Situation

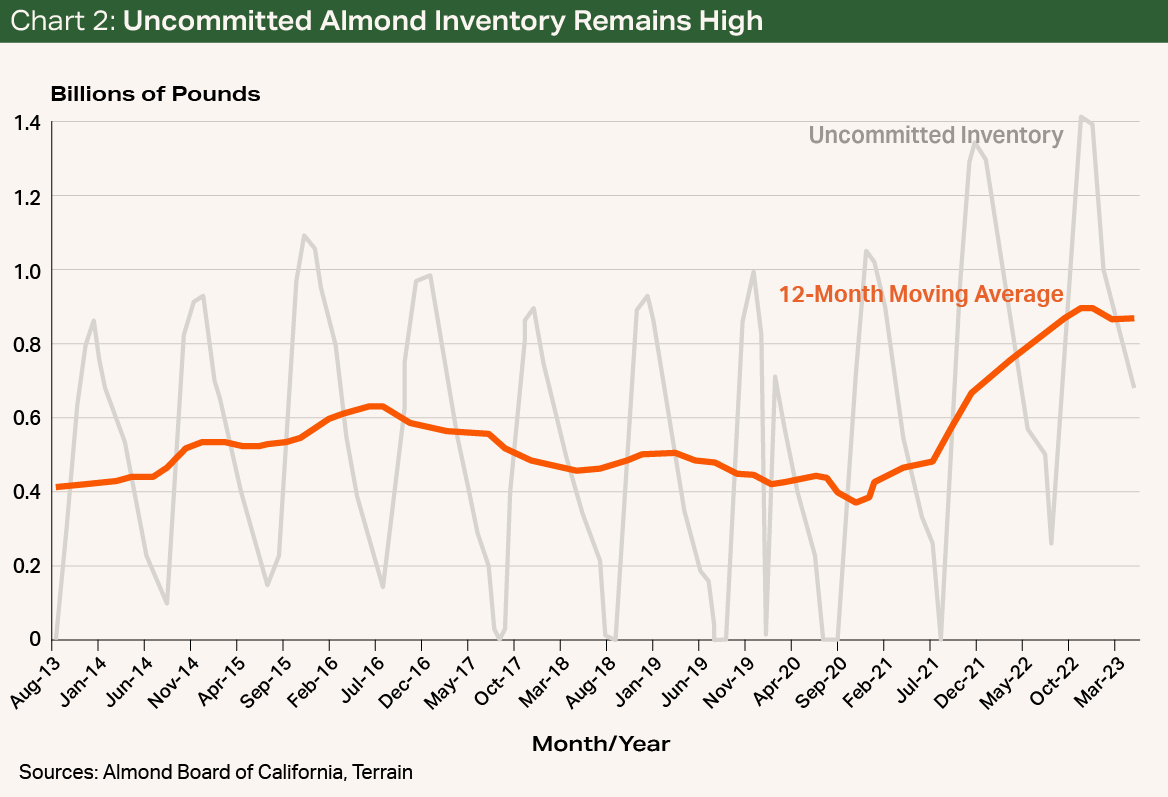

Ever since the supply-chain issues brought about by the pandemic, uncommitted almond inventory has posed a challenge for the industry. To put the scale of this issue in context, the amount of above-normal uncommitted almond inventory as of May is about 400 million pounds — equal to the weight of 40,000 elephants. This represents 2.5 times more uncommitted inventory than pre-pandemic levels for the same month.

Earlier this year, the combination of record-setting shipment numbers in the first quarter and below-average yields forecast for the 2023 crop signaled that uncommitted inventory levels may start to drop to a more comfortable level. More recent numbers, however, reveal that the 40,000 elephants' worth of almonds remain stubbornly uncommitted.

Given this glut of inventory and uncertainty over the size of the 2023 crop, there has been much speculation around where the almond price will shake out. To move inventory, prices will likely have to come down from the increases we have seen this year.

Production Forecast

On May 12, the USDA published a forecast of 2.5 billion pounds for the 2023 almond crop. Given the USDA’s estimate of 1.38 million bearing acres, this puts the average almond yield at 1,810 pounds per acre, the lowest since 2005. Though these numbers are low, some in the industry were surprised by the USDA’s relatively optimistic forecast, given that an earlier industry estimate put the average yield at 1,650 pounds.

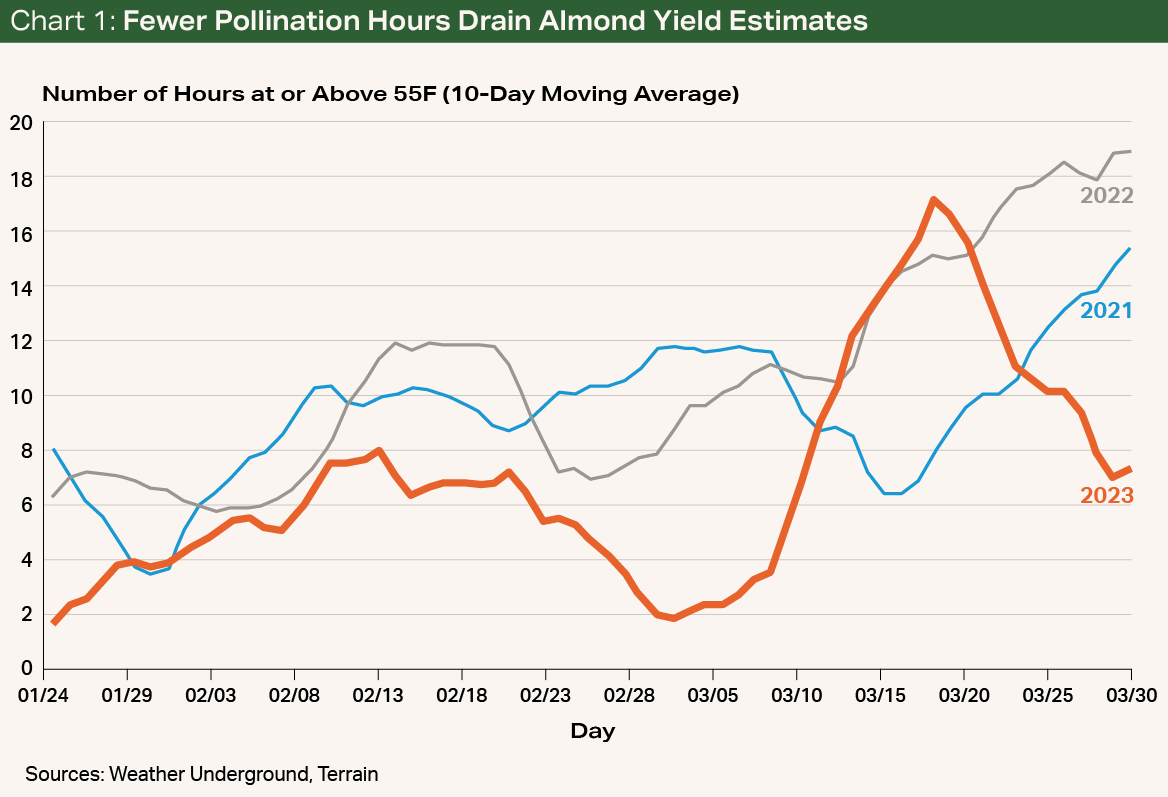

Such low numbers are hardly a surprise to growers who experienced firsthand the atypical weather at the peak of this year’s bloom. To put numbers onto these observations, I gathered weather station data from locations throughout the Central Valley to show that there were approximately 35% fewer bloom-hours compared to the last two years. The cool weather, combined with heavy rain and higher-than-average wind speeds, meant conditions were unfavorable for almond pollination (see Chart 1).

Price Forecast

Some of the speculation around the 2023 crop size seems to have been good for the market — at least during the worst of the weather. As winter storms moved through the valley, buyers were securing inventory at low prices in anticipation of a smaller crop and the possibility of higher future prices. This increase in demand was reflected in the March shipment report where the first quarter of 2023 was the highest first quarter on record, and March 2023 had the highest shipments for that month on record.

These strong numbers were bolstered by certain export markets, where shipments to the Middle East/Africa and Asia-Pacific were up considerably from March 2022. Interestingly, shipments to the domestic U.S. market and Europe both shrank by about 8% where both markets are more saturated and consumer confidence has been shaky. Nevertheless, the strong demand from the export market was enough to offset soft U.S. and Europe demand, causing an uptick in almond prices, which remain higher than they were at the beginning of the year.

However, shipment reports from April and May 2023 show that demand has slowed from these record highs. Shipments for April and May were down 20% and 24%, respectively, from their 2022 levels. The slowdown in almond shipments was likely a result of the recent increase in prices and buyers choosing to wait for the USDA’s estimate to be released to gain clarity before buying. Now that the USDA is estimating higher yields than other previously published estimates, we have begun to see downward pressure on prices. While most producers may not be quick to celebrate a declining price, a lower price may help accelerate shipments — a critical metric for an industry sitting on a heap of uncommitted inventory.

Looking ahead, the 2023 crop and future market conditions may allow the market to absorb its oversupply. This could be challenging given the U.S. dollar, which remains strong despite some weakening since late in 2022. Given the industry's reliance on the export market, I expect prices will have to come down between now and harvest if significant inventory is to move. In fact, some of that uncommitted almond inventory may have to sell at a discount as the 2023 crop is processed (see Chart 2).

Going Forward

Despite these challenges, there is a structural factor that can continue to push the supply-to-demand ratio in the right direction. The USDA forecasts global consumption of almonds to be about 3.49 billion pounds this year. Given that the U.S. accounts for 80% of production, this implies there is demand for about 2.79 billion pounds of American almonds. Year-to-date almond shipments remain a bit higher than 2022 at just over 2.19 billion pounds, but down from what we might expect in the 10th month of the marketing year. Though the industry must contend with its recent spike in supply, the numbers suggest that demand for U.S. almonds remains strong.

The next key crop size projection is the USDA’s California objective estimate, which will be published on July 7, 2023. The estimate will give us further insight into the size of this year’s crop as well as what to expect throughout the summer and into harvest.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.