Quarterly Outlook • September 2023

Surplus Milk Has Evaporated, Supporting Higher Prices in Q4

Milk prices have improved dramatically from the depths of the low point registered in July. The August Class III milk price was announced at $17.19/cwt, an improvement from the $13.77/cwt July price, but not enough to tilt the scales toward widespread profitability. The most recent Milk Production report from the USDA indicated total U.S. milk production turned negative year on year (YOY) in July by 0.7% and by 0.2% YOY in August. I expect the trend of YOY declines to continue for most, if not all, of the rest of 2023.

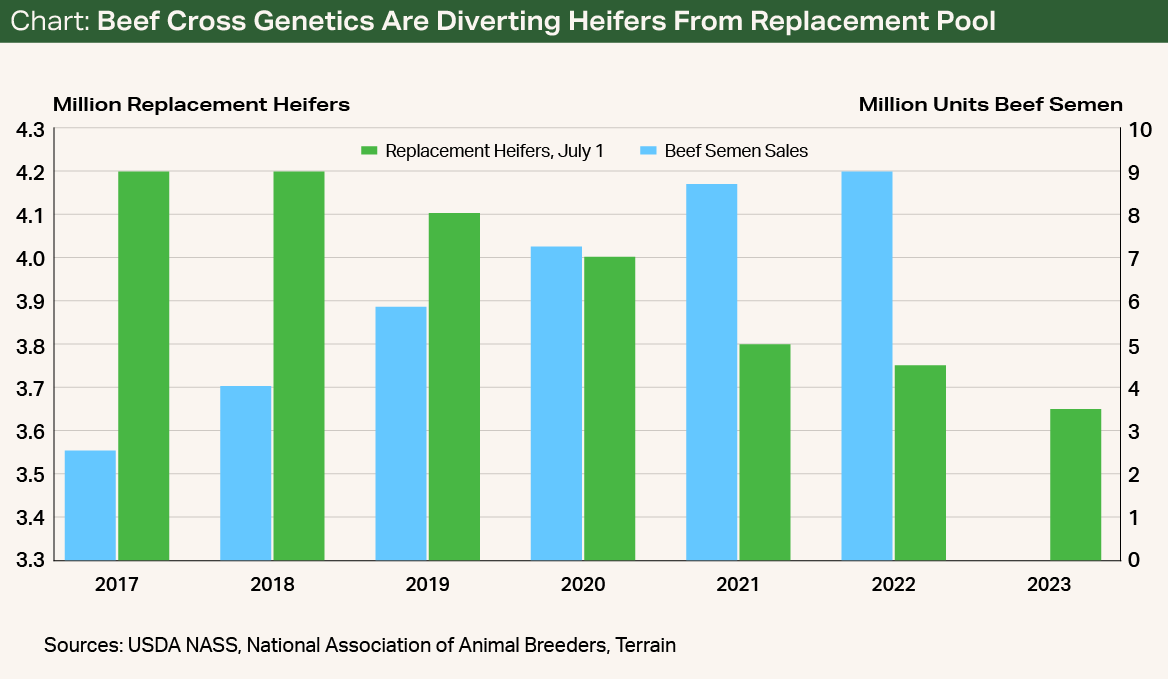

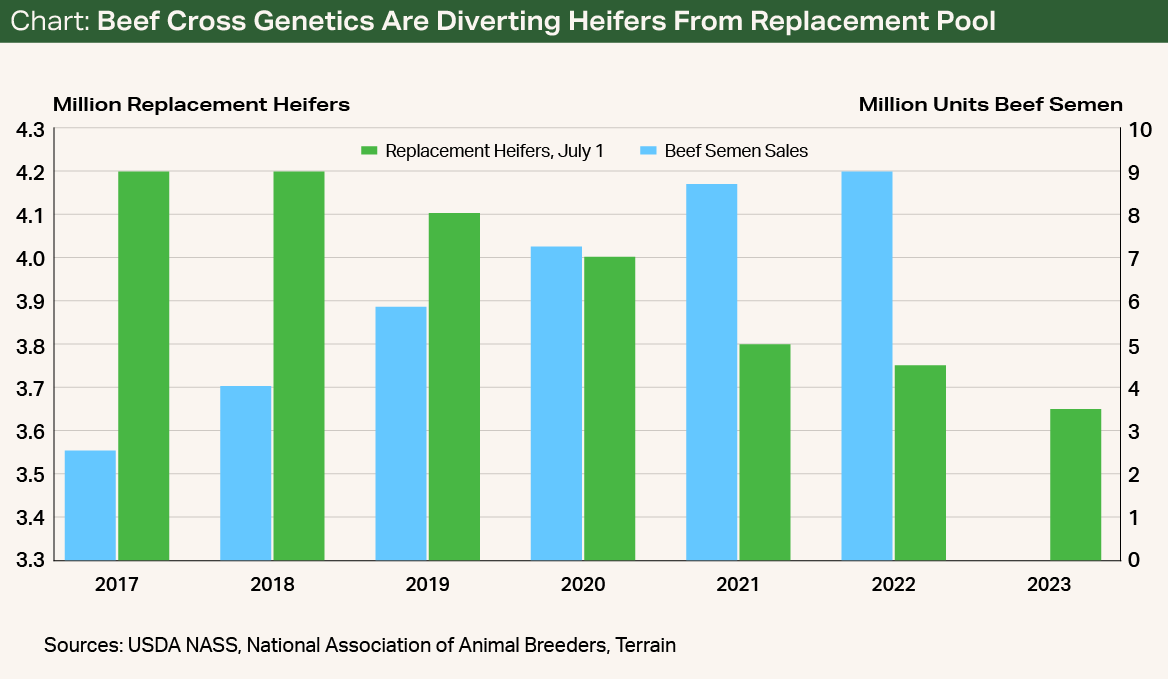

The milk production outlook for 2024 will depend heavily on the trajectory of milk cow numbers over the next couple of months. If slaughter rates remain elevated and cow numbers decline sharply, rebuilding the herd could be a gradual process given the low heifer inventories available for replacement. YOY milk production growth in 2024 should increase compared with 2023 by between 0.5% and 1%. The gains will be driven mostly by yield improvements, but a degree of uncertainty remains around cow numbers.

Feed prices are showing signs of improvement and will provide some needed relief next year. Silage prices in the field are down dramatically, by nearly half from what is currently being fed. Hay prices are still elevated but coming down from their peaks.

Another bright point is the continued value in beef-dairy cross calves. Prices for day-old beef-dairy cross calves have skyrocketed to nearly double their normal value. Not only will this help with revenue in Q4, but it will continue to incentivize more cross calves going toward beef rather than rebuilding the replacement heifer pipeline (see chart).

Spot loads of milk in the Upper Midwest have finally started trading at a positive basis to Class III, after being sold at a steep discount of around $10 below class for most of the year so far. When this price series turns from negative to positive, it tends to bode well for price strength in the months that follow.

Domestic demand for cheese has been good, and the surplus milk situation has evaporated with late-summer heat waves. Unfortunately, cheese exports, which provided an extra boost to markets last year, have slowed. They could take a while to come back, since production in the EU is ample and the U.S. has lost its price advantage.

Exports for other dairy commodities have struggled for a variety of reasons, mostly stemming from slower demand from China due to increases in its production and economic sluggishness, and the knock-on effects that spill into the rest of Southeast Asia. Global dairy commodity markets remain depressed, and regaining any advantage will take time. So far, Mexican imports have been the only bright point, partially softening the blow of the lost volume to Southeast Asia.

Milk prices should continue to improve somewhat into Q4, especially if we see signs of a strong holiday season, but further upside potential appears limited in 2024 barring any major export improvements. Still, milk prices in the current range should provide better margin next year than this year against a backdrop of easing feed costs.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.