Quarterly Outlook • September 2023

Ripe for Opportunity: 2023 Likely to Be a Good Year for Processing Tomatoes

Situation

Since 2017, the grower price for processing tomatoes has nearly doubled. In 2023, it reached $138 per ton, up 30% from where it was just last year. The increase in price is meant to boost what has been a short supply. In the last decade, growers have been shifting away from planting tomatoes because of increases in growing costs and stubbornly flat yields.

With these recent price hikes largely outweighing the increase in growing costs, processing tomatoes have emerged as a bright spot in the specialty crop market, with growers likely to see strong profitability on this year’s crop. As we move into the 2023/2024 season, farmers with open land and water who are willing to take on some risk might consider growing processing tomatoes, especially as pricing in other commodities remains low.

Background

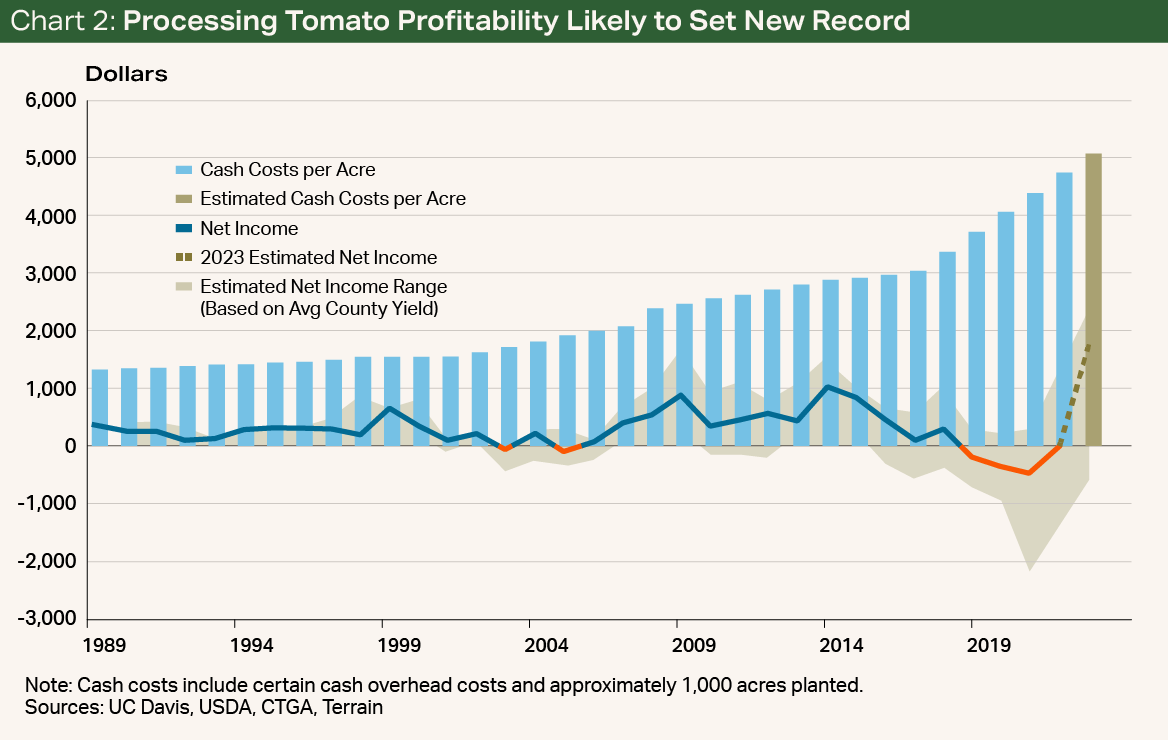

Processing tomato acreage has been on the decline in California for the last decade. In 2012, there were 260,000 acres; in 2022, there were only 231,000. This decline can be attributed to increases in costs and flat yields, which have been eating into overall profitability. Though costs have risen across the board, the increased costs of materials, labor, fuel, water and interest payments on operating lines have been especially impactful. Whereas the cash costs to grow an acre of tomatoes in 2017 totaled between $3,000 and $4,000, they are now easily in the $5,000 to $6,000 range.

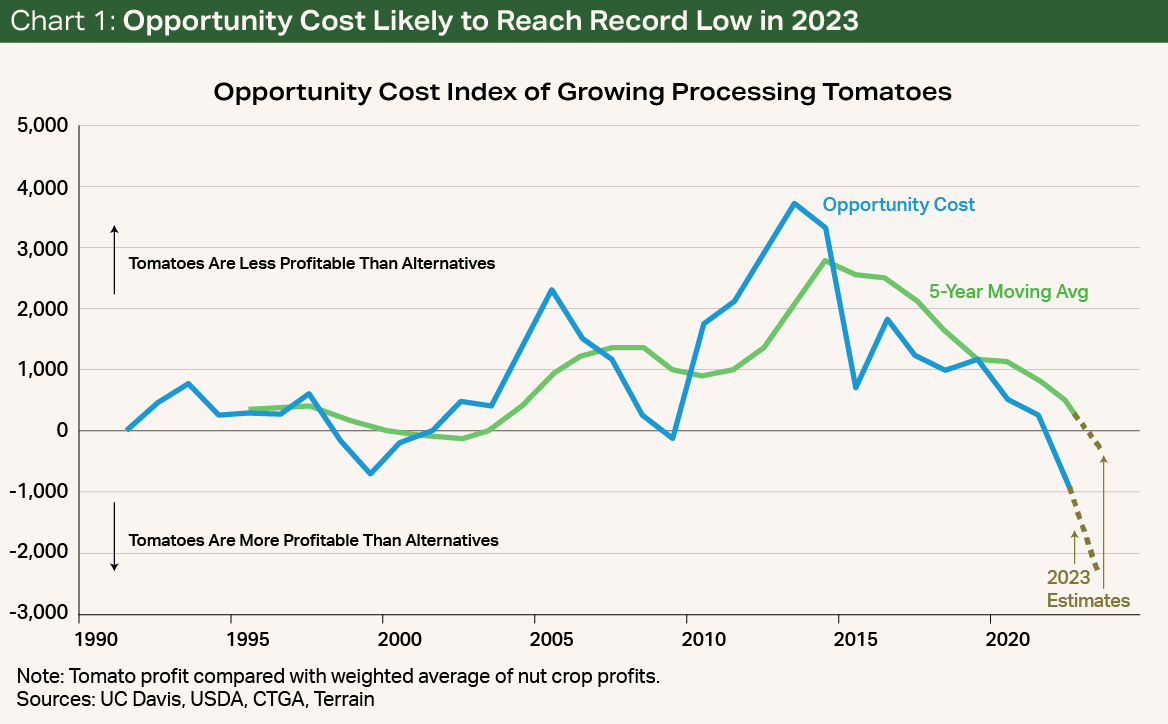

The opportunity cost of growing tomatoes has also been a significant factor driving acres away from processing tomatoes over the past decade. With nut crops booming throughout the 2010s, many tomato growers moved toward planting almonds and pistachios.

On top of increased costs, yields have remained flat (and in some years dropped) because of the increased use of groundwater and increased pest pressure. As growers who get water from the Central Valley Project and State Water Project manage years of little to no allocation, many have turned to groundwater, which is higher in salinity. The buildup of salts has led to a flattening of land productivity in many regions. Growers have also struggled to manage pests including sugar beet leafhoppers, which transmit the curly top virus and proliferate in hotter conditions.

The combination of flat yields and higher growing costs has meant that the margins in growing tomatoes have been thin or even negative — though financials are highly dependent on location.

Based on calculations using data from the University of California Davis, the California Tomato Growers Association and the USDA, the typical processing tomato grower in California has lost about $200/ac. to $500/ac. every year since 2017 as the increase in gross revenue has been outpaced by the increase in total cost. In counties where yields were lower or costs were higher, losses were even greater. For growers who were able to remain profitable throughout this period, returns were approximately $200/ac. to $300/ac.

Outlook

Rather suddenly, the tables have turned. Though there are more risks associated with growing processing tomatoes compared with many other crops, the opportunity cost is currently projected to be at an all-time low because of the price increases (and almond prices being stuck well below where they were a decade ago) (see Chart 1). The sudden increase in the relative return of growing tomatoes has been reflected in the 2023 contracted acreage number of 254,000, the highest since 2016.

The price increase will also be reflected in the bottom lines of growers who can keep costs down. Assuming yields are 50 tons/ac. as the USDA forecasts, I expect gross income per acre to be in the $4,500 to $7,800 range, while net income per acre will likely be around $1,700 statewide and closer to $2,700 for high-yielding regions like Kings County and Fresno County (see Chart 2). Growers who have already harvested in 2023 have reported higher yields this year that could easily push this number into the $3,000 to $3,500 range.

Though the outlook is positive for the processing tomato market, a lot can change as harvest moves into the second half of the season — especially this year, as weather conditions have made it difficult to stagger harvests.

Though it appears the impact of Hurricane Hilary was limited, the weather may continue to prove challenging for the second half of harvest, as California is headed for El Niño conditions. The Central Valley has already experienced some rainfall in early September, the total impact of which remains to be seen.

Nevertheless, at this point in the season, it is likely to be a very good year for tomato growers. And this also appears likely to continue into next year.

As we head into the next crop season with other commodity prices likely to remain low, adventurous growers who have open land, water and some experience with the crop might consider tomatoes. This is especially true of nut growers, many of whom will continue experiencing losses. Preparing for the next crop season now, however, can be critical to increase the odds of success. This is because it is easier to have higher yields and lower costs with early-season contracts.

Though it is difficult to know what the price will be next year, processing tomato growers who can deliver on yield and quality are likely to continue to benefit from this bright spot in the specialty crop market.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.