Quarterly Outlook • December 2023

Will Gilt Retention Decline Enough Amid Productivity Gains?

Production Forecast

- I expect both hog slaughter and pork production to be even to up about 2.2% during Q4 2023 versus a year earlier. This is slightly larger than the top end of my previous forecast. During Q1 2024, I expect hog slaughter to be up 0.5% to 1% versus a year earlier given the 0.3% increase in market hog inventories that the USDA reported in the September Hogs and Pigs report.

- I project fewer gilts will be retained in the breeding herd, driving the swing to larger-than-expected slaughter totals. I expect productivity gains to prompt an upward revision to pigs saved per litter, thereby adding to the June through August pig crop.

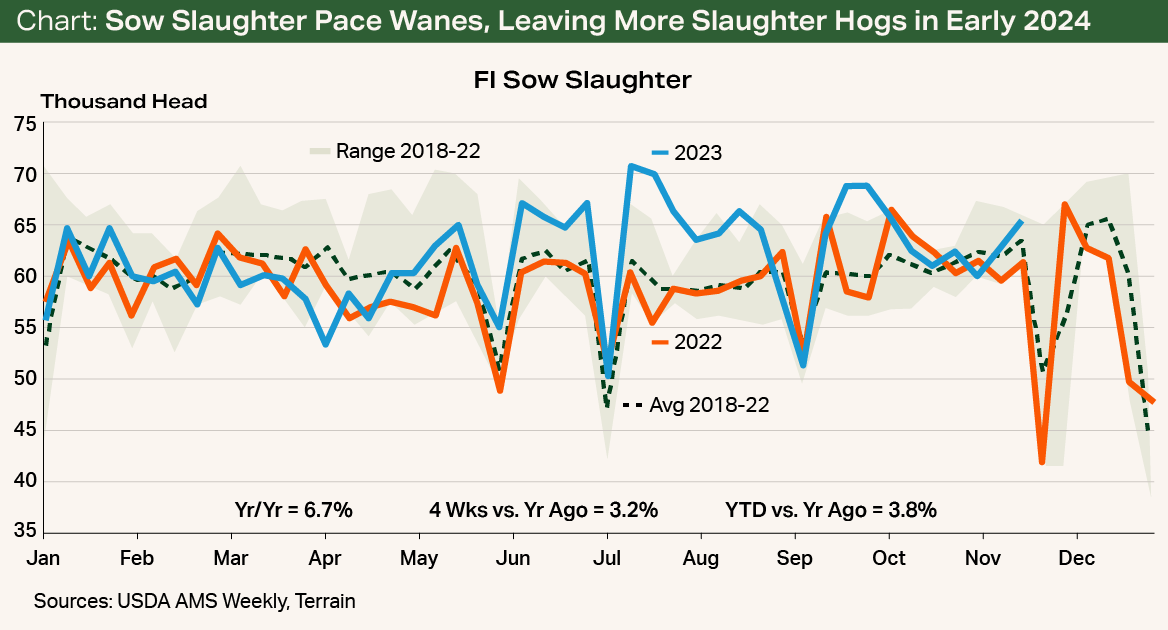

- Continued poor margins in the farrow-to-finish sector led to another quarter of year-over-year (YOY) increases in sow slaughter. During Q4 2023, I expect sow slaughter to rise 3.3% versus a year earlier, down from the 8.9% YOY increase seen in Q3 2023.

- Year-to-date (YTD) sow slaughter is up 3.8% (or 105,400 head) versus a year ago, likely leading to a 1.25% to 1.5% YOY decline in the sow breeding herd total for December 1, 2023 (see Chart). I expect the breeding herd to continue to decline into mid-2024 via sow liquidation and very limited gilt retention.

I expect the breeding herd to continue to decline into mid-2024 via sow liquidation and very limited gilt retention.

Price Forecast

- Market hog prices have declined at twice their normal seasonal pace since setting their summer highs in late July. The short-lived return to break-even prices or slight profits faded quickly in August, returning $25/head to $40/head of red ink to ledgers for the balance of 2023.

- Industry hopes of a smaller-than-normal increase in weekly average slaughter totals from Q3 to Q4 were met with just the opposite. I expect that the increase in weekly average hog slaughter from Q3 to Q4 2023 will average 192,000 head per week, which is 41,000 head above the normal seasonal increase and 67,000 head per week above the previous forecast, fueled by breeding gilts entering the slaughter mix.

- Given larger-than-expected supplies, I predict Q4 2023 producer-sold barrow and gilt prices will average $78/cwt to $79/cwt, down 10% to 11% versus a year earlier. For Q1 2024, I project prices will be in the $73/cwt to $77/cwt range, or 3.5% to 4.5% below year-earlier levels.

- I expect pork cutout values to perform only slightly better than market hog prices during Q4 2023 and average $85/cwt to $87/cwt, down 7% to 9% from Q4 2022. For Q1 2024, I predict cutout values will be anywhere from even with to 2% higher than early-2023 levels. They should benefit from supplies that are above year-earlier levels but tightening, with some consumers trading away from high beef prices.

Production Dynamics

Average weekly barrow and gilt slaughter hog weights set new five-year lows in early August as packers out-slaughtered available supplies. But available supplies increased rapidly during mid-September and remained large throughout Q4 2023.

For Q1 2024, I predict cutout values will be anywhere from even with to 2% higher than early-2023 levels.

Softening domestic and export demand slowed slaughter hog movement to packers, leading to growing front-end available supplies and a larger-than-seasonal move to heavier weights from mid-Q3 to mid-Q4.

Exports remain a sticking point for U.S. hog producers, with stiff competition from Brazil and a significant oversupply situation in China that has caused Chinese pork prices to fall and producers to register losses of $30/head to $50/head.

Exports remain a sticking point for U.S. hog producers, with stiff competition from Brazil and a significant oversupply situation in China.

Herd liquidation is underway in China as well as in the EU, which is producing about 8% less pork than a year ago. YTD U.S. exports through September were up 7.2% YOY, but key market Japan was down 1.5%. Canada, up 10.4%, and Mexico, up 8.5%, led YOY growth. Both countries have seen more growth on an annual basis during the second half of 2023 versus the first.

YTD through September, U.S. pork exports to China were down 3% YOY, which doesn’t sound that bad, except all the growth happened in the first half of the year, with exports up 16.7%. Q3 2023 pork exports to China were down 32.6% YOY. If the average decline of the August and September shipments continues through the rest of the year, exports will be down 20% YOY, recording the smallest annual total since 2018.

I expect EU production to continue to shrink, limiting its exportable supplies even further. Additionally, the Chinese herd liquidation should trim supplies and rally prices by Q3 or Q4 2024, leading to more opportunities for U.S. producers. The wild card in the international market remains the potential spread of African swine fever into additional EU and Asian countries as well as the Americas.

I and many industry analysts agree that the significant increase in sow slaughter totals since May 2023 and the apparent lack of gilt retention will likely result in producers bringing fewer slaughter hogs to market in February through at least April.

The USDA will release its December 1 Hogs and Pigs inventory report on December 22, 2023. The inventory estimates that it contains will be closely scrutinized for additional details that could lead to changes in nearby hog numbers, but most of the decisions and changes producers will make will largely impact the second half of 2024.

Wait-and-See Isn’t a Winning Strategy

In the meantime, it seems producers have adopted a wait-and-see approach by continuing to absorb losses and market hogs as aggressively as they can amid faltering slaughter hog prices. One way or another, the cure for low prices is low prices.

It appears that sow herd liquidation may not end up as a collective effort across the industry. In this cycle, it seems more likely that the sizable equity drain on producer balance sheets will end up taking out big numbers of sows in fewer places to get the industry rightsized.

Hope of better prices — driven by better export trade volumes — while a slightly more favorable supply picture evolves appears to be the strategy being employed versus a broader-based and active reduction in productivity to jump-start prices. But hope doesn’t make for a very effective risk management plan.

But hope doesn’t make for a very effective risk management plan.

The trouble with this strategy is that it devolves into which operations can withstand the biggest equity drain, and then the consolidation of operations begins.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.