As we approach the two-year mark of the Russian invasion of Ukraine, the war between the two countries rages on and markets have become numb to news flowing out of the Black Sea region.

Wheat prices have suffered a painful grind lower since the highs of late July after the termination of the Black Sea Grain Initiative. Even through the conflict, both Russia and Ukraine have beat expectations and continue to be major wheat suppliers on the global stage.

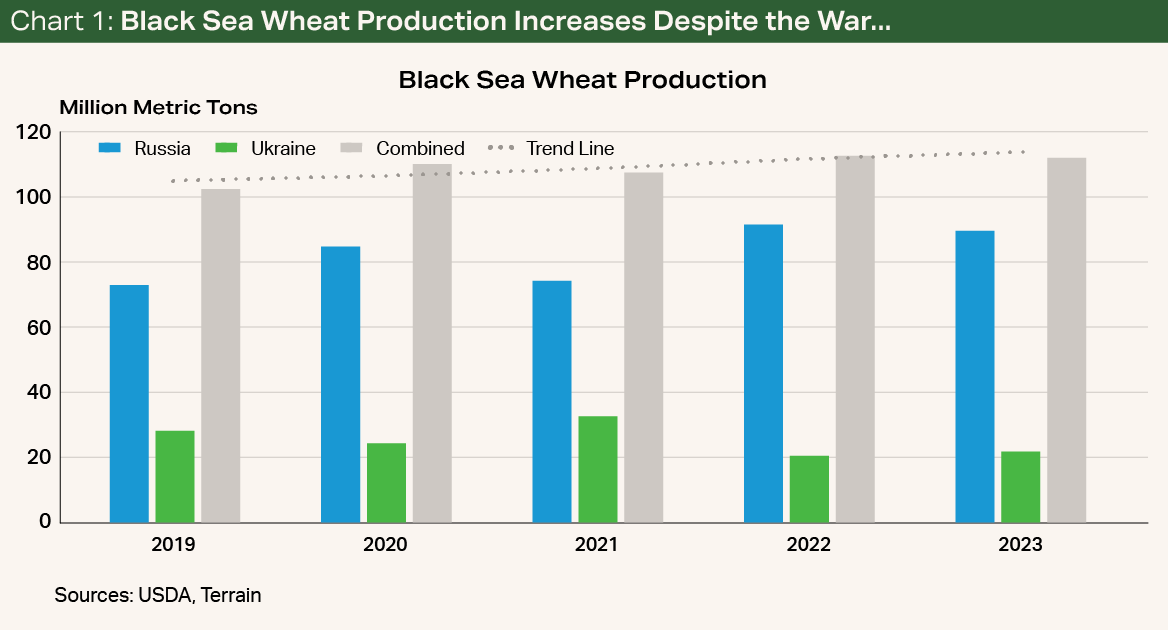

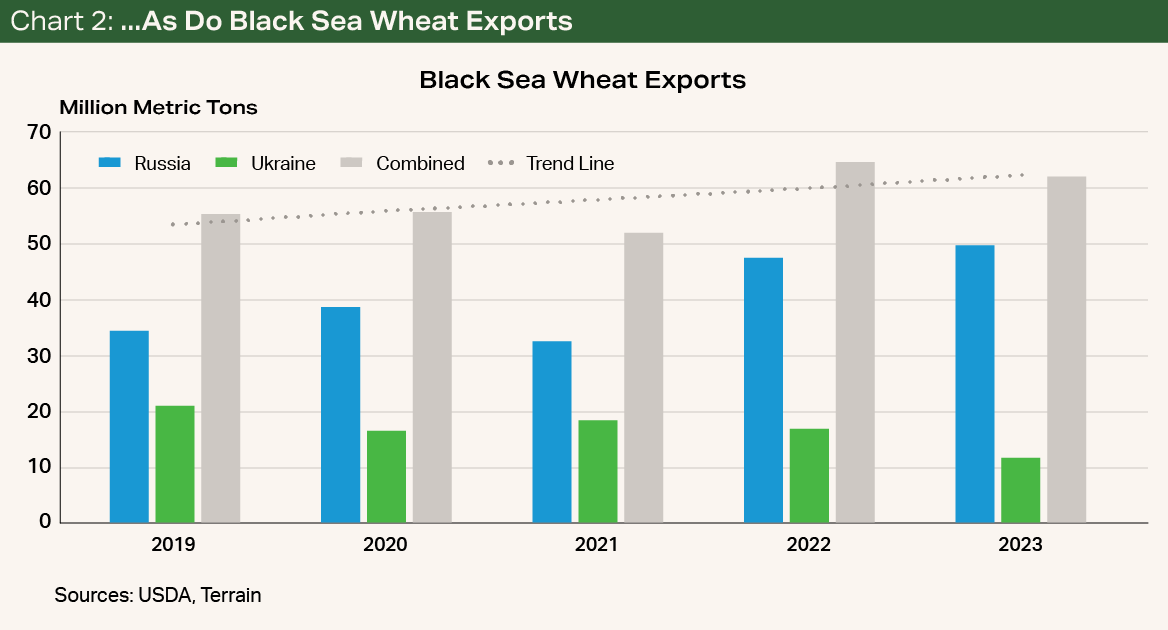

In the 2022/2023 crop season, wheat production in Ukraine declined by 23% compared with prewar levels. Ukraine also exported 17 million metric tons (MMTs) of wheat during this period, a decline of only 5% compared with the five-year average.

For the 2023/2024 marketing year, the USDA projects a significant export decline of 39% versus the five-year average due to the loss of the Black Sea Grain Initiative.

Even through the conflict, both Russia and Ukraine have beat expectations and continue to be major wheat suppliers on the global stage.

Since the Black Sea Grain Initiative expired on July 17, Ukraine has relied on exports through the Danube River ports. These ports are a strategic location because of their proximity to the NATO nation of Romania. However, the possibility of missing the target and hitting Romanian turf instead has not deterred Russia from continuing drone strikes on the ports of Izmail and Reni on the Danube.

The Danube River ports now handle 65% of Ukraine’s grain exports while rail and truck handle the remainder. The Danube River ports handle less than half of the capacity of the Odesa port. These ports are critical to Ukraine, but they don’t replace the volume that was exported through the Black Sea Grain Initiative.

One of the most surprising statistics from the conflict is that Black Sea wheat production and exports have increased from prewar levels instead of declined (see Charts 1 and 2).

Russia’s record wheat crops have offset Ukraine’s decline in wheat production and exports. After hitting a record-high 46 MMTs in the 2022/2023 marketing year, Russian wheat exports are on track for a new record in the 2023/2024 marketing year.

Russia Continues to Set the Global Floor Price

Cheap Russian wheat has been driving down global wheat prices. Russian 12.5% protein wheat is $50 per metric ton cheaper than U.S. Hard Red Winter (HRW) FOB prices. The price spread is narrowing, however, and the futures market appears to have found some recent strength after bottoming near $6 on the Kansas City March HRW contract.

A significant reduction in Russian wheat production or exports is necessary to rally U.S. wheat prices, as declines in Ukraine’s production and exports have already been priced into the market.

The situation appears unlikely to end soon. It’s likely that Ukraine will continue its counteroffensive for as long as it can, and Russia will not relent because Ukraine has a better chance of becoming a NATO nation during peacetime.

The cornerstone of NATO’s alliance is Article 5, which provides that an attack on one member is considered an attack on all members. If Ukraine were to join NATO during the war, it would invoke Article 5.

A significant reduction in Russian wheat production or exports is necessary to rally U.S. wheat prices, as declines in Ukraine’s production and exports have already been priced into the market. However, given the unlikelihood of the Russia-Ukraine conflict ending soon, I do not expect such a reduction in Russian wheat production or exports in the near term.

In the U.S., wheat exports are on pace to hit the USDA’s projection of 725 million bushels, the lowest export volume in 52 years. At the same time, wheat imports have increased because it is cheaper for some East Coast millers to import wheat from the EU than to rail it from the Midwest.

I expect wheat prices to stabilize in the first quarter of 2024 after a painful slide in the second half of 2023. A more reasonable price spread between U.S. wheat and other major exporters will help drive the price stabilization.

I expect wheat prices to stabilize in the first quarter of 2024 after a painful slide in the second half of 2023.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.