Around this time of year, all eyes are on the Texas Panhandle to see if there will be enough moisture to get cotton out of the ground. This year is a little different, as it isn’t a question of how dry but how wet it is in the Panhandle. Cotton growers in Texas were in a race to find dry fields and plant the crop before the insurance planting deadline of May 31. Many areas of the Texas Panhandle received over 10 inches of precipitation in May. I like to keep a close eye on Texas, as it accounts for nearly half of U.S. cotton production. A big crop or even low abandonment in Texas can swing the U.S. cotton supply significantly. Time will tell how many acres were planted and if the planted acres survived the wet conditions.

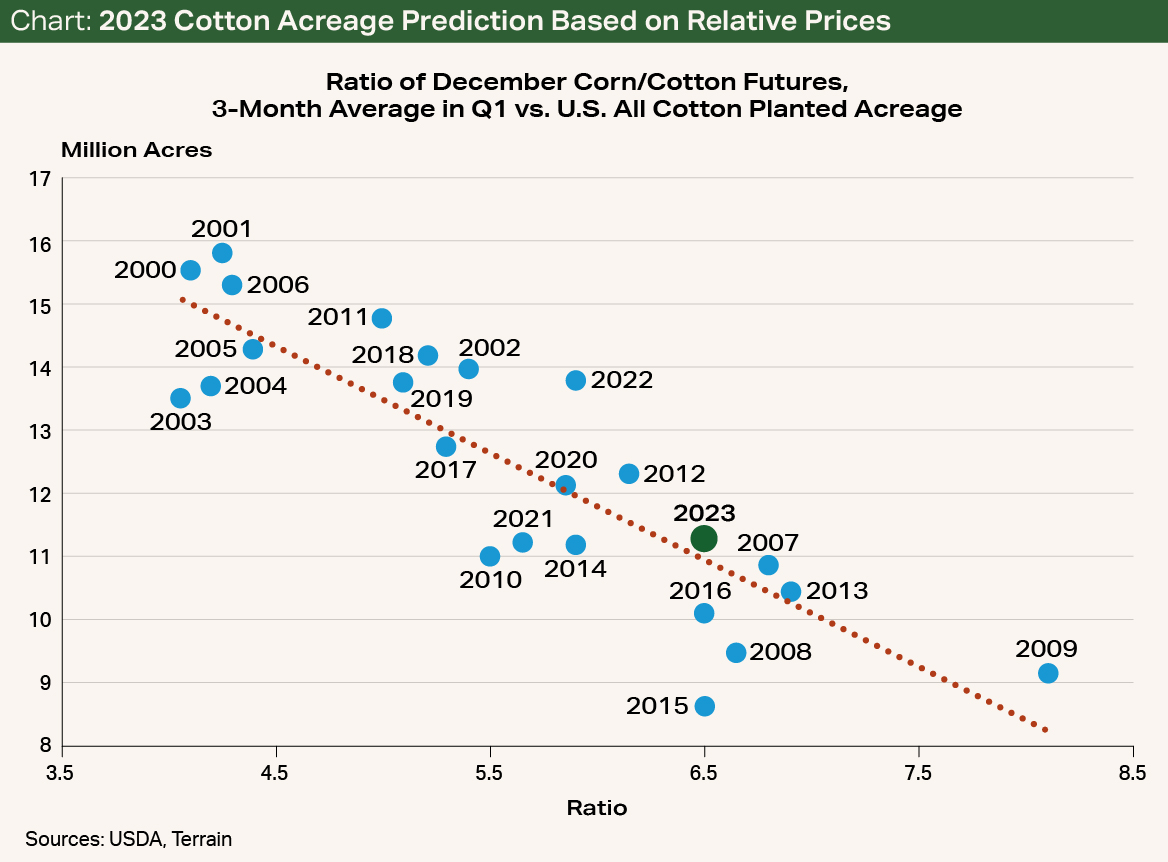

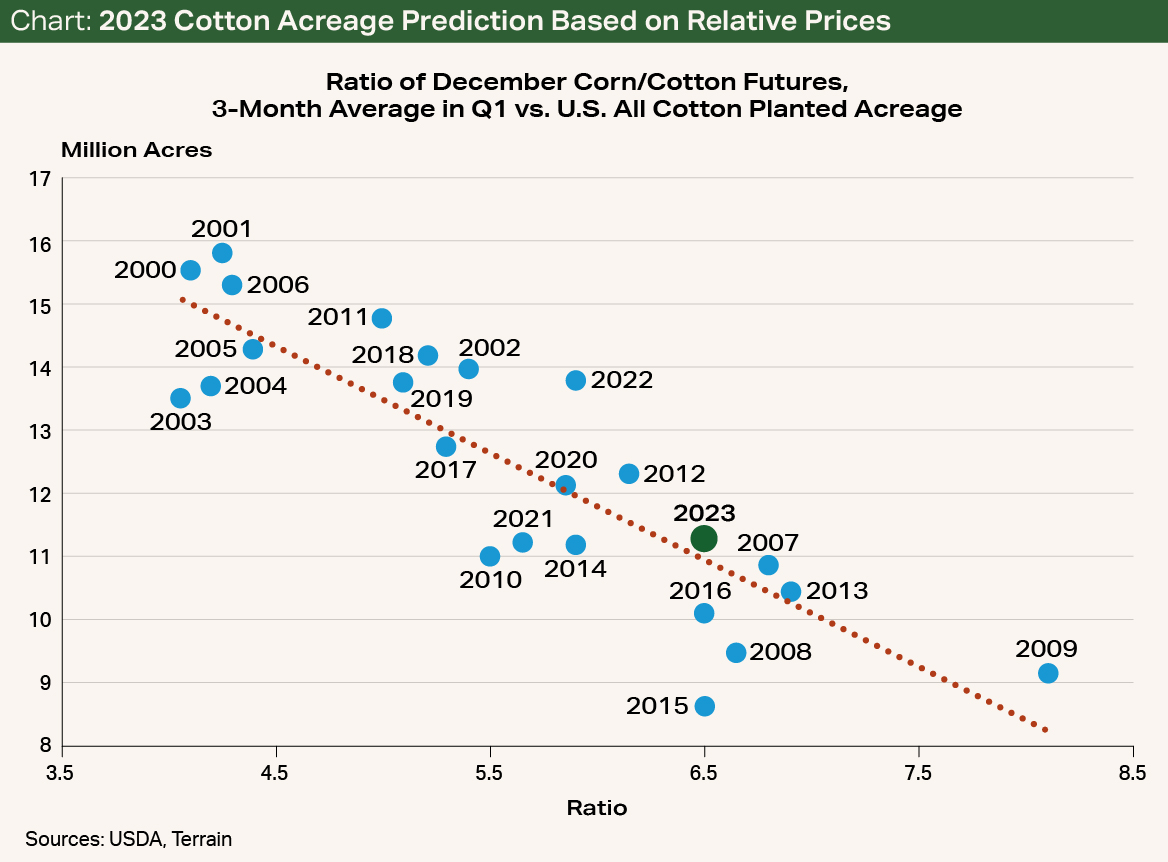

U.S. upland cotton acres are expected to decline by 18% from last year’s 13.76 million acres to this year’s 11.26 million acres, according to the USDA. This is no surprise to the trade, as harvest price expectations favor corn, milo, soybeans and wheat. In fact, cotton has traded sideways around $0.80/lb. for the last eight months. When comparing new crop corn with new crop cotton prices, the ratio works out to be approximately 6.5 ($5.20/bu. / $0.80/lb.). This has historically indicated around 9 million to 11 million acres of cotton for the U.S. (see chart).

Another reason for the decline in cotton acres is the insurance price decline from last year to this year. The insurance price for the 2022 cotton crop was $1.02/lb. Most producers locked in a profit the day their cotton went into the ground. This incentivized increased cotton acres last year. This year’s insurance price is $0.84/lb., which doesn’t offer the same profit guarantee as last year.

Even with the lower planted acreage, the USDA expects harvested acres and production to be up from last year. Nearly half of the cotton acres were abandoned last year because of the drought in the southern plains. The USDA lowered its national abandonment figure by 700,000 acres month over month for the 2023/2024 marketing year because of the recent rains in Texas. This results in an expected 16% abandonment, compared with the 47% abandonment last year.

Cotton prices are largely driven by global economic strength, consumer confidence and consumer spending on textiles and apparel. The strength of the U.S. dollar in relation to major importers of cotton also has a strong influence on the price of cotton. The U.S. exports 80% to 90% of its produced cotton, making it the world’s leading cotton exporter. In contrast to the pace of corn or wheat exports, U.S. cotton exports have remained strong. On the global front, the USDA expects production to remain at similar levels to last year. Global ending stocks are also expected to remain mostly unchanged.

Global cotton use is forecast to be at a three-year high, driven by low global cotton yarn stocks and greater margins for spinners. Higher cotton yarn prices compared with decreased and more consistent cotton lint prices, which are half of the input cost, support these profit margins. The world’s three largest consumers of raw cotton — China, India and Pakistan — are expected to lead demand growth, and all the top 10 consuming countries are expected to have higher use.

Cotton lint consumption and changes in global GDP are correlated and must be monitored. There is a tremendous amount of economic uncertainty due to sticky inflation, financial sector turmoil, slowness in growth in Europe (Germany may technically be in a recession already) and China, a more levered U.S. consumer, and ongoing impacts from the war in Ukraine. If a soft landing in the U.S. and abroad were to play out, cotton producers could expect prices to remain range-bound from the high-70s to the mid-80s. If the U.S. were to fall into a recession and consumer spending tighten, it would put downward pressure on cotton prices.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.