Quarterly Outlook • September 2023

When Record Prices Are Not Enough to Drive Herd Rebuilding

Production Forecast

U.S. cattle slaughter through August 2023 was down about 4.1% year over year (YOY), resulting in lower beef production by about 4.8% YOY. Year-to-date (YTD) cattle slaughter has averaged about 7,000 head per week below the previous five-year average.

Q4 2023 cattle slaughter and beef production are forecast to be down 5% to 5.5% versus 2022. For the whole of 2023, cattle slaughter and beef production are expected to be down 4% to 4.5% versus 2022. In Q1 2024, beef production is likely to be 7% to 8% smaller than a year earlier.

Price Forecast

Feedlot replacement cattle prices rallied all through the summer, supported by declining grain prices and tightening feeder cattle and calf supplies. Meanwhile, fed cattle prices became range-bound at near-record prices in the mid-180s/cwt. I expect Five Area live cattle prices to retest support near $180/cwt in late Q3 2023 before rallying into the holidays and retesting the record highs set in June 2023 at just below $190/cwt.

I expect seasonal price pressure early — but to be limited — in 2024 with continued tightening of market-ready supplies driven by sharply lower late-summer placements. As spring grilling season approaches, I expect beef prices to continue to rally and drive fed cattle prices to new records in late Q1 and early Q2 2024.

I expect Q4 2023 feeder cattle and calf prices to trade sideways at $250/cwt to $260/cwt for 700- to 900-pound steers and $275/cwt to $300/cwt for 500- to 600-pound steer calves, depending on quality. Price gains for feeder cattle during this period will be hard-fought. Fed cattle profits are expected to turn to losses in mid- to late Q4 2023, a result of record feeder cattle prices during early Q3 2023. Calf prices will face these same headwinds as well as seasonal (but less than normal) supply pressure. Forecast limited beef replacement heifer retention will be enough to support prices, but likely not enough to create a firestorm in light cattle prices.

Rebuilding on Pause

U.S. beef cow herd rebuilding appears to be on pause. The limited areas that could build numbers are overshadowed by the drought impacts that continue to plague the Central Plains and southern Midwest. Re-emerging dryness since early August has led to worsening drought in the eastern half of Texas and much of Missouri, adding to pressure across most of Kansas, central and eastern Nebraska, and Iowa. These are major cow-calf areas, accounting for 35% of the U.S. beef cow inventory. Many operations are still liquidating cows because of lack of surface water, forage or both.

For these operations, the signals that high prices are sending to build numbers simply cannot be heard.

In areas where water and forage are less of a concern, producers are still faced with using added revenue from high calf prices to pay for the extra volume of high-priced hay and forage they had to purchase to get through the drought and rebuild hay stocks for the winter, all in an environment with much higher interest cost. Many operations have approached 2023 as an opportunity to rebuild their balance sheet, or at least not make it any worse. Adding high-priced bred females or forgoing revenue for very valuable heifer calves and adding two years of carrying costs to develop them into cows simply does not make sense for many operations.

As we forecast earlier this year, the net result so far in 2023 has been that beef cow slaughter — while down nearly 14% YTD versus a year ago but still 3% above the previous five-year average — will be large enough and beef replacement heifer numbers small enough to preclude cow-herd rebuilding during 2023 and potentially 2024. The July 2023 U.S. cattle inventory report from the USDA showed beef replacement heifer numbers were down 100,000 head, or 2.5%, versus the previous year. For July 1, 2023, beef replacement heifer numbers hit a record low at 4.05 million head. This is the smallest total reported since the USDA started reporting July inventory numbers in 1973.

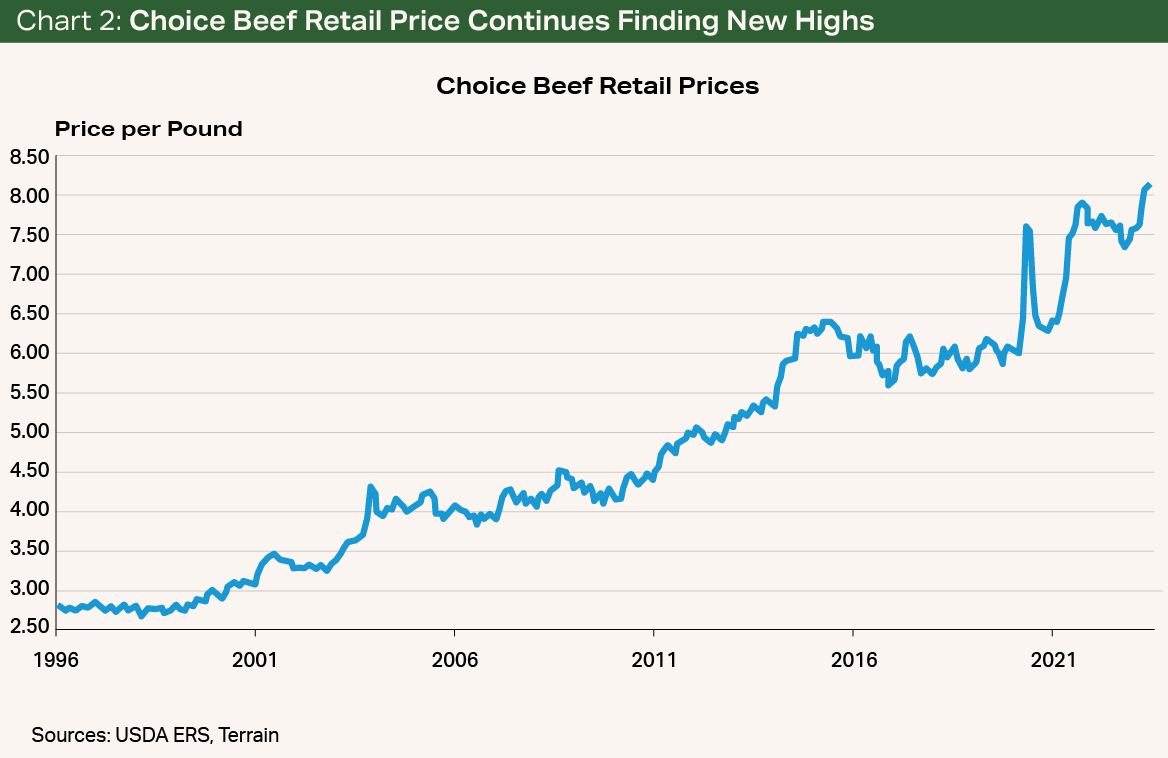

Even as inflation puts pressure on consumers, the U.S. beef supply chain continues to benefit from strong consumer spending (see Chart 1). YTD retail prices for choice graded beef have averaged about 2% above year-earlier levels. Prices rose sharply during Q2 2023 after being nearly even with year-earlier levels during Q1. By June, choice retail beef prices were 6.2% above June 2022 levels and at a record high. Domestic supplies for the month were down 2%, leaving monthly spending up 0.6% after adjusting for changes due to higher inflation.

If retail beef prices can hold current levels (though I believe they are likely to rise), nominal beef spending in 2023 could be equal with last year’s record total, despite a 4% decline in commercial beef production. The increase in forecast retail beef prices (see Chart 2) will likely add about $7.7 billion to total beef spending and supply chain revenue for 2023 versus my expectation at the beginning of the year. This added spending will further support beef and cattle prices at all levels of the industry.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.