation.

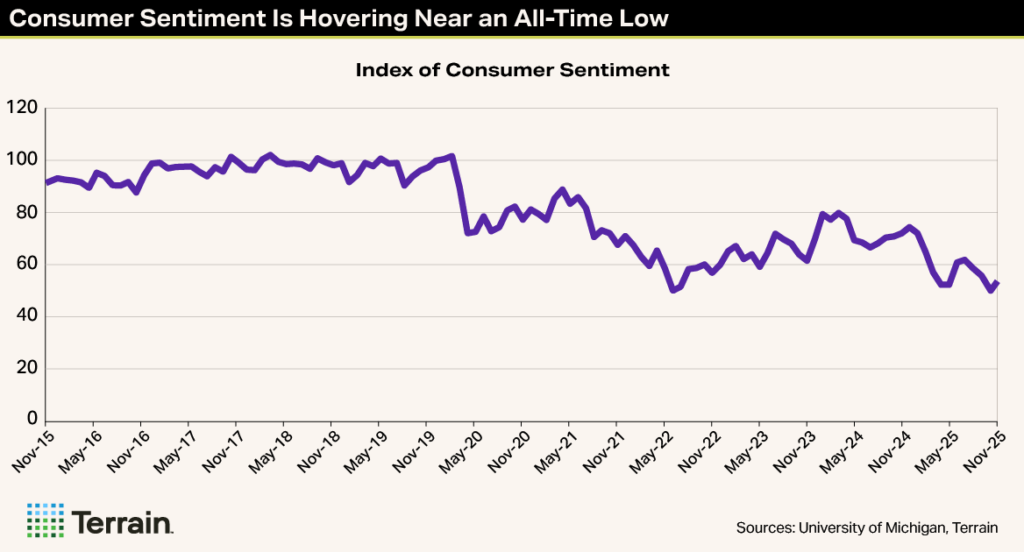

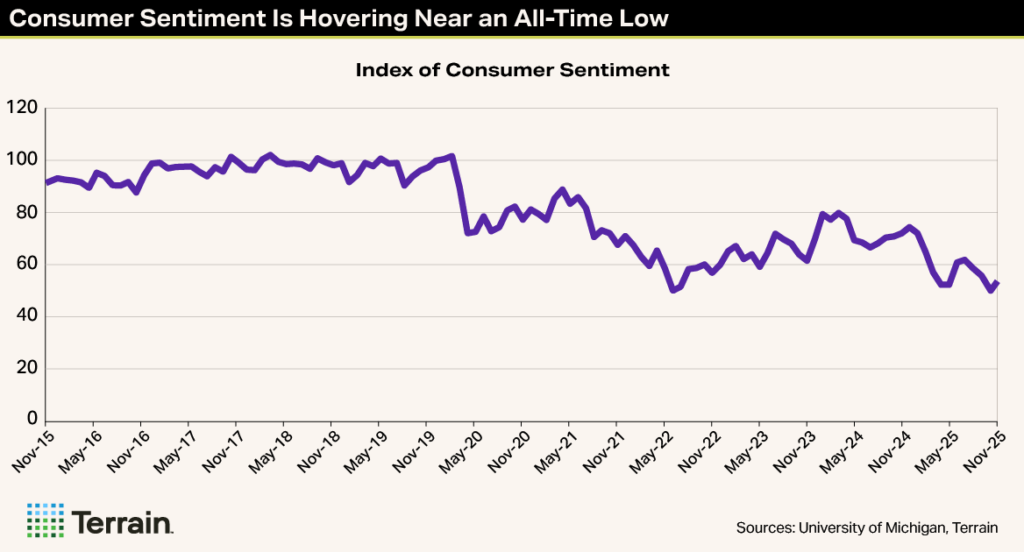

Despite these reasonably benign indicators, consumer sentiment fell in the third quarter. The consumer sentiment index dipped to 51 in November, just a point above the all-time low recorded in 2022. Inflation, economic uncertainty and the government shutdown have weighed heavily on consumers’ psyches.

I’m not expecting much improvement or deterioration in the economic backdrop in the near term. The Q4 GDP figure is likely to be weak because of the government shutdown, and we expect growth to remain sluggish in early 2026 as tariffs and policy uncertainty continue to constrain growth. Inflation is also likely to remain uncomfortably high, and additional softening in the labor market is possible.

Consumer sentiment may improve now that the government has reopened, but the mood is likely to remain pessimistic due to rising prices, economic uncertainty and political strife.

Nonetheless, consumers look reasonably well-positioned to continue spending — particularly those in the upper half of the income distribution, whose wealth has been boosted by a buoyant stock market. But they are apt to remain conservative and price-sensitive when it comes to discretionary purchases.

The economic backdrop could see slight improvement by midyear 2026 as the stimulatory effects of the 2025 tax bill and deregulation become more evident. Additionally, the president’s plan to issue eligible Americans a "tariff rebate” check could also act as a one-time income stimulus, though this is far from a certainty.

Given my outlook for sluggish economic growth, I don’t expect a material change in the trajectory of wine sales in the near term. Fourth-quarter retail sales figures will likely be weak, in part because the year-ago comparison was the strongest of 2024, but also because of weaker consumer sentiment heading into Q4 2025.

I continue to believe that longer-lasting structural factors are the primary cause of the slump, particularly in the value segment of the market.

Exports are also not likely to rebound anytime soon. Canadian provincial bans on American alcohol remain in place in all but Alberta and Saskatchewan, which represent just 15% of the population. Even after provincial bans are lifted, Canadians will likely be slow to return to American wine.

It is possible that domestic wines could begin to take some market share from imports in the months ahead as pre-tariff import stockpiles are depleted. Nonetheless, price taking will continue to be challenging for domestic producers due to heightened consumer price sensitivity.

Once the economic backdrop improves, there should be some improvement in the trajectory of wine sales. Even so, I continue to believe that longer-lasting structural factors are the primary cause of the slump, particularly in the value segment of the market. So, I don’t expect a return to outright growth in wine sales. The premium and luxury segments should continue to outperform.

Grape Market Outlook:

Sour Grapes for Growers

Vintage 2025 has been one of the most taxing in memory for California grape growers. The growing season was challenging due to cool weather and a rainy harvest, which made it difficult to achieve desired brix levels in some cases and caused some issues with mold.

The grape market proved to be an even greater challenge. There simply wasn’t enough demand to absorb all the grapes grown, even with a lighter crop.

Spot market activity was limited, and deals were generally done at unprofitable prices for growers. Those with uncontracted fruit, of which there were many, were mostly left out in the cold for a second year in a row, and hundreds of thousands of tons of fruit are thought to have been left on the vine.

Yields look to have been near average in most regions. But given the volume of fruit left behind and less bearing acreage, industry experts expect the harvest to come in below 2.5 million tons, and perhaps well below. A crush of 2.5 million tons would be the smallest in a quarter-century. This compares with 2.9 million tons last year and an average of 4 million during the mid-2010s.

We may not have hard data to confirm the crush until mid-March, as a legislative bill passed in October extends the reporting deadline for grape processors to January 31. Consequently, the deadline for the release of the preliminary Grape Crush Report has been pushed from February 10 to March 15, though I haven’t been able to confirm this change will take effect in 2026.

The grape glut ultimately traces back to declining wine sales.

Declining sales imply the need for fewer grapes each year. The slump in consumption has also resulted in a wine inventory glut, as wineries were slow to pull back on production in years past. Thus, even fewer grapes were needed in 2025 than were warranted by wine sales. This situation, along with an abundance of caution on the part of wineries, depressed grape demand in 2025.

The glut will eventually be corrected by an increase in demand, a decrease in supply or a combination of the two. I believe the slump in wine sales is primarily structural, particularly at the value end of the market, so most of the adjustment will likely come on the supply side.

I believe that more grapes will be needed in 2026 than were crushed in 2025, offering a slight silver lining.

Substantial progress toward rightsizing has already been made. The California Association of Wine Grape Growers indicates that 38,000 acres of wine grapes were removed between October 1, 2024, and August 1, 2025, a reduction of 7.5%. This comes on top of heavy removals the prior year, though we don’t have a firm estimate of total acres. More acreage is likely to be removed in the coming months as growers without contracts throw in the towel.

The small 2025 crush will help to reduce the wine inventory overhang, a subject I address in the Trending Topic section of this report. The magnitude of inventory reduction will depend on how many tons were crushed in 2025 as well as the path of wine sales. The imperfect data preclude precise calculations, but under my base-case scenario, I believe inventory will still be modestly long heading into the 2026 harvest. However, I believe that more grapes will be needed in 2026 than were crushed in 2025, offering a slight silver lining.

I expect the grape market to be in a better position overall next year, but perhaps not yet strong enough to generate profitable prices for all growers.

The potential for improvement in grape demand coupled with vineyard removals sets the stage for a more balanced grape market in 2026, though there is uncertainty on both sides of the equation. We simply don’t know how many grapes will be needed or how much the land will be capable of producing due to ambiguity on how much acreage has and will be removed, how much will not be farmed, and how quickly mothballed vineyards will spring back.

I expect the grape market to be in a better position overall next year, but perhaps not yet strong enough to generate profitable prices for all growers. As always, supply and demand dynamics will vary widely across appellations and varieties, so there could be shortages or surpluses even when the market is in balance in an aggregate sense.

Supply-side rightsizing represents a delicate balancing act. It is not beyond the realm of possibility that there is a shortage of grapes next year, though I don’t believe this is likely. We’ll have a better sense of the situation as fresh data arrive over the coming months on 2025 crush size, vineyard removals, wine sales and more.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.