Situation

Carcass weights began to climb during the first quarter of 2024 as Midwest cattle feeders held cattle to replace the weight lost during severe weather and poor pen conditions in January and February. The rebound of carcass weights at the end of the first quarter has extended well into the second quarter, resulting in record-high monthly average fed cattle weights in April and May.

The record weights are largely a function of cattle feeders responding to market economics. These signals included record-high first-quarter feeder cattle costs (bad swap); first-quarter fed cattle marketings that were projected to be losing nearly $100 before accounting for weather losses; profitable cost-of-gain projections; and very poor pen conditions.

Given these factors, it was a better decision to feed the animal than to liquidate inventory and start over with an equally bad or worse projected outcome.

Outlook

Despite these record-high carcass weights, I am optimistic that fed cattle prices will remain resilient the rest of this year. Weights will likely tamp down Q3 prices only slightly before tighter supplies help prices in Q4 retest spring highs.

A Better Problem to Have

By the first week of May, USDA-reported fed cattle carcass weights were 36 lbs./head, or 4.2%, heavier than a year earlier. The heavier weights, by my calculations, added the beef tonnage equivalent of about 27,000 head to weekly beef production.

Placements of cattle into feedlots were below year-earlier levels in three of the four reported months of 2024 and were down 320,000, or 4.3%, in the first four months versus a year earlier. Marketings for January through April were down only 42,000 head, or 0.6%, versus a year earlier, leaving the May 1 cattle-on-feed total down 0.9% year over year (YOY).

In the current environment of tightening feeder cattle and calf supplies and rallying prices for those classes of cattle, the cattle feeding industry has had a “kind” problem with smaller placement totals. So far, it’s avoided a worse “numbers of head” problem that results in cattle feeders losing all their leverage and margins to packers for two turns of cattle before the problem gets solved.

For Q3 2024, I expect fed cattle prices to average between $185/cwt and $190/cwt.

I don’t foresee the numbers issue becoming a problem because of the smaller placements that have occurred year to date, which will likely continue for the next several months. I expect peak fed cattle availability during June, followed by a faster than normal seasonal decline in the third quarter. Depending on the May placement total and weight mix, the total number of cattle placed to be marketed during the third quarter could be down 250,000 to 300,000 head.

Price Forecasts

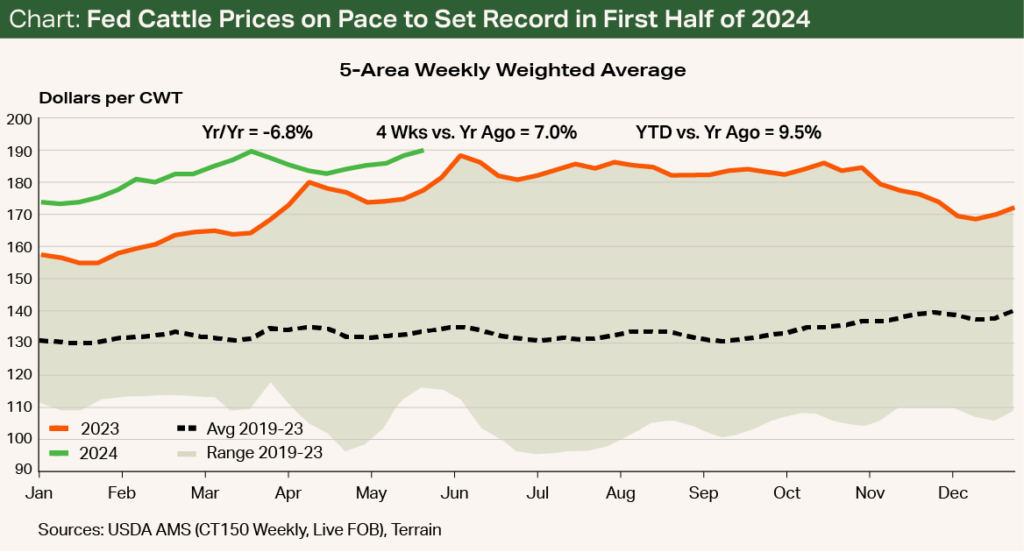

For Q3 2024, I expect fed cattle prices to average between $185/cwt and $190/cwt, which is about $5/cwt lower than my previous forecast, largely because of weights (see Chart). Looking ahead to Q4 2024, my forecast for available fed cattle supplies tightens further, leading to an early-Q4 retest of the spring highs in the low-$190s/cwt, with the potential to reach $200/cwt during the holiday demand period. Declining grain costs could push some cattle to $150/head to $200/head profits.

Optimism for continued profits for the second half of 2024 combined with 740,000 fewer cattle left outside feedlots on May 1 versus a year earlier will well support feeder cattle and calf prices. Replacement cattle will be in shorter supply the back half of the year versus the first half of 2024.

For perspective, placements were down 80,000 head, on average, in each month from January to April on a YOY basis. The USDA’s January 1 Cattle Inventory report showed that feeder cattle and calf supplies outside feedlots were down 1.06 million head versus January 1, 2023. I expect that the average decline in placements for May through December will be closer to 92,500 head per month.

I forecast the CME Feeder Cattle Index to spend the bulk of Q3 and Q4 2024 in the $275/cwt to $285/cwt range. I expect Oklahoma City 400- to 500-pound steer calves to average about $360/cwt, with an approximate range of plus or minus $10, for Q3 and early Q4.

During November and December, supplies for light calves destined for turnout on small grain pastures will decline further as heifer retention for cow herd expansion begins. This has pushed my November/December forecast for these light steers to $380/cwt to $400/cwt.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.