Soybeans have been rangebound between $13 and $14 since July. As we approach the end of the calendar year, the outlook for soybeans in early 2024 is promising. Exports’ pace has been accelerating and is now on track to match USDA projections for the current marketing year. At the same time, crushings continue to increase, running 2% faster than last year. The gap above last year is expected to increase as new crushing plants enter operation in 2024.

The outlook for soybeans in early 2024 is promising.

The biggest concern for Q1 2024 exports is water levels in the Mississippi River and Gatun Lake in Panama. At the start of December 2023, Mississippi River levels were already at -9’ at Memphis, below the -5’ that is considered low water.

Low barge shipping prices mean that current water levels are sufficient to meet the demands for barge traffic, but winter is also the season that the river level declines, as most precipitation falls as snow instead of rain.

If river levels are typical over the first three months of 2024, barge loadings will be cut. This will increase shipping costs just as South America is at the end of its marketing year, when we should have an advantage in meeting global soybean demand.

Gatun Lake in Panama was created when the Canal was built and forms the majority of the Canal’s journey. It also provides the water to operate the locks that allow ships to transit the Canal. An ongoing drought has lowered water levels such that the Canal cannot operate at full capacity.

Increased crushing demand and a return to export levels similar to those in 2022/2023 would result in ending inventories close to 2023/2024’s, though I expect prices to be somewhat lower at $12.60/bu.

In late October 2022, 83% of all grain shipments from the U.S. Gulf to Asia transited the Panama Canal. In late October 2023, 87% of those shipments transited the Suez Canal. While the Panama restrictions also affect Brazilian exports, if they persist, it will give a significant advantage to Argentine exports for Asian destinations in 2024.

Price action in soybeans remains overall supportive.

Price action in soybeans remains overall supportive. Storage is breakeven or better through the end of March, and while overall usage is below last year’s — primarily because of strong export competition — demand is on track to meet or exceed current USDA forecasts.

Basis levels are relatively normal in historical terms. Some areas are seeing basis pops as new crushing plants are opening, but these have remained local. As always, storage past South American harvest in February and March has lots of additional risk.

Growing weather in South America has been mixed. It is unlikely at this point that Brazil will have the yields that it had in the past two years, though area will likely continue to increase.

2024/2025 Marketing Year Predictions

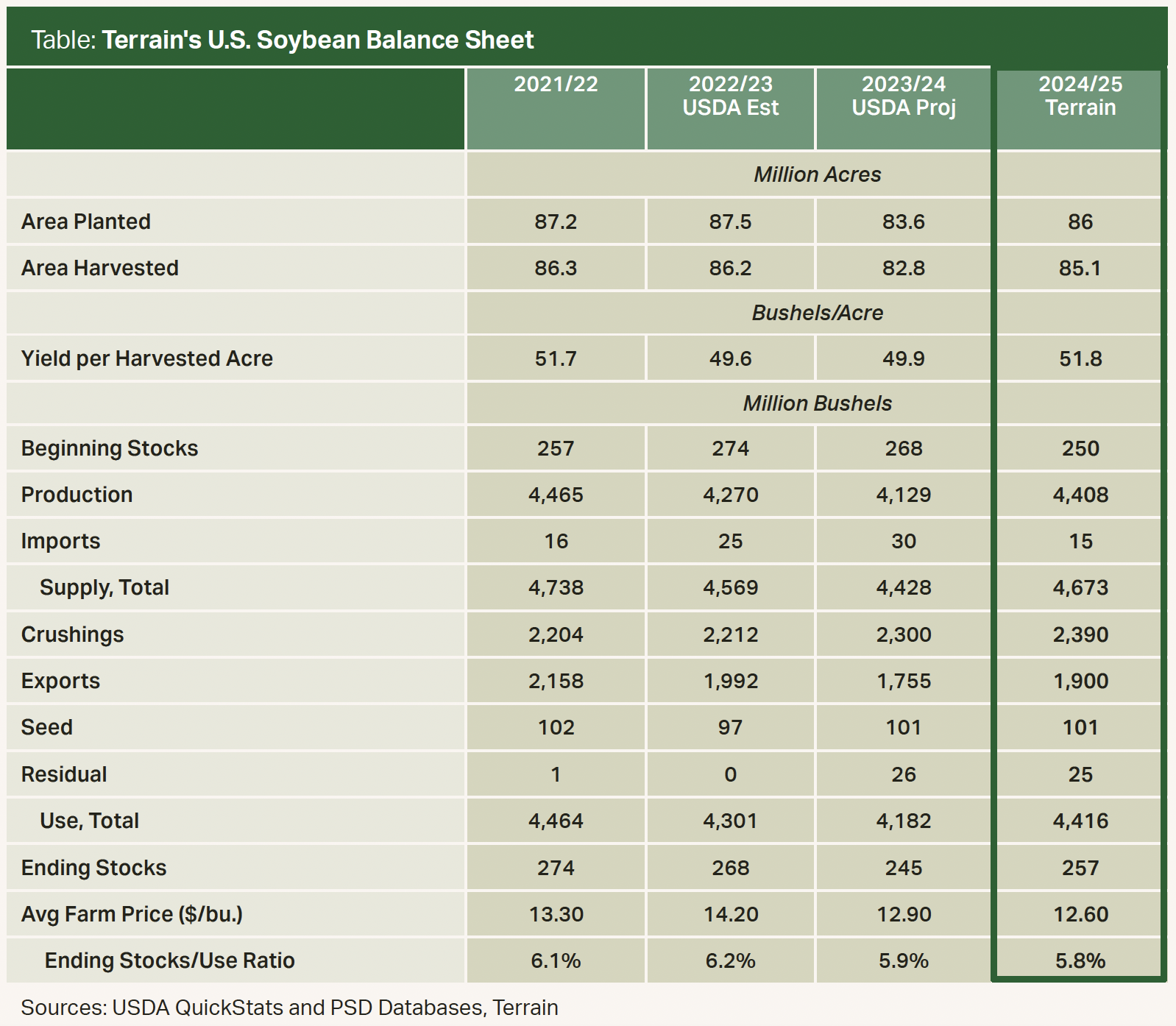

For the 2024/2025 marketing year, I predict that yields will be 51.8 bu./ac. on increased planted acreage of 86 million acres, compared with 49.9 bu./ac. and 83.6 million acres, respectively, in 2023/2024 (see Table).

Increased crushing demand and a return to export levels similar to those in 2022/2023 would result in ending inventories close to 2023/2024’s, though I expect prices to be somewhat lower at $12.60/bu. This implies prices somewhat lower than currently but not exceptionally so.

The real uncertainty about this forecast in the short run is continued growing conditions in South America. Although the global situation is not tight, it is balanced enough that any shocks to global production will be felt in prices.

The real uncertainty about this forecast in the short run is continued growing conditions in South America.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.