Key Takeaways

- While the 2025 growing season is just underway, near-historic levels of ad hoc support provided to farmers in 2025 mask the economic challenges facing row crop producers in the form of declining commodity prices and elevated, sticky input costs.

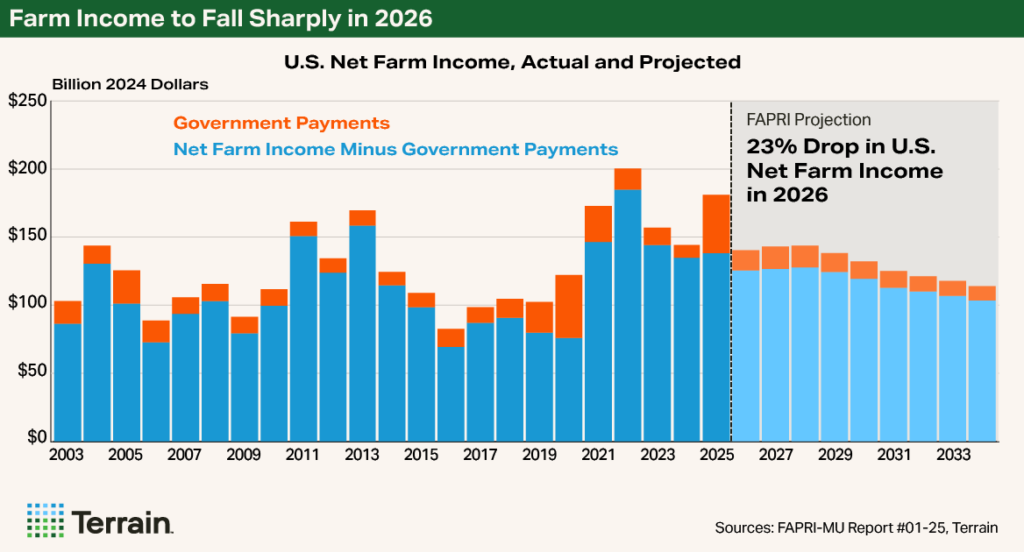

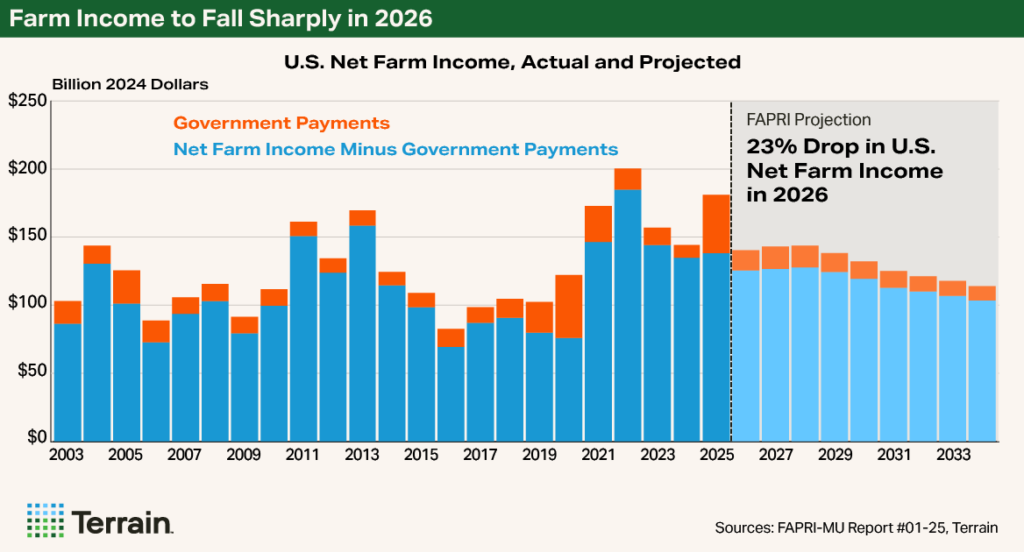

- If current supply, demand and price expectations hold, U.S. farm income could fall sharply from $180 billion in 2025 down to $139 billion in 2026, a decline of 23% or more than $40 billion. If realized, this decline in U.S. net farm income would be the third-sharpest in more than 30 years.

- There are many known unknowns in the form of opportunities and risks for the farm economy. Managing downside price risk and taking advantage of opportunities as markets rally are critical. Seeking ways to adjust fixed or operating costs in this environment can also help.

Temporary Sense of Relief for Crop Farmers

It’s no secret that row crop producers have faced stiff economic headwinds in recent years. After rising sharply in 2022, input costs remain stubbornly high still today. At the same time, the prices received for major crops like corn, soybeans and wheat have fallen by as much as 30%, e.g., Examining the Economic Crisis in Farm Country.

In response to these economic challenges, Congress stepped in through the American Relief Act to provide financial relief through one-time economic assistance payments to farmers totaling $10 billion (Official ECAP Payment Rates Released), in addition to approximately $21 billion to help farmers recover from catastrophic natural disasters. Combined, more than $30 billion in ad hoc support is expected to be distributed to farmers and ranchers throughout 2025.

Driven in large part by the ad hoc support and strong economic returns in the cattle sector, estimates from both USDA’s Economic Research Service and the University of Missouri’s Food & Agricultural Policy Research Institute (FAPRI) project that aggregate U.S. net farm income will reach $180 billion in 2025. This lofty farm income estimate, however, provides only a temporary sense of security in farm country as the underlying economic stresses, e.g., high input costs, show little signs of fading.

What Could Be Around the Corner In 2026

What does a status quo economic environment look like in 2026 – an environment with no change in U.S. farm policy, no additional ad hoc support, no supply shocks, and no meaningful changes in consumption?

According to FAPRI’s most recent baseline, the prices received for major field crops are projected to fall or remain flat again in 2026. The season-average corn price is projected at $4.19 per bushel, soybeans at $10.06 per bushel, wheat at $5.33 per bushel and cotton at less than 70¢ per pound.

While some may view this as a return to normal crop prices, the stickiness of production costs and a higher interest rate environment make the current price cycle more challenging than the most recent downturn experienced from 2014 to 2020.

Despite crop prices being flat-to-lower, there is no relief on total input costs. FAPRI projects farm input costs to rise to nearly $460 billion in 2026 – up nearly $90 billion since 2021. Then, as further evidence of the stickiness, FAPRI projects inputs such as chemical costs, energy costs, and labor costs will push total expenses up by $37 billion over the next decade to nearly $490 billion by 2034.

The combination of lower crop prices, rising input costs, and a decline in government payments is projected to result in an aggregate U.S. net farm income of $139 billion in 2026, down 23%, or $41 billion compared to 2025. If realized (and there is a lot of runway in front of us) this would be the third-largest year-over-year decline in farm income in more than 30 years.

Known Unknowns Approaching 2026

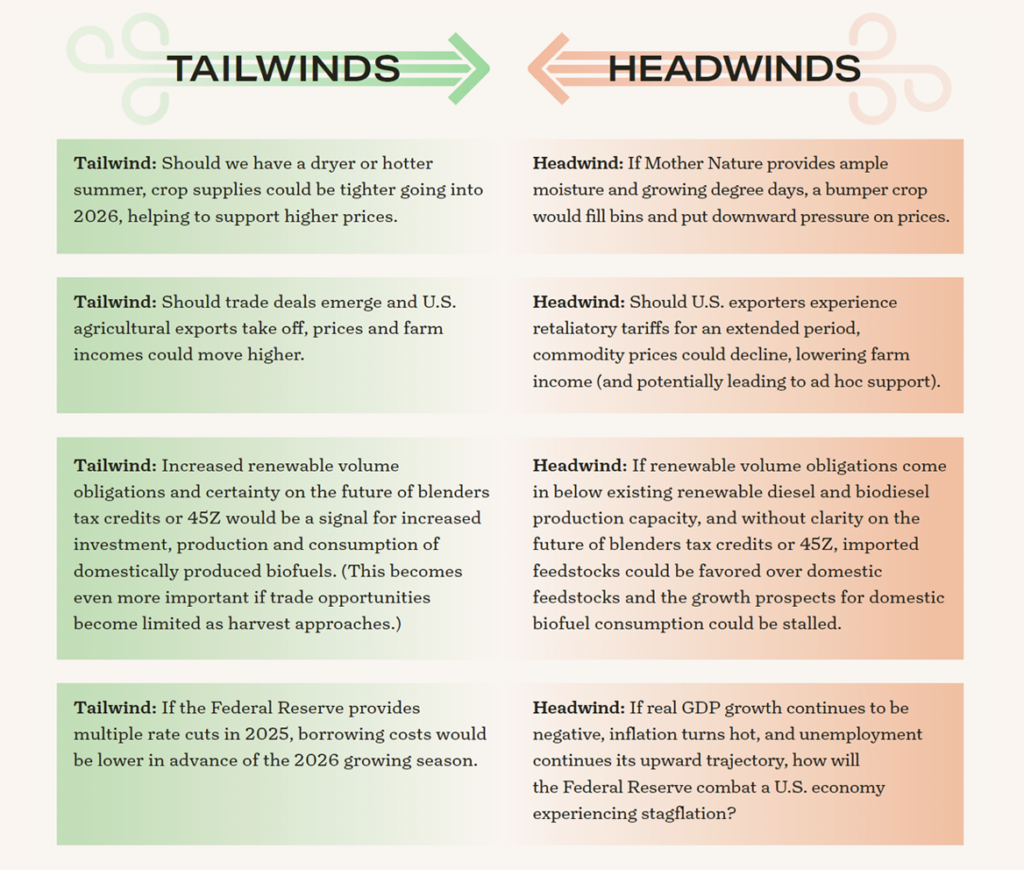

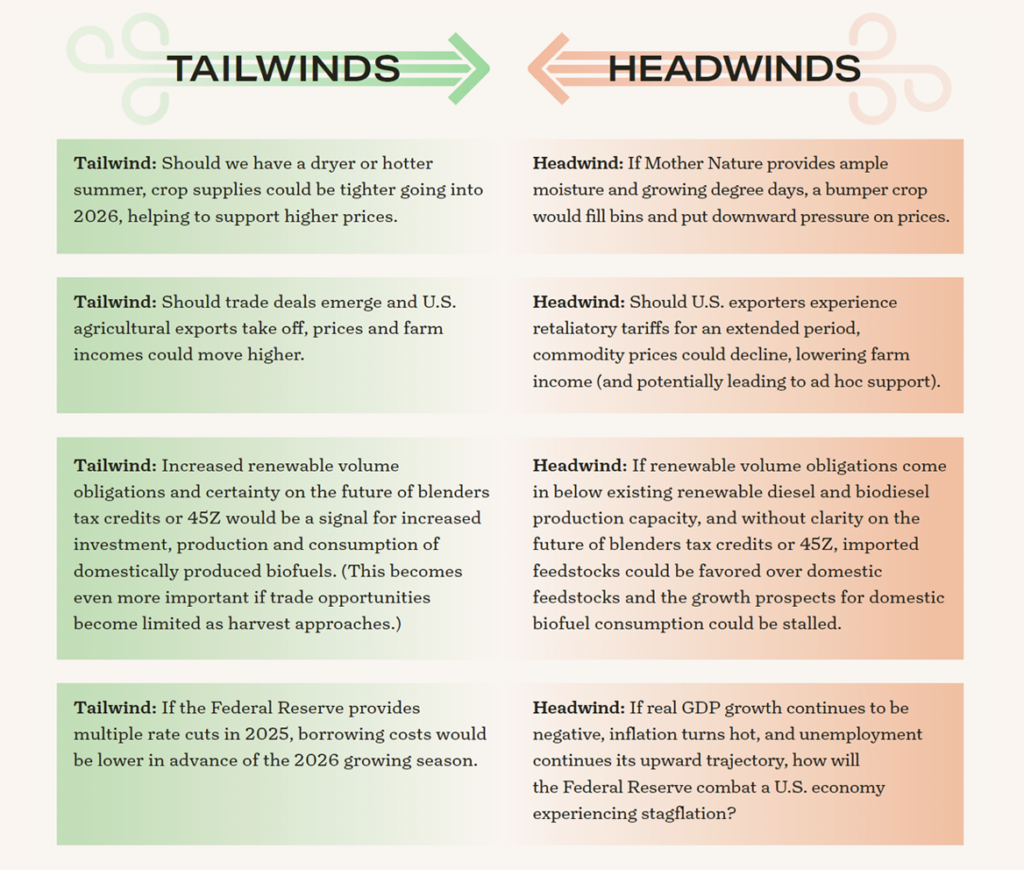

Like college football, this is a way-too-early projection of farm income in 2026. However, it recognizes that the current headwinds facing crop producers are showing no signs of letting up, nor are there any tailwinds clearly visible on the horizon. Known unknowns include but are not limited to:

Given the uncertainties that abound in the farm economy, risk management and knowing your bottom line are critical. Managing downside price risk and taking advantage of opportunities as markets rally could reduce price volatility and potentially enhance farm profitability. Seeking ways to adjust your fixed or operating costs such as managing machinery expenses can also help provide breathing room.

Current farm bill commodity programs are not well equipped to shield growers against a prolonged downturn in the farm economy. Efforts to enhance farm bill programs like crop insurance or Agriculture Risk Coverage and Price Loss Coverage could provide stability, certainty, and additional working capital (when needed) to help farmers endure through the down cycle. Knowing if any potential changes to farm programs are coming and how to make informed risk management decisions across the suite of tools in the toolbox will be key.

The 2026 growing season may be a long way away, but without much-needed tailwinds in the U.S. farm economy for crop producers, the tale of two farm economies favoring cattle over crops looks to continue in the years ahead.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.